Thesis

Afya (NASDAQ:AFYA) is a company that represents the intersection between education and health care. It is one of the major providers of medical education in Brazil. The company has a strong balance sheet, generates above-average free cash flow, and has excellent leadership. Afya represents a macro bet on Brazil’s tailwinds – a young population, a growing economy, and a robust business model.

Strong demographics and a more affluent population are the two ingredients required for any business to succeed in the long term. Among the industries most affected by that trend are education and health care. Hence, more teachers and physicians will be required. As a lead provider of medical education in Brazil, I believe Afya is perfectly positioned to benefit from those dynamics.

Company Overview

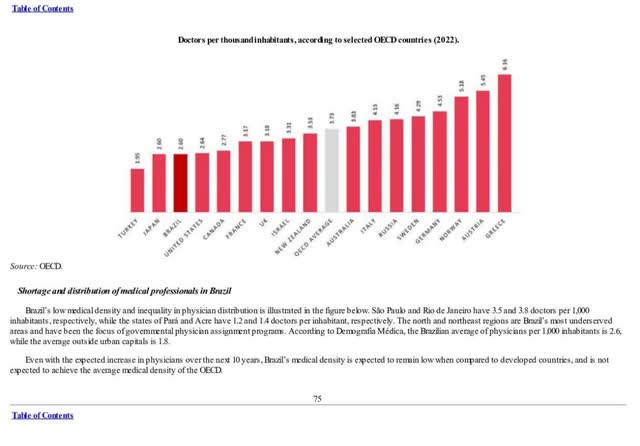

Brazil has solid demographics and is still classified as a developing economy. A growing and increasingly affluent population will seek better healthcare services. The demand for physicians with higher qualifications will rise. The need for skilled medics in Brazil will keep rising for the foreseeable future. The following graph from Afya’s 2022 annual report illustrates the number of medical professionals per 1,000 people in OECD countries:

OECD and AFYA annual report 2022

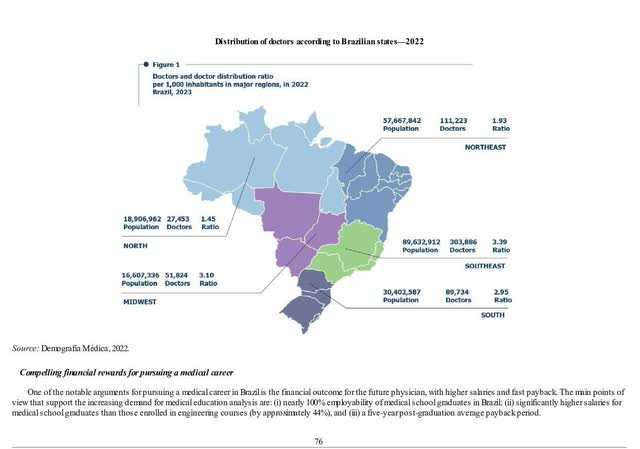

The grey bar represents the OECD average of 3.73 medics per 1,000 people. For Brazil, the average is 2.60. However, they are not evenly distributed. The number in southern Brazil, where the wealthiest states are, exceeds the national average. At the same time, in the poorer but more densely populated north, the number of medics per 1,000 people is well below the Brazilian average. The following graph illustrates the distribution of physicians:

OECD and AFYA annual report 2022

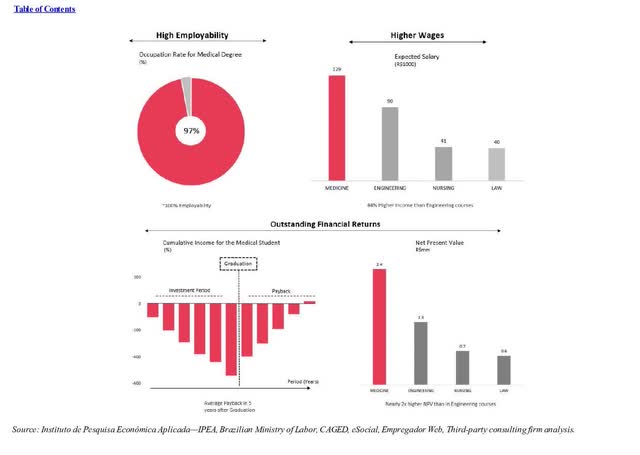

The attractiveness of the medical profession is very competitive compared to other white-collar jobs, such as lawyers and engineers. The wages of doctors significantly outweigh those of the other two professions. Employment in the industry after graduation is 97%. The return on medical education, measured by NPV (Net Present Value), is twice as high as the next in the ranking, an engineering degree.

AFYA annual report 2022

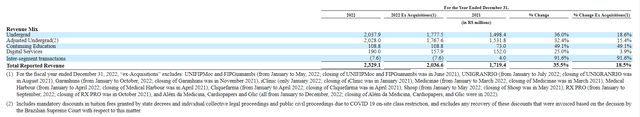

Considering these three variables – the number of medics per 1,000 people, the growing population, and the attractiveness of the medical profession – Afya is well positioned for long-term growth. The company’s business includes undergrad, continuing education, and digital services. The table below from Afya’s annual report 2022 shows the distribution of the revenue by type:

AFYA annual report 2022

Undergrad qualification

The admission of new students (undergrads) is the main activity of AFYA. In 2022, there were several significant developments in this segment. One of these was opening four Mais Médicos campuses, including Abaetetuba, Bragnca, Itacoatiara, and Manacapuru, which increased the number of locations in the company’s portfolio by over 200. An additional 92 new medical seats were added, 64 of them at Faculdade Santo Agostinho in the state of Bahia and another 28 seats at the UniSL Ji-Paraná campus located in Rondônia.

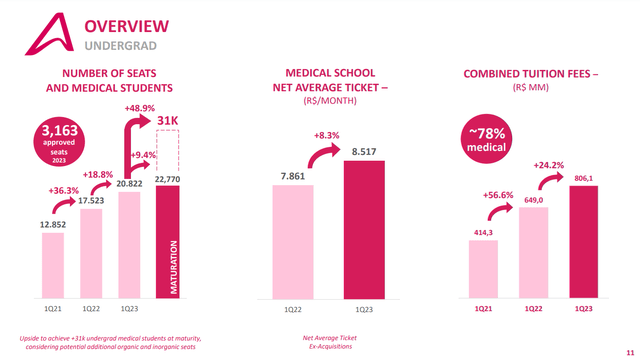

The other development was the acquisition of UNIT Alagoas. It fitted Jaboatão dos Guararapes, which increased the number of medical seats by another 340, bringing them to a total of 3,163, making the company the market leader for medical education in Brazil. The image below from the last company presentation illustrates sustainable growth.

AFYA investors presentation Q3 2023

The total number of medical students at the end of 2022 was around 18,000; the company expects this number to surpass 22,000. Finally, the company completed the integration of Unigranrio, which was acquired just over a year ago.

Continuing Education

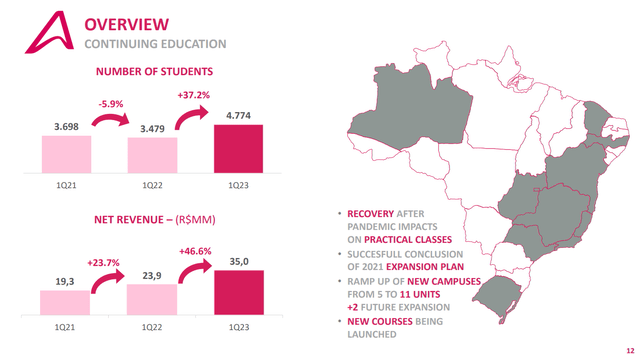

Although admitting new students is AFYA’s core business, postgraduate education has become the company’s most productive segment. In recent years, its revenues have grown by almost 50% annually. There are several reasons for this – the resumption of practical classes after the pandemic and the addition of six new campuses. The segment is now geared for growth, and students can attend most of the courses, which should allow the company to maintain its growth rate.

AFYA investors presentation Q3 2023

The image above represents the growth of continuing education students. Last year, we saw a strong recovery from the pandemic levels. That is apparent from the healthy growth.

Digital services

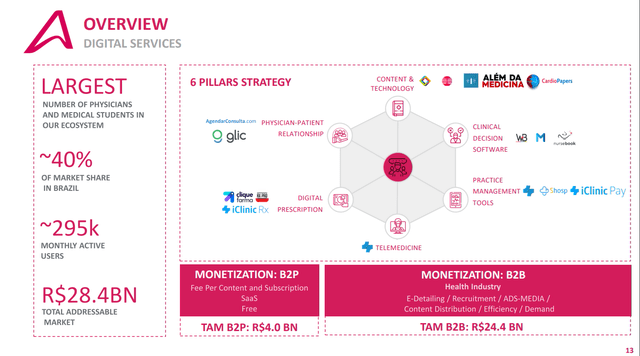

Digital Services segment revenue is estimated at BRL190 million for 2022. This is up 25% from the previous year. This segment has two categories: B2P and B2B. B2P is the main category of Digital Services, with a revenue of more than BRL166 million, while the B2B business generates BRL23 million. B2B revenue grew 154% annually last year and continues to grow. The combination of B2B and B2P has the potential to be a catalyst for future growth.

Management seeks new revenue streams beyond medical education with the expansion of the Digital Services segment. New focuses include pharmacy chains, hospitals, laboratories, and pharmaceutical companies. The image below illustrates the company`s strategy:

AFYA investors presentation Q3 2023

In the latest financial report for Q2 2023, Afya published information about 100 contracts signed with 45 different companies in the pharmaceutical sector. I assume that these numbers are yet to grow, and the role of the Digital Services segment will be increasing.

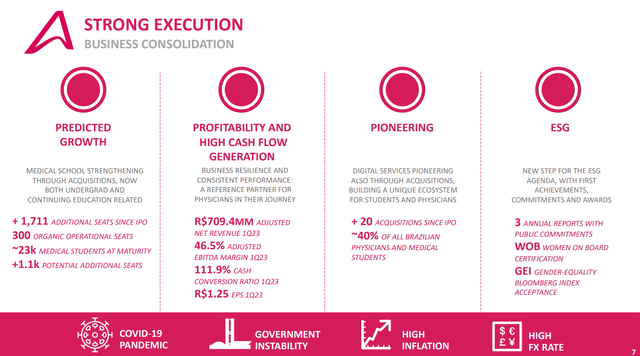

All three segments have performed successfully in recent years. The number of places available on campuses and students enrolled is increasing. Revenue per customer (Net average ticket) is growing steadily. Struggling students and medics using Afya services are about 10% of the total for Brazil. The following graph from Afya Investors’ presentation presents the listed parameters:

AFYA investors presentation Q3 2023

Afya has successfully converted a growing number of users into steadily increasing revenues at relatively stable costs, which translates into growing operating and net profits. The bottom graph from the last presentation shows it:

AFYA investors presentation Q3 2023

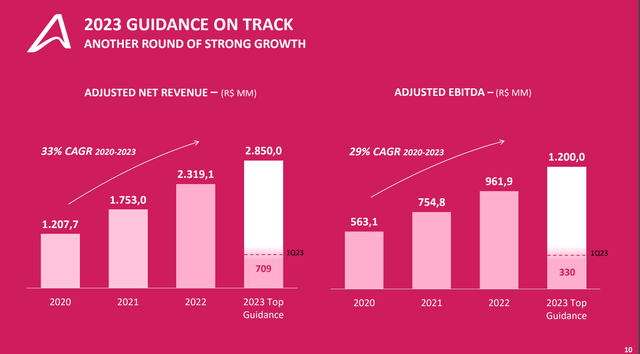

Net income in the fourth quarter of 2022 reached BRL595.1 million, an increase of 17.8% year-on-year. Revenue for the full year 2022 was BRL2,319.1 million, a growth of 32.3% year-on-year. The company expects revenue for 2023 from R$2,750 million to R$2,850 million. Adjusted EBITDA for the full year 2022 is BRL961.9 million, a growth of 27.4% per year. Adjusted EBITDA margin for the full year 2022 is 41.5%.

The company has borrowed capital skillfully to expand its operations, but without taking too many risks. That is visible on the company`s balance sheet. The table below shows the most critical ratios measuring the company`s solvency and liquidity:

|

EBITDA/Interest expense |

2.8 |

|

EBITDA-CAPEX/Interest expense |

2.8 |

|

Quick Ratio |

1.1 |

|

Current Ratio |

1.0 |

|

Net debt/EBITDA |

2.3 |

|

Net Debt/ EBITDA – CAPEX |

2.9 |

|

Long-term debt/Equity |

75 % |

|

Total debt/Equity |

84 % |

|

Total liabilities/Total assets |

56.8 % |

Sources of data: Seeking Alpha Afya company profile

It is worth mentioning Afya’s debt structure. 75% of the company’s debt is bonds issued on December 9, 2022, maturing in 2028. The other 25% is allocated through Soft Bank and Itau Unibanco SA loans. The company has liquid assets of $252 million, with which it can repay 75% of its long-term liabilities in the event of a crisis. At the same time, net profit and free cash flow significantly exceed the cost of servicing the liabilities.

The steady increase in customers in all segments has successfully translated into profits. The company can skillfully manage both sides – increasing revenue and balancing costs. The results are evident – Afya is a clear leader among its competitors.

|

Free cash flow/EV |

8.8 % |

|

Sales/EV |

30% |

|

Gross Margin |

62.7 % |

|

Operational Margin |

28.5 % |

|

ROI% |

7.7 % |

|

ROE% |

11.2 % |

|

Net income per employee |

13 360 $ |

Sources of data: Seeking Alpha Afya company profile

The company maintains high profit margins relative to the industry and its averages. This shows that the increase in users does not significantly increase costs. ROI and ROE have been slightly below Afya’s average for the past five years. At the same time, they exceed the industry average by 20%.

My favorite parameter, Net Income per employee, has grown steadily in recent years. It is above the company average by 22% and above the competition average by 35%. The long-term success of a company depends on the performance of its employees. A steady upward trend in net profits per employee illustrates this dependence.

People

When we buy a single share, we become business owners and delegate company management to its executives. That means one thing: we must know with whom we are dealing. That means who are the managers and who are the principal shareholders? The former tells us who will manage our funds, and the latter tells us about the other people who share our views.

The company’s shares are divided into two groups, giving different rights: class A and class B. 45 million B shares are divided between the company’s founders, the Esteves family, and the company’s largest shareholder, Bertelsmann SE & Co KGaA. 22 % of 47.9 million class B shares are owned by Bertelsmann SE & Co KGaA. The remainder is distributed among institutional investors, company employees, and other shareholders.

Only 33.6% of all shares are float (Class A shares only). This is a great advantage because the share price is determined by the market price, i.e., the price of the shares traded on the stock exchange (float).

Managers

- CEO Virgilio Gibbon – owns 1.54% of the company’s Class A shares

- Chair Nicolau Esteves – holds 0.25% of Class A shares and 36.5% of Class B shares

Investors

Significant funds own a large proportion of A-shares. They are as follows:

- Bertelsmann SE & Co KGaA – a fascinating company, owning 44% of all shares (class A and class B) of Afya. This is not an investment fund but a media conglomerate. It holds some of the world’s most popular print and television media – the publishing house Penguin Random House, the record company BMG, and the television RTL. In recent years, the company’s interests have expanded into other sectors – education and services.

- Softbank Capital Partners – venture capital bank behind the first funding rounds of companies like Ali Baba and Media Tek. It owns 5.411% of the shares.

- BAMCO Inc, an American investment company, holds 4.15%.

- Esteves family members – own 18.6% of all shares (Class A and Class B).

The rule is simple – eat your own cooking. In Afya, insider ownership is well presented. It does not guarantee profitable investment but mitigates the risk of management acting solely for its interest.

Valuation

At this point, I will calculate the intrinsic value of Afya. For this purpose, I use a 2 Stage Discounted Free Cash Flow Model by Professor Damodaran. For equation inputs, I use his database and Seeking Alpha’s symbol page for Afya.

Assumptions and inputs:

- Risk-free rate is equal to the 5Y average of US long-term Government bond Rate – 2.2%

- Perpetual growth rate, g, is equal to the 5Y average of US long-term Government bond Rate – 2.2 %

- Brazil’s equity risk premium is 9.6 %

- Education industry unlevered Beta 0.90

- Education Debt to Equity ratio 30.61 %

- AFYA effective tax rate 5Y average 7.9 %

The above parameters are inputs in the following steps:

1. Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E)

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk Free Rate + (Levered Beta * Equity Risk Premium)

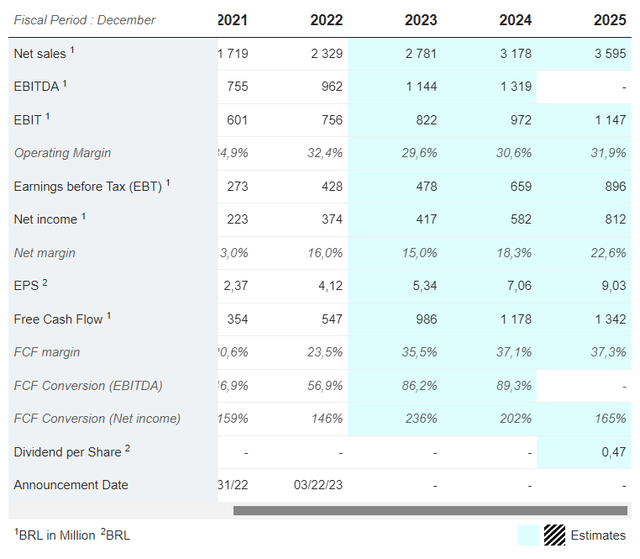

3. Stage 1: I calculate the present value of discounted free cash flows for ten years using 2024 FCF estimates from Market Screener. I assume the FCF will grow at a stable rate of 2.2 %.

Market Screener AFYA projections

4. Stage 2: I calculate the Terminal Value of the free cash flows over ten years at stable growth into perpetuity, g, and the resulting discount rate. Then, calculate the present value of the Terminal Value:

Terminal Value = FCF2033 × (1 + g) ÷ (Discount Rate – g)

Present Value of Terminal Value = Terminal Value ÷ (1 + r)10

5. Sum the final results of stage 1 and stage 2. Their sum is called the Total Equity Value (TEV);

Total Equity Value = Present value of next ten years cash flows + Terminal Value

6. Divide the TEV by the total number of company-issued shares. The result is the intrinsic value of the acacia, which I compare against the current market price.

For Afya, I get the following results:

Levered Beta = 0.972

Discount Rate = 11.5 %

Total Equity Value = $2,612,295,000

Total shares outstanding = 89,900,000

Intrinsic value per share = $29.35

Current market price = $14.78 (as of Aug 23, 2023)

The margin of safety at the current market price of $14.78 is 49%. I get more than I pay – for every dollar of future free cash flow, I pay $0.51.

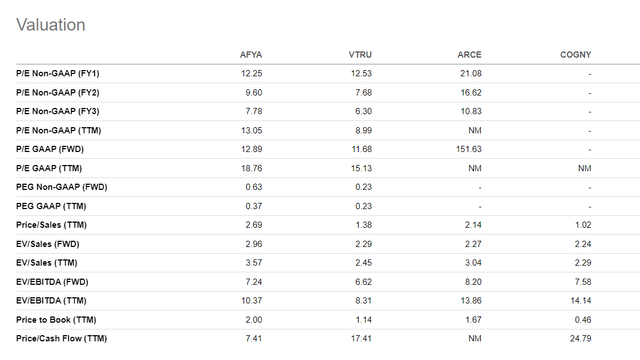

Afya has a relatively higher valuation than its main competitors in Brazil based on Price/Earnings and Price/Book. I consider these ratios very generic with little informational value. I prefer to use EV/Sales and EV/cashflow. They give a better picture of what is happening at the core of the business and how to convert the revenue into cash flow. Considering those ratios, Afya is relatively cheaper. The table below compares Afya with its Brazilian competitors.

Seeking Alpha AFYA profile

Based on the 2-stage discounted cash flow model and relative valuation against its peers, Afya is undervalued. That means we have a sufficient margin of safety. The current price is an excellent opportunity to start building a long-term position.

Risks

The Brazilian economy and stock market closely follow the commodity cycle. That’s why the charts of IBOVESPA companies resemble those of a mining company – sharp declines followed by epic highs followed by new lows.

Apart from that, Afya carries two company-specific risks: strong dependence on acquisitions-and Brazilian Ministry of Education regulations. The company has been proven to be a capable capital allocator for the last two decades. But it is not guaranteed to keep up with its standards in the future. The company`s balance sheet did not suffer from asset impairment in the last two years, but it is not too late to happen.

The other risks stem from the regulatory frame the Brazilian Government and the Ministry of Education pose. That has two-fold implications. The first one is the Higher Education Student Financing Fund or FIFE. It helps low-income students to pay their fees. Changes in that program might affect AFYA’s cash flow because of more extended reimbursement periods.

Conclusion

I give Afya a Strong Buy because of the significant tailwinds for the Brazilian economy and the company’s strengths. Combined with a great price, it brings a distinct opportunity to bet on Brazil’s rising physician demand. Afya is an excellent company with a robust balance sheet providing liquidity and solvency, the ability to convert an increasing number of customers into growing net profit and cash flow, and has a capable leadership with skin in the game.

The current share price is an excellent opportunity to start building a position while the company is still overlooked. Once it gathers investors’ focus, the price will be higher. The last two earnings calls affected the share price but did not change the fundamentals. Afya’s s customer base and revenue keep rising while the costs will remain relatively steady. Investors will recognize the company’s strengths in the next 12-18 months, and its share price will move accordingly.

Read the full article here