Introduction

ADMA Biologics (NASDAQ:ADMA) is a commercial biopharmaceutical company that specializes in creating plasma-derived biologics for treating immunodeficient patients. Through its subsidiaries, ADMA BioManufacturing and ADMA BioCenters, the company produces and distributes FDA-approved products such as Bivigam and Nabi-HB. Originating from the acquisition of the Biotest Therapy Business Unit, ADMA also operates a plasma fractionation facility in Boca Raton, FL. Additionally, ADMA offers contract manufacturing, laboratory services, and aims to expand its range of plasma-derived therapeutics.

The following article discusses ADMA Biologics’ financial performance, growth potential, challenges, and my recommendation to “Hold” their stock due to financial concerns.

Q2 2023 Earnings

Looking at ADMA’s most recent earnings report, the Q2 2023 revenues rose to $60.1M from $33.9M in Q2 2022, a 77% increase mainly due to higher sales of immunoglobulin products Asceniv and Bivigam. This growth was slightly offset by a $1.4M decline in third-party plasma sales. Q2 2023 saw a gross profit of $16.7M (27.8% gross margin) compared to $7.8M in Q2 2022, with a potential 31-32% normalized gross margin considering a $2.1M IT disruption cost. The consolidated net loss was $6.4M in Q2 2023, improved from a $13.8M loss in Q2 2022, while Adjusted EBITDA stood at $6.4M, a significant boost from a loss of $6.3M a year prior. As of June 2023, working capital was $224.3M, with cash on hand at $62.5M.

Cash Runway & Liquidity

Turning to ADMA’s balance sheet, ‘cash and cash equivalents’ sum up to $62.5M. In examining their operating activities, the company experienced a net cash usage of approximately $20.8M over six months, translating to a monthly cash burn rate of about $3.47M. Should this rate of consumption remain steady, and using our aforementioned asset aggregate, ADMA can potentially maintain operations for roughly 18 months. However, these values and estimates are based on past data and might not forecast future performance.

As for liquidity, the firm possesses an array of current assets amounting to $266.2M, offering flexibility in addressing short-term financial obligations. Their current liabilities stand at approximately $41.9M, indicating a comfortable current ratio. The company does, however, have significant long-term debts, particularly a senior note payable net of $140.3M. Given their current assets and the debt burden, the company might face challenges in securing additional financing, unless they can demonstrate potential profitability or other compelling reasons to prospective lenders. These observations and/or estimates are my own and might vary from other analyses.

Valuation, Growth, & Momentum

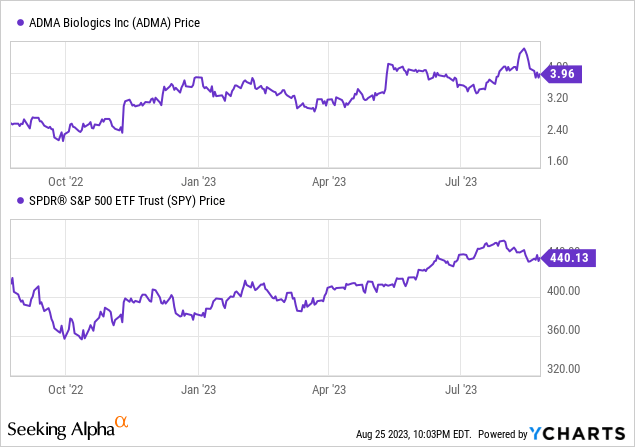

According to Seeking Alpha data: ADMA exhibits a capital structure with a relatively moderate debt position compared to its market capitalization, and a small cash reserve. Its enterprise value stands at $959.39M. In terms of valuation, the company is hard to gauge with non-GAAP P/E and GAAP P/E both being non-measurable, though the Price/Book ratio indicates a potential overvaluation at 5.92 times. Growth-wise, ADMA is in a post-revenue phase, evidenced by its growing sales. The projected sales and EPS growth rates for the next few years are optimistic, particularly for 2025. Stock momentum appears favorable, outperforming the S&P 500 across multiple time horizons, notably with a year-over-year return of 42.80%.

ADMA Rides the High Wave: Revenues and Revisions!

In the latest earnings call, ADMA Biologics shared some upbeat financial news, showcasing an impressive 160% jump in adjusted EBITDA and a hearty 77% surge in revenues compared to the previous year. Much of this success can be credited to thoughtful leadership, strong operational strategies, and rising revenues. Riding this wave, ADMA has bumped up its revenue forecasts for 2023 to $240 million, and for 2024 and 2025, the figures touch $275 million and $325 million, in that order.

Some Takeaways:

- Financial Muscle: ADMA stands tall in a crowd of biopharma peers, owing to its distinct blend of robust revenue growth and adjusted EBITDA. This is bolstered by its rare asset worth and its blossoming presence in the massive $10 billion immunoglobulin sector.

- Spot in the Market: ADMA continues to carve its path as a dynamic supplier of immune globulin in the U.S., rooted in its targeted approach to patients with primary immune deficiencies. Their record treatment numbers in the recent quarter are testament to their firming grip on the market.

- Setting Products Apart: ADMA’s product, Asceniv, shines because of its singular blend and its proven efficacy in real-life scenarios, notably for those with primary immunodeficiency. Its role in fending off respiratory viral infections in these patients could be a game-changer in the market.

- Eye on Expansion: The company isn’t resting on its laurels and is exploring growth avenues, like ramping up Asceniv’s production, enhancing yields, and engaging in after-market clinical studies. It’s worth noting that the revised revenue projections haven’t incorporated the potential wins from these endeavors.

- Building a Robust Supply Chain: ADMA is bolstering its supply network by growing its Biocenters collection and partnering with third-party entities. They’re proud to say nine of their ten collection hubs are FDA-approved, with the last one on track for 2023.

The worth of the immunoglobulin domain, meshed with ADMA’s growth streak, paints a bright future for the company. Their niche focus on the immune-deficient demographic gives them an edge, and their current projects might enhance their market slice. Still, like any business, their future will hinge on constant innovation, smart supply chain management, and adapting to market shifts.

My Analysis & Recommendation

The progress at ADMA Biologics over the past two years is undeniable. A tripled stock price within this timeframe clearly underscores the market’s recognition of the management’s ability to deliver on their promises. The company’s meteoric 77% revenue rise, impressive growth in the gross profit margin, and the reduction of net losses, all play their part in telling a compelling story.

However, investors should take care not to be overly swayed by optimism. ADMA’s narrow cash runway, with a monthly burn rate of about $3.47M and a potential 18-month operational window, demands attention. It’s commendable that they’ve managed to decrease their net losses, but the reality remains that they’re still in the red. With the company’s stock having already risen so sharply, it’s prudent to question how much more upward momentum remains, especially when balanced against the company’s ongoing financial challenges.

Another point of consideration is ADMA’s capital structure. While they maintain a respectable position relative to their market capitalization, their small cash reserve combined with a significant senior debt might make securing additional financing a tougher task. Lenders usually prioritize profitability and stability, so ADMA’s challenge lies in convincing them of their future potential.

In the coming weeks and months, keen-eyed investors should watch out for:

-

Cash Burn Rate: Any fluctuations could alter the operational runway and impact the company’s medium-term stability.

-

Further Financing Activities: Especially in light of their current debt and limited cash reserves. How they address this will be telling.

-

Market Positioning: With their unique products and emphasis on the immunodeficient demographic, any significant market shifts or innovations will be pivotal.

Given the company’s current standing and the factors outlined above, I recommend a “Hold” stance on ADMA Biologics stock. While their progress is remarkable and merits applause, the inherent risks related to their financial health cannot be ignored. An investor should await clearer signs of long-term profitability or further stabilization of their cash position before making more aggressive moves.

Read the full article here