A Quick Take On Park City Group

Park City Group (NASDAQ:PCYG) provides various supply chain software functionalities to businesses worldwide.

I previously wrote about Park City with a Hold outlook.

While the company appears to have the makings of improving operating leverage, management will need to do more to reignite revenue growth despite the potential for a slowing macroeconomic environment if it is to create a further upside catalyst for the stock.

I’m Neutral [Hold] on PCYG for the near term until we see evidence of higher growth.

Park City Group Overview And Market

Murray, Utah-based Park City Group was founded to provide B2B supply chain software systems to organizations seeking to improve efficiencies and reduce risks in their supply chain processes and relationships.

The firm is headed by Chairman and CEO Randy Fields, who co-founded Mrs. Fields’ Cookies and developed early versions of software that were spun off into what became Park City Group.

The company’s primary offering is its ReposiTrak system, which provides the following solutions:

-

Supplier Discovery Marketplace

-

Compliance Management

-

Supply Chain Solutions

The firm acquires customers via its in-house sales and marketing teams.

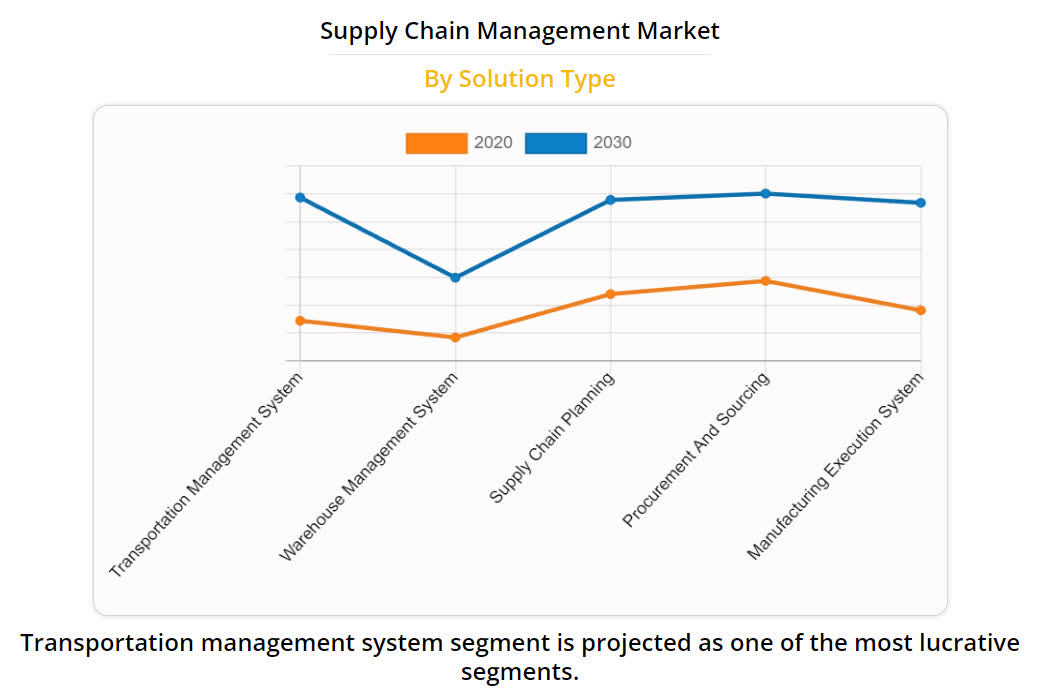

According to a 2021 market research report by Allied Market Research, the market for supply chain management software and services was an estimated $18.7 billion in 2020 and is forecast to reach $52.6 billion by 2030.

This represents a forecast CAGR of 10.7% from 2021 to 2030.

The main drivers for this expected growth are demand for increased supply chain visibility, especially after the disruptions caused by the COVID-19 pandemic.

Also, the chart below shows the supply chain management market changes between 2020 and 2030 by solution type:

Supply Chain Management Software Market (Allied Market Research)

Major competitive or other industry participants include:

-

Epicor Software

-

HighJump

-

Info

-

IBM

-

JDA Software Group

-

Kinaxis

-

e2open

-

Oracle

-

SAP

-

Manhattan Associates

-

Descartes Systems Group

-

Others

Park City Group’s Recent Financial Trends

-

Total revenue by quarter has grown at a low single-digit percentage growth rate; Operating income by quarter has turned upward more recently:

Total Revenue and Operating Income (Seeking Alpha)

-

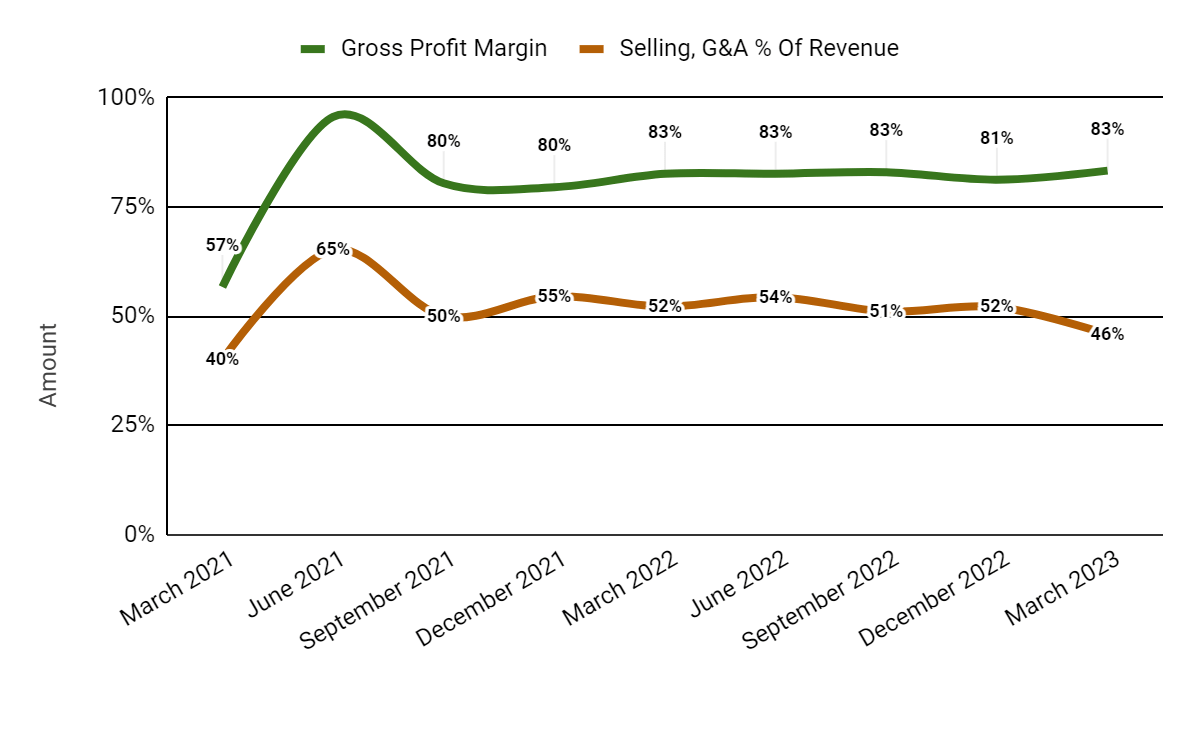

Gross profit margin by quarter has trended higher recently; Selling and G&A expenses as a percentage of total revenue by quarter have dropped in the most recent quarter:

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

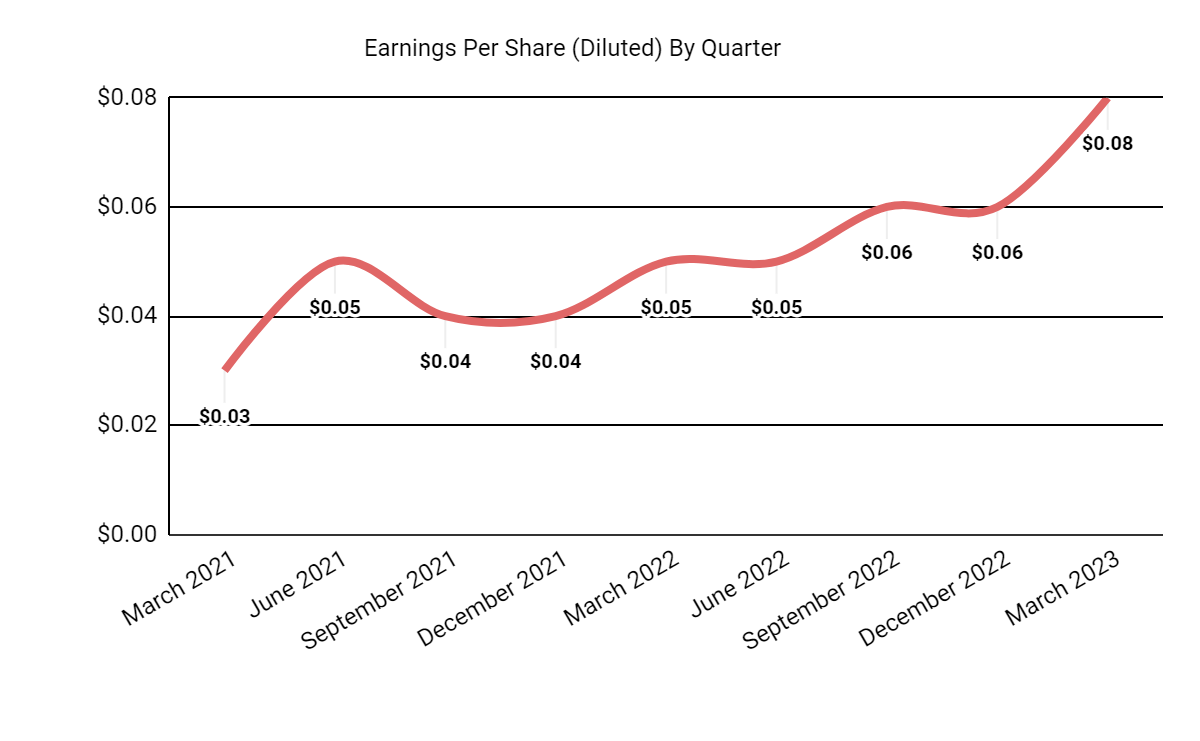

Earnings per share (Diluted) have continued to rise, per the following chart:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

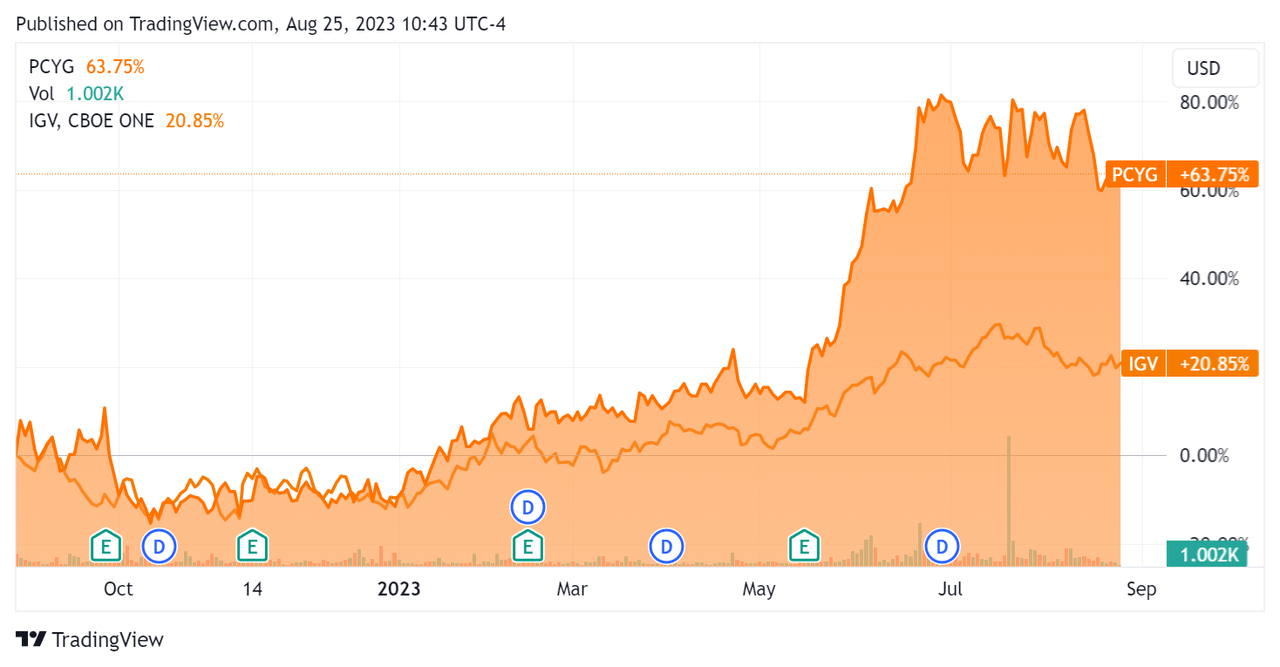

In the past 12 months, PCYG’s stock price has risen 63.75% vs. that of the iShares Expanded Technology-Software ETF’s (IGV) rise of 20.85%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $22.9 million in cash and equivalents and $0.4 million in total debt, of which $0.2 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $9.0 million, during which capital expenditures were $0.1 million. The company paid $0.4 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Park City Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

7.6 |

|

Enterprise Value / EBITDA |

24.1 |

|

Price / Sales |

8.8 |

|

Revenue Growth Rate |

4.5% |

|

Net Income Margin |

28.1% |

|

EBITDA % |

31.5% |

|

Market Capitalization |

$165,390,000 |

|

Enterprise Value |

$143,210,000 |

|

Operating Cash Flow |

$9,130,000 |

|

Earnings Per Share (Fully Diluted) |

$0.25 |

(Source – Seeking Alpha)

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation – PCYG (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $6.87 versus the current price of $8.95, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PCYG’s most recent unadjusted Rule of 40 calculation was 36.1% as of FQ3 2023’s results, so the firm has improved year-over-year, per the table below:

|

Rule of 40 Performance (Unadjusted) |

FQ3 2022 |

FQ3 2023 |

|

Revenue Growth % |

-10.5% |

4.5% |

|

EBITDA % |

32.1% |

31.5% |

|

Total |

21.6% |

36.1% |

(Source – Seeking Alpha)

Sentiment Analysis

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited ‘Challeng[es][ing]’ once and ‘Headwind’ four times.

Analysts questioned company leadership about its AI strategy and the firm sees value in increasing productivity through the use of AI and has also been developing products with enhanced intelligence to help clients serve their customers better.

The CFO was also asked about the firm’s M&A strategy and it appears the firm will focus more on stock buybacks and wait until valuation multiples come down in a more capital-constrained and uncertain environment.

Commentary On Park City Group

In its last earnings call (Source – Seeking Alpha), covering FQ3 2023’s results, management highlighted continued reduction in ‘certain high touch non-core’ revenue streams, which will create a ‘modest headwind’ for revenue in the near term.

Leadership believes it is seeing initial demand with its traceability customers and that the demand ‘will only accelerate’ as it has been picking up faster than expected.

Notably, the firm highlighted its operating leverage, with ‘a 6% in recurring revenue generat[ing] a 61% increase in the bottom line this quarter, meanwhile investing heavily in the ReposiTrak Traceability Network, or RTN.’

Total revenue for FQ3 2023 rose 4.3% year-over-year and gross profit margin increased by 0.7%.

Selling and G&A expenses as a percentage of revenue fell 6.3% year-over-year indicating increasing efficiencies and operating income rose 25.0%.

The company’s financial position is strong, with ample liquidity, very little debt and positive free cash flow.

Park City’s Rule of 40 performance has improved due to a positive revenue growth rate.

Looking ahead, full fiscal year 2023 revenue is expected to grow at 4.8%.

If achieved, this would represent a restart of revenue growth rate versus FY 2022’s decline rate of 13.3% over FY 2021.

Regarding valuation, the market is valuing PCYG at an EV/Sales multiple of around 7.6x on TTM revenue growth rate of 4.5% against a median Meritech SaaS Index implied ARR growth rate of 21% (Source).

The Meritech Capital Index of publicly held SaaS application software companies showed an average forward EV/Revenue multiple of around 9.3x on July 19, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, PCYG is currently valued by the market at a discount to the broader Meritech Capital SaaS Index, at least as of July 19, 2023.

Risks to the company’s outlook include an economic slowdown that may be underway, reduced credit availability which may affect customer/prospect spending plans and lengthening sales cycles which may reduce its revenue growth potential in the near term.

A potential upside catalyst to the stock could include increasing demand for its ReposiTrak Traceability Network offering.

While the company appears to be back on track to revenue growth, with gathering recession clouds getting darker, I remain cautious on the stock, so I’m Neutral [Hold] on PCYG for the near term.

Read the full article here