Tesla’s (NASDAQ:TSLA) stock has been on a steady decline since the company reported its Q2 earnings results a month ago. While we’re currently seeing a slight rebound in share price, the company faces several headwinds that could prevent further appreciation in the upcoming weeks. Even though Tesla has reported decent results and continues to ramp up its production to achieve its long-term goals, the ongoing price war in China along with the worsening of the Sino-American relations could undermine the company’s growth story in the foreseeable future. As investors are deciding what to do with their shares in the company, this article highlights the major challenges that Tesla already faces as it tries to diversify its supply chains to mitigate geopolitical risks.

The Great Diversification Begins

Let’s start with the good news. The latest earnings report for Q2 showed that Tesla continues to ramp up its production and in Q2 it set a new record by producing and delivering 479,700 vehicles and 466,140 vehicles, respectively. At the same time, its revenues during the period increased by 47.3% Y/Y to $24.93 billion and were above the estimates by $200 million. The company also had $23.1 billion in cash reserves at the end of June, which is an increase of 22% Y/Y primarily thanks to the $1 billion in FCF that it generated in Q2.

Another piece of good news is that Tesla is about to extend its lead in autonomous development in the following quarters as it recently started producing its supercomputer which goes under the name of Dojo.

What’s more, is that the company has started to actively mitigate geopolitical risks by diversifying its supply chain. Just last month, the news came out that Tesla is planning to launch the production of its cars in India, while in early August it was reported that the company has already started leasing office space in the country. On top of that, earlier this week Elon Musk himself admitted that he plans a trip to India next year, which signals that Tesla is truly interested in expanding its footprint in the most populous country in the world.

At the same time, there’s also an indication that Tesla is aiming to build its biggest Gigafactory so far with an annual capacity of 1 million vehicles in Mexico by 2025. At the beginning of this month, various popular outlets reported that Tesla had already hired its Chinese suppliers to set up EV component plants in Mexico.

All of those diversification efforts are certainly aimed not only at meeting the growing demand for EVs across the globe but also at decreasing Tesla’s exposure to China in case a Sino-American confrontation enters a new and more dangerous phase. However, those efforts still don’t fully solve Tesla’s problems.

Major Headwinds To Consider

Several major headwinds could undermine Tesla’s bullish case and prevent its shares from rallying again in the short to near-term. The first such headwind is the relatively weak performance of the Chinese economy. Considering that China is the second biggest market for Tesla, it’s likely that the company will be negatively affected by the fact that the country is on the brink of deflation as its consumer confidence wanes due to structural problems that the economy faces.

The deflation along with the ongoing Chinese EV war have already altered Tesla’s margin story. In Q2, Tesla’s GAAP gross margin was 18.2% against 25% a year ago and below the estimates of 18.7%. At the same time, its operating margin was 9.6%, down from 11.4% a quarter ago. Considering that Tesla recently once again trimmed prices for some of its models in China, there’s a risk that margins would contract even more in the following months.

What’s interesting though is that despite those cuts, the company’s deliveries fell to record lows in July. While some of this is attributed to the retooling of the Shanghai Gigafactory, there’s still an indication that the company is set to miss its 2023 sales growth target.

On top of that, the company’s main competitor BYD (OTCPK:BYDDF) is also catching up and could pose a threat to Tesla’s dominance in the EV business in the foreseeable future. In addition to expanding its presence in China, BYD’s flagship SUV has recently outsold Tesla in Sweden, while the company’s global market share in the EV industry has increased to 16.2% against Tesla’s 21.7%.

As for the geopolitical risks, it becomes obvious that Sino-American relations are likely to enter a new phase of confrontation in the future, which could make it even harder for Tesla to achieve its goals. In addition to getting its cars banned in various public places across China, Tesla’s battery supply chain continues to greatly rely on Chinese companies. Considering that China recently imposed export controls on various materials that are needed to create semiconductors, while the Biden administration restricted investments into the Chinese tech sector, a further confrontation could disrupt Tesla’s supply chains that rely on undisrupted globalization to grow the business.

What’s Next?

Considering all of this, there are questions about whether Tesla would be able to continue to trade at a significant premium if its business is at a constant risk of disruption by external forces. Its shares have already depreciated in recent weeks after they’ve entered the overbought territory but with a forward P/E and forward P/S of over 60x and ~7x, respectively, there’s a case to be made that there’s still more room to fall in case additional negative news comes out.

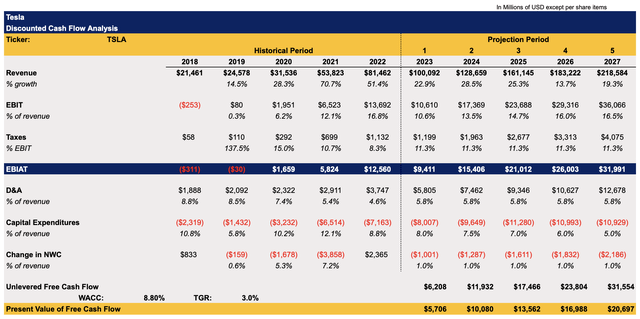

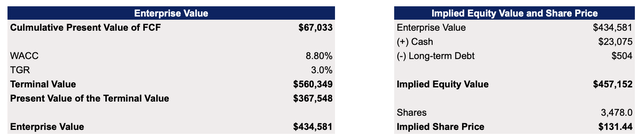

Given the amount of challenges Tesla currently faces, the street has already made a number of downward revisions for the following quarter due to the tough environment in which the company operates. In addition, even though my updated DCF model below showed that the company would continue to grow at a double-digit rate with a WACC of 8.8% and a TGR of 3%, while its earnings would slowly rebound, it appears that Tesla’s shares nevertheless trade at a significant premium based solely on the fundamentals.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The model shows that Tesla’s fair value is $131.44 per share, below the current market price.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

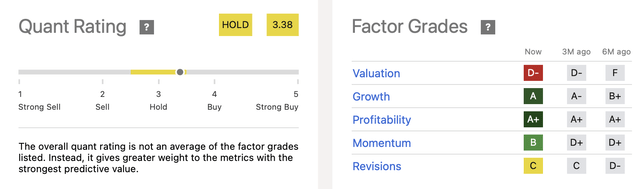

Seeking Alpha’s Quant system also shows that Tesla is overvalued solely based on the fundamentals as it has given its stock a rating of D- for the valuation and an overall rating of Hold.

Tesla’s Quant Rating (Seeking Alpha)

Despite this, it doesn’t mean that Tesla would suddenly depreciate to those levels on no negative news. We shouldn’t forget that Tesla is a growth stock that has been trading at excessive premiums for years thanks to the constant improvement of its top-line performance that was fueled by the aggressive increase in cars sold. The street and my model itself show that the company’s revenues are expected to continue to grow at a double-digit rate in the following years. This might indicate that even if Tesla’s shares depreciate in the following months, they would still be trading at a decent premium to the fundamentals if the company manages to adapt to the constant disruptions to its operations.

However, if the geopolitical risks substantially increase in the following months and Sino-American relations enter a new phase of confrontation, then overvalued stocks of businesses that rely on undisrupted globalization such as Tesla are likely to experience the most amount of pain in such a scenario.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here