While going through the performance of one of my smaller portfolio diversifiers, the KraneShares Global Carbon ETF (KRBN), I noticed that the KraneShares California Carbon Allowance ETF (NYSEARCA:KCCA), a sub-component of KRBN, had been performing much better than KRBN (Figure 1).

Figure 1 – KCCA had been outperforming KBRN (Seeking Alpha)

Since my article on KRBN, the KCCA has outperformed the flat performance of KRBN by almost 20%. Why has KCCA outperformed, and should I consider adding KCCA to my portfolio?

Fund Overview

The KraneShares California Carbon Allowance ETF provides targeted exposure to the California Carbon Allowances (“CCA”) cap-and-trade carbon allowance program.

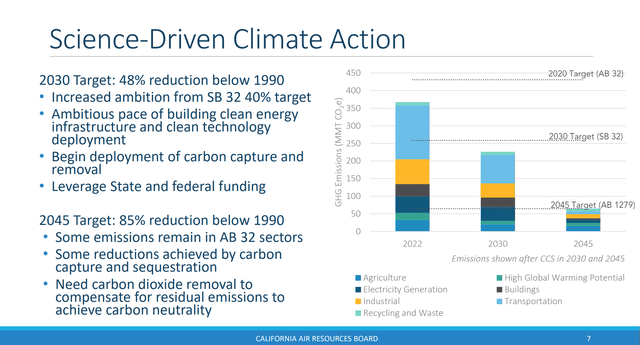

California is a global leader in climate policies and the CCA cap-and-trade program was started in 2012 and is implemented by the California Air Resources Board (“CARB”). CCA covers about 80% of California’s greenhouse gas emissions. Under current regulations, California plans to reduce carbon levels to 60% of 1990 levels by 2030 and achieve carbon neutrality by 2045. To achieve this objective, the California emissions cap is reduced 4% per year.

The KCCA ETF has $262 million in net assets and charges a 0.81% expense ratio.

Carbon Credits As A Portfolio Diversifier

Before delving deeper into the performance of KCCA, let me refresh readers on why carbon credits may be an attractive investment.

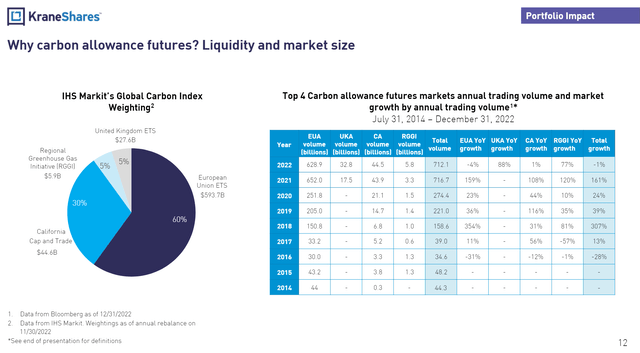

First, carbon credits is a novel and fast growing market. IHS Markit, a market research firm, estimates that the four largest global carbon futures markets (EUA, CCA, RGGI, and UKA) transacted over $700 billion in 2022, making carbon credits one of the largest alternative investment asset class (Figure 1).

Figure 1 – Carbon credits are a fast growing asset class (Kraneshares investor presentation)

However, transactions in carbon credits are typically reserved for emitters and other regulated entities, so KraneShares’ ETFs are one of the few ways for retail investors to gain access to this market.

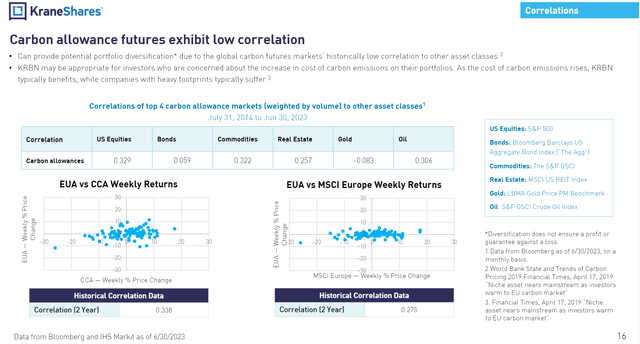

A second reason why carbon credits may be attractive is because historically, carbon credits have exhibited low correlations to other asset classes like equities and bonds (Figure 2).

Figure 2 – Carbon credits may act as a portfolio diversifier (Kraneshares investor presentation)

So an allocation to carbon credits may enhance overall portfolio returns through diversification.

Finally, for investors who have exposure to companies negatively impacted by tightening carbon credit programs (i.e. heavy industrial companies), investing in carbon credits can act as a portfolio hedge.

Portfolio Holdings

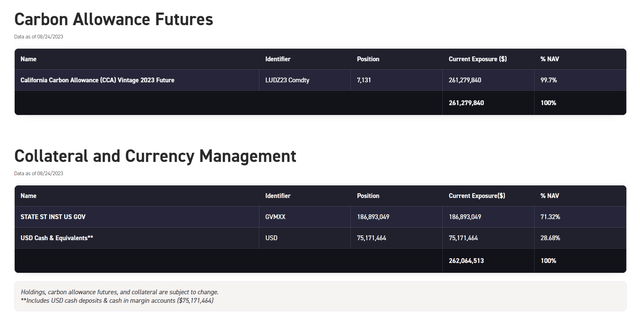

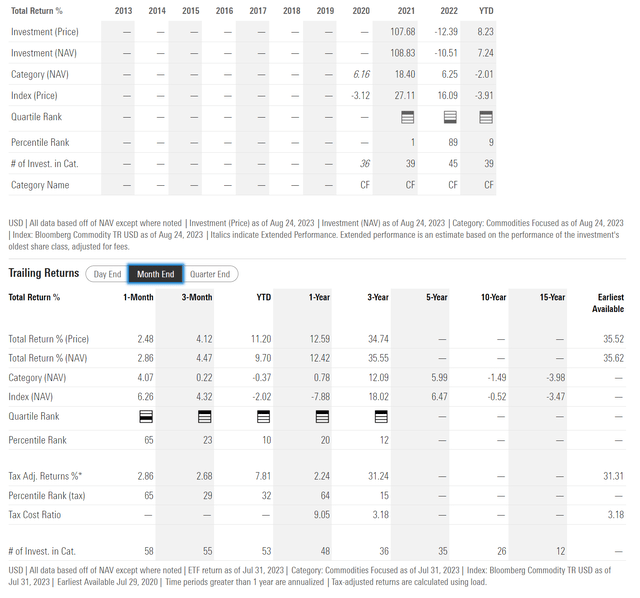

Figure 3 shows the current holdings of the KCCA ETF. The KCCA ETF is a pure play on CCA futures, so its holdings is 100% invested in 2023 CCA futures with excess cash invested in treasuries.

Figure 3 – KCCA holdings (kraneshares.com)

Returns

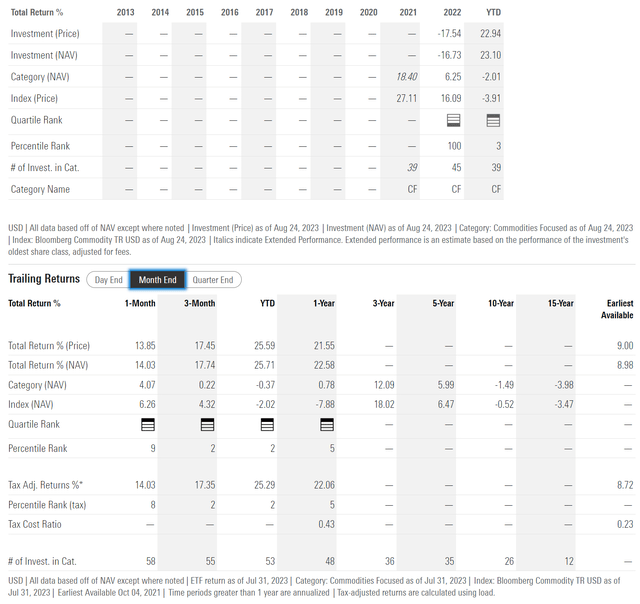

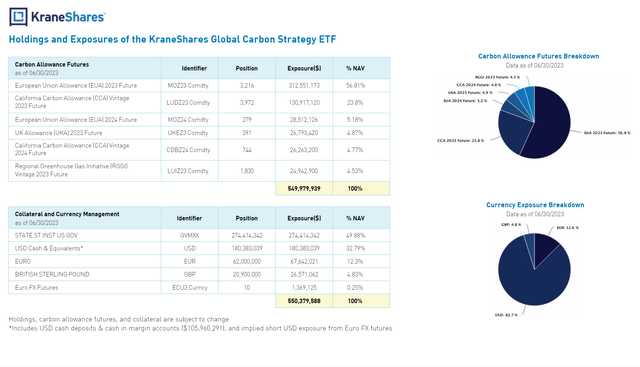

The KCCA ETF was only launched in late 2021 and since inception, returns for KCCA have been volatile. 2022 was a down year for KCCA, while returns so far in 2023 have been robust. Overall, this returns profile gives KCCA a 9.0% average annual return since inception to July 31, 2023 (Figure 4).

Figure 4 – KCCA historical returns (morningstar.com)

Figure 5 shows the returns of the KRBN ETF for comparison. KRBN was launched in 2020 and stormed out of the gates in 2021 with a 108.8% return. However, 2022 returns were soft, and YTD to July 31, 2023, KRBN has underperformed KCCA (Figure 5).

Figure 5 – KRBN historical returns (morningstar.com)

What Explains KCCA’s Outperformance versus KRBN In The Past Few Months?

Coming back to the main point of this article, what explains KCCA’s recent outperformance relative to KRBN and should investors consider adding KCCA as a supplement to their KRBN holdings?

First, we need to understand that the KBRN ETF invests in all four of the major carbon futures markets, namely the EUA, the CCA, the RGGI, and the UKA (see chart below). Within the KRBN, EUA futures hold the largest weight at 57%, while CCA is at 24%.

Figure 5 – KRBN allocation to various carbon markets (Kraneshares investor presentation)

EUA Soft On Surge In Renewables And Weak European Economy

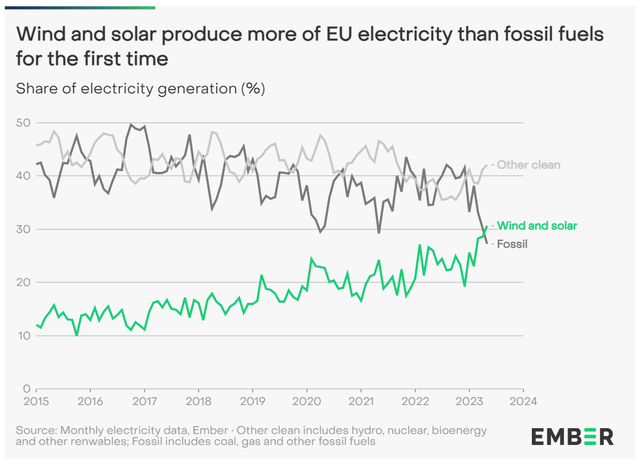

European EUA futures have underperformed so far in 2023 primarily on lower power-related emissions in the European Union. According to the energy think tank EMBER, EU power emissions were 17% lower in H1/23 vs. the same period in 2022 as Europe saw an uptick in power generation from renewable sources such as hydro, wind, and solar. In particular, hydro rebounded in 2022 as the region recovered from a severe drought in 2022. For the first ever, wind and solar combined produced more of EU’s electricity than fossil fuels in 2023 (Figure 6). Lower power generation from fossil fuels will reduce the demand for EUA credits/futures.

Figure 6 – Wind and solar overtake fossil fuels (ember-climate.org)

Furthermore, a slowdown in industrial demand continued in Europe due to high energy prices and disruptions from the Russia/Ukraine war, leading to less demand for carbon credits.

California Looking To Tighten Climate Regulations

On the other hand, California CCA futures benefited from regulatory developments as the CARB is looking at potentially reducing excess allowances in circulation (representing about 5% of allowances in circulation) as well as implement a scoping study targeting 48% reductions in emissions below 1990 levels by 2030, an increase from the current 40% target (Figure 7).

Figure 7 – CARB looking to tighten emissions to 48% below 1990 levels (CARB)

The draft proposals are expected to be finalized by the end of this year, with changes taking effect in 2025, so some compliance entities may have been acquiring CCA credits/futures in anticipation of future deficits and/or price increases.

The combination of softer EUA markets combined with a robust CCA market have led to KCCA outperforming KRBN significantly in the past few months.

Weak European Economy May Weigh On EUA Futures

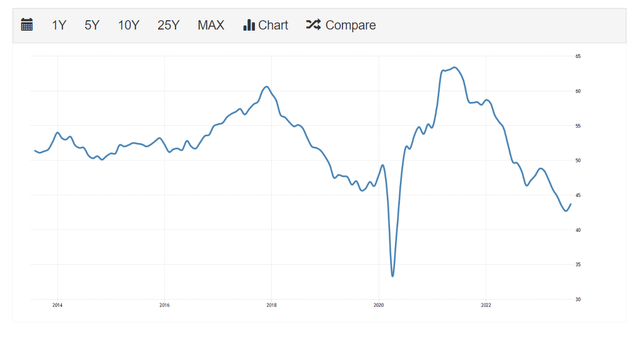

Looking forward, the European economy remains weak, with the latest manufacturing PMI registering at a contractionary 43.7 (Figure 8). This suggest heavy industrial demand for EUA credits may continue to be soft in the next few quarters.

Figure 8 – European economy remains weak, weighing on demand for EUA (tradingeconomics.com)

Therefore, for an investor currently holding the KRBN ETF, it may make sense to reduce one’s holding in KRBN and allocate capital to the KCCA, to address the potential weakness in EUA futures and take advantage of potential tightening in California climate policies.

For me personally, I am looking to reduce my KRBN holdings by 25%, which will take my EUA exposure down to 43% (0.75 x 57%). I will reallocate the 25% into KCCA, which will take my CCA exposure up to 43% (25% + 0.75 x 24%).

Conclusion

The KraneShares California Carbon Allowance ETF provides targeted exposure to Californian CCA futures. CCA futures is expected to outperform EUA futures in the coming quarters as the European economy stays weak, negatively affecting demand for EUA credits. On the other hand, CCA may benefit as California is looking to further tighten its emission standards at year-end, potentially increasing the demand/price for CCA credits.

I rate the KCCA ETF a buy and am personally looking to add the KCCA ETF to my portfolio to supplement my existing KRBN exposure.

Read the full article here