Introduction

Xeris Biopharma (NASDAQ:XERS), a biopharmaceutical firm, focuses on enhancing patient lives with innovative therapies. It offers products like Gvoke, Keveyis, and the FDA-approved Recorlev, while advancing further treatments using its unique XeriSol and XeriJect technologies.

The following article discusses Xeris’ financial performance, growth in product sales, research initiatives, partnerships, and future prospects.

Q2 Earnings Report

Looking at Xeris’ most recent earnings report, Q2 2023 witnessed notable revenue growth in its main products: Gvoke ($15.6M, up 36%), Keveyis ($14.1M, up 10%), and Recorlev ($7.2M, a significant increase from its launch). For the first half of 2023, total revenue reached $71.2M, marking a 50.3% growth. However, expenses also surged with a 57.1% rise in the cost of goods sold for Q2 2023 and increased research and development expenses by 63.7% for the same quarter, primarily due to the OPTICS study and product development costs. Selling and administrative expenses climbed 14.1% in Q2 2023 due to personnel, marketing, and new lease costs. Net loss stood at $19.8M for Q2 2023 and $36.7M for the first half. Cash on hand decreased, with $80.7M available at the end of June 2023, down from $122M at the end of 2022.

Cash Runway & Liquidity

Turning to Xeris’ balance sheet, as of June 30, 2023, the combined assets under ‘Cash and cash equivalents’, ‘Short-term investments’, and ‘Trade accounts receivable, net’ amount to $110.9M. When evaluating the company’s cash flow for the six months ending June 30, 2023, Xeris used approximately $39.9M for its operating activities. This translates to an estimated monthly cash burn of roughly $6.6M. Considering the company’s combined assets, their cash runway stands at approximately 16.8 months. It’s worth noting that these values and estimates are based on past data and may not accurately predict future performance.

In terms of liquidity, Xeris possesses a satisfactory reserve for short-term needs. However, it’s important to acknowledge the long-term debt on their books, standing at $188.2M, which indicates significant leverage. This debt might deter some potential investors or lenders. But, given the company’s assets and the possibility of securing revenues from its products and services, they could potentially secure additional financing if required. These observations and/or estimates are my own and might vary from other analyses.

Valuation, Growth, & Momentum

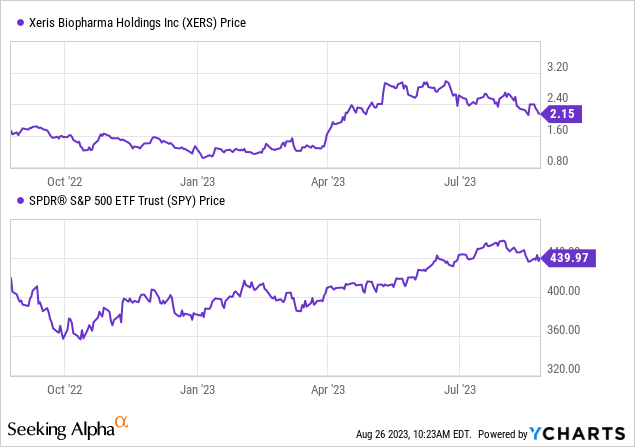

According to Seeking Alpha data: Xeris’ capital structure shows a significant amount of debt relative to its market capitalization, offset somewhat by a small cash position. The enterprise value stands at $442.54M. In terms of valuation, traditional metrics like P/E are not meaningful, but the company trades at an EV/Sales of 3.30. Xeris demonstrates strong growth, with sales projected to grow by +43.07% in 2023, and subsequent growth in the next two years. The stock has displayed strong momentum over the past year, outperforming the S&P 500.

However, with a market capitalization of just below $300M, potential investors should exercise caution: microcap stocks inherently carry higher risks due to liquidity concerns, potential for heightened volatility, and limited public information.

Q2 Earnings Call

Xeris is pioneering patient-centric solutions with an ambition to establish a robust biopharmaceutical footprint. They’ve consistently recorded a 50% YoY growth, with their Q2 revenue rising by 14% from Q1 2023. Among their products, Gvoke, targeting hypoglycemia, saw a 36% YoY boost. Recorlev, designed for Cushing’s syndrome, witnessed a staggering 640% growth from its 2022 Q2 numbers. Keveyis, even amidst generic competition, marked a 10% YoY growth.

On the research front, the company has initiated a Phase 2 trial for XeriSol Levothyroxine, aiming at a potential market worth up to “$3 billion”. They’ve also forged collaborations with pharmaceutical powerhouses like Merck (MRK), Horizon (HZNP), and Regeneron (REGN). Even though Merck opted out of a particular venture, the partnership provided Xeris with critical insights.

Financially, Xeris has updated its 2023 revenue forecast to range between “$145 and $165 million”, keeping an eye on achieving a positive cash flow by the close of the year. In summary, Xeris Biopharma’s impressive Q2 performance, coupled with their proactive approach to research and strategic alliances, signifies a promising trajectory ahead. Their financial aspirations hint at potential rewards for stakeholders in the near future.

My Analysis & Recommendation

Upon reviewing Xeris Biopharma, I’m struck by their consistent 50% YoY growth, particularly with core products like Gvoke and Recorlev. Their partnerships, notably with Horizon and Regeneron, signal strong strategic moves, and even if the collaboration with Merck wasn’t as fruitful, the lessons learned are invaluable.

The launch of the Phase 2 trial for a weekly, subcutaneous levothyroxine (as opposed to an daily oral) shows Xeris’ ambition to capture larger market shares (5% of Americans have hypothyroidism). However, I’m concerned about their hefty long-term debt of $188.2M. Their current liquidity seems short-term sound, but such significant leverage could make them susceptible in an unpredictable market.

Their revised 2023 revenue forecast and the aim to achieve positive cash flow by year-end speaks to their commitment. If they can sustain their growth while managing expenses and leveraging partnerships, profitability may not be a distant dream.

All in all, my investment recommendation is “Hold”. Xeris shows significant upside potential with its product growth and R&D initiatives. Still, the long-term debt, path to profitability, and microcap risks require caution. I recommend monitoring their financial performance in the next few months before committing further.

Read the full article here