I was very lucky with the timing on my last article on Curaleaf (OTCPK:CURLF), when I suggested that readers should sell the stock. This was in early July, and the stock had closed at $4.00. The stock fell sharply and is now at $2.90, down 27.5% in seven weeks. Not bad!

While some might want to declare a victory after a good call like that, I want to provide an update that suggests there could be more downside. The stock remains very expensive relative to peers. In this piece, I update my year-end target, which was $3.09 in early July. The company, though, reported its Q2, and the estimates have come down, and my target, which I share below, has too.

In this update, I provide a look at Q2 and the analyst estimates ahead, I review the chart, I discuss a big risk and also a possible growth driver, and I assess the valuation.

Q2

Revenue growth slowed in Q2 from Q1, increasing just 1%. This represented growth of 4% from a year ago to $339 million. Adjusted EBITDA fell far short of expectations, which were for $80 million, falling from $73.2 million in Q1 and $86.6 million a year ago to $70.0 million.

The balance sheet deteriorated and is stunningly risky. Cash fell 48% in the first half, and net debt has expanded to now $529 million. The company has a current ratio of just 0.9X, suggesting a potential liquidity event ahead. The company’s filings indicate that it will need to repay $53.5 million in debt in 2024 and $60 million in 2025. With just $85 million in cash, there could be a problem with debt maturity. The company has generated operating cash flow in 2023, but it has been exceeded by the capital spending. The tangible book value moved from -$592 million at the end of Q1 to -$722 million.

The Outlook

After a big miss on adjusted EBITDA, the forward estimates for 2023 and 2024 fell sharply. Ahead of the Q2 report, analysts were looking for 2023 revenue of $1.368 billion, increasing in 2024 to $1.471 billion. Now, the analysts expect revenue to increase 2% in 2023 to $1.36 billion and 6% in 2024 to $1.44 billion, a slight decline.

The outlook for adjusted EBITDA fell more sharply. The pre-report forecast was $343 million in 2023 and $386 million in 2024. Now the analysts project $301 million in 2023, a decline from 2022 of 1%, and then $358 million in 2024, up 19%. This would be a margin of nearly 25%.

The Charts

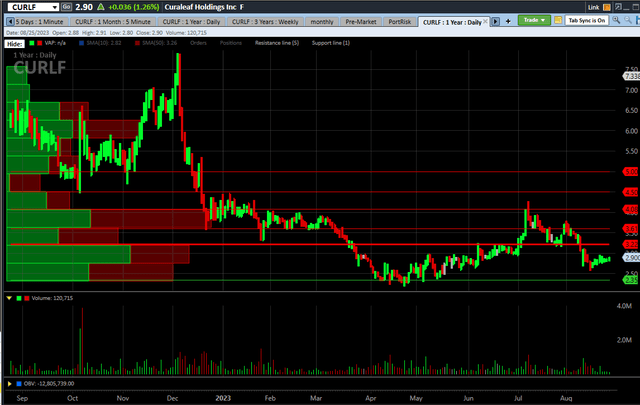

Curaleaf peaked in December near $8 and set a new all-time low in April:

Charles Schwab StreetSmart edge

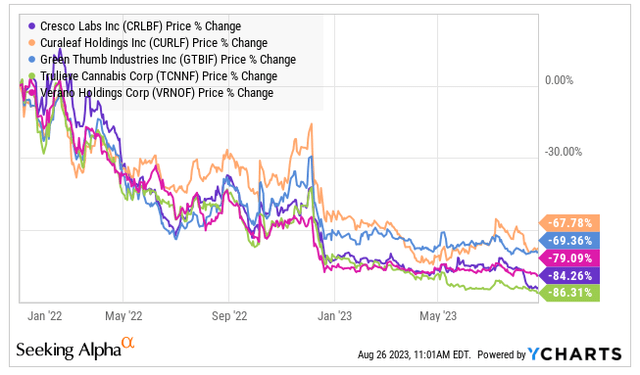

The stock is down a lot from the peak in 2021, but it’s not down as much as its peers. Here is a look since 12/31/21:

YCharts

CURLF is down the least, with Green Thumb Industries (OTCQX:GTBIF) close behind. The others, though, are down a lot more, with Trulieve (OTCQX:TCNNF) down the most, slightly worse than Cresco Labs (OTCQX:CRLBF). Verano (OTCQX:VRNOF) too has lost almost 80%.

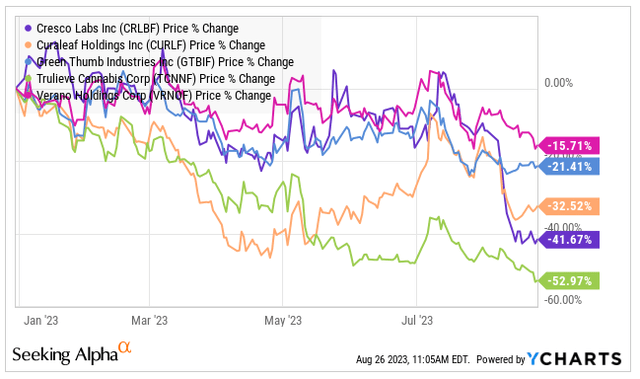

In 2023, CURLF is down, but two are down more:

YCharts

A Big Risk

AdvisorShares Pure US Cannabis ETF (MSOS) owns 67.6 million shares, over 21% of the fund and its second-largest position. This weighting is very high compared to the market cap relative to peers and to its market share.

In December, MSOS started seeing redemptions, and it actually sold shares of Curaleaf and others. Despite the recovery in the number of shares, which have increased 3.2% now year-to-date, they are still down more than 5% from the peak. The year-over-year growth has slowed dramatically and is just 16.3%. That ETF is down 29.9% in 2023, and it is losing its appeal to investors. If it begins to redeem again, it would likely sell some CURLF.

A Possible Driver of Growth

While it’s not a done deal yet, Germany may be moving towards adult-use legalization. Curaleaf stands out among peers for its involvement in that market after buying what it now calls Curaleaf International. The company it bought, EMMAC, cost $50 million and 17.5 million shares in 2021, a deal that was announced near the top of the market. The folks running it were the people who sold Nuuvera to Aphria in a very expensive deal in 2018. It sold at closing 31.5% of Curaleaf International to a single strategic investor for $130 million.

Curaleaf International is insignificant at present. It’s H1 revenue at $26.8 million was just 4% of overall revenue, and its contribution to gross profits is lower. Most of its sales are wholesale rather than retail.

My own view is that while it is exciting to see a major country liberalize its cannabis laws, the program may not be that big of a deal for Curaleaf in 2024. It’s not yet official, so the analysts may not be including anything. There is a chance that as Germany adopts the potential program, Curaleaf estimates may increase.

The High Relative Valuation

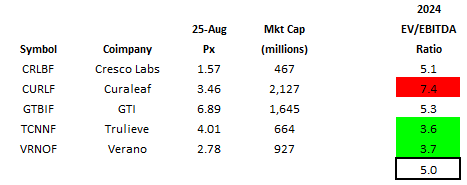

I have already pointed to the bad balance sheet, and this gets factored into my valuation through the use of enterprise value, which adds the net debt to the market cap. Here is the ratio of enterprise value to projected adjusted EBITDA for each of the largest MSOs:

Alan Brochstein, using Sentieo

Curaleaf commands a big premium, and I don’t believe it is justified. I have lowered my multiple of projected adjusted EBITDA from 7X to 6X, which is still higher than the current ratio for its four peers. Using the current 2024 projected adjusted EBITDA of $358 million, this works out to be $2.20, near the all-time low that was recently set in April. $2.20 represents a 24% decline from the current price. Of course, it could fall more. I am using 5X for some other MSOs, and this would represent $1.72.

Conclusion

While Curaleaf has fallen a lot since I called it out in early July and is down 32.5% year-to-date, it could fall more to get its valuation in line with peers. My year-end target is $2.20, a big decline from the current price, and it would represent a full year decline of 48%. It could fall about 10% lower to the round $2.00.

If MSOS sees share redemptions, this could result in the ETF selling the shares of its second-largest holding, but there is another source of shares: Curaleaf. I pointed to the weak balance sheet, and the company may need to sell stock to cover debt maturities. Either way, investors should be careful.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here