In a previous non-crypto article, I gave my rationale for why I suspect a recession is likely just around the corner. One of the more straightforward reasons that I can provide is that the Federal Reserve is now openly acknowledging a possible recession as well. Many of the traditional metrics that investors have paid attention to leading into a recession are flashing some warning signs. For the benefit of this specific article, I won’t re-hash the entire thesis from my prior work. But the main points are as follows:

- The 10s minus 2s are deeply inverted

- We had two negative real GDP print quarters in 2022

- Inflation adjusted retail sales peaked two years ago

- Consumer sentiment is horrid

In my view, these factors taken together could certainly justify moving portfolios to more of a risk-off strategy. For crypto investors, this is something that should also be considered. The problem for market participants in this industry is we don’t have a large amount of historical context to serve as a guide because most of these assets are less than 10 years old. Furthermore, the crypto response to the 2020 recession is unlikely to repeat unless there is a large and immediate pivot to easing from the central bank. While I won’t get into the probability of that happening, I will say that there are things we can do within crypto rails to play defense.

The Stablecoin Problem

One of the simplest approaches crypto investors can take right now is allocating to stablecoins. There are several to choose from, but the overwhelming majority of them still require a centralized custodian that has traditional banking rails for collateralization. My personal preference is to not utilize those strategies because of the counterparty risk. Especially heading into a recession where financial institutions are potentially holding collateral that is underwater.

USDC Peg (CoinMarketCap)

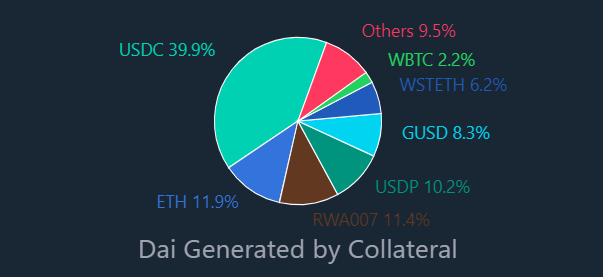

In mid-March we saw how exposure to traditional banking rails could lead to significant problems in the crypto market when USDC (USDC-USD) briefly de-pegged by more than 10%. One of the most popular decentralized stablecoins is Dai (DAI-USD) and even that coin wasn’t immune from the banking scare because it is collateralized by USDC to a large degree:

DAI Collateral (Daistats)

40% of DAI’s collateral backing is USDC. When USDC’s peg broke, DAI’s did too. While there are other decentralized stablecoins being developed on blockchains like Cardano (ADA-USD) that are very interesting, most of these coins are still experimental and subject to peg risks.

Litecoin Is Still Solid

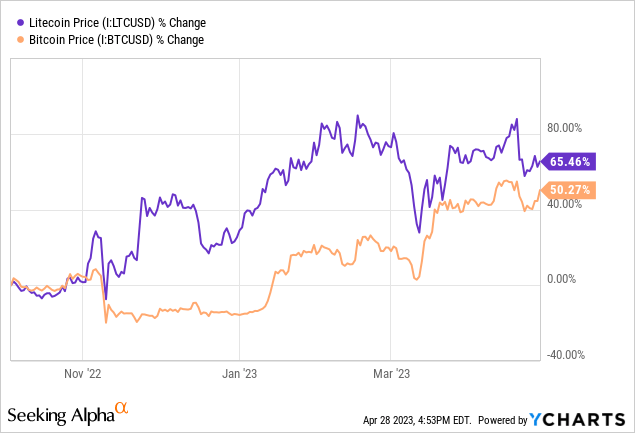

Back in October I wrote what I felt was a strong contrarian take on Litecoin (LTC-USD). Litecoin is a proof-of-work fork of Bitcoin (BTC-USD) that many in the crypto investment community choose to ignore. My view since October has been that skipping over LTC out of some nonsensical Bitcoin zealotry is silly and diversification within crypto makes sense.

Not only is Litecoin up more than 65% since that article was published, but it’s also the only top 10 layer one crypto that is beating BTC over the last 6 months. Much of what I talked about in that October article still applies today. It’s still one of the most distributed coins in crypto and one of the most widely used for payments according to BitPay.

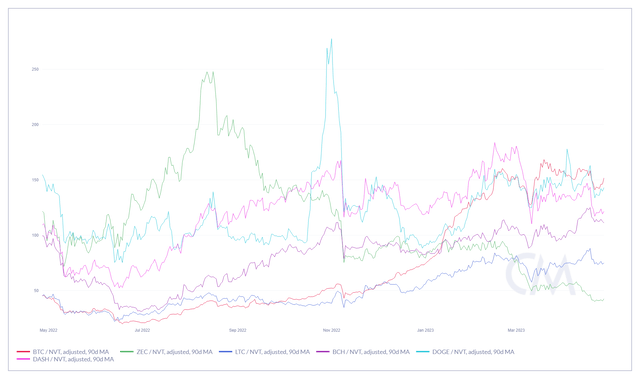

90 Day Adjusted NVT (CoinMetrics)

From a pure network valuation standpoint, only ZCash (ZEC-USD) is cheaper from a 90 day adjusted NVT ratio standpoint. The question for Litecoin bulls is how do you manage your holdings in a recession if valuations in the broader market are elevated and you’d prefer to not swap back into fiat or other cryptocurrencies? You can adopt a staking strategy to generate yield without giving up control of your keys.

How To Stake Litecoin

Even though Litecoin is a proof of work blockchain, it is possible to deposit LTC and return in-kind yield. The most popular ways to do this have historically been through centralized entities like Celsius (CEL-USD) or Nexo (NEXO-USD). However, there are obvious drawbacks going with that approach and Celsius didn’t survive crypto winter. Those depositors are still waiting for a portion of their funds back. Giving up control to a non-transparent, centralized custodian is not what I’m suggesting.

THORChain (RUNE-USD) allows Litecoin holders to deposit LTC on-chain and earn in-kind yield through THORFi “savers vaults.” These vaults differ slightly from THORChain LPs because the asset deposits don’t require RUNE exposure to qualify for rewards:

Savers Vaults are a pivotal innovation for THORChain and the first decentralized product to offer yield on native Bitcoin, and many other native assets. Users anywhere in the world can enter and exit THORChain Savers Vaults at will and earn yield without the need for wrapping, impermanent loss risk, or price exposure to multiple assets.

The difference between staking collateral through a proof-of-stake chain and doing it through THORChain is PoS staking usually generates returns from token emissions while THORFi savers are more similar to LPs for THORChain swaps. Essentially the yield comes from fees that users pay when they swap between chains. This results in an APR that fluctuates but the yields can often be higher than US treasury bills.

| Asset | Savers Depth | Savers Filled | Savers APR |

|---|---|---|---|

| BTC | $20.35M | 100.68% | 3.41% |

| LTC | $741.95K | 54.45% | 5.22% |

| DOGE | $224.61K | 22.64% | 7.46% |

| BCH | $203.95K | 33.65% | 4.30% |

Source: THORChain Explorer, PoW Coins

For Litecoin specifically, the coin’s annual inflation rate is currently 3.7%, which means the THORFi savers pool is currently generating a 1.5% real yield in the native asset if demand for the coin stays constant. This also doesn’t take the halving into consideration. Much has been made about Bitcoin’s halving which is roughly a year away. Litecoin also has an impending block reward halving but that halving is less than 100 days away.

Following that event, the LTC annual rate of inflation will drop to 1.8%. Assuming the THORFi savers vaults’ APR stays in line with current levels, LTC’s THORFi real staking yield will jump to 3.4% in the native asset.

Risks with THORFi

Of course, yield doesn’t come without trade-offs and one of the major risks inherent to any on-chain DeFi application is loss of funds through hot wallet phishing scams or a larger network hack. When providing liquidity through something like THORChain, the liquidity pools generate synthetic assets. What this means is when a user deposits LTC into THORFi savers vaults, what that user actually has is a claim on the LTC deposited rather than complete control of the original asset. The THORFI savers program is also variable rate. So as pool depth increases, the reward associated with staking through that pool could go down. Since the savers vaults are paying out swap fees to liquidity providers, more liquidity chasing less fees could also diminish the yield.

Crypto Commodities

There has been no shortage of instances lately of the Securities and Exchange Commission designating various cryptocurrencies as unregistered securities through enforcement actions. Despite Dash (DASH-USD) acting as a notable recent exception, the common thread that most of the SEC’s securities designations share is the coins had an ICO and are native to proof of stake chains. Litecoin never had an ICO. In a recent lawsuit against Binance (BNB-USD), the CFTC claimed Bitcoin, Ethereum (ETH-USD), and Litecoin are all commodities.

While I think we’re probably still quite a bit of time and litigation away from the US market getting better clarity on digital asset designations, it’s difficult for me to imagine the SEC trying to argue LTC is an unregistered security since it’s a proof of work coin with no centralized issuer and no initial coin offering. In the event the courts do find that a large majority of the crypto market coins are unregistered securities, it could position LTC fairly well as a digital commodity that is a cheaper alternative to Bitcoin.

Summary

This THORFi yield approach is not a strategy that everybody will want to do and it’s also not a strategy that everyone will be able to do. The savers vaults have depth levels and program fill targets. The Litecoin vault is only 54% filled and has the second best yield of the PoW THORFi offerings. For a more defensive-themed cryptocurrency portfolio, finding safer yield opportunities without forfeiting keys is an attractive option.

There aren’t a lot of individual assets or asset classes that figure to perform well in a recession. Crypto is likely not an asset class that will have a lot of winners in a recession and that’s if it has any winners at all. However, Litecoin specifically has a halving coming up in the very near future. It’s a coin that has legitimate utility as a decentralized payment network. Long term crypto holders that don’t want to convert back to fiat but that would like to position defensively can utilize THORFi savers to generate in-kind yield on LTC positions while they wait out a downturn.

Read the full article here