With interest rates sky-high and investors expecting more volatility throughout the end of the year, it has become abundantly clear to me that we need to pursue lesser-known single-stock positions to beat the markets. Smaller-cap stocks present great opportunities here, as long as they have a strong growth trajectory and are not tremendously overvalued.

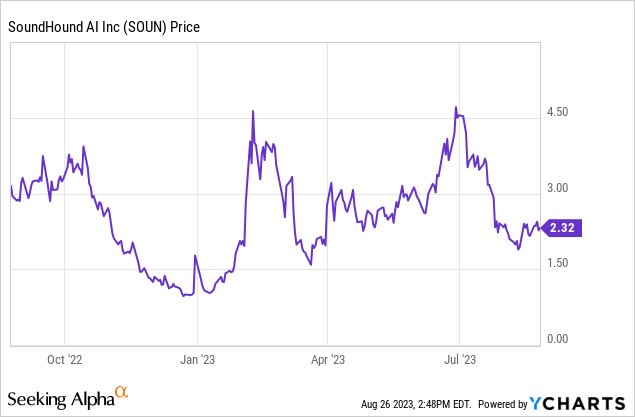

One lesser-known tech stock I’ve discovered recently is SoundHound (NASDAQ:SOUN), a conversational AI technology company that has indeed ridden the AI boom this year, but is down sharply from YTD highs near $5. Up more than 70% year to date but down more than 50% from this year’s peak reached in June, I think investors have a tremendous opportunity to capitalize on this early-stage tech name.

I am initiating SoundHound with a bullish rating. Now, a word of caution: this is a small-cap, volatile stock that has been a public company for barely over one year. Its revenue scale is still small and its ability to execute is still nascent. This being said, I think the company’s technology is exciting and its market opportunity wide enough to merit a limited position in your portfolio.

Many pillars to monetization in a broad market

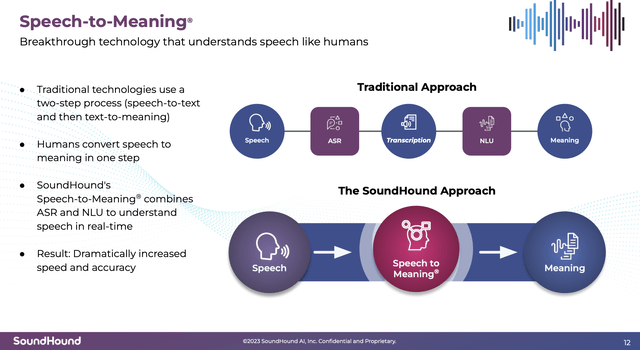

Few topics in technology have been as buzzy this year as generative AI. SoundHound has been playing in the space since its founding in 2005. One of the company’s core distinguishers versus other conversational AI platforms is its “Speech to Meaning” technology.

Most other AI platforms typically translate humans’ voice into text first, and then deploy a second function to translate that text into meaning. SoundHound’s technology, meanwhile, can replicate what humans can do: which is to translate speech to meaning within the same step. According to SoundHound, this capability improves both speed and accuracy of the platform’s translation capabilities.

SoundHound technology (SoundHound Aug 2023 investor presentation)

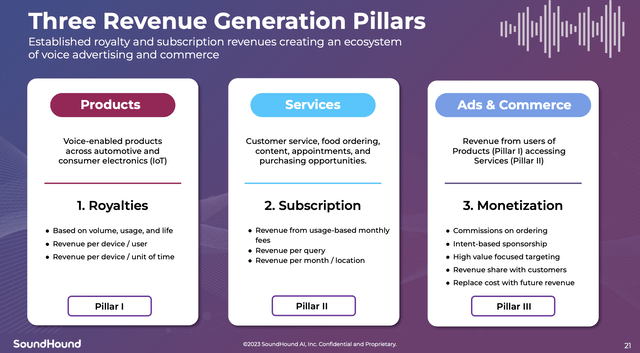

SoundHound can monetize this technology in three ways. Product revenue is generated when SoundHound supplies this technology as part of other OEMs’ products (as is the case for the company’s automotive deals). Services revenue is accrued when companies deploy SoundHound’s conversational AI for customer service use-cases, as is the case for the company’s fast-food drive through customers. And lastly, the technology can also be deployed to deliver voice ads on e-commerce platforms.

SoundHound revenue avenues (SoundHound Aug 2023 investor presentation)

Though SoundHound’s current revenue scale is rather small, the company has already signed up a very impressive client roster across various key verticals. The following snapshot, taken from SoundHound’s website, displays some of its most impressive blue-chip clients, especially in the auto industry:

SoundHound clients (SoundHound.com)

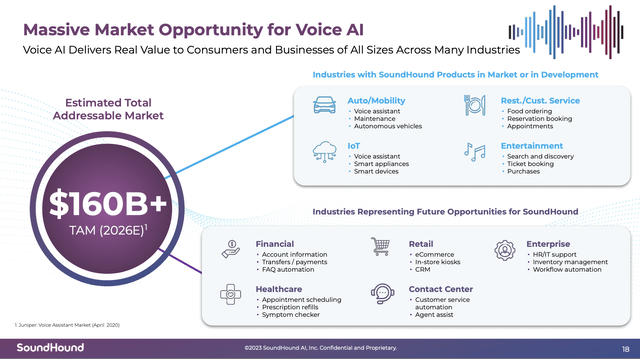

When investing in technology, especially in the small-cap space, it’s critical to ensure that the product is broadly applicable enough to serve a large market opportunity. In SoundHound’s case, the company is estimating its 2026 TAM at $160 billion, representing all of its core industries and three monetization opportunities:

SoundHound TAM (SoundHound Aug 2023 investor presentation)

Financials reflect a small company making giant strides

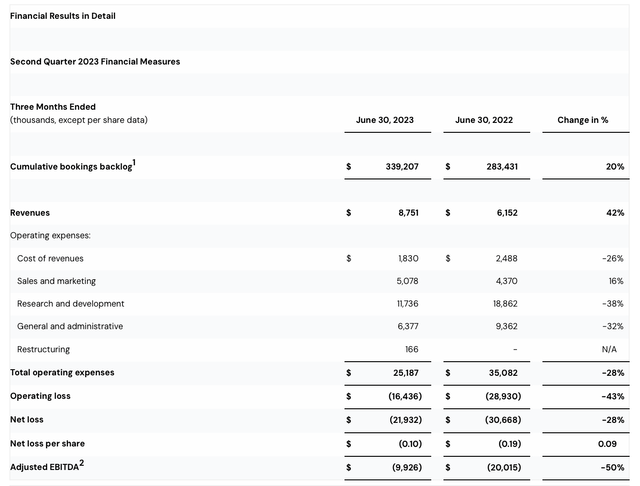

The summary below showcases SoundHound’s most recent quarterly results, released in mid-August:

SoundHound Q2 results (SoundHound Q2 earnings release)

Revenue grew 42% y/y to $8.8 million, ahead of Wall Street’s expectations for $8.1 million (+32% y/y). Note that reported revenue trails substantially behind the company’s backlog, as its technology involves long-term implementations with complex OEM partners. Cumulative backlog rose 20% y/y to $339.2 million, well above the company’s ~$40 million revenue outlook for the year.

The company notes that despite having played in the AI space for years, traction has picked up this year thanks to the rise of ChatGPT and generative AI. Per CEO Keyvan Mohajer’s remarks on the Q2 earnings call:

We continue to see a surge in enthusiasm for AI, which has brought SoundHound significant interest from customers and AI followers. We believe the new AI disruption that is catalyzed by generative AI will have a larger impact in nearly all industries than the last mobile disruption. We believe SoundHound is uniquely positioned to achieve significant long-term success in the new AI era, given our deep voice and conversational AI expertise, robust patent portfolio, full technology stack and our years of collaborating with major brands within key industries, including automotive, smart devices and now customer service.

In line with our track record as a leading innovator in AI, SoundHound is training its own foundational model in generative AI. But our approach is different. Instead of yet another large language model, we are combining everything you’ve learned in nearly two decades to take it to the next level. Our foundational model will be multimodal, supporting audio and text inputs and audio and text output, which prompts based instant customization capabilities that used to take significant software engineering and machine learning to achieve.”

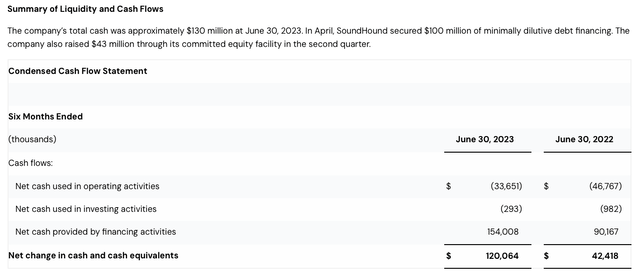

Also important to note is that SoundHound recently raised $100 million in debt financing to pad its balance sheet; at the same time, adjusted EBITDA losses cut in half to -$9.9 million in the second quarter, while YTD operating cash burn of -$33.7 million is 28% less than the year-ago period.

SoundHound cash flows (SoundHound Q2 earnings release)

Alongside the company’s expectations of becoming adjusted EBITDA neutral in Q4 of this year, this gives me plenty of confidence that the company is well-capitalized to execute on its growth strategy.

Valuations, risks, and key takeaways

At current share prices just north of $2, SoundHound trades at a market cap of $558.4 million. After we net off the $115.8 million of cash and $66.4 million of debt on SoundHound’s most recent balance sheet, the company’s resulting enterprise value is $509.0 million.

For next fiscal year FY24, consensus is calling for $81.6 million in revenue, representing 79% y/y growth (data from Yahoo Finance). Taking consensus estimates at face value, SoundHound is trading at 6.2x EV/FY24 revenue, which I’d consider to be quite an attractive multiple for an AI company currently growing revenue at >40% y/y, with a huge backlog and impressive customer list, and a path to breakeven adjusted EBITDA by year-end.

Risks, of course, are very prevalent in a relatively young company. An AI “arms race” is ongoing with many technology companies rushing to build similar products and capabilities. This may prove to be a boon to SoundHound investors if a tech giant chooses to acquire SoundHound for its technology as a faster way to build a minimum viable product; but it could also be a risk if much better-capitalized companies develop more robust solutions that outshine SoundHound’s technology.

On the whole, I do think SoundHound remains an appealing investment opportunity with a reasonable valuation that accounts for its executional risks. Especially with the sharp fall in share prices since June, I think buying a small position is very appropriate here.

Read the full article here