No Risk, No Reward

Lending, at its core, is a generally uncomplicated business: companies borrow money (through banks, customer deposits, etc.), and then re-lend that money at a higher interest rate and collect the spread. This business, however, becomes infinitely more complicated when human factors–such as credit scores, macroeconomic conditions, and ever-fluctuating interest rates–are introduced. Prudence, then, is generally the name of the game for most companies in the business of lending, and for the vast majority of said companies, lending to borrowers categorized as subprime does not seem prudent.

Enter OneMain (NYSE:OMF), a lending and finance company specializing in the subprime market, which as of this writing offers a 10% dividend yield.

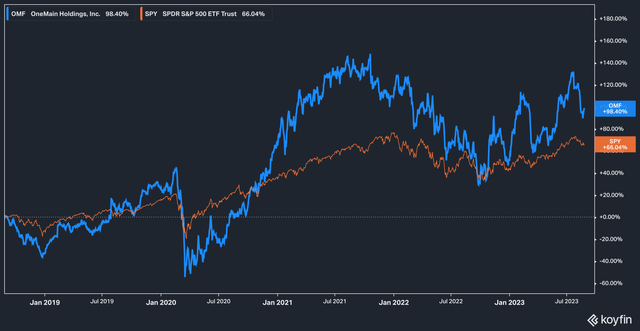

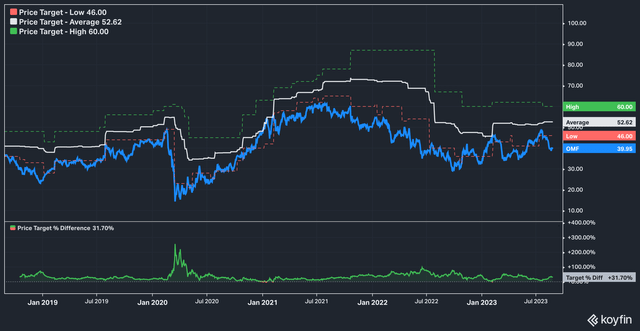

Koyfin

Over the last five years the stock has performed admirably, returning 98% on a total return basis against the S&P 500’s (SPY) return of 66%. In the near term, however, the stock has experienced some weakness, falling by almost 15% in the last month.

It’s our opinion that this recent decline in price is driven by concerns around underlying business trends and, more specifically, concerns about the ability of OneMain’s client base to repay their loans against a worsening macroeconomic backdrop. We think that these concerns are overblown, and that the stock may be compelling for investors of a certain risk tolerance. Let’s get to it.

A Quality (And History) Question

The selloff in OneMain’s stock over the last month was precipitated by the company’s second quarter earnings call where OneMain reported that net charge-offs had risen to 7.6%. Charge-offs are categorized as loans more than 90 days delinquent which have gone through the company’s internal collections process and which OneMain has effectively given up hope of recovering.

Now, 7.6% is nothing to shrug off–it’s a high number and one that would send any traditional banking outfit’s stock plummeting. 7.6% also seems high against the charge-off comps from previous quarters.

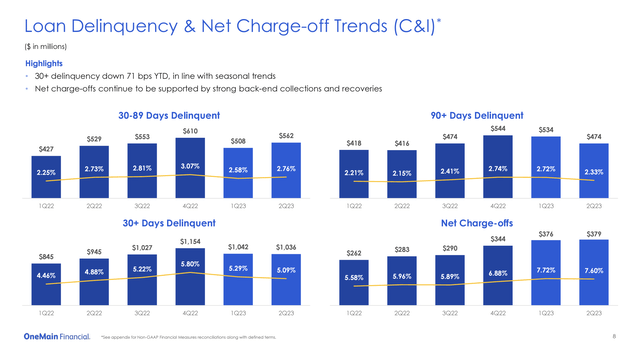

Company Presentation

Investors, however, would do well to remember two things:

- OneMain’s business is predicated on lending to the subprime market, which carries a much higher risk profile than the prime market, and

- the charge-off comps going back to the first quarter of 2022 (pictured above) represent a very different macroeconomic picture, thus making the comps quite difficult.

In other words, investors shouldn’t be surprised that the boom-time for subprime lending is over. Rising interest rates combined with dwindling household savings means that subprime lending will go back to pre-covid business as usual, which means that investors will have to get re-accustomed to higher delinquency and charge-off rates than they’ve been used to in recent years.

OneMain has been taking steps to tighten its credit lending standards in response to building macroeconomic pressures since August, and the results are starting to show.

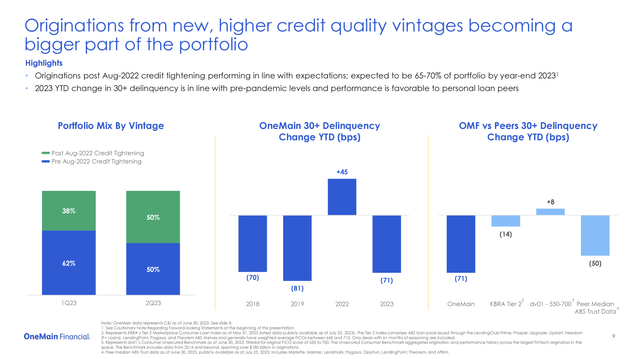

Company Presentation

As of last quarter, the post-credit tightening vintage of loans represented 50% of OneMain’s portfolio, an impressive turn from just 34% in the first quarter of 2023.

Standards for secured underwriting are being tightened as well, and according to the company’s second quarter filing OneMain’s portfolio mix between secured and unsecured lending stood at 51%.

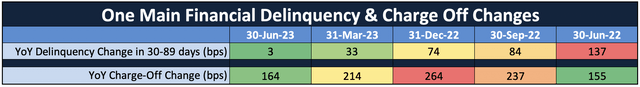

Of course, stocks aren’t priced on what’s happened, but what is expected to happen in the future. To that end, we collected delinquency data from OneMain’s filings for its 30-89 day delinquent loans as well as its charge-off percentages and compared year-over-year quarterly changes.

Author Presentation from Company Filings

What we found is that the basis point change year-over-year in both categories is decelerating, with the deceleration most pronounced in the 30-89 day delinquent category. In the quarter ending June 2023, 30-89 day delinquencies overall grew by only 3 basis point from the prior year.

This, we believe, is evidence that management’s credit tightening strategy is yielding fruit, since flattening/normalizing delinquencies is a sign of improved lending quality in the portfolio.

This is also important because a key metric for OneMain (and the metric which has most eaten into its profits) is the provision for finance receivable losses. This provision ballooned by almost $300 million between the six months ending June 2022 and 2023, and was the chief culprit for the falloff in reported net income. The flattening of delinquencies–as long as they remain relatively flat–indicates to us that the current glut of loss provisions is a bit of an ‘elephant moving through the snake,’ and that the P&L should normalize as the new, post-tightening credit vintages become a larger and larger part of the overall portfolio.

With a forward price to earnings ratio of only 5.9x, OneMain may appear cheap, but not insanely so given that it is currently in the lower bound of the P/E rage it has traded in for several years. Analysts, as well, have consistently assigned higher price targets than the stock has achieved (pictured below).

OneMain Analyst Price Targets (Koyfin)

Keeping this in mind, we would consider $49 to be a fair price for the stock, which is 5.9x OneMain’s estimated FY 2025 earnings, and still below the median analyst price target.

The Bottom Line

OneMain Financial’s issues are, we believe, temporary in nature. As the company adjusts its lending practices to conform with current economic and customer conditions, we think the company will resume roughly the same profitability profile it has in the past. Risks to our thesis include further, worse than expected deterioration of household balance sheets among OneMain’s core clientele which could cause the unsecured loans that make up roughly 50% of OneMain’s loan book to underperform more than forecasted, as well overall macroeconomic uncertainty.

Read the full article here