In the BDC world, there is Main Street Capital (NYSE:MAIN) and there is everyone else. Generally, no other BDC has been able to command anywhere close to the premium MAIN has. At least not in a consistent manner. NewtekOne Inc. (NEWT) briefly did try and match up, during its euphoria days, but that bubble quickly burst. MAIN remains the undisputed champion for investors looking for a healthy mix of dividends and long term growth.

MAIN Q2-2023

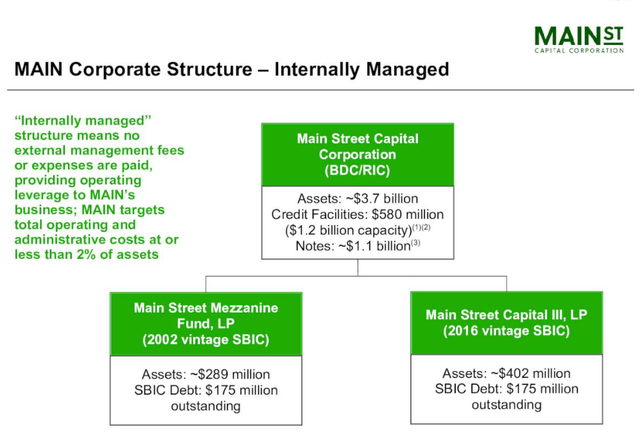

The Company

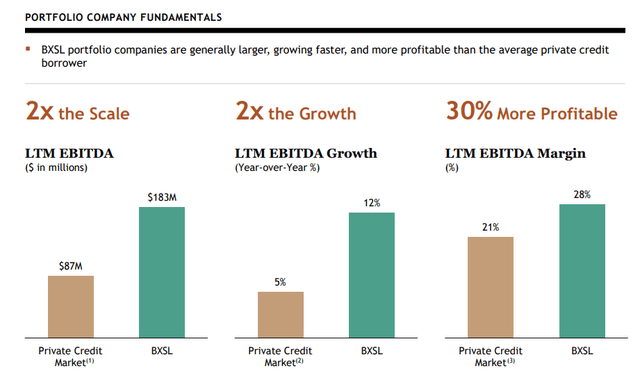

MAIN focuses on the lower end of the middle market and most companies that it loans to have an EBITDA of between $3 million to $20 million. Just to give investors an example, (BXSL) is at the other end of the spectrum with trialing 12 month EBITDA of companies it lends to approaching almost $200 million.

BXSL Q2-2023

So MAIN does sound slightly riskier on paper relative to the BDC universe, but the opposite has been the case. It has delivered steady results with minimal defaults and a 13% compounded return on equity over the long term.

MAIN Q2-2023

Current Setup

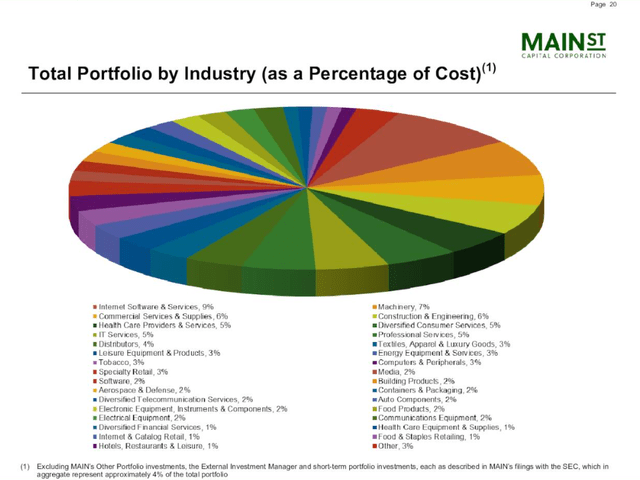

While MAIN may be lending to small(er) companies, it is certainly not skipping on diversification.

MAIN Q2-2023

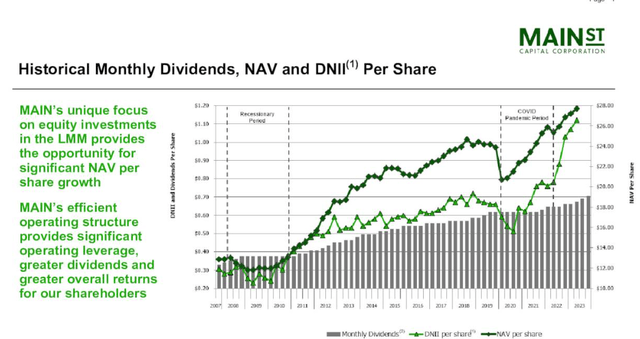

You are essentially getting every sector of the economy in there, though MAIN does keep ultra-cyclical exposure on the low side. For the quarter net investment income or NII came in at $1.06 per share. This was up over 45% from last year. BDCs became the chief beneficiary of the rate hike cycle from the Federal Reserve as all of them had a large base of fixed rate debt or liabilities and the loans they made very levered to rising rates. MAIN was no different, but even within the BDC universe the performance was impressive as the 19% return on equity showed. Net asset value or NAV was $27.69 per share at June 30, 2023, and that up $0.83 from December 2022. The company declared regular and special dividends that had investors laughing all the way to the bank.

Declared regular monthly dividends totaling $0.69 per share for the third quarter of 2023, or $0.23 per share for each of July, August and September 2023, representing a 7.0% increase from the regular monthly dividends paid in the third quarter of 2022

Declared and paid a supplemental dividend of $0.225 per share, resulting in total dividends paid in the second quarter of 2023 of $0.90 per share and representing a 25.0% increase from the total dividends paid in the second quarter of 2022 and a 5.9% increase from the total dividends paid in the first quarter of 2023

Source: MAIN Q2-2023

Investment activity was strong and the company deployed over $130 million in the quarter. Total assets, which adjust for redemptions and fair value changes, were up $180 million from December 31, 2022. Only 9 loans, which represent about 0.3% of the total portfolio fair value, were on accrual status at the end of the second quarter.

Valuation

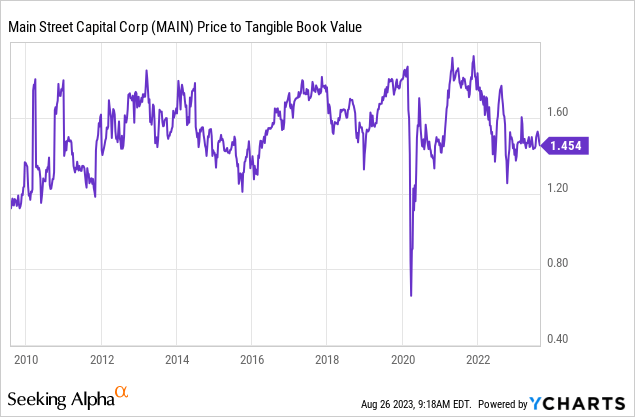

With MAIN, you have to accept that you will never really buy it on the cheap. As the price to tangible book value ratio shows, your best bet is to hope to pick it up near 1.2X tangible book value.

COVID-19 was a brief exception, but 1.2X is generally the best you can do. If you take the current NAV and account for some drift upwards, your great entry point might be near $34-$35 in the coming months. On a P/E ratio the company is getting a bit cheap, but that has to be balanced against the fact that we are quite late in the cycle. All those rate hikes that are increasing MAIN’s income are also causing stress for the companies they are lending to. At present we see the valuation as middling despite some exceptional near term results.

What We Like

While the common stock remains a “hold” for us, the company’s exceptional long term performance and credit metrics are definitely attractive. Here we see that the near term bonds offer an exceptional rate of return, relative to the risk. The July 2026 bonds have a very low coupon, and that is probably why it is shunned by “income investors”. After all, a 3% par coupon will only 3.4% income stream at the current price of $88.48. But the same bond has a yield to maturity of 7.52%.

FINRA

7.52% is exceptionally good for a 3 year bond from a top level BDC. The company has investment grade ratings from S&P and Fitch, though those understate just how well it manages its debt profile. In this category we view asset coverage cushion as an important metric and MAIN’s is right up where we would like for a bond investment.

Leverage, as measured by par debt-to-equity, was 0.95x at Dec. 31, 2022. Excluding Small Business Administration (SBA) borrowings, Main Street’s statutory leverage was 0.79x, which was within the firm’s targeted range of 0.8x-0.9x. Leverage at YE22 implied an asset coverage cushion of 34%, which was above the peer average and above the high-end of Fitch’s ‘bbb’ category benchmark range of 11%-33%. Fitch expects the firm to operate with a higher asset coverage cushion than peers, given the risk profile of the portfolio. A sustained decline in the cushion below 25% could result in negative rating action because of the higher-risk nature of the portfolio.

Source: Fitch

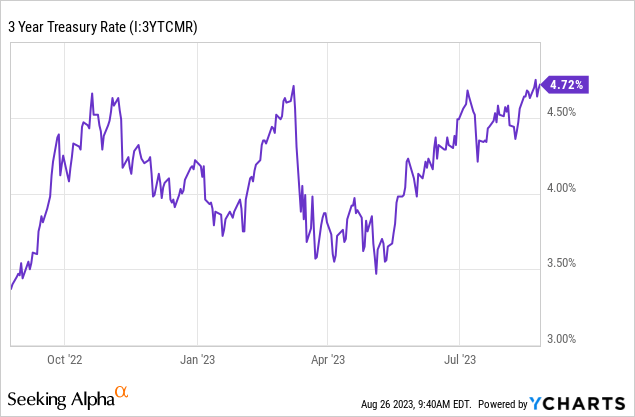

The 7.52% yield is also quite generous relative to benchmarks. The first being the 3 year Treasury rate which is the closest is match to the duration of this bond. 2.8% spread is a good lock, regardless of how aggressive the Fed might get.

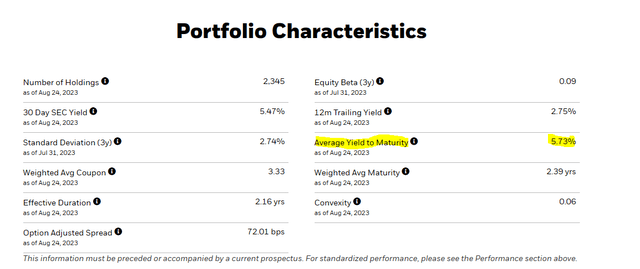

The other more relevant benchmark would be the yield you can get from short term investment grade ETFs like iShares 0-5 Years Investment Grade Corporate Bond ETF (SLQD). The yield to maturity here is 5.73% and about 5.67% after expenses.

SLQD

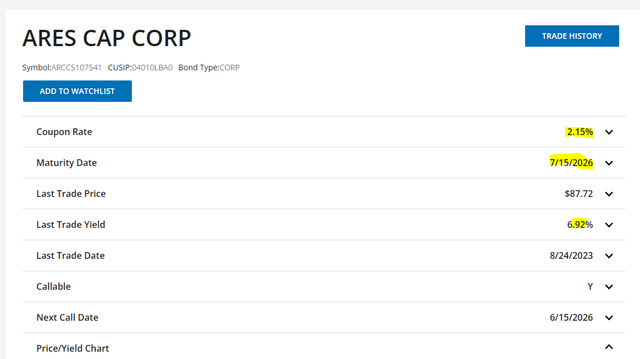

A final benchmark for us is what similar top quality BDC bonds provide. While there is subjectivity here as to what would be the best comparative from a credit perspective, Ares Capital (ARCC) comes very close to MAIN for our money. It would be nice if they had a bond maturing on the same day as our pick for MAIN. Well, we have got a real close match, as the bond matures 1 day after the one from MAIN.

FINRA

The 6.92% YTM again, makes the MAIN’s 2026 look quite appealing. ARCC also sports a very low coupon (even lower than MAIN’s), so there really is no reason to favor ARCC over MAIN here.

Verdict

While we wait for the recession metrics to come through, we remain on the lookout for high-quality, low-risk yields. MAIN’s 2026 bonds are Class A in that regard. We have recently picked up two investment grade bonds with 7.5%+ yields to maturity that work for our risk profile. In a full scale market swoon, we might even get 8% for our favorite plays. That is what we are picking up here and the low coupons means that they create a tax advantage for the return profile (more taxed as long term gains vs interest income).

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here