The major Canadian banks (as well as many banks in many other countries) are presenting themselves in an interesting – but potentially dangerous – situation. In my last article about the Royal Bank of Canada (NYSE:RY) published in January 2023 I rated the stock as a “Hold” and stated it is not yet the time to invest. In the meantime, the stock declined about 7%.

On the one hand, we have the very compelling valuations – with most major banks (including the Royal Bank of Canada) trading for low double digit or even single digit valuation multiples – and the banks still reporting great results. On the other hand, we have looming risks on the horizon that could generate huge problems. The following article will therefore be structured in two major parts – first, the positive results and low valuation and second the reasons to still be cautious.

Quarterly Results

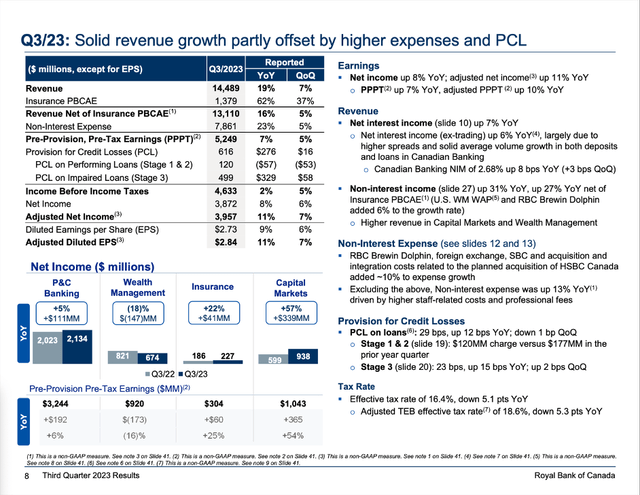

The Royal Bank of Canada could report strong third quarter results and total revenue increased 19.4% year-over-year from $12,132 million in Q3/22 to $14,489 million in Q3/23. And although non-interest expenses increased and especially provision for credit losses almost doubled from $340 million in the same quarter last year to $616 million this quarter, bottom line also improved. Diluted earnings per share increase 8.8% year-over-year from $2.51 in Q3/22 to $2.73 in Q3/23. Finally, adjusted earnings per share increased from $2.55 in Q3/22 to $2.84 in Q3/23 – resulting in 11.4% year-over-year growth.

RY Q3/23 Presentation

When looking at the different segments, only Wealth Management is struggling and had to report an 18% net income decline year-over-year. However, the other three segments could report at least solid growth with P&C Banking increasing net revenue 5% while Capital Markets increased net income 57% year-over-year.

RY Q3/23 Presentation

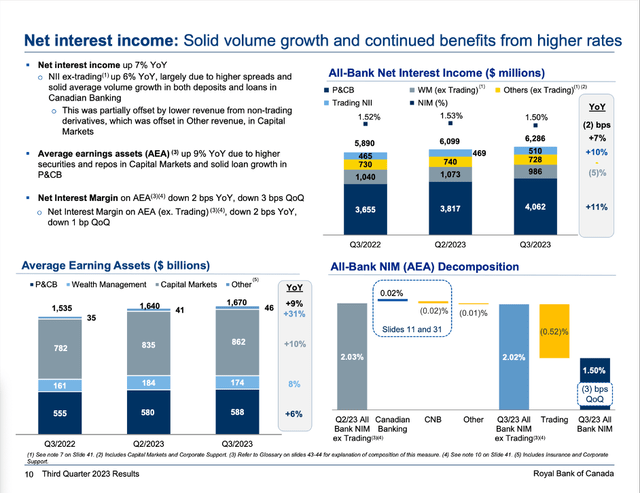

Net interest income increased from $5,890 million in the same quarter last year to $6,286 million this quarter – 6.7% year-over-year growth, which was mostly driven by continued benefits from higher interest rates as well as the average amount of earning assets increasing from $1,535 billion in the same quarter last year to $1,670 billion this quarter.

RY Q3/23 Presentation

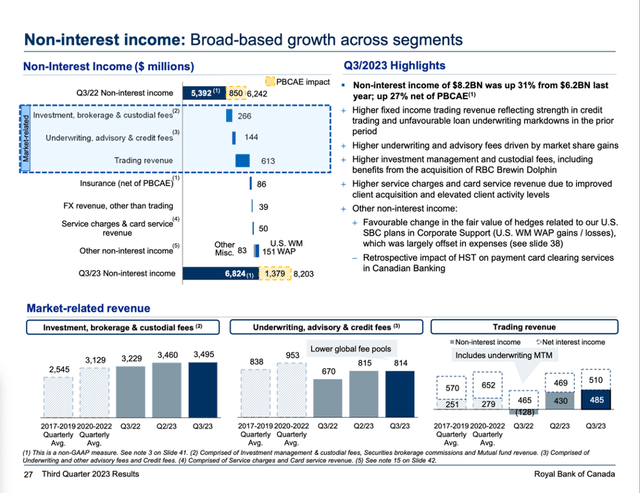

When looking at non-interest income we also see high growth rates of 31.4% year-over-year as the amount increased from $6,242 million in the same quarter last year to $8,203 million this quarter.

Still Cheap (On The Surface)

Aside from reporting great results, the Royal Bank of Canada is also trying to persuade by its compelling valuation. Similar to many other banks all around the world, the Royal Bank of Canada is trading for a rather low valuation multiple. At the time of writing the stock is trading for a P/E ratio of 11.86 – in line with the average of the last ten years (12.17).

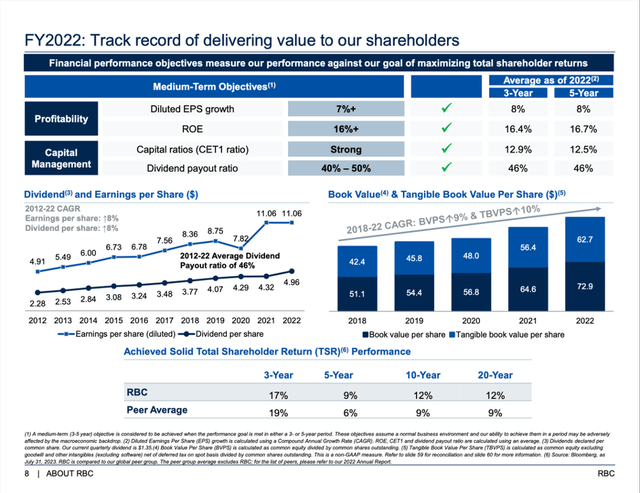

When using a simple discount cash flow calculation and take the net income of the last four quarters as basis (which was $14,443 million), the Royal Bank of Canada must grow its net income between 1% and 2% annually till perpetuity to be fairly valued (assuming a 10% discount rate and calculating with 1,395 million outstanding shares). When looking at the performance of the Royal Bank of Canada in the last years, we can see high single digit bottom line growth on average. In the last ten years, earnings per share grew with a CAGR of 8.42% and therefore assuming 5% growth seems realistic in my opinion. When calculating with these numbers, the intrinsic value of the Royal Bank of Canada would be $207.07 (with the stock currently trading for $122). And just by looking at these numbers, we must see the stock as a bargain.

RY Q3/23 Presentation

And when looking at the past performance and the medium-term objectives we could be even more optimistic and assume 7% annual growth for the next ten years followed by 6% growth till perpetuity, which would lead to an intrinsic value of $277.84 for the Royal Bank of Canada.

Risks

Talking about growth potential (and I really believe in the long-term growth potential of the Royal Bank of Canada) is completely ignoring what could be upon us in the next few quarters (or years). To be clear, the Royal Bank of Canada can be seen as fairly valued or undervalued even when taking into account the potential recession and net income declining steeply.

But as I have argued several times in the past, I don’t want to bet on banks right before a potential recession. And although I don’t assume the Royal Bank of Canada is in serious trouble, I also see no reason to bet my money on banks right now.

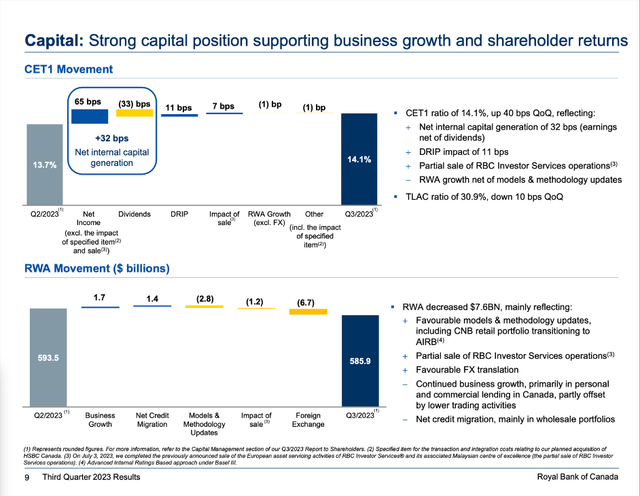

When looking at the surface and many reported metrics, the picture still looks good. We can start by looking at some metrics for risk and the health of the business. The CET1 ratio – one of the ratios most looked at for banks all over the world – improved from 13.7% in the same quarter last year to 14.1% this quarter and it is a rather high CET1 ratio when looking at different banks all over the world.

RY Q3/23 Presentation

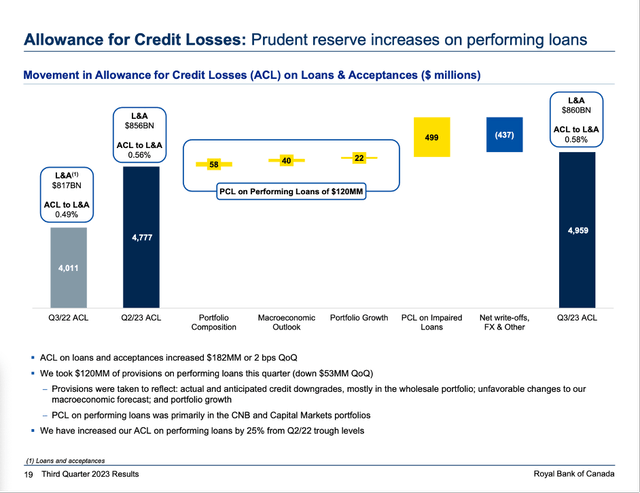

And as mentioned above, provision for credit losses increased compared to previous quarters and therefore allowance for credit losses is also increasing to $4,959 million (or 0.58% of total loans & acceptances).

RY Q3/23 Presentation

Of course, increased provision for credit losses (and therefore higher allowance for credit losses) is showing that banks are getting more cautious and expect a higher rate of borrowers not to be able to meet payments. On the other hand, it would also just be a sign that banks are cautious (maybe too cautious) and building reserves for stressful times is not a bad sign.

When focusing on one aspect that has the potential to generate huge troubles for banks, it is real estate and housing and especially the housing market in Canada is often seen as overvalued and expensive. I already looked at Canadian housing prices and the number of transactions in several articles. And in the first half of 2023, we saw the number of transactions as well as the average sold price per house increased again and come rather close to previously reached peak prices in 2022.

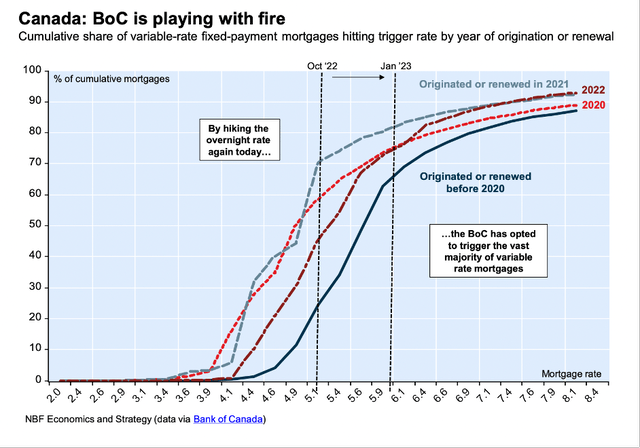

In his last article about the Royal Bank of Canada, Patrick Doyle pointed out an interesting piece of information. According to the National Bank of Canada the latest interest hikes might have a huge negative impact on the Canadian real estate market. The bank estimates that between 73% and 80% of variable-rate fixed-payment mortgages originated between 2020 and 2022 will have been triggered during the rate rise in the last few quarters. And if you are not familiar with the trigger rate, you can find an explanation here.

National Bank of Canada

According to the National Bank of Canada only 30% of Canadian mortgage holders have variable mortgages. Nevertheless, the number is still high enough to have a meaningful impact when about 25% of all people who financed their house might be in the situation to pay monthly a lot of money – but these payments are only interest while house prices are declining (see above).

And it is difficult to clearly see the state of the market as these are just some pieces of information. Management of the Royal Bank of Canada was rather optimistic during the last earnings call. When commenting on the macro situation, CEO David McKay stated:

On the macro front, consumer spending remains resilient. At the same time, it appears the magnitude of interest rate hikes is having its intended effect of reining in persistently elevated inflation. The increase in the price of goods and services has slowed to 2% and 4% respectively.

While immigration levels and labor markets also remain strong, we are seeing evidence of slowing labor markets, as evidenced by slowing wage growth, lower job postings, and an increase in Canadian unemployment. Consequently, our base case forecasts a softer economic outlook. We expect slowing growth and lower inflation due to the lagging impact of monetary policy, combined with a slowdown in China and elevated climate in geopolitical risks. The length of time Central Banks will have to be in a whole pattern before decreasing interest rates will be a key determinant of the impact on consumers, and businesses and the economy.

And Chief Risk Officer Graeme Hepworth added:

Provisions on performing loans were predominantly in the City National and Capital Markets, reflecting the more challenging conditions in the United States. Allowances on performing loans for our retail portfolios were largely unchanged this quarter, as negative drivers were offset by an improvement in our baseline forecast for housing prices. In total, our allowances for credit losses on loans increased by $182 million this quarter to $5 billion.

(…)

Expected losses in the retail portfolio continued to be delayed due to strong employment and elevated levels of consumer deposits.

In these statements, we see some caution from management, but obviously no reason to worry so far.

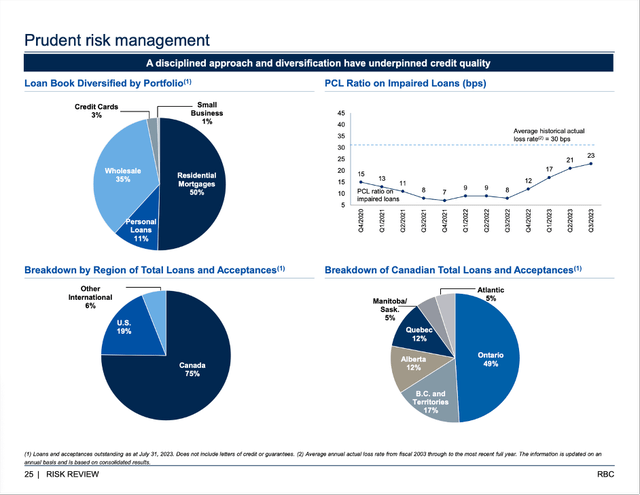

RY Q3/23 Presentation

When looking at the breakdown by region, 75% of total loans and acceptances are from Canada – and therefore Canada is posing the biggest risk for the bank. Aside from Canada, the United States are also important with 19% of total loans and acceptances being issued there. And in the United States, the situation in the real estate market is probably worse than in Canada.

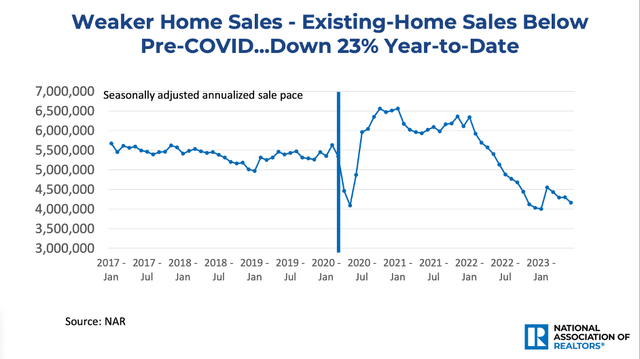

For starters, we can look at the declining number of housing permits in the United States, although the number stabilized in the last few quarters. The National Association of Realtors is providing further information like the steeply declining numbers of existing home sales, which is clearly below pre-COVID levels.

National Association of Realtors

And when looking at pending home sales index, we can see a slight month-over-month increase of 0.2% but year-over-year we see a 15.6% decline. And when looking at long-term data, we can see this is the steepest decline since the early 2000s – although we should also keep in mind the extreme increase during COVID-19 that preceded the decline we saw in 2022 and 2023.

Why Is Caution Appropriate?

One might ask the question why I am so cautious about banks when most data is maybe not showing a perfect picture, but we are (apparently) far away from a crisis like in 2007/08. The answer is rather simple: The financial system is a complex, non-linear system with thousands (or millions) of nods and connections. And in such a system it is hard to see problems arise and even more difficult to contain a problem – instead problems will spread quickly throughout the system. And although more than five months have passed, the strong warning signs we got in March 2023 should not be forgotten (Signature Bank, Silicon Valley Bank, Credit Suisse).

Looking back on the Financial Crisis, the FDIC wrote in Crisis and Response:

Yet, through the end of 2006, most macroeconomic indicators continued to suggest that the U.S. economy would proceed uninterrupted on its path of moderate growth. Indeed, aside from some concerns about an overheated housing market, there was little in the way of financial data to suggest that the U.S. and global economies were on the verge of a financial system meltdown (FDIC, p. 5).

And who can blame people for not seeing the huge problems on the horizon: Banks are lending money to each other; financial institutions hold assets of other institutions or financial products (like derivatives) issued by other banks. With so many connections and such an interconnected system who is to blame for not see a crisis evolving.

In my article Banking Crisis: The Next Domino Is Falling published in March 2023 I also mentioned the complex and interconnected system. In the article I wrote:

And I don’t even want to try to pretend I understand the ripple effects that could occur throughout the financial system. My knowledge of the banking system is much too limited to foresee what ripple effects can occur. However, I know that the banking system, the stock market, and the economy are complex, non-linear systems with thousands of nodes and links intertwined in a complex system and that knowledge is enough to make me cautious. I don’t know what will happen, but I can see what could happen in a complex, non-linear system and knowing what could happen is enough to make me very cautious. And with so many unanswered questions, I still don’t think now is the time to buy banks.

Conclusion

At this point I am not saying that the Royal Bank of Canada is in trouble right away. And we don’t have to see a collapse of the housing market in Canada like we saw in the United States in 2007/2008. However, I see strong warning signs on the horizon, and I would be cautious – especially as the financial system sometimes seems like a black box and it is difficult to see troubles from the outside before they are really obvious.

Read the full article here