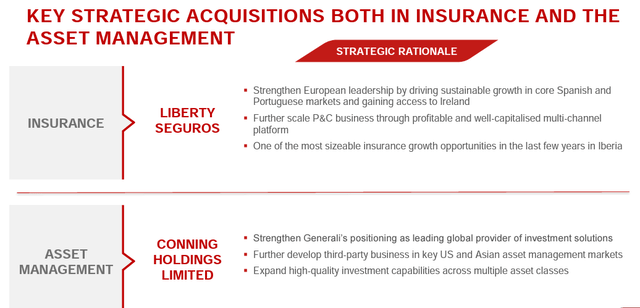

We still miss Assicurazioni Generali Q2 results comment in our top-EU insurance coverage (OTCPK: ARZGF). Since mid-February, with our initiation called “Generali is a buy,” the company has been delivering on its promises: 1) M&A, 2) internal bank performances, and 3) improving results. Here at the Lab, we positively view Generali’s strategic plan called Lifetime Partner 24: Driving Growth. In addition, the company recently announced the Conning Holdings acquisition, and we still believe there is room to grow Generali’s M&A optionality. This is also combined with higher shareholders’ remuneration. The Italian insurer is a well-managed company confirmed by a solid track record of stand-out results that we last highlighted in May with upside thanks to its local bank (Generali owns a 50.15% equity stake in Banca Generali that offers a tasty dividend yield of 7.5%).

Q2 results Comment

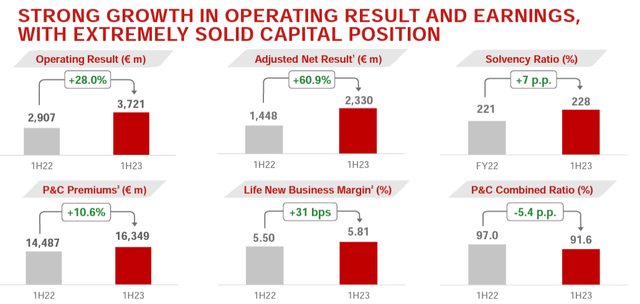

Starting with the Generali Assicurazione account analysis, the insurance group’s net profit reached €2.33 billion from the €1.44 billion recorded last year. Net income increased by 60.9% thanks to the operating profit acceleration up to 28% due to higher revenue generation diversification and non-recurring profit. This positive one-off was due to selling a London residential property for €193 million after tax. On a negative note, there was also a write-down of €97 million related to Russian fixed-income instruments.

Looking at the H1 results, the company is entirely on track to achieve Generali’s ambitious goals. The company has the balance sheet solidity to govern the complex macroeconomic and geopolitical scenario successfully. In line with our investment thesis, with the latest acquisition, Generali strengthened its European role in leaders again. Aside from Conning in the asset manager division, the company acquired Liberty Seguros for €2.3 billion and confirmed its leadership position in the Iberian peninsula.

In detail, looking at the accounts, the operating result of €3.7 billion rose thanks to the strong development of the non-life business, which grew by 85.7%, thanks to a solid combined ratio, which improved to 91.6 % due to lower claims. In the life business, net inflows, affected by the sudden increase in interest rates, were negative by 877 million. Still, the operating result was solid, at 1.813 billion, only down by a single-digit percentage at 3.5%.

Finally, regarding the Asset & Wealth Management segment, the operating result was 498 million, with Banca Generali contributing €233 million. With these performances, we again confirmed a cumulative DPS distribution of €8 between 2023 and 2025. On a negative note, there is a proposal in Italy to tax the bank’s profits due to higher interest rates. Here at the Lab, we calculated a potential impact for Generali Bank, and it is minimal. According to our analysis, we are talking about €20 million, equal to a maximum of 0.1% of total assets. Therefore, we see a limited downside risk going forward.

Generali H1 Financials in a Snap Generali M&A development

Source: Assicurazioni Generali Q2 results presentation

Mare Ev. Lab New Upside and Conclusion

Aside from solid results in H1, here we present additional key upside:

- After the last two acquisitions, the company has €200 million available liquidity for inorganic opportunity, to which we should add the Liberty Seguros excess capital of €300 million. Therefore, the total cash disposal is €500 million. If the resources are not used within the industrial plan, which ends in 2024, we anticipate a potential buyback, as Generali did in the last strategic plan. Therefore, M&A optionality or a buyback yield of 1.7% calculated with cash disposal dividend by the current market cap;

- AuM trajectory recovery. In Q1, Generali recorded net outflows of €1.6 billion; in Q2, AuM decreased to €0.8 billion, and here at the Lab, we now estimate that they will turn at a positive output of €0.1 billion in Q3. This will help eliminate any worries that Generali may have to finance outflows by selling assets and realizing principal losses;

- More important to note is the Contractual Service Margin evolution; this is the insurance ratio representing future unrealized profits from the existing business. This will likely grow at a compound annual average rate of 5.2% from 2022 to 2025 thanks to strong new business and income from investment;

- On the balance sheet, Generali’s Solvency II Ratio reached 228% from 221% at year-end, supported by a solid capital generation;

- Given the results and the combined ratio evolution, we forecast a 2023 net profit of €3.79 billion with a net income acceleration of approximately 70%. In our estimates, aside from the potential buyback yield, we forecast a DPS of €1.26 with a projected yield of 6.8% (from the €1.16 dividend paid in 2023).

- According to 2024 consensus estimates, Assicurazioni Generali shares are trading at 7.9x the price/earnings multiple. This is below its five-year average of 8.5x. Looking at the comps landscape, at the aggregate level, Generali is in line with significant peers’ Solvency II ratio; however, as a best-in-class Combined Ratio. Zurich and Allianz reached a 92.9% and 92.2% ratio, respectively. Continuing to value Generali with a target P/E 10x, we confirmed our buy rating of €21 per share ($11.2 in ADR). We are also following our publication called “Allianz Vs. Generali – We Like Them Both,” Generali shareholders’ equity combined with the Contractual Service Margin evolution is a catalyst that cannot go unnoticed.

On the downside, our significant risks include 1) equity and credit default potential, given Generali’s conspicuous AuM portfolio, 2) higher natural catastrophes, 3) execution risk on M&A, 4) regulatory changes, especially in the tax framework (as recently happened in the Italian banking landscape), and 5) private equity and real asset performance evolution. Given the company’s equity market exposure, Generali is exposed to volatility. In addition, another downside risk is the Generali Life segment performance. The Italian leading player sells lower unit-linked policies due to better corporate bonds and government debt yield.

With our EU insurance coverage, we suggest our readers check our comps analysis to be well-informed about the results of Allianz, Zurich Insurance Group, and AXA.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here