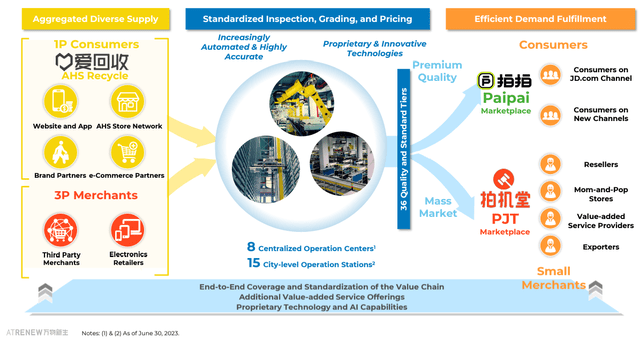

ATRenew Inc. (NYSE:RERE) is China’s largest pre-owned consumer electronics transaction and services platform. RERE stock is now traded at $2.23, down by 36% YTD, as compared to 52-week high of $3.52 and 52-week low of $1.52. Please see my previous articles: ATRenew Q4 Earnings: Strong Revenue Growth & Positive Profits; ATRenew: Well Positioned For Long-Term Growth In Multi-Category Recycling; ATRenew Stock: Drive Business Scale, Efficiency Through Automation.

Company presentation

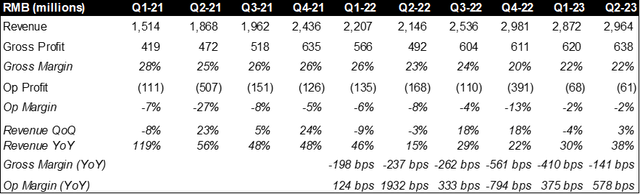

RERE reported Q2 ’23 financial results, another strong quarter with strong revenue growth and improved profitability.

Revenues: RMB2,963.7 million, +38.1% YoY, mainly driven by product revenues due to an increase in the sales of pre-owned consumer electronics. Service revenues saw a decent growth (+12.1% YoY) with the post-COVID recovery of Paipai and PJT marketplaces.

Operating Losses: RMB61.0 million, narrowed down from RMB168.2 million in prior Q2. Non-GAAP op income was RMB52.0 million, as compared to a Non-GAAP loss from operations of RMB42.3 million in prior Q2. Total Operating costs and expenses were RMB3,032.5 million, +30.3% YoY, primarily driven by Merchandise costs increase of 40.6% YoY due to product mix shift to more product sales. Despite gross margin decreased by 141 bps YoY, op margin improved by 578 bps, benefited from the company’s continued efforts in optimizing store and operation station networks, as well as operating leverage gains from platform related tech costs as the Company’s platforms matured.

If we look into RERE’s last three years’ financials, there are three main takeaways. First, RERE’s revenue growth is accelerating, and its quarterly run rate reached RMB3.0 billion, doubled from its topline two years ago. Second, RERE’s Op losses have been narrowing down benefiting from economies of scale. RERE is fairly close to breaking-even considering its current Op margin of -2% and its RMB3.0billion quarterly run rate. Third, Gross margin had a notable downward trend (e.g. 22% in Q2 ’23 vs 25% two years ago), which is not necessarily a concern as product sales continued to outpace the growth of service revenues.

Capital IQ

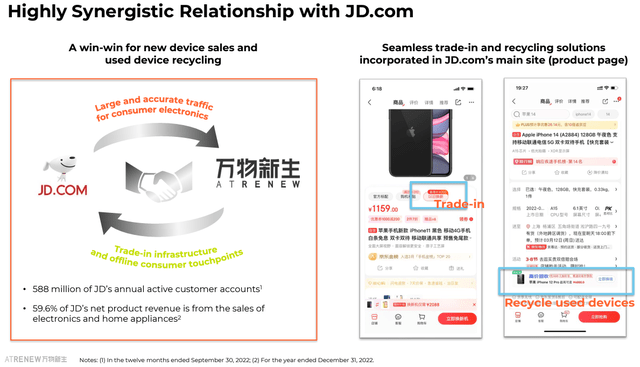

In June 2023, AHS was listed as “Apple Trade In” service provider in both Apple (AAPL) online and Apple Stores. This was the first time since eight years ago Apple added a new Trade In service provider. I view this a very positive milestone for RERE with Apple’s ‘endorsement’ for RERE’s leading expertise and service capacity (as of Q2 ’23, RERE has 1,944 physical stores in 269 cities in China). Moreover, I expect RERE to continue acquiring more transacted users by cross-selling to owners of Apple’s various products. The way to think about the potential upside with the RERE and Apple partnership is to look at the high synergy played out between RERE and JD.com (JD) (China’s Amazon) today. RERE and JD.com have operated with a win-win for new device sales and used device recycling. JD.com’s ecommerce website offers seamless trade-in and recycling solutions for shoppers.

Company presentation

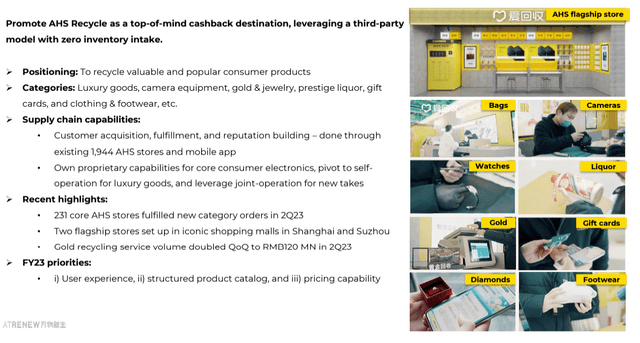

The AHS New Category Offering represents a long-term amplifier for RERE’s future performance. On top of RERE’s investments in building its strong B2B2C networks, expanding new categories makes complete sense to maximize its return. As shown in the following picture, AHS flagship stores have successfully expanded to new categories including bags, cameras, watches, liquor, gold, gift cards, diamonds, and footwear. In Q2 ’23 RERE disclosed a couple of promising figures, 1) 231 core AHS stores fulfilled new category orders, 2) 2 flagship stores set up in iconic shopping malls in Shanghai and Suzhou, 3) Gold recycling service volume doubled QoQ to RMB120 million.

Company presentation

While I remain positive about RERE’s future growth, and I am excited about a variety of opportunities RERE is to embrace, I wanted to call out several risks that investors will have to take into account.

First, RERE stock price has been fluctuating a lot in the past 12 months (52-week high of $3.52 and 52-week low of $1.52). For a company generating RMB3.0 billion in quarterly revenue and growing at 38% YoY, 0.16x EV/NTM Sales and 1.2x P/B suggest room for RERE price to grow, however it may take a bit more time for the market to recognize the value.

Second, although the pre-owned electronics market has a high barrier to entry, there are other strong players on the market. RERE has to continue to differentiate itself through expansion strategies and operation efficiencies.

Lastly, there could be uncertainty in China’s economic recovery post COVID. The strong rebound we had all hoped for has not yet come as of H1 ’23.

Read the full article here