For September, I am maintaining my August forecast for West Texas Intermediate (WTI) oil prices ranging between $70 and $90 per barrel.

OPEC+ will likely extend its production cut into October. Although it may reduce its cut somewhat, I expect that cut to remain at its current levels at roughly one million barrels per day from Saudi Arabia and five hundred thousand barrels per day from Russia.

Reuters’s August 25, 2023, article “Russia’s oil exports via western ports slightly up in August despite pledged cuts” questions whether Russia is completely adhering to their cuts.

MOSCOW, Aug 25 (Reuters) – Crude oil loadings from Russia’s western ports in August are seen slightly higher from July despite Moscow’s pledge to cut oil exports by 500,000 barrels per day, according to traders, shipping data and Reuters calculations.

The loadings remain well below a four-year export peak achieved in May, the data shows.

…

But as Russia has not provided the baseline for its supply reduction, the rise of loadings in August from July does not mean Moscow is not fulfilling its pledge.

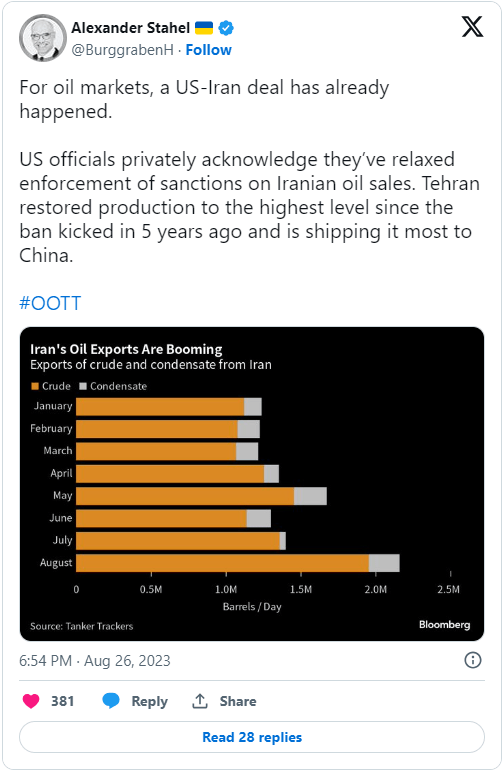

Although the voluntary OPEC+ cuts by Saudi Arabia and Russia have tightened physical markets, oil prices have not moved very much at all. Some point to increased production by Iran and China tapping its strategic petroleum reserves.

Others point to China’s and Europe’s weak economies with the threat that the American economy soon slows too.

There is also the possibility that the American economy reaccelerates, and the Fed is forced to raise rates yet again, thereby cooling the global economy even further.

Most point to all these factors as reasons for oil prices having remained range-bound in August.

As I look back over the past several months, I notice that some prominent oil pundits have made very bullish claims that have failed to materialize. Coming into June, they blamed the debt ceiling crisis for prices remaining low.

Then, once the debt ceiling crisis was over, they forecasted that prices would work steadily higher, possibly hitting $100 by the third quarter. When that did not materialize, it was because higher interest rates caused destocking, meaning that higher interest rates made keeping inventory an expensive proposition.

Then, once OPEC+ made its announcement of curtailing production on a voluntary basis, that was a sure sign that prices would accelerate to the upside. As July and August have passed, many are still clinging to the idea that oil prices will still hit $100 by year-end.

Stepping back from narratives from pundits, we can look to an options model to quantify the likelihood of WTI exceeding $100 in December or January.

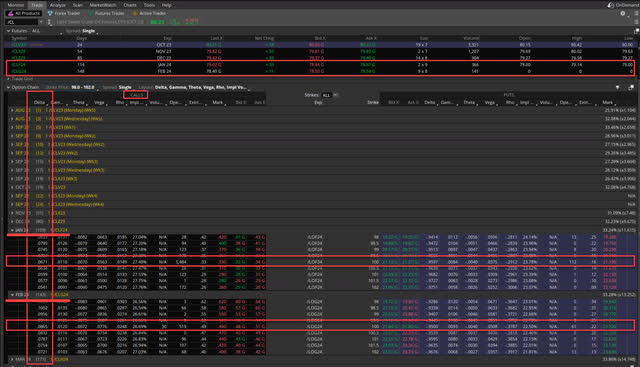

Figure 1: Screenshot of thinkorswim’s Quotes for Oil Futures and Options

Figure 1 shows thinkorswim’s option Greeks for /CL, which is WTI, for options expiration in December, even though it says January, and for options expiration in January, even though it says February.

The January 2024 oil futures expire 114 days from today, Sunday, August 27, 2023, on Tuesday, December 19, 2023. The last day for trading options on thinkorswim is 109 days on Thursday, December 14, 2023.

And the February 2024 oil futures expire 148 days from today on Monday, January 22, 2024. The last day for trading options on thinkorswim is 143 days on Wednesday, January 17, 2024.

The CME Group provides an oil futures calendar as to when the futures expire. The brokerage thinkorswim indicates when the last date for options trades are allowed on its platform. As we saw, the last options trading date precedes the futures expiry date by a few days.

Looking at the options that expire on December 14, 2023, we note that the call delta is 0.0671. Delta can be used as a rough proxy for the probability that the underlying future will close at or above the strike price.

In other words, the probability that WTI closes at or above the strike price of $100 by option expiration is about 6.7 percent. The probability of touching the strike price between now and option expiration is roughly twice the delta value.

In other words, between August 27 and December 14, there is a 13.4 percent probability that oil prices at least touch the strike price of $100.

Following the same logic and process, the probability that WTI closes at or above the strike price of $100 by option expiration on January 17, 2024, is about 8.7 percent. And between August 27 and January 17, there is a 17.3 percent probability that oil prices at least touch the strike price of $100.

It is important to note that looking at the oil prices, we need to reference the correct future price. For example, when I took this screenshot, the commonly quoted WTI price was 80.21, which is the October futures that expire in 24 days on Wednesday, September 20, 2023. The January and February futures prices, however, were $79.02 and $78.40 respectively.

From this information, the odds of WTI surpassing $100 by year-end do not look overwhelming. If one believes that oil prices will easily exceed $100 per barrel by year-end, then the call options are seemingly inexpensive.

Also, please note that this information is dynamic. If oil prices spike in September to $90, those January and February options will be more valuable then than they are today.

Although I have never traded options on oil, I have traded a lot of options on equities. There have been several times when I have had an equity blow through options that were initially at a 10 percent probability. These prices and probabilities are a snapshot in time; they can change dramatically in a heartbeat.

So when you listen to pundits opining on extreme price movements, ask yourself if the options markets agree. If the options markets do not agree, then you can either reassess the pundits’ opinions, or if you believe a pundit, then take action in the futures or options markets.

Having said taking action, I would caution those who are considering using futures or options in commodities. These contracts are often large, in that a lot of capital is at risk, and if you are not careful, you can lose a lot of money fast.

Many commodities have mini and micro contracts. Those contracts are likely a better place to start until your understanding and risk tolerance increases to match that for larger-sized contracts.

Caution is also warranted for equity options. It is easy to wrap your account around the proverbial pole. Before investing in options, make sure that you have sufficient knowledge and start small.

Wrapping up, I forecast September WTI oil prices to range between $70 and $90 per barrel.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here