Past Caution on PSQ

Three months ago, we wrote this article warning against buying NYSEARCA:PSQ and shorting the QQQ. Now, after a four week decline, many are wondering if it’s now time to buy PSQ and short QQQ. This article will update the situation by looking at the same indicators that made us cautious last May, and also introduce another we think clarifies what to do.

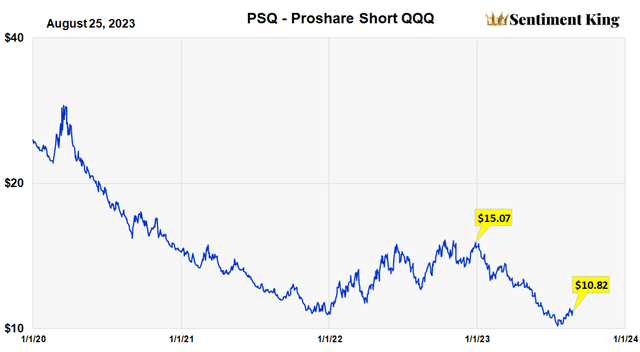

PSQ is a ProShares ETF that goes short the QQQ. It’s NAV is graphed below.

NAV of PSQ since 2020 (Sentiment King)

The chart pattern of PSQ moves opposite to the QQQ as you would expect. While the QQQ is substantially up since January, PSQ is down over 28%.

The graph clearly shows the rally in PSQ over the last four weeks, as the general market has declined. The key question is, “Is this small rally the start of a major price rally in PSQ, and therefore the start of a major decline in the market?”

We think the answer to this question is, “No”, and for the same reasons we stated in the May article. Let’s look at the current indications.

Investor Interest In PSQ Is Still Too High

In a strange way this is bad for investing in PSQ. With this fund you want to buy it when no one wants it and sell it when everyone wants to buy it. At The Sentiment King we base most decisions on the theory of contrarian opinion and market sentiment. We often decide whether to invest in a ProShares fund by measuring investor activity in that fund.

Since PSQ goes short the QQQ, measuring how much investors are buying it functions like the old short selling indicators of old. Too many short sellers is positive for the market and right now there are too many buyers of PSQ.

Buying In PSQ As A Percent Of Assets Is Rising

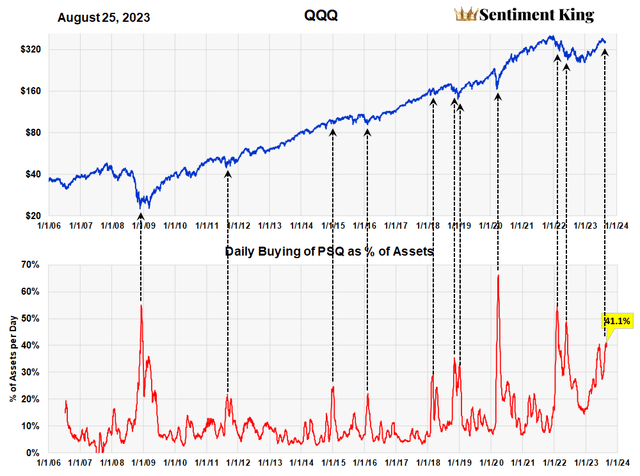

The graph below charts of daily buying in PSQ as a percent of assets, plotted against the QQQ. It shows how much investor interest there is in going short QQQ. It goes back to 2006 and we highlighted it in last May’s article as a major reason to avoid PSQ.

Investor buying of PSQ is currently at 41% of assets per day. This is historically a very high purchasing ratio, even higher than last May. High ratios in the past have almost always signaled price lows before major advances. It’s strongly signalling this four week decline is short term and there purchasing PSQ is not advised.

Buying in PSQ as Percent of Total Assets (Sentiment King)

Dollar Buying Of PSQ Is Still High But Below Peak Levels.

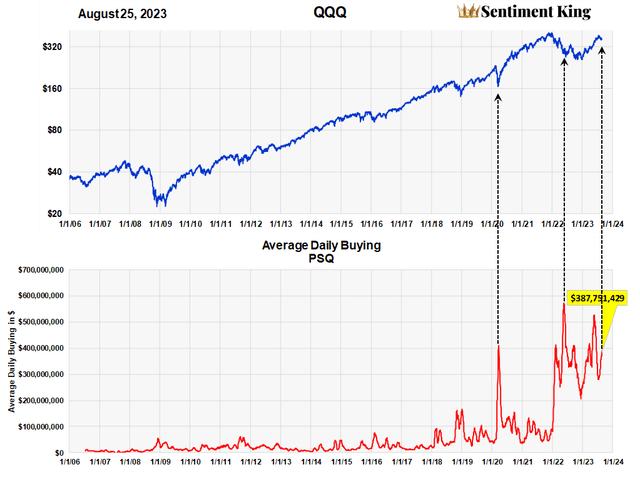

Because the buying ratio in the previous chart is independent of AUM, we prefer to use it when measuring investor interest in shorting the market. But sometimes it’s also instructive to look at the actual purchasing amounts going into PSQ each day. That’s what the next chart graphs.

Dollar Amounts Buying PSQ per Day (Sentiment King)

This graph, which plots purchase amounts going into PSQ each day, shows buying of PSQ is currently averaging a little over $387 million per day. This is less than the $510 million a day last May but, as you can tell from the third dashed line, it is still very high.

While an improvement over May, it does show that there is still too much investor interest in shorting this market.

Buying and Selling In ProShares Funds Points To A Higher Stock Market

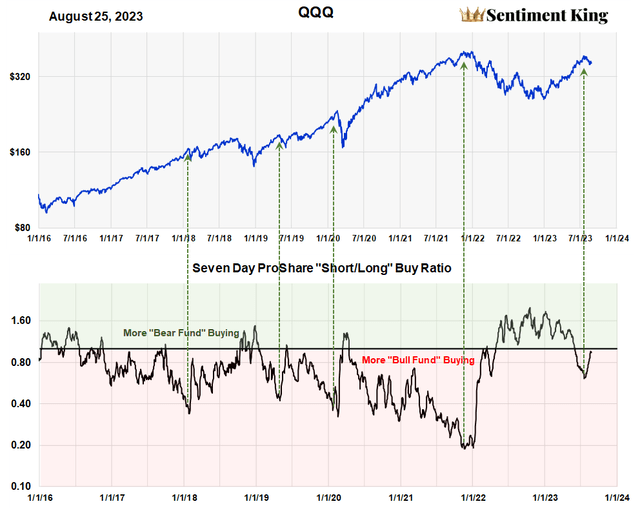

We rely very heavily on this next chart. It’s the ratio of the amount of money going into all the ProShares “short” ETFs divided by the amount going into all the ProShares “long” ETFs. It shows how much investors are interested in both the “long” and “short” side of the market.

Ratio of Buying of ProShare Short Funds to Long Funds (Sentiment King)

The pink area is when more money is going “short” than “long” and the green area the opposite. The black line across is one for one. As you can see, except at extreme lows in bear markets, there is usually a lot more money going “long” then “short.”

Historically, whenever 2 1/2 times more money is purchasing “long” ETF’s than “short” ETF’s, it signals too much bullish enthusiasm and generally indicates a market top. 2 1/2 times is a ratio of .4 on the chart.

We’ve indicated four of these with green arrows on the chart. They usually occur after a long price advance when investors have become complacently bullish. What’s important is that no major decline ever started when the ratio was more than .4.

You can see from the chart that during the recent eight month rally, the ratio never got much below .8, and is currently around 1.0. This high ratio is the kind of reading you get before a major price advance, not before the start of a major price decline.

Since this indicator is made from the combined investment activity of millions of investors, we believe it gives deep insight into what investors everywhere are thinking about this market. To us, it indicates far too much investor pessimism, which never occurs before a major market decline.

We feel these indicators of investor activity in the ProShare family strongly suggest investors should not buy PSQ, or go short this market.

Summary

Investor activity in the ProShare fund family, and PSQ itself, confirms the view that this recent market decline in short term and that one should not short this market or buy PSQ. Other indicators we follow point to the same conclusion, which we explained in this recent article. At some moment there will be a time to buy PSQ; it’s just not now.

Risk Warning

There are unique risks that come with investing in PSQ not found in most other ETFs. There is a constant downward price erosion that increases the longer one holds the fund. This comes from what are called “carrying costs” due to the fact the ETF must use some form of margin.

This risk is especially burdensome now due to the higher than normal interest rates created by the FED to fight inflation. Both the ProShares website and the SEC have detailed messages on the inherent risks using leveraged ETFs.

Read the full article here