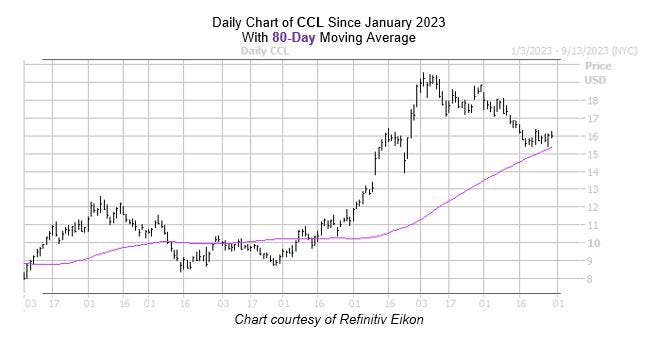

Since touching a July 5, roughly 15-month high of $19.55, Carnival Cruise (CCL) stock has suffered amid the broader mark’s August pullback, shedding nearly 15% this month despite support from the $15.50 mark, as the $16.50 level keeps rallies in check. Amid this pullback, however, the shares are trading near historically bullish trendline that could signal a bounce on the horizon.

A study from Schaeffer’s Senior Quantitative Analyst Rocky White shows Carnival Cruise stock coming within one standard deviation of its 80-day moving average, with three other instances occurring during the past three years. The security was higher 67% of the time after these pullbacks, averaging a one-month return of 10.1%. Trading flat despite a price-target hike to $22 from Stifel, a similar move from its current perch at $16.05 would place the stock above the $17.60 area.

Now looks like an ideal time to speculate on the equity’s next move with options, as its Schaeffer’s Volatility Index (SVI) of 42% stands in the lowest possible percentile of annual readings. Plus, its Schaeffer’s Volatility Scorecard (SVS) ranks at 72 out of a possible 100. This means options traders are pricing in low volatility expectations, and CCL tended to exceed these expectations over the past year.

Read the full article here