Salesforce

is the best-performing stock in the

Dow Jones Industrial Average

this year and it looks to be heading for another leg up following its latest earnings report. However, some Wall Street analysts are still cautious about whether the enterprise software company can return to its previous high rates of growth.

Salesforce

(ticker: CRM) shares were up 5.4% in premarket trading at $226.62 on Thursday after its quarterly earnings topped estimates. That will add to its 62% increase this year, which has seen it outshine

Apple

(AAPL) and

Microsoft

(MSFT) in the Dow this year.

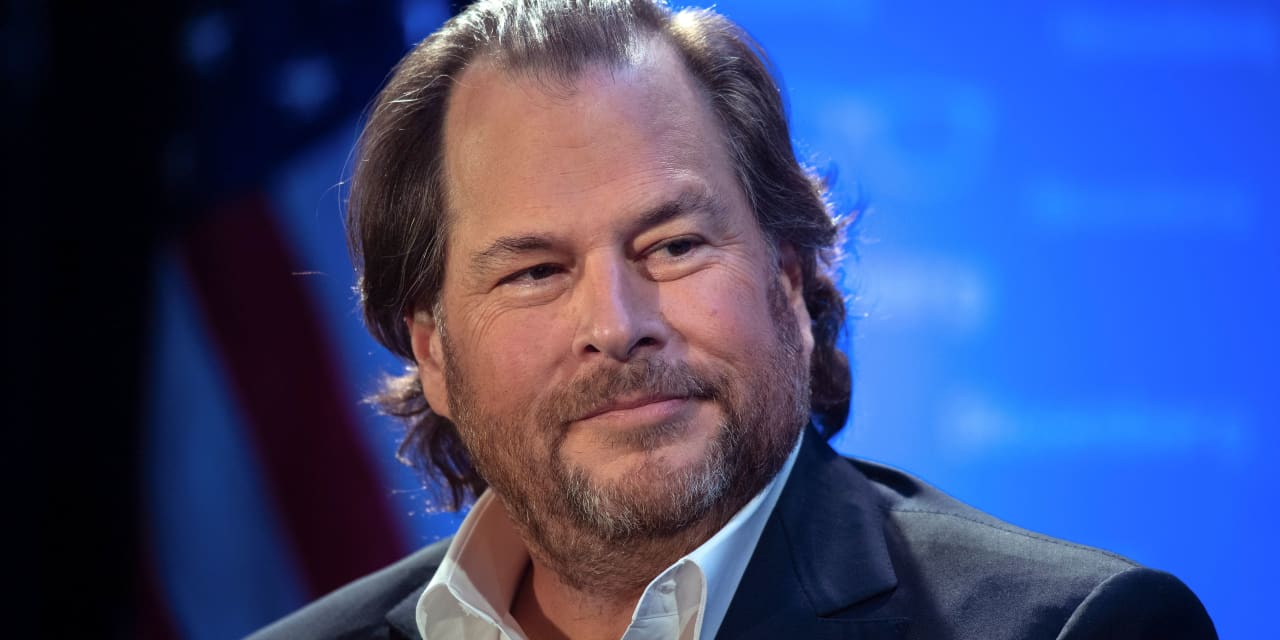

However, the stock still languishes well below its highs of more than $300 in 2021 and not all analysts are convinced it will regain those levels despite CEO Marc Benioff’s strategy of raising prices and investing in artificial intelligence.

D.A. Davidson’s Gil Luria noted that Salesforce’s revenue growth continues to hover closer to historic lows of 10% to11%. He kept a Neutral rating on the stock and a price target of $200.

“With no indication of a potential for revenue acceleration, we remain on the sidelines,” Luria wrote.

Salesforce is aggressively embracing the AI trend, having embedded the technology into its flagship customer-relationship-management software, messaging app Slack, and other tools. However, it doesn’t expect any material contribution from AI in its current fiscal year.

“We remain skeptical of Saleforce’s ability (as well as other application vendors) to monetize on its AI investments. For us, the key question remains whether or not Salesforce can remain a double-digit grower,” wrote John DiFucci at Guggenheim Securities.

Guggenheim kept a Neutral rating on the stock.

Even more bullish commentators have questions over the timeframe that AI benefits will flow through to Salesforce’s bottom line.

“Generative AI largely remains a wait-and-see story for Salesforce and the per-user functionality seems unlikely to be a needle-mover anytime soon as customers are only in the very early stages of testing/experimenting,” wrote Rishi Jaluria at RBC Capital Markets.

However, Jaluria kept an Outperform rating and $240 target price on the stock. He noted Salesforce’s operating margins reached 30% three quarters ahead of schedule and its guidance should relieve concerns about growth dropping to low single-digit percentages.

Write to Adam Clark at [email protected]

Read the full article here