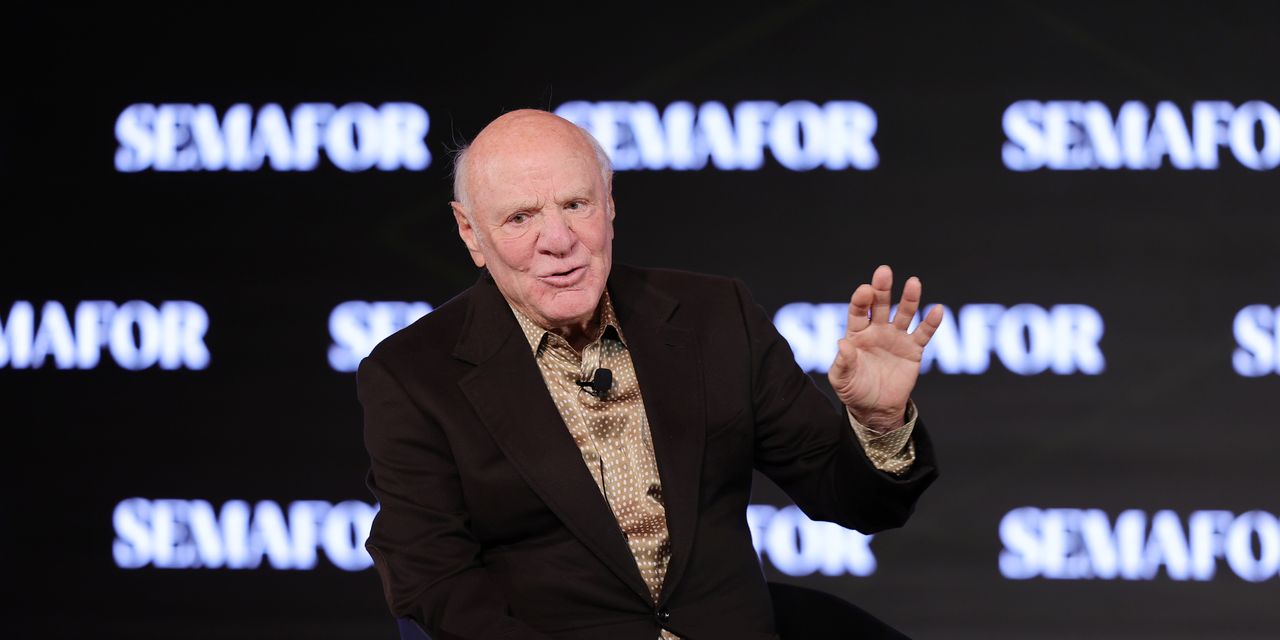

Hollywood’s legacy studios need to settle the writers and actors strikes soon — even if it means cutting their own deals without Netflix and Amazon — or face “catastrophic” consequences to their business, entertainment mogul Barry Diller says.

Diller, who founded Fox Broadcasting Co. and is currently chairman of IAC Inc.

IAC,

told tech journalist Kara Swisher on her podcast Thursday that the studios need to realize that Netflix and other tech companies are their enemies, not their allies, with fundamentally different business models.

The traditional studios — such as Paramount

PARA,

Comcast’s

CMCSA,

Universal, Disney

DIS,

Sony

SONY,

and Warner Bros.

WBD,

— are currently teamed with Netflix

NFLX,

Amazon

AMZN,

and Apple

AAPL,

as part of the broad Alliance of Motion Picture and Television Producers in their negotiations with the writers and actors unions.

“They should certainly get out of the room with their deepest fiercest and almost conclusive enemy — Netflix — and probably with Apple and Amazon, because Netflix is in one business and and they are the rulers of the business,” Diller said on the podcast. “Apple and Amazon Prime are in completely different businesses that have no business model relative to production of movies and television, it’s just something they do to support Prime or something they do to support their walled garden at Apple.”

“ “The strike does one thing, and one thing only in the end … It strengthens Netflix and weakens the others.” ”

“I just don’t think they belong in the same room,” Diller said, adding that the studios should reach out to the striking guilds on their own and repair their more-than-century-old relationship. “We are your natural allies, not your enemies,” he said.

Diller argued that Netflix was the “architect” of the strikes by breaking Hollywood’s traditional business model, and that the studios may have slit their own throats by abandoning their lucrative business models in favor of starting money-losing streaming services.

Also see: What’s worth streaming in September 2023? Here are your best bets amid slim pickings.

“The strike does one thing, and one thing only in the end, because the strike will get settled,” Diller said. “What does it do? It strengthens Netflix and weakens the others.”

He said if the strike continues much longer, the studios will feel serious — and perhaps irreversible — pain in 2024, when they will inevitably lose streaming subscribers as their backlog of content runs dry.

“When they have to gear up to make more programming to get back subscribers, they won’t have the revenue base to be able to produce,” Diller said. “So that is kinda catastrophic.”

His solution? Aside from a separate peace, studios should “reorient themselves” by rebuilding their broadcast and pay-TV networks, which remain profitable despite more consumers cutting the cord.

Diller said he was pessimistic that would happen, though.

“Out of consolidation, these businesses are so down the ladder from where they were, that I think they have in various ways atrophied,” he said. “There are and have been, and are right now, some good leaders of these businesses — but my god the problems they have.”

Read the full article here