Investment Thesis

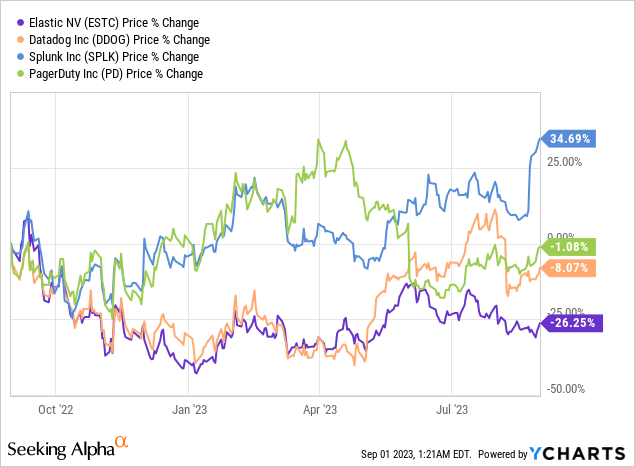

Elastic (NYSE:ESTC) is a stock that hasn’t recovered since its Covid heydays even as many of its peers have now started to recover. In fact, in the past year, Elastic has underperformed its peers, as you can see below.

Elastic had been left for dead. However, it appears that now is Elastic’s time once again, as on the back of its fiscal Q1 2024 results, the stock jumped higher as investors saluted its upward revised guidance.

However, as I unpick these results, despite recognizing that the stock is up significantly premarket, I struggle to get bullish on this company that is still priced at more than 60x this year’s EPS.

Why Elastic? Why Now?

Elastic is a data analytics company that leverages search technology to help organizations extract valuable insights from vast amounts of data, providing Search, Observability, and Security, all designed to facilitate rapid information retrieval.

At its core, Elastic’s platform is underpinned by the Elastic Stack, a product that allows for the ingestion of data from any source, searching, analyzing, and visualizing it. Elasticsearch, a highly scalable search engine, and Kibana, a unified user interface, are key components.

Elastic excels in handling large datasets and accommodating various data types. The example I often provide is that Elastic’s platform is as content to ingest “always-on” data from Twitter as it is from a rigid Excel spreadsheet.

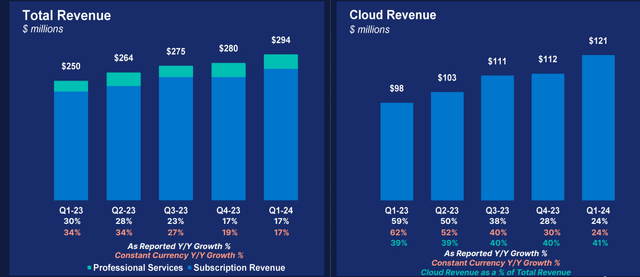

Moving on, this quarter requires some interpretation. On the one hand, Elastic Cloud, a crucial segment of their offerings, exhibited remarkable growth with a 24% y/y increase. This allowed Elastic to point out the value they are providing customers.

ESTC Q1 2024

On the other hand, to a large extent, this is simply cannibalizing their legacy on-premise offering. It’s a bit like taking from the left pocket and adding to the right pocket and saying, “look how much bigger this right pocket now looks”. At the end of the day, its growth rates aren’t what they used to be.

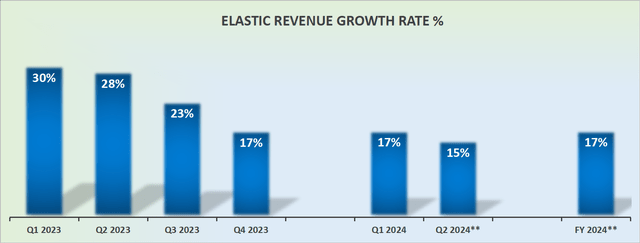

Revenue Growth Rates Below 20% CAGR

ESTC revenue growth rates

In the past year, we’ve heard from countless IT and software companies noting customers’ proclivity towards consolidating their workloads onto just one platform.

Here’s a quote from the earnings call highlighting just that,

… [a] distinct trend in our business is the continued push by customers to consolidate onto the Elastic platform for multiple use cases. In Q1, customers continued to make large multi-year commitments as they sought ways to lower their total spend without sacrificing innovation by bringing more workloads from other incumbent solutions onto Elastic.

Customers are eager to optimize costs without sacrificing innovation. This trend highlighted Elastic’s competitive strengths in core areas such as search, log analytics, and security analytics. Customers appreciated the ease of use, scalability, and advanced features offered by Elastic for observability, search, and security and thereby continue to reach out to Elastic.

This allowed Elastic to upwards revise its fiscal 2024 revenues. Slightly. All that being said, where Elastic’s results truly shined was its improvements to its bottom line.

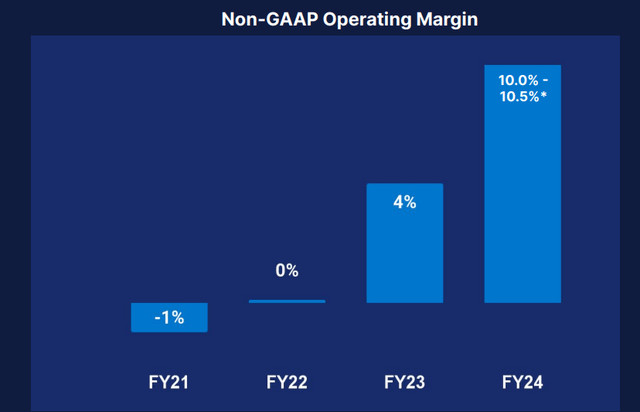

Profitability Profile Jumps Higher

ESTC Q1 2024

Similarly, Elastic upwards revised its underlying profitability for fiscal 2024. At the high end, Elastic now expects as much as $1.11 of non-GAAP EPS compared with $1.06 of EPS at the high end it previously guided for together with its prior results.

This means that we are just one quarter into its fiscal year and its non-GAAP EPS has improved nearly 5% relative to investors’ expectations as they headed into this earnings print.

This puts the stock priced at 64x this year’s non-GAAP EPS. Despite Elastic increasing its non-GAAP EPS estimate, together with investors saluting this set of results plus the stock jumping by 14% pre-market, I simply don’t believe that this is a reasonable valuation when all is said and done. Why?

Not only because its valuation is stretched for what it offers, but also because we should be mindful of risks to its operations.

The Sector is Under Pressure

Elastic’s sector is under pressure. Elastic operates in a highly competitive and rapidly changing market. Elastic’s top two competitors are Splunk (SPLK) and Datadog (DDOG). Splunk is a well-established player in the observability and security analytics space, offering a robust platform for monitoring, analyzing, and visualizing machine-generated data. With a broad customer base and a strong brand presence, Splunk competes directly with Elastic in delivering real-time insights and solutions for IT, security, and business operations.

Datadog, on the other hand, specializes in cloud-scale monitoring and analytics, providing a unified platform for observability and application performance management. It excels in offering comprehensive visibility into cloud-native environments and containerized applications, making it a formidable competitor in the modern application monitoring and troubleshooting arena.

Both Splunk and Datadog pose significant challenges to Elastic, especially in the context of observability and security solutions. What’s more, in my opinion, both these peers are growing at a pace that is significantly lower than they had been historically, once again echoing that the sector is not as vibrant as it once was.

The Bottom Line

The stock is soaring in the premarket following its fiscal Q1 2024 results and an upwardly revised guidance, however, I find it challenging to feel bullish about the company, especially considering its current valuation, which is valued at +60x this year’s EPS.

Further, the company’s revenue growth rates are now below 20% CAGR, and its recent success seems to stem partially from cannibalizing its legacy on-premise offering rather than substantial organic growth.

Moreover, Elastic faces several risks, including dependence on the growth of its Elastic Cloud offerings, competition from established and emerging rivals like Splunk and Datadog, plus a soft macro environment in the IT space.

Despite its recent stock price jump and improved profitability, Elastic’s current valuation appears stretched considering these risks. I’ll pass on this for now.

Read the full article here