Passive income investing simplifies the retirement planning process by enabling an individual to focus on dependable dividend stocks that cover living expenses and grow their payouts over time. This approach removes emotions – an investor’s worst enemy – from the investing equation and enables an investor to take advantage of market downturns rather than fearing them.

Moreover, dividend growth stocks typically have strong underlying businesses because a company that can throw off an ever increasing amount of cash flow on a per-share basis over the course of many years typically has a very strong moat and exceptional management.

As a result, dividend growth ETFs like the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) and the Vanguard Dividend Appreciation Index Fund ETF (NYSEARCA:VIG) are popular funds among retirees. They pay out consistently growing dividends and also generate attractive long-term total returns for investors. In this article, we compare them side by side and offer our take on which one is the better buy at the moment.

SCHD Stock Vs. VIG Stock: Total Return Track Record

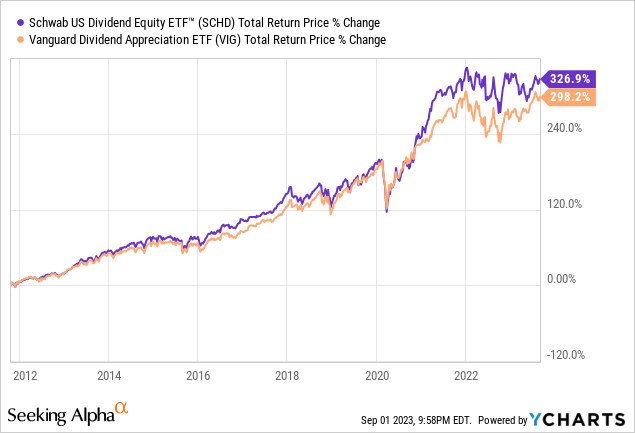

While there is a lot more that goes into making an investment decision that past performance (which is, after all, no guarantor of future results), many investors do still like to know how an ETF has performed in the past before deciding to pull the trigger on investing their own funds into it. Here is how VIG and SCHD stack up against each other:

As the chart makes evident, both of these funds are tightly correlated with each other and have delivered exceptional performance over the past decade plus. However, SCHD’s total returns have slightly outpaced VIG’s. It is worth noting that both charge a very low expense ratio of 0.06%, so SCHD’s outperformance of VIG is based solely on the performance of its underlying holdings and is not influenced at all by differences in expense ratios.

SCHD Stock Vs. VIG Stock: Dividend Growth Track Record

When it comes to dividend growth, SCHD has significantly outpaced VIG over the past decade, posting a 11.32% CAGR compared to VIG’s CAGR of 7.88%. Over the past five years, SCHD has generated a dividend CAGR of 13.92% compared to VIG’s CAGR of 9.89%. Over the past three years, VIG’s dividend CAGR has increased significantly, coming in at 11.75%, though it still trails SCHD’s dividend CAGR of 12.33% over that span. That said, over the trailing twelve months, VIG’s dividend growth rate was 8.56%, which actually outpaced SCHD’s dividend CAGR of 7.13% Despite VIG’s slightly superior dividend growth rate over the past twelve months, SCHD overall wins the crown for being a superior dividend grower.

SCHD Stock Vs. VIG Stock: Dividend Yield

SCHD’s trailing twelve month dividend yield is 3.49%, well above VIG’s trailing twelve month dividend yield of 1.90%. When combining its clearly superior dividend yield with its better track record of delivering dividend growth, SCHD appears to be the clear winner in the competition over which is the better dividend stock. Moreover, it also explains why it has delivered superior total returns over the long-term.

SCHD Stock Vs. VIG Stock: Portfolio Composition

That said, when making a forward looking investing decision on an ETF, it is particularly important to assess its current portfolio constituents.

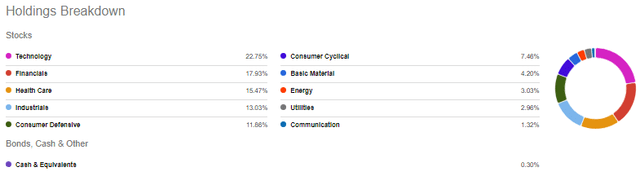

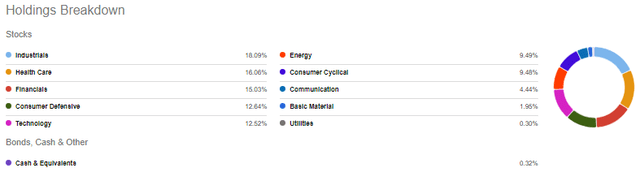

As the graphics below illustrate, the biggest difference between VIG’s and SCHD’s portfolios is that VIG has far more exposure to technology than SCHD does and far less exposure to energy and industrials than SCHD does. This helps to explain why SCHD offers a much higher dividend yield than VIG does since energy stocks in particular – as well as some industrials – tend to offer much higher dividend yields than technology stocks do.

VIG Portfolio (Seeking Alpha)

SCHD Portfolio (Seeking Alpha)

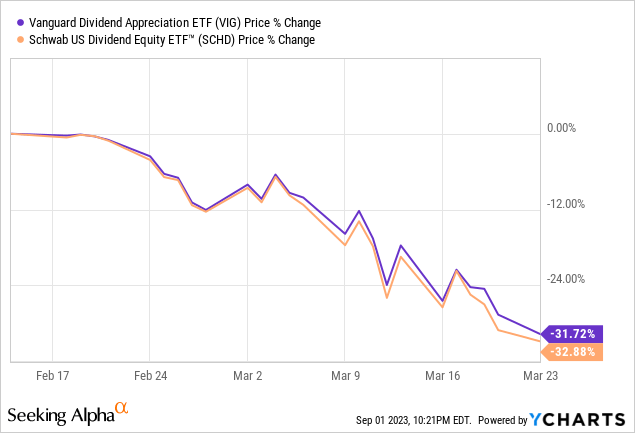

When it comes to number of individual holdings, VIG is more than three times as diversified as SCHD, with 317 compared to 104. That said, 104 is still plenty of individual holdings, so it does not appear that VIG benefits much in terms of risk-reward from having so many more holdings. In fact, looking back at the total return performance chart indicates that the two ETFs have similar volatility. For example, during the COVID-19 crash, SCHD dropped out slightly more than VIG did, reflecting very similar amounts of volatility:

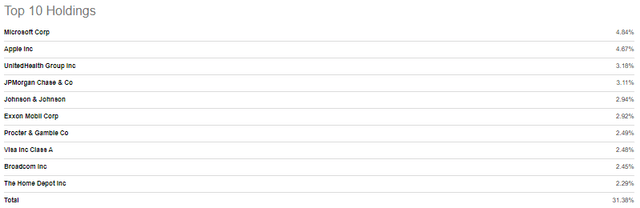

When looking at their top 10 positions, we see that SCHD is significantly more concentrated than VIG is, though relative to its number of total positions it is actually less concentrated in its top 10 positions.

VIG Top 10 Holdings (Seeking Alpha)

SCHD Top 10 Holdings (Seeking Alpha)

It is also interesting to note that VIG is heavily invested in the two dividend growth mega cap tech stocks, with Microsoft (MSFT) and Apple (AAPL) taking its top two spots and occupying nearly 10% of its total portfolio. This helps to explain how VIG has so much exposure to technology while also having a fairly low yield (since AAPL and MSFT both have pretty low yields).

It also helps to explain why their dividend growth rate has lagged SCHD’s a bit in recent years since AAPL’s 10 year dividend growth CAGR is only 8.73% and even less impressive over the past 3 and 5 years (5.74% and 6.69%, respectively). That being said, AAPL and MSFT have delivered exceptional total returns over that period, so VIG’s relative underperformance in that category must stem from weaker investment performance elsewhere.

Investor Takeaway

While SCHD and VIG are both very solid dividend growth ETFs, SCHD appears to be head and shoulders better than VIG given its superior total return and dividend growth performance track record, its vastly superior dividend yield, and its more defensive posturing in its portfolio towards more undervalued energy and industrial names and less exposure to the currently richly valued technology sector.

In our view, the main reason to own VIG is if you want all-in-one exposure to mega cap tech and dividend growth names. However, if you truly want a fund that combines an attractive current passive income stream with long-term dividend growth and total return potential, SCHD is clearly the superior choice.

Read the full article here