Investors in Invesco QQQ Trust ETF (NASDAQ:QQQ) suffered a steep pullback in August as sellers digested the technology-led ETF (50% weighting), sending it down nearly 9% from its July highs (388 price level). As such, QQQ revisited levels last seen in early June (355 price level) within three weeks of topping out.

Despite the steep pullback, buyers returned with conviction, taking advantage of the bear trap or false downside breakdown in mid-August, as QQQ’s short-term uptrend remains well-supported.

As a reminder, I encouraged investors to cut exposure (not bearish) in early July as I anticipated a sharp pullback. While the pullback occurred as anticipated, I was pleasantly surprised by the robust defense buyers mustered at QQQ’s August lows (355 price level).

I also capitalized on the opportunity to add exposure to my portfolio in the recent rotation. The market then rallied to its recent top as we ended Q3, although a late selloff dampened some of the recent momentum.

I believe Bulls and Bears are battling to define the market’s next move, particularly for the tech-heavy QQQ, which has outperformed the SPX since its bottom in January 2023. With its earnings multiple having surged to nearly 26x (Vs. SPX’s 19x), investors are justified to assess whether SPX could overturn its relative underperformance against QQQ moving ahead.

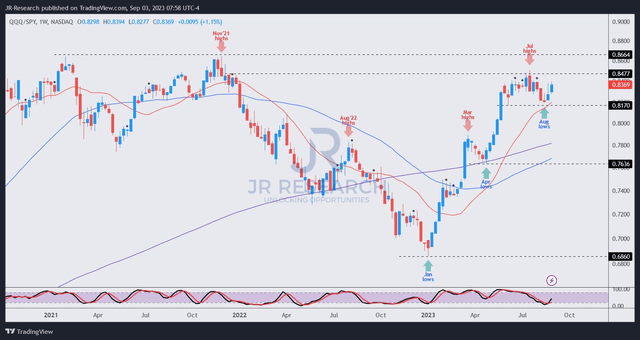

QQQ/SPY price chart (weekly) (TradingView)

To be clear, I have yet to glean any decisive breakout signals on the QQQ/SPY chart above as it continues to consolidate. While its August lows were well-supported, the 388 level is expected to remain a significant resistance level that has stymied QQQ’s continued outperformance against the SPX since early June 2023.

As such, I believe caution is still necessary despite the recent recovery. If you didn’t manage to buy more shares at the 355 level, I don’t think you should chase the recent upside, as it has moved much closer to its resistance zone.

Despite that, I believe there are reasons to be optimistic even as QQQ/SPY re-attempts its re-test of its July highs. Fed Chair Jerome Powell and the FOMC are increasingly likely to sustain a rate pause as recent inflation and employment data demonstrate the effectiveness of the Fed’s restrictive policies. As such, strategists and economists have started to favor longer-duration bonds, expecting the yield curve to steepen as interest rates are expected to normalize.

While the 10Y Treasury yield re-tested its October 2022 highs (4.36%), SPY and QQQ remain far above their 2022 lows (348 and 254 price levels, respectively), suggesting that investors are likely looking past inflation rate headwinds. My assessment of the 10Y suggests it has formed a double-top bull trap (potent false upside breakout), indicating that it has likely formed its long-term top.

Therefore, it seems like the tech-heavy QQQ is expected to be driven further by the recovery in forward earnings estimates instead of yields. Despite that, the topping out of long-term yields, as it is expected to steepen further, should bolster the upward recovery of the QQQ, suggesting investors should consider holding on to their exposure.

Investors who added at the market’s recent August lows should be glad that they ignored the stubborn bearish prognosticators who have been proven wrong since the start of 2023. Given the constructive price action on QQQ and the likely topping out of the long-term yields, I’m ready to upgrade my rating, as I consider my previous thesis to have played out as QQQ fell toward its early June lows.

Rating: Upgraded to Hold. Please note that a Hold rating is equivalent to a Neutral or Market Perform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here