As part of our aerospace coverage, I cover aerospace supply chain stocks, OEMs, airplane lessors and airlines. Airlines generally are seen as the riskier investments due to the tendency to increase capacity in an unconstrained setting eroding fare strength with significant reactions to macro-economic indicators and oil price fluctuations. Airport names are not completely shielded but could provide for safer investment opportunities.

In this report, I will be discussing the most recent of Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR). Since my most recent April report, the company has lost 5% of its value while the S&P 500 (SP500) has gained more than 8%. Since my October 2022 report, the stock gained 22% compared to 18.4% for the S&P 500. So, over the longer term, there is some outperformance, but it might be a good time to revisit our projections for the stock.

About Grupo Aeroportuario del Sureste

Grupo Aeroportuario del Sureste is an international airport group operating airports in Mexico, the U.S., and Colombia. The company operates nine airports in Mexico, including Cancún International Airport which is the second biggest airport in Mexico with over 22 million passengers annually accounting for over 75% of the traffic flow through the Mexican airports operated by the airport group. Luis Muñoz Marín International Airport in San Juan with over 9 million passengers annually is the second biggest airport in the company’s portfolio and the only airport it operates in the U.S. The third biggest airport that the group operates is the José María Córdova International Airport that serves the Medellín Metropolitan Area and has nearly 8 million passengers each year. It is the biggest airport in the portfolio of six airports operated in Colombia.

How Do Airports Make Money?

So, how do airports make money? It is basically two revenue streams, the first one is aeronautics revenues that include landing and departure fees, passenger charges, terminal space rentals, security, and aircraft parking. The second stream is non-aeronautical revenues, which include things like car parking, car rental, ground transportation, retail, food and beverages, and fast track.

So, there are two revenue streams that are well-suited to capitalize on the travel rebound. On one hand, we have airlines increasing their flight schedules again, which benefits the airline via aeronautical revenues. On the other hand, the passengers are returning to the terminal halls, and they have money to spend which benefits the commercial revenues, which form a big portion of the non-aeronautical revenues.

So as an airport, to make money, you have to appeal to airlines providing smooth operations and offer travelers a unique experience.

Grupo Aeroportuario del Sureste Profit Tumbles

Southeast Airport Group

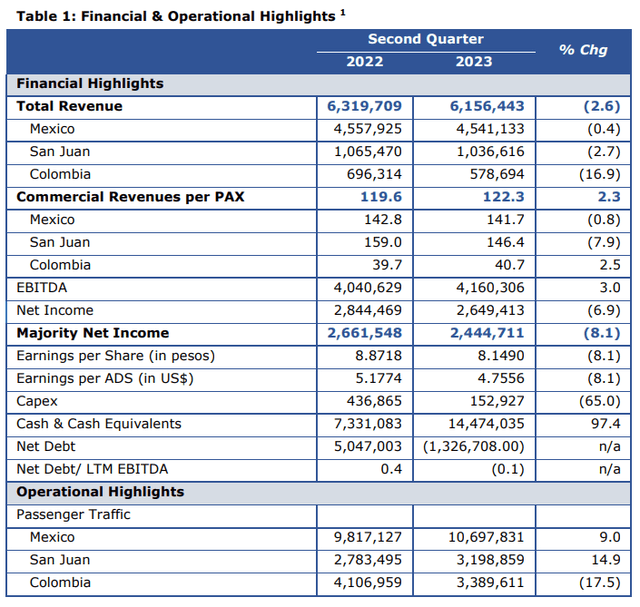

As I already mentioned in my previous report, we would see the year-over-year growth rates taper as the Q2 comp is more challenging due to higher air travel demand in the second quarter last year. Second quarter results were down 2.6% and when we exclude the construction revenues, which are recognized as revenues and simultaneously added to the cost balance, the revenues increased 5.1% on 3.5% higher traffic.

In Mexico, the revenue growth was 10.4% excluding construction revenues on a 9.1% increase in passengers and costs excluding construction costs increased by 16.1% driven by minimum wage being hiked by 20% and higher energy costs resulting in 8.6% higher EBITDA .

Puerto Rico booked a 0.6% decrease in revenues on 14.9% higher passenger numbers, which is driven by the appreciation of the Mexican peso appreciating 16% compared to the USD. Operating costs and expenses excluding construction costs declined by 14.5% driven by recovery of expenses under the CRRSAA Act. Excluding this effect, the costs would have increased by 11%, which I think shows cost control despite the forex pressure. Adjusted EBITDA margins declined for 58.8% to 54.5% due to higher passenger flow not translating favorably due to the appreciation in the Mexican pesos.

In Colombia, revenues dropped by 16.9% on 17.5% higher passenger numbers. This decline was driven by Viva Air and Ultra Air ceasing operations which resulted in 28.8% lower operating profits due to unfavorable cost absorption and volumes.

Consolidated EBITDA was up 3.2%, which was more or less in line with the 3.5% growth in passenger traffic. The adjusted EBITDA margins, however, dropped from 70.5% to 69.1% as we saw negative effects from the appreciating pesos and the problems in Colombia with the demise of two carriers which for the time being will not be filled by LATAM (OTCPK:LTMAY) or Avianca. Overall, the results were not great with pressures in Colombia airline operations and forex pressures and higher costs and less appreciable cost absorption. Nevertheless, the company saw EBITDA growth in line with traffic growth and while that was not quite in line with the 5% revenue growth I think it is decent altogether.

The Risks For Sureste

I believe the opportunities for Sureste are plenty, it has shown years of growing passenger numbers and it has investing for the future with a new airport to serve Cancún. Its acquisition of Colombian airports provides a nice diversification that could further translate to growth. However, so far that has also shown to be a risk to the business with negative forex effects and two airlines operating from Colombian portfolio airports going bust.

Overall, inflationary pressures are a risk, as is the case for many businesses these days, and we did see that back in the first and second quarter results. What we also saw is that the appreciating Mexican peso had a significant impact on the results in Puerto Rico, which is dollar-denominated.

Additionally, Cancún is Sureste’s show pony and that is not something bad, but Cancún is a tourist destination and not so much an airline hub. Therefore, continued leisure, demand, and more importantly international leisure demand is required. If macroeconomic headwinds are prevalent, this could become a problem for Sureste. Mexico is not really known for being the safest place for locals or for tourists, and that means that any eruption in violence could bring tourist sectors to their knees, like we saw happening in Tunisia some years ago. Furthermore, the expectations and reality of nearshoring could affect stocks in Mexico.

Is Grupo Aeroportuario del Sureste Stock Still A Buy?

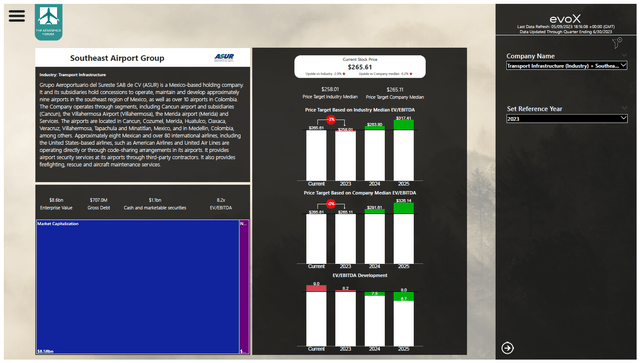

Valuation Southeast Airport Group stock using evoX Financial Analytics (The Aerospace Forum)

With the results being somewhat mixed, the big question is whether ASR stock is still a buy, especially when we keep the lingering issues in Colombia in mind. In order to find a balanced answer to that question, I have added the fundamentals and forward projections into the evoX Financial Analytics tool and the only right thing to do is to downgrade ASR stock from buy to hold given that it is fairly valued against the company median and the industry median for 2023 with limited upside in the years beyond. There is some upside, but definitely not enough for me to consider it a buy.

Conclusion: Southeast Airport Group Is A Hold

The most recent quarterly results were mixed, given that there are some headwinds in Colombia as well as higher minimum wages in Mexico while the appreciation of the pesos does not translate favorably for the San Juan and Colombia operations. With that in mind as well as the forward projections which show no upside for 2023 and limited upside in the years beyond, I am downgrading Grupo Aeroportuario del Sureste stock to Hold from Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here