Investment thesis

My first thesis about Enphase Energy (NASDAQ:ENPH) worked well until the market overreacted to the latest earnings release. The company faces headwinds due to the weak macro environment, which weighs the stock price. For us, Enphase bulls, it is good. We can buy this high-quality business with a substantial discount. Today, I want to discuss the recent developments and update my valuation analysis. Secular trends are still favorable for Enphase, and it is still a high-quality business with exceptional performance. The stock is massively undervalued, and I am reiterating my “Strong buy” rating.

Recent developments

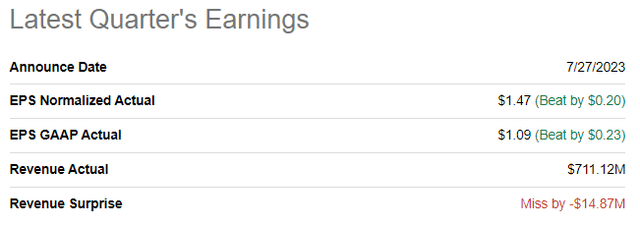

The company released its latest quarterly earnings on July 27, missing consensus revenue estimates but outperforming from the bottom line perspective. Revenue demonstrated a stellar 34% YoY growth, which is impressive amid the current uncertain environment. The adjusted EPS followed the top line and expanded notably from $1.07 to $1.47.

Seeking Alpha

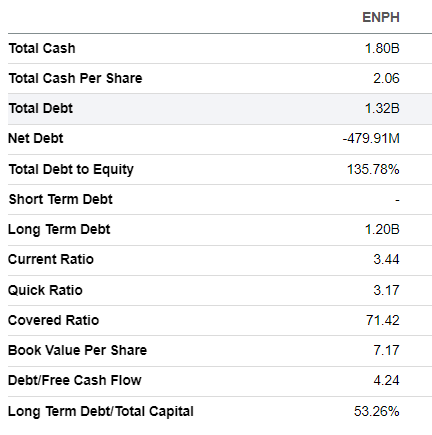

Profitability metrics demonstrated significant expansion, a solid positive sign for me. The gross margin expanded by more than four percentage points, and the operating margin expanded even more comprehensively by more than six percentage points. The profitability metrics improvement enabled the company to boost its cash flow from operations by about 35%. A significant part of the expanded operating cash flow was allocated to a $212 stock buyback. Levered quarterly free cash flow [FCF] of $120 million enabled the company to improve its balance sheet. As of the latest reporting date, the company was in a substantial, almost half-a-billion net cash position and had robust liquidity metrics.

Seeking Alpha

All in all, the latest quarter’s financial performance has been stellar. However, the stock price dropped more than 20% after earnings were released. The major reason for a dramatic stock price drop is the soft revenue guidance for the upcoming quarter’s earnings. The management expects Q3 revenue of $575 million at the midpoint of their range, which would mean almost a 10% YoY decline. Indeed, after eleven straight quarters of double-digit revenue growth, a 10% decline might look like a disaster. But it is crucial not to lose forest for the trees. We are currently amid a very challenging macro environment, with interest rates at their highest level since the beginning of the 21st century. Economies across Europe, a notable market for Enphase, are mostly already in recession. The American economy demonstrates resilience against all odds, but the environment is harsh and uncertain. According to CNN, the credit crunch is worsening in the U.S. as bankruptcies are rising. While the U.S. labor market is still relatively strong, the unemployment rate is expanding steadily. Since Enphase primarily focuses on the residential market, the increasing unemployment is an apparent unfavorable factor for the company. But swings in macroeconomic conditions are just part of business cycles in the economy. That said, all the above-mentioned headwinds are temporary.

As long-term investors, we should focus on secular trends. From a secular perspective, Enphase Energy is a profitability star compared both to the sector median and historical metrics. The company has a strong track record of operating success and profitability metrics expansion, which enabled the company to build a fortress balance sheet. Having wide profitability metrics and a strong balance sheet enables the company to invest heavily in innovation. The company has diversified product portfolio makes it well-positioned to build long-lasting customer relationships. It is also important to remember that the Enphase valuation is under pressure in this market. Many other innovative solar energy companies’ valuations also suffer amid the harsh environment, and a cash-rich company like Enphase can potentially use this favorable environment from the valuation perspective to fuel long-term growth with a strategic acquisition.

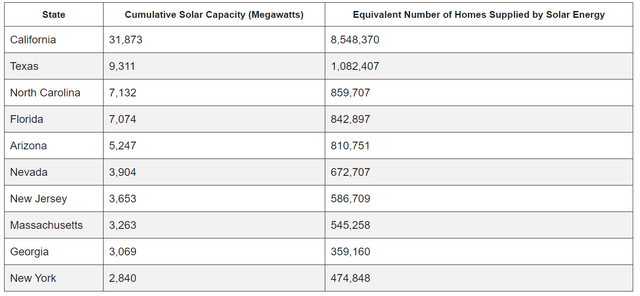

It is also crucial that the U.S. residential solar still has vast room for growth. In California, the undisputed leader in residential solar penetration among all U.S. states, the penetration rate is still below 50%. And other states are lagging significantly in solar energy penetration. For example, the population of Texas is about 25% lower than in California, but the number of homes supplied by solar energy is more than eight times lower. To add context, Texas is the second leading solar energy state in the U.S.

ecowatch.com

That said, there is still vast room for business expansion for Enphase, even within the U.S., not to mention international markets as another strong long-term growth driver.

Valuation update

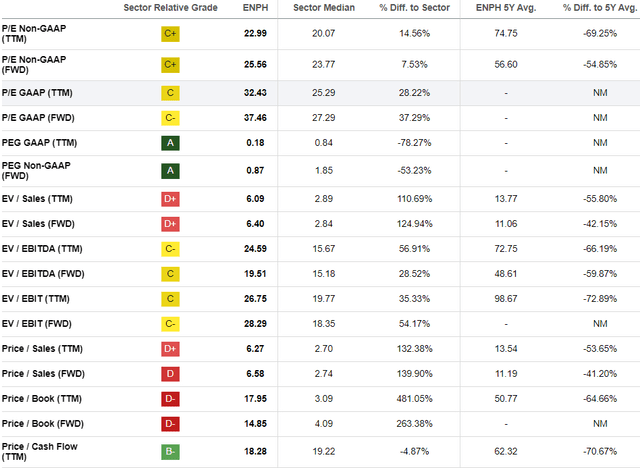

The stock price dropped almost 50% year-to-date, significantly underperforming the broader U.S. market. Seeking Alpha Quant assigns the stock a decent “C-” valuation grade, suggesting the stock is approximately fairly valued. At the same time, current multiples are substantially below the company’s historical averages, which indicates significant undervaluation to me.

Seeking Alpha

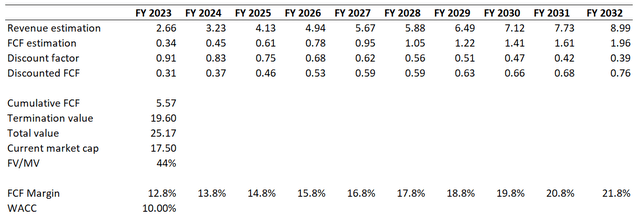

To get more evidence regarding the undervaluation, let me simulate the discounted cash flow [DCF] model. I use the same 10% WACC for discounting as I did in May. Consensus revenue estimates were slightly downgraded after the latest quarterly earnings release, so I incorporated these changes into my DCF calculations. Revenue is now projected to compound at 14.5% annually for the next decade. I use the TTM FCF ex-SBC margin for the base year at 12.8% and expect it to expand by one percentage point yearly.

Author’s calculations

According to my DCF calculations, the business’s fair value is slightly above $25 billion. This indicates that the stock is currently about 44% undervalued, which is a very attractive valuation for me.

Risks update

Enphase is at significant risk of underperforming aggressive growth estimates as a growth company historically traded with premium to peers. Growth investors are very sensitive to even insignificant growth projection downgrades, and we have seen it clearly after the latest quarterly earnings release. That said, investors should be ready to tolerate substantial short-term volatility and hold this investment long-term. The best approach that I implement to mitigate high volatility risk is dollar-averaging my position in the stock.

The current macro environment of high interest rates and the looming credit crunch in the U.S. is unfavorable for the solar energy industry. While recession fears have eased in recent months, the fresh news suggests that the question is still not off the table. For example, David Rosenberg, one of the top American economists, expects a recession to hit the U.S. within the next half a year. This would be a significant headwind for Enphase, but I believe these fears are already priced in after a massive after-earnings sell-off. The biggest question if a recession hits is how long it will last. I have no doubts that Enphase has enough financial resources to weather even a long storm, but overall sentiment in the broader economy will apparently weigh on valuations. That said, I have no doubts regarding Enphase as a business, but Enphase as a stock might experience multiple quarters of undervaluation until conditions in the macro environment start indicating switching to the recovery stage of the business cycle.

Bottom line

To conclude, Enphase Energy stock became even more “Strong buy” after its recent stock price drop. The business faces severe headwinds due to the harsh macro environment, but these are temporary. Secular trends are favorable for this high-quality business. There is still a vast room to expand business within the U.S. as residential solar energy penetration levels are still low. The company continues generating strong profitability metrics and has a robust balance sheet, enabling the company to continue investing in innovation and long-term revenue growth. Last but not least, the stock is massively undervalued, according to my valuation analysis.

Read the full article here