While the price of gold has demonstrated remarkable resilience to raising interest rates and has even risen itself, not the same could be said about producers of the precious metal. Miners have been hit by considerable cost inflation, which pressured their margins. Q2’23 data indicates that AISC and cash cost metrics are stabilizing and even improving compared to Q1’23. At the same time, the monetary tightening cycle should be coming to an end soon, which could offer additional boost to gold prices. Such an environment should be excellent for miners and result in share price appreciation across the sector. An instrument such as the Sprott Gold Miners ETF (NYSEARCA:SGDM) offers gold equities exposure in a single asset and has a competitive cost structure.

Gold remains resilient

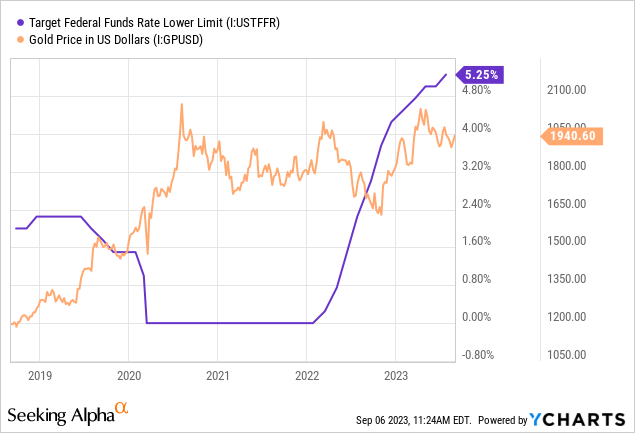

The still ongoing monetary policy tightening has been the most aggressive in decades with interest rates raising considerably in a relatively short period of time. This has created an opportunity for risk-averse investors to pick a quite safe 4-5% yields through money-market securities. Such conditions should theoretically be bad for gold as the alternative costs for holding the precious metal instead of MM securities are rising. However, gold has shown remarkable resilience and has even risen compared to its levels from the beginning of the rate hikes.

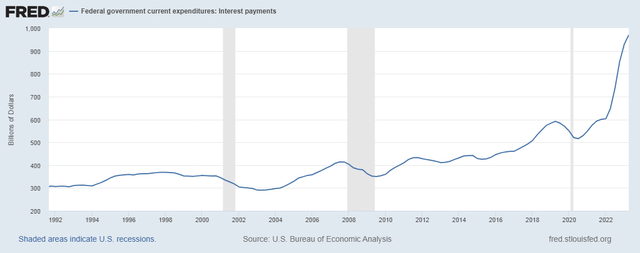

At the same time, some FED officials are signaling that the interest rate cycle might be peaking, which is to be expected amidst falling inflation. Also, with mountains of debt outstanding, high interest rates will make it quite costly for companies as well as governments to roll over their liabilities. For reference, official data indicates that interest payments as part of government spending reached nearly US$970B. If the government had to pay the 5.25% lower band of the FED funds rate range on its US$32T debt, interest alone would be 1.68T – roughly double the military spending. The longer the rates are kept high, the bigger the pain will be, so I fully expect a reversal to lower rates rather soon.

Federal interest payments (U.S. Bureau of Economic Analysis)

Regarding gold, a potential monetary policy easing should be a strong catalyst.

Cost pressures on miners are easing

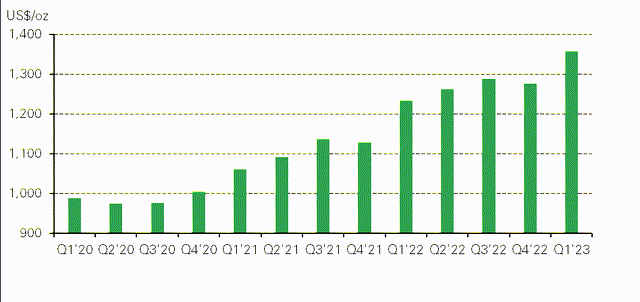

While gold itself has been resilient, not the same could be said for miners. While their revenue has been more or less supported by the precious metal’s price, expenses have been hit by inflationary pressures. As such, global average AISC jumped from below US$1000/oz in 2020 to over US$1300/oz in Q1’23.

Gold miners average AISC (Metals Focus Gold Mine Cost Service)

About half our cost base is labor, about 50% is labor made up pretty evenly between employees and contractors.

Employees largely stable and expect that to remain largely stable through the rest of this year and into next. Certainly, seeing some settling down in Australia, Canada, United States. Contracted services also have stabilized. So still at a higher cost that we saw with the inflation coming through last year, but largely stabilized, maybe a little bit of easing into the second half of this year, but certainly seeing the volatility come out of that, and that’s at 50%, that’s a pretty important driver.

30% materials and consumables. So it’s the various reagents, particularly cyanide, explosive, steel for grinding media and the like. We’re seeing those largely consistent with what we expected. Natural gas prices have come off, which is then flowing through to the prices that we’re seeing for both cyanide and explosives. So a little bit of relief tailwinds with those consumables and would expect that to flow through the second half of this year.

– Tom Palmer, CEO of NEM

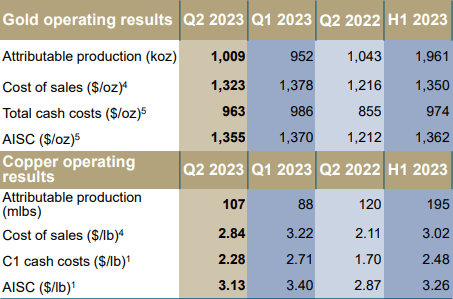

Similar positive developments could be observed in Barrick Gold’s (GOLD) Q2’23 results, which indicate lower QoQ AISC.

Barrick Gold’s Q2’23 results (Barrick Gold)

Why SGDM

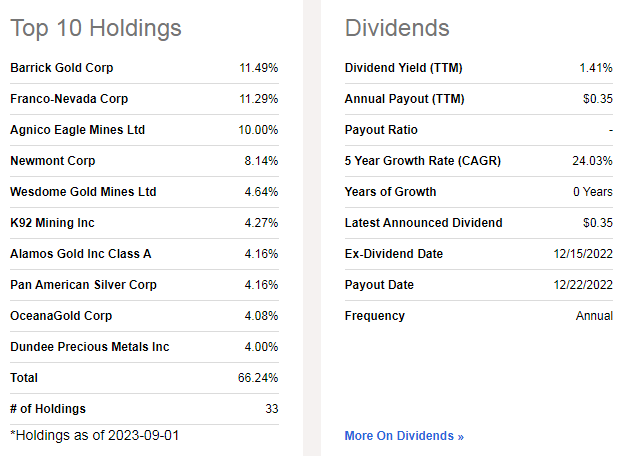

With expenses getting under control, margins amongst gold miners should stabilize and even expand if precious metals’ prices surge. Such an environment should be quite positive for the industry and share prices could appreciate substantially, potentially outperforming the commodity itself. A single instrument that offers diversified, industry wide equity exposure to the gold space is the Sprott Gold Miners ETF. According to its prospectus, it tracks the Solactive Gold Miners Custom Factors Total Return Index. The latter has its weightings tilted towards companies, which have strong fundamentals.

SGDM key facts (Seeking Alpha)

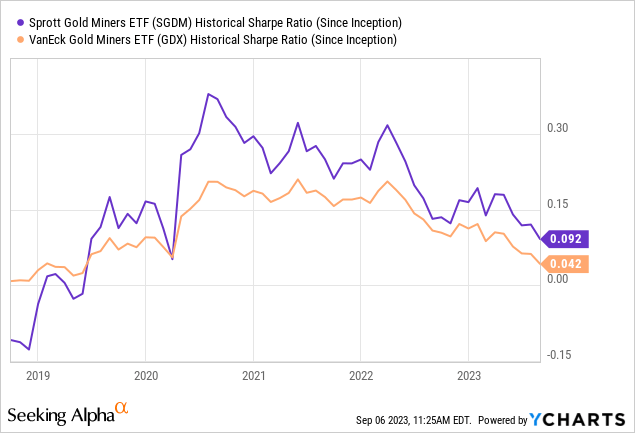

While less popular than GDX, SGDM is on par with its most popular alternative when it comes to expenses, sporting an expense ratio of 0.50%. In terms of performance, it has actually a bit higher Sharpe ratio, indicating better risk-adjusted returns.

Conclusion

Gold has been quite resilient to the most aggressive interest rate hiking cycle in decades. At the same time, miners have been hit by costs inflation but now expenses are beginning to stabilize. I believe this creates an opportunity in gold equities, which could benefit substantially in a gold bull market. A relatively cheap, diversified equity exposure could be gained through an ETF such as SGDM.

Read the full article here