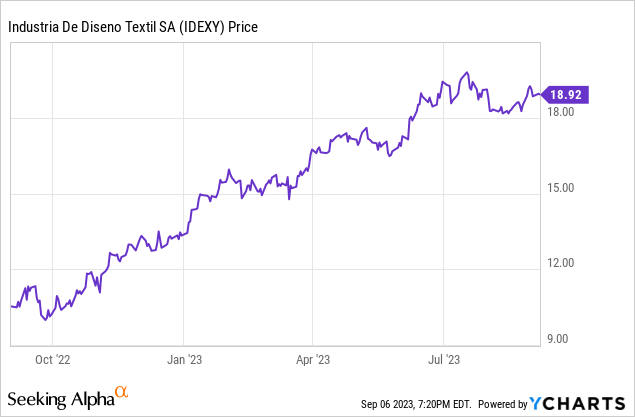

Inditex (OTCPK:IDEXY) has been on a tear this year, underpinned by its structural advantages in omnichannel and speed to market, both of which have allowed for growth through a challenging macro backdrop. Despite my prior concerns about slower growth without contribution from Russia and in light of a China slowdown, the Q1 update defied expectations, with consistent growth across all channels and geographies. Even if you account for the favorable Southern Europe weather tailwinds in Q1, the continued high teens % growth in the early parts of Q2 (store and online) points to impressive underlying momentum ahead of Q2 results next week. And over the mid to long run, it’s hard to bet against a compounder capable of sustaining >20% returns on capital. So even with the stock screening quite richly at >20x P/E, I wouldn’t be surprised to see this year’s rally extending through year-end. In the meantime, investors get paid a well-covered low to mid-single-digit % fwd dividend yield to wait.

Puts and Takes from the Q1 Trading Update

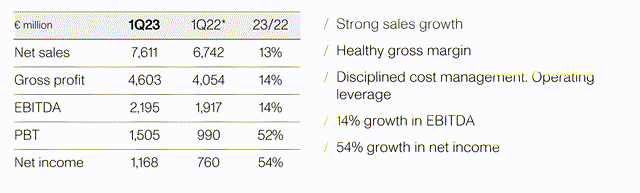

Helped by demand accelerating further past pre-COVID levels, Inditex posted Q1 top-line growth of +13% YoY (+15% YoY FX-neutral) despite a higher-than-expected FX headwind (1 percentage point higher than guidance). Within the Q1 period, momentum was particularly robust through the spring season, with Feb. to early March seeing local currency gains of +13.5% (up high-teens % ex-Russia/Ukraine). Some of this was down to more favorable weather in Southern Europe, which helped to offset lost contributions from Russia and Ukraine. But management also deserves credit for being on-trend, with Inditex’s ‘going-out’ offerings shining through this time around.

Inditex

Margin expansion was another notable theme, as the company’s pricing power helped to offset inflationary pressures from raw materials and labor without sacrificing volumes. All in all, Inditex’s operating leverage benefits (opex growth 150bps below sales growth) saw its reported Q1 EBIT margin expand by 420bps; even adjusting for Russia/Ukraine, the margin benefit was a solid +95bps. Cash conversion was strong as well, driving the Q1 net cash position to EUR10.5bn. In addition to keeping the current ~4% dividend yield supported, the growing cash pile potentially even paves the way for buybacks down the line.

Blowout Near-Term Guidance Justifies More Optimism

While an earlier Spring in Southern Europe (Spain/Italy) helped Inditex in Q1, the strength of demand through the first five weeks of Q2 (+16% in local currency terms) indicates the momentum is here to stay. Note also that the sequential improvement on Q1 levels comes without Russia/Ukraine contributions and with the weather turning into a headwind in Southern Europe. On the other hand, the later Spring in Northern Europe likely contributed positively, offering a small Q2 boost from catch-up demand.

Inditex

Despite the H1 performance, management has kept its full-year guidance intact, with expected improvements in sales productivity and space contribution met with stable gross margins (within a 50bps range). Capex also remains unchanged at EUR1.6bn, in line with management’s plans to optimize and expand space in 2023/2024 (via relocations and extensions). And with the near-term guidance bar still low, Inditex looks primed for a guidance raise sooner rather than later.

Inditex

Addressing Potential Downside Risks Ahead of the Q2 Report

To be clear, there are still downside risks worth considering – for one, the overall inventory position did accelerate higher (+5%) in Inditex’s most recent quarter alongside the strong sales print. That said, management did note that the inventory stock is of high quality and should, thus, be cleared easily. Given the Q2 spring/summer season and in light of supply chain normalization globally, I’m inclined to look past the inventory concerns. In the meantime, I would keep a close eye on cash conversion – Q1 saw the net cash balance rise to EUR10.5bn (up from EUR10bn in Q4 2022), though any deterioration here will warrant a closer look into the inventory position into H2. Elsewhere in the P&L, the ability for Inditex to lean on pricing in the likely event we see more wage inflation pressures in H2 will be worth monitoring as well.

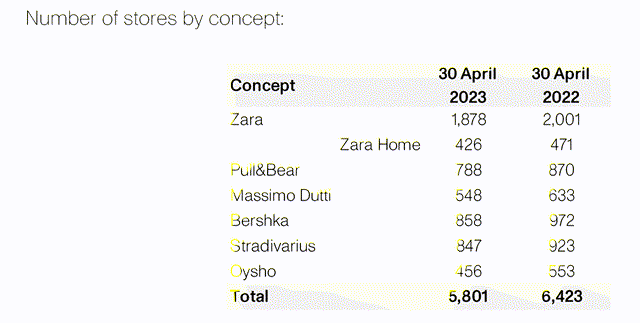

Over the mid to long run, net store growth remains key to sustaining the current earnings growth algorithm. The path ahead isn’t straightforward – Inditex still needs to navigate the impact of closures in its core markets, with overall gross space growth targeted at +3% despite a decline in net store growth (mainly Zara store closures) this quarter. The loss of Russia will also penalize the store growth runway, along with reduced China operations. To mitigate the impact, Inditex will focus on the US (currently the largest non-EU market) as its growth engine, with most of its investment dollars earmarked for the region in 2024. Shortfalls here could de-rate the stock from its current >20x earnings valuation, though ongoing productivity improvement initiatives for the existing base (mainly via store optimization) add some useful buffer.

Inditex

Compounders Don’t Come Cheap

Investor expectations are as high as they’ve ever been on Inditex, with the stock now trading at over 20x fwd earnings (high-teens fwd P/E on a cash-adjusted basis). Yet, even ex-Russia, the company continues to outperform expectations, as demonstrated by its impressive Q1 print. In the likely scenario that this momentum sustained through the Q2 spring/summer season (management cited constant-currency sales growth of +16% for the five weeks through early June), expect more of the same in next week’s Q2 report. Even if the next trading update disappoints, though, there’s still plenty here for long-term investors, with the company unlocking more earnings via an accretive store expansion into the US and store-level productivity optimizations. Plus, there’s an attractive low to mid-single-digit % dividend yield on offer for patient investors, along with buyback optionality (net cash of EUR10.5bn).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here