Introduction

The reinsurance industry is all about proper risk management as the companies here leverage this ability to drive growth. The risks mainly involve sudden events that are hard to predict and cause short-term earnings pain. For RenaissanceRe Holdings Ltd (NYSE:RNR) I think the performance so far has been very solid and the company continues to prove why it has been a winner in the industry for so long. The annualized ROE is over 13% as of the last report and this is beating out the sector by a fair bit right now too.

The fee income for the company has been growing at a very steady rate and right now the company has also gotten a decent discount rate in comparison to the sector. For investors who seek decent exposure to the reinsurance industry, I think that RNR offers a good opportunity right now. The shares outstanding have been a little bit all over the place but I think as the company continues to perform well and generate a high ROE it will be inclined to start buying back shares more aggressively to appease investors. This all concludes me rating of RNR a buy right now.

Company Structure

RNR stands as a dedicated reinsurer with a specific focus on the property sector, bolstered by its remarkable expertise in natural catastrophe modeling. This specialization empowers them to excel in accurately assessing and mitigating the risks associated with catastrophic events, setting them apart in the insurance landscape. The industry can be difficult to properly navigate as the need to properly manage risks more or less outweighs everything else.

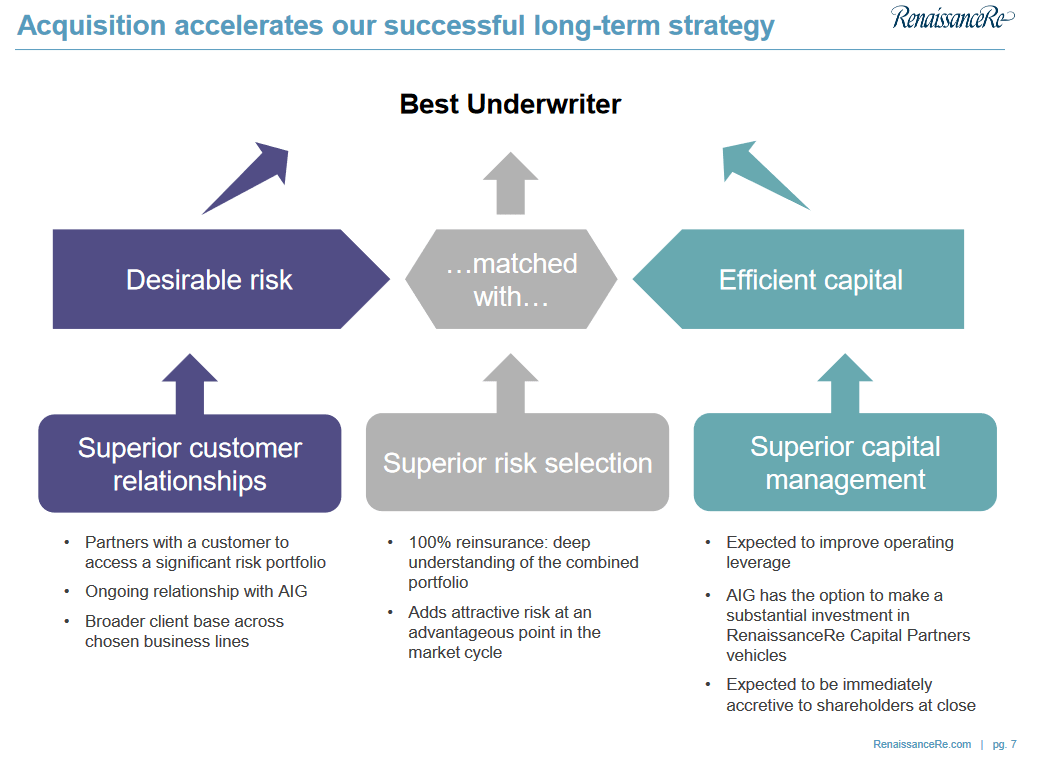

Underwriter Performance (Investor Presentation)

The company has however made it very clear that it intends to grow quite quickly through acquisitions and taking more market share from competitors. Quite recently the company closed the acquisition of Validus for example which adds a diversified established reinsurance business to the portfolio of RNR. The combined value now of the gross premiums written for the company is over $11.9 billion, representing a growth of over 20% as the company acquired Validus. This is setting RNR up to be able to grow the bottom line at a very quick rate in the coming years I think. The dividend has not been growing that fast in the last few years, just under 3% annually. But with the new business introduction, I think we are looking at RNR possibly growing at an annual rate closer to 5% instead. The payout ratio is also really not that high, at under 10%.

Earnings Transcript

From the last earnings call the CEO Kevin O’Donnell shared some good comments about the performance of the company so far and what we can expect going into the remaining part of 2023 as well.

-

“Beginning with Validus Re, we are very excited to partner with AIG on this win-win transaction. For RenaissanceRe, this advances our strategy as a leading P&C reinsurer. We are gaining access to a large, diversified business in a favorable reinsurance market. Validus Re has a great team and their underwriting portfolio consists of a high-quality mix of property casualty, specialty, and credit lines that closely mirrors our own”.

The addition of Validus to RNR is a real win-win I think as the management also described it. It broadens their market share and the possible returns they could be made as well. With the expertise of RNR in the industry they are further equipped as well to grow at a fast rate and deliver strong ROI for investors.

-

“We expect the Validus acquisition to be highly accretive across our financial metrics. For a premium over book value of $885 million, we anticipate receiving a gross written premium base of $3.1 billion in 2022, of which we are targeting at least $2.7 billion of premium, $4.5 billion of investable assets and a $250 million equity investment by AIG and our common shares as well as up to $500 million in our capital partner business.”

The added book value that the deal brought will make RNR grow at a very good rate YoY and should hopefully be able to leverage this added size into a higher valuation in my opinion. If a p/e of around 8 – 9 is given I think RNR is further looking like a solid buy right now. Arguments for a higher earnings multiple would be a better capability of growing earnings, which would be achievable I think from a larger market share and broader exposure which the deal brought.

Risk Associated

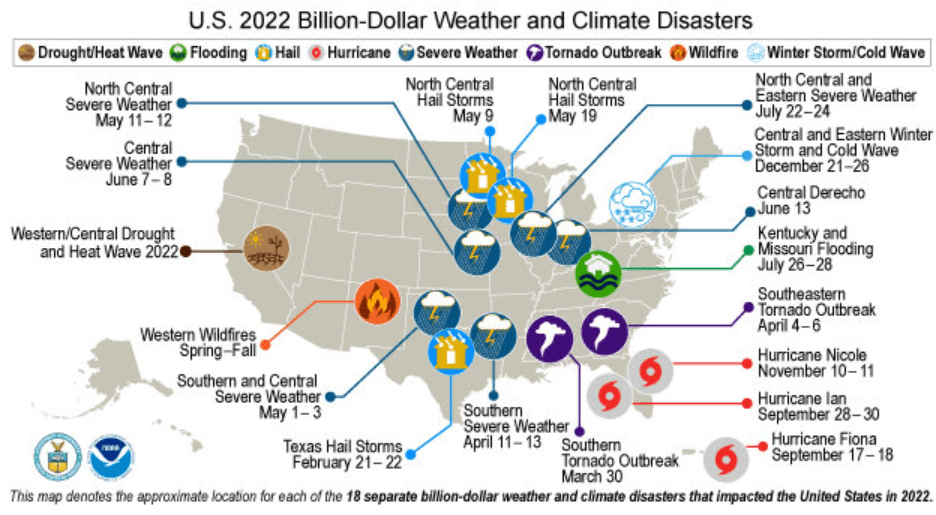

The evolving landscape of climate change introduces a notable challenge to the insurance sector, making the accurate pricing of risks increasingly complex. This complexity arises from the fact that traditional models used to assess the potential impact of natural catastrophes may become outdated in the face of changing climate patterns.

Climate change brings about shifts in weather patterns, temperature extremes, and the frequency and intensity of natural disasters such as hurricanes, wildfires, floods, and droughts. These alterations in environmental conditions can significantly impact the occurrence and severity of these events, rendering historical data and conventional risk assessment models less reliable.

Climate Disasters (NOAA)

Renowned as the undeniable market leader in natural catastrophe reinsurance, RNR possesses exceptionally robust in-house catastrophe modeling capabilities, giving them a significant advantage over many other insurers who heavily depend on vendor models. This strategic edge underscores their commitment to precision and risk management. With the position and track record that RNR has amassed I think that they are in a strong position to continue growing their business even though the industry is undergoing some sort of revaluation as climate change is affecting it, RNR remains capable of continuing to generate strong earnings still.

Investor Takeaway

The price of RNR is in my opinion at a very good point right now for investing. The company has been growing its ROE at a decent rate over the years and the recent acquisition the company performed added a lot of value to it, which should lead to better earnings down the road. Investors seeking a stable reinsurance company should be considering RNR which leads to rating it a buy.

Read the full article here