Meta Remains A Long-Term Hold, Thanks To Its Improved Monetization Strategy

We previously covered Meta Platforms, Inc. (NASDAQ:META) on July 08, 2023, discussing Mark Zuckerberg’s growing social media ambitions through Threads, which recorded more than 100M new sign-ups in less than five days, easily surpassing ChatGPT.

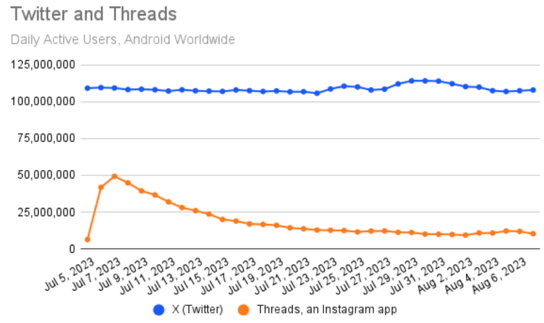

X and Threads’ Daily Active Users

Similarweb

As an update to the previous article, Threads’ prospects appear to be uncertain, since its Daily Active Users have declined drastically from the peak of 44M to 10.3M as of August 07, 2023.

Then again, we believe these are still early days, since the social media company has committed to improved features and tools as “retention-driving hooks.” For example, a web version has been launched on August 24, 2023, on top of multiple other features to “bump engagements.”

While the Threads monetization potential remains to be seen, we are cautiously optimistic since the platform has only been launched for two months, with its DAUs already stabilizing at these levels.

For now, META has demonstrated its successful monopoly, with the Family Monthly Active People expanding to 3.88B by June 30, 2023 (+1.8 QoQ/ +6.3% YoY), with its Average Revenue Per Person also increasing to $8.32 (+9.6% QoQ/ +5.1% YoY) by the latest quarter.

As a result, it is unsurprising that the advertising giant has recorded an impressive FQ2’23 double beats, with revenues of $31.99B (+11.6% QoQ/ +10.9% YoY) and GAAP EPS of $2.98 (+35.4% QoQ/ +21.1% YoY).

Given the top-line delivery near to the upper range of its previous guidance of $32B and accelerating bottom line, it appears that META’s aggressive Year Of Efficiency has worked as intended after all.

The recovery of the global ad spend is also visible in the social media company’s FQ3’23 revenues guidance of $33.25B at the midpoint (+3.9% QoQ/ +19.9% YoY).

This is a sentiment similarly shared by Alphabet (GOOG) (GOOGL) in the recent earnings call, with accelerating Google Search’s revenues of $42.62B (+5.6% QoQ/ +4.7% YoY) and YouTube ads of $7.66B (+14.4% QoQ/ +4.3% YoY), suggesting that the peak recessionary fears may be behind us.

Thanks to the ongoing cost optimizations, META has also been able to intensify its R&D efforts to $9.05B (+5.6% QoQ/ +4.1% YoY) by the latest quarter, further highlighting the management’s determination to maintain its competitive edge (including in Threads), while staying “as lean as possible.”

We are already hearing highly promising results, with an “annual revenue run rate across our apps exceeding $10B” (+233.2% YoY) and “AI recommended content from accounts driving a +7% increase in overall time spent on the platform,” with the latter mostly attributed to Reels.

This is on top of the improved monetization strategy on its WhatsApp Business platform, largely contributing to the Family of Apps other revenues of $225M in the latest quarter (+9.7% QoQ/ +3.2% YoY), with its daily click-to-WhatsApp ads revenue also growing by over +80% YoY.

All in all, we believe the long-term tailwind to META’s top-line remains robust, with the global advertising spend likely to pick up from H2’24 (if not H1’24) once the macroeconomic outlook lifts and the Fed pivots, especially since advertising spend has started to return.

Based on Oberlo and eMarketer, the global digital ad spend may further expand to $667.58B in 2024 (+10.9% YoY), while growing at a CAGR of +9.65% through FY2027 to $870.85B.

This led us to conclude that the META stock is highly suitable for long-term investors, since the strength of its execution continues to support its recovering valuations and stock prices.

The Unraveling Of META’s Year Of Efficiency

However, META investors must also take note of Reality Lab’s accelerating losses of -$3.73B in FQ2’23 (-6.3% QoQ/ +33.2% YoY). While the losses may be temporarily balanced by the Family of Apps’ growing profitability of $13.13B (+17.1% QoQ/ +17.6% YoY), the net effect has been less than promising, since the management has guided more Metaverse losses ahead.

On the one hand, we believe its partnership with Roblox (RBLX) on the Quest platform may moderately improve its monetization efforts, with the latter boasting an average Daily Average Users of 66.1M (+12.4% QoQ/ +22.1% YoY) and an average booking per DAU of $11.70 (-23.4% QoQ/ inline YoY) in the latest quarter.

On the other hand, RBLX remains unprofitable with expanding operating losses in the latest quarter, suggesting that the path toward Metaverse profitability may be slower than expected.

In the meantime, we expect META to guide higher AI-related data center/ server capex in FY2024, despite the temporal FY2023 capex reduction from $31.5B to $28.5B. We have observed a similar strategy with GOOG and Microsoft (MSFT) as well, as more advertisers and cloud partners demand generative AI tools.

With the social media company increasingly relying on AI tools to improve user engagement while growing its headcount in “higher cost technical roles,” it remains to be seen how much of its cost optimizations may be retained from the Year of Efficiency moving forward.

So, Is META Stock A Buy, Sell, or Hold?

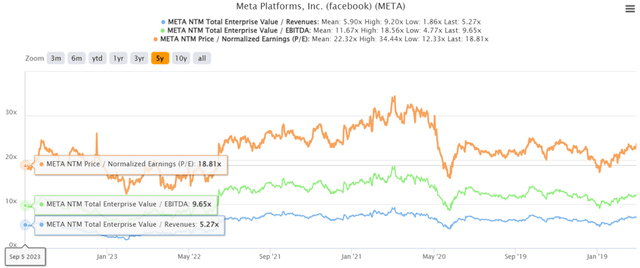

META 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, META is trading at NTM EV/ Revenues of 5.27x, NTM EV/ EBITDA of 9.65x, and NTM P/E of 18.81x, normalized compared to the hyper-pandemic highs and lows, nearer to its pre-pandemic mean of 6.48x, 12.15x, and 22.20x, respectively.

This alone suggest that the market sentiment surrounding the stock has drastically recovered, thanks to the management’s capability of overcoming the Apple (AAPL) privacy headwind, first reported in the FQ4’21 earnings call.

With META on track to achieving pre-correction EBITDA margins by FY2024, the company’s rapid transformation has been impressive indeed, as similarly celebrated by the stock market alike.

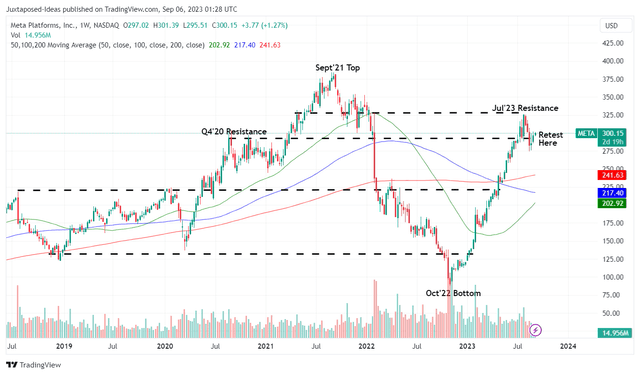

META 5Y Stock Price

TradingView

However, here is where the META investment thesis may be risky. Given its overly fast and furious recovery from the October 2022 bottom and subsequent rally from the FQ2’23 earnings call, it is unsurprising that the stock has also met immense resistance at $325.

For now, the stock is retesting its previous Q4’20 levels of $300s, suggesting more short-term volatility, depending on how market sentiments develop prior to the upcoming Fed meeting on September 20, 2023.

There is also a minimal upside potential to our long-term price target of $362.09, based on its NTM P/E and the consensus FY2025 EPS estimates of $19.25.

As a result of the reduced margin of safety, we prefer to rate the META stock as a Hold (Neutral) here.

Read the full article here