We present our note on Shell (NYSE:SHEL) (OTCPK:RYDAF), one of the world’s largest integrated oil & gas companies, with a Buy rating. We are drawn by Shell’s strong project pipeline, leadership in LNG, disciplined investment framework, relative valuation, and capital returns. We will provide a brief overview of Shell’s business, discuss Q2 results and the Capital Markets Day, analyze the project pipeline, and lay out our thesis and valuation.

A brief overview of Shell

Shell is a UK-based multinational integrated oil & gas company, operating across Upstream, Integrated Gas, Renewables & Energy Solutions, and Downstream (Refining, Marketing, and Chemicals). It is one of the top three private oil & gas producers in the world and one of the world’s largest companies by revenue in any industry. Shell is listed on the London Stock Exchange, with secondary listings on the Euronext Amsterdam, and the New York Stock Exchange, and has a market capitalization of £167 billion.

Q2 results

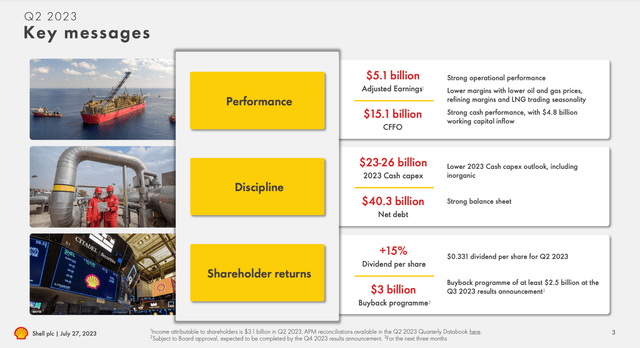

Shell reported Q2 results below company-compiled consensus estimates. Post-tax operating profit came in at $5.75 billion, and CCS adjusted earnings came in at $5.07 billion, respectively, 8% and 9% below consensus. The miss was driven by lower trading and optimization revenue, a ca. $700 million negative impact in the production mix in Upstream due to a higher level of maintenance in higher margin Gulf of Mexico areas, and a slower ramp-up of US petrochemicals plant Monaca. Meanwhile, cash flow was in line with estimates as there was a sizeable working capital release of ca. $4.8 billion. It is important to note that net debt is down ca. $4 billion vs. Q1 and down 50% vs. 2019 levels at around $40 billion. We have a neutral view of the results as factors leading to the miss are temporary.

Shell Q2 Results Slides

Capital markets day

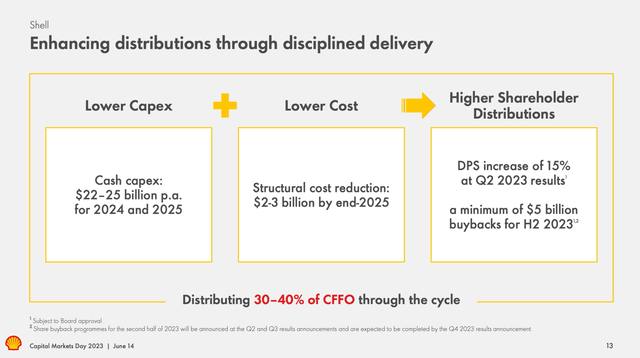

Shell made several important announcements on its Capital Markets Day in mid-June, reassuring shareholders over various topics, making changes to the capital returns policy, providing additional color on its green transition plans with unchanged target emissions, and allowing the market to become more familiar with the new CEO Wael Sawan.

Shell expects ca. 10% annual FCF growth per share through 2025. The company announced an increase of 10% in capital returns to 30-40% of CFFO vs. the previous range of 20-30%. Quarterly dividends will increase by 15%, effective as of Q2, and there will be at least $5 billion of share buybacks in H2. Management believes the company is significantly undervalued and buybacks will continue even at $50 / bbl scenarios. By 2025 at $65 / bbl, the company expects $24-26 billion of FCF after capex, implying $47 billion of CFFO. At $50 / bbl, the CFFO would be $36 billion and shareholder distributions would be ca. $13 billion. The lower capex guidance of $22-25 billion vs. the previous $23-27 billion came as a positive surprise and further emphasized Shell’s focus on returns.

We find the messages of the CMD reassuring and clear, confirming our positive outlook on the company.

Shell CMD Presentation

Strong project pipeline

Shell has a robust upstream project pipeline that will strengthen the portfolio and enhance profitability. 500kboe / day of new production will be added through 2023-25, 40% of which in conventional, 40% in deepwater, and 20% in LNG, with the latter remaining an important strategic priority. Shell’s production growth stands out among European oil majors, with multiple projects with attractive project economics and high IRRs (up to 20%) coming online including LNG projects such as Oman Block 10, LNG Canada, Prelude FLNG, as well as offshore oil projects in Brazil and the Gulf of Mexico. Moreover, the decision to quit lower returns projects with high capital intensity such as Browse LNG in Australia and a CCS project in the UK, freeing up more than $8 billion of capex, demonstrates impressive capital discipline and commitment to value creation. The strong project pipeline, a key component of our long thesis, will enable higher sustained cash generation and higher shareholder distribution over the mid-term.

Value-focused downstream and renewables

Shell will invest around $35 billion in Downstream and Renewables, of which $10-15 billion in low-carbon energy businesses such as hydrogen and carbon capture and storage. Shell’s downstream and renewables strategy has been tweaked to have a greater focus on profitability vs. simple numerical-based targets, enhancing value creation. Shell will focus its renewables investments in markets where it has trading activities and higher customer reach, leveraging its competitive advantage in offering a complex decarbonization package. The numerical production targets have been dropped in favor of pursuing an unlevered IRR of 6-8% plus upside from financing and trading & optimization.

Leadership in LNG

With 66 MT of sales in 2022 i.e., approximately 20% of global sales, Shell is a leader in LNG. Shell’s leading position will be sustained through a substantial growth in liquefaction volumes by 25% i.e. ca. 11MT through 2030, with Canada, Nigeria, and Qatar volumes coming online. Additionally, the company will focus on the optimization of existing assets such as in Trinidad and Nigeria. Shell’s positioning in Integrated Gas and exposure to higher LNG prices is one of the drivers of our long thesis. While we expect the LNG market to normalize by 2025/26 as multiple new projects come online, we remain cautiously optimistic longer term.

Investment case, valuation, and capital returns

We value Shell using PE multiples and FCF yields. Assuming mid and long-term Brent price at $60-70/bbl and natural gas prices at $11-14/mcf we forecast $240.5 billion of sales and $60 billion of EBITDA in FY2024e. Our assumptions are reasonably conservative and our numbers are slightly below consensus estimates. We would like to note that forecasts are sensitive to long-term assumptions and commodity strategists forecast a range of prices. We then forecast a net profit of $25.1 billion and FCF of $24.9 billion (in line with company guidance for oil at $65/bbl), implying a forward PE ratio of 8.3x (before taking into account buybacks) and an FCF/EV yield of 10%.

Currently, brent stands at $89/bbl, and continued elevated oil prices would drive our forecast much higher. With brent at $80/bbl net income would be around $31 billion implying a forward PE of just 6.7x and a mid-teens FCF yield.

Shell is trading at a significant discount to its 20-year historical ratio, and a major discount to Chevron and Exxon, while likely distributing >3/4th of its market cap as dividends and buybacks by FY2030e. At $47 billion of CFFO, we forecast $16.5 billion of capital returns (i.e., 35% as guided) implying Shell will be returning 9%+ of market capitalization next year.

Given Shell’s upstream duration and quality, as well as its focus on value creation, we believe the gap vs Exxon and Chevron should narrow and we apply a conservative 10x PE multiple, implying 20% upside, and a share price of £30 per share or $37.4 (OTCPK:RYDAF). Combined with high single-digit capital returns, this makes Shell an attractive investment.

Risks

Downside risks include but are not limited to weaker macroeconomic conditions, lower than expected oil and gas prices resulting in lower earnings, lower recovery rates in mature assets, downward revisions to production volumes, excess profit/windfall taxes, higher than expected capital expenditure in new developments leading to declining returns, delays in project execution, allocation of capital to low returns renewables projects, misallocation of capital, lower than expected shareholder distributions, energy transition and climate change risks, geopolitical risk given the geographic mix, natural disasters, accidents, etc.

Conclusion

Given the robust fundamentals outlined in our note, as well as the compelling valuation and shareholder distributions, we recommend buying Shell shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here