It’s been just over two months since I added to my stake in Canadian National Railway Company (NYSE:CNI), and in that time, the shares are down about 7% against a gain of about ½ a percent for the S&P 500. Since my investment here isn’t doing too well, I thought I’d review the name yet again to see if it makes sense to buy more, hold, or take my lumps and sell. I’ll make that determination by looking at the most recent financial results, and by comparing that to the valuation.

We’ve all got very busy lives, and time seems to be always at a premium. That, coupled with the fact that I’m absolutely obsessed with making my reader’s lives as pleasant as possible, leads me to put a “thesis statement” at the beginning of each of my articles. This paragraph gives you a bit more than you would get from the title and bullet points, but doesn’t expose you to 1,300 words of my rants, bad jokes, and correct spelling. You’re welcome. Although I am comfortable with this investment, I’m going to neither add to it, nor sell it. I think the most recent financial performance has been rather good, though I don’t like the fact that the company increased debt while they bought back stock. This needlessly adds to the risk in my view. In spite of the fact that the shares are between 5%-7% more cheaply priced than they were when I last purchased, they’re still not cheap enough to get excited, especially given the alternatives available. Additionally, I don’t like the fact that the analyst community seems to be fairly optimistic in their forecast. That’s never a good sign in my view.

Financial Snapshot

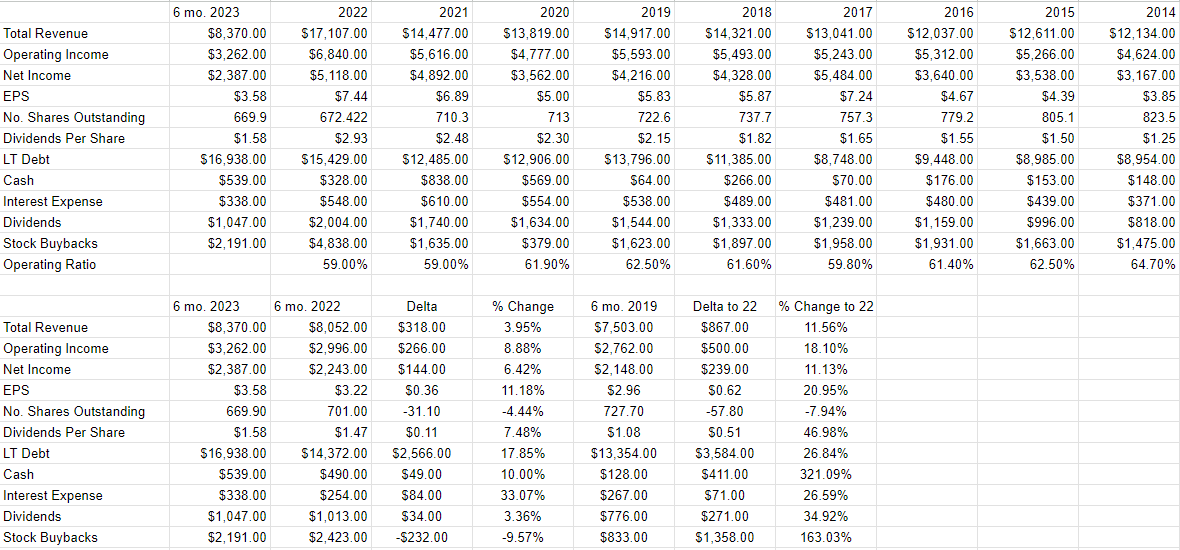

The latest financial results have been mixed in my view. All of the good news is hanging out on the income statement in particular. Revenue, operating income, and net income are up by about 4%, 8.9%, and 6.4% respectively over this time last year. Earnings per share have climbed by 11.2%, largely driven by the fact that share count is down fairly dramatically (4.4%) over the same period a year ago. Comparing the performance in 2023 to the same period in 2019, for instance, things look even better. Revenue, operating income, and net income are higher in 2023 by 11.6%, 18%, and 11%, respectively. I’ve covered a few companies recently that have not yet returned to pre-Covid levels of profitability. Canadian National is not one of those companies.

Things are far less rosy when we venture into the capital structure, though. Specifically, debt has climbed by just shy of 18% from the same period a year ago. I don’t know if you’re paying attention at home, but interest rates are dramatically higher now than they were, so this may not be the most auspicious time to take on an extra $2.56 billion in debt, especially when the company spent $2.2 billion on buybacks during the first half of this year alone. Extra debt obviously increases the risk to the enterprise, no matter the size of the “economic moat.”

That written, I still like the operation, and I’m likely always going to have a soft spot for Canadian National because they can avoid much of the congestion around the city of Chicago. For that reason, I’d be willing to buy more at the right price.

Canadian National Financials (Canadian National investor relations)

The Stock

On the rare occasions that I actually check to see how many people follow me on this platform, I’m always surprised and somewhat mystified by the size. If you’re a new person, welcome, I guess, and please strap in for one of my more common rants, namely that “stocks” and “businesses” are very different things. I like to consider “the stock” to be a distinct thing from “the business”, because the two are, well, distinct. The business generates revenue by hauling bulky cargo across North America, while the stock is a piece of virtual paper that gets traded around, and it moves up and down based on the ever-changing moods of an often capricious market for stocks. If you’re still of the view that “we don’t buy stocks, we buy businesses”, consider two theoretical investors, the first of whom bought Canadian National Railway on my birthday in 2022 (Dec 2nd in case you forgot) , and the second who bought a month later. The person who bought on my birthday is down about 15% since then, while the person who bought only 1 month later is down only 8.5%. Not enough happened at the firm over this month to account for over 6.5% variance in returns. We do buy stocks, and the price at which we acquire them massively influences whether our investment is “good” or “bad.” Second, the person who bought shares cheaper in this case, as in all cases, did less badly. This is why I strive to buy shares as cheaply as possible. I’d also note that shares should trade most cheaply when future expectations are relatively muted.

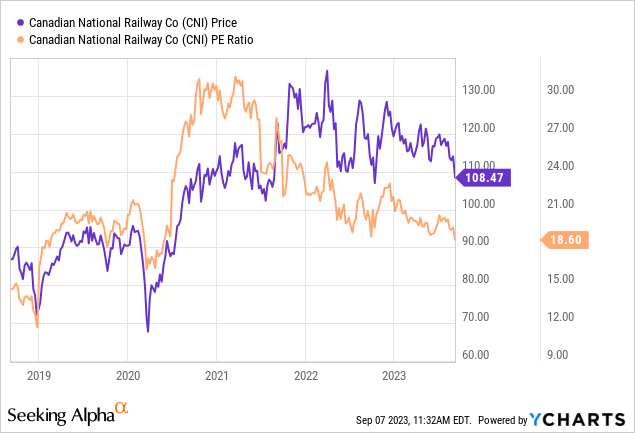

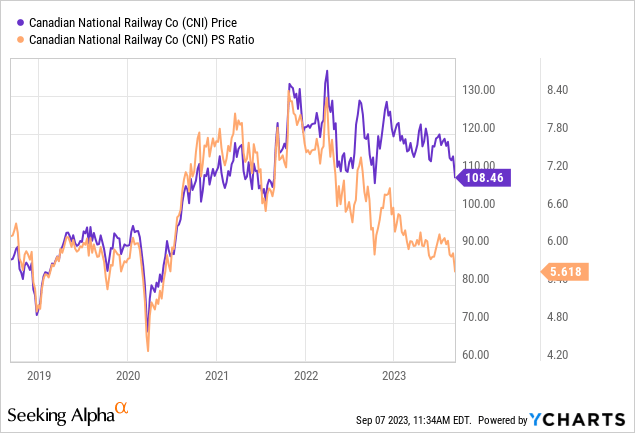

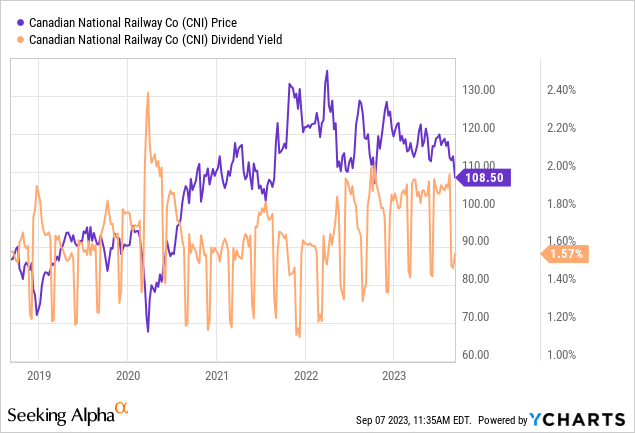

My regulars know, and you knew people will soon find out, that I measure the cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I look at ratios of price to some measure of economic value, and I like to see a stock trading at a discount to both the overall market and its own history. When I bought some more Canadian National, shares were trading hands at a PE of about 19.6 times, and the market was paying about $6 for $1 of sales (i.e. the PS ratio was about 6.027), and the shares were yielding about 1.9%. At the moment, the shares are between 5% and 6.7% cheaper, but the dividend yield is about 17.4% lower than it was when I last reviewed the stock. This bothers me less than it might, though, because the dividend is well covered, and because the company has a history of raising it with some consistency.

I think ratios are helpful, but I also want to try to work out what the market is “thinking” about a given investment. The way I do this is by employing methods described in books like Professor Stephen Penman’s “Accounting for Value,” and Mauboussin and Rappaport’s “Expectations Investing”, especially the second edition of this book. Each of these use the stock price itself as a rich source of information. Penman, in particular, shows investors how they can employ a bit of high school algebra to isolate the “g” (growth) formula in a standard finance formula to work out what the market expects from a given company. Applying this way of thinking to Canadian National Railway at the moment suggests the market is assuming that this company will grow earnings at a rate of 6% from current levels. I consider this to be fairly optimistic forecast. We see from the following that Wall Street itself is forecasting EPS growth at a CAGR of about 11.5% over the next six years. That’s a fairly optimistic forecast in my view. Given that, and given that it’s possible to park capital and earn a nice, safe 4%+ return elsewhere, I’ll neither add to, nor sell my stake here. I am comfortable investing in this stock for the long term, but I think there are safer, superior alternatives available today.

Read the full article here