The Cash App Growth Cadence May Justify SQ’s Premium Valuation

We have previously covered a few fintechs, with the incumbent being PayPal (PYPL) and startups being SoFi (SOFI), Upstart (UPST), and Affirm (AFRM).

In this article, we will be covering Block (NYSE:SQ), focusing mostly on its Cash App performance, since the segment commands 64.1% of its top line and 51.7% of its bottom line in the latest quarter.

In FQ2’23, SQ’s Cash App generates $3.56B of revenues (+8.8% QoQ/ +35.8% YoY) and gross profits of $968M (+3.9% QoQ/ +37.3% YoY). This is compared to Square’s revenues of $1.92B (+15.6% QoQ/ +11.6% YoY) and gross profits of $888M (+15.3% QoQ/ +17.6% YoY).

It is important to highlight that the management has seen the immense opportunity to grow its offerings within the Cash App ecosystem, since it allows cross selling within its existing active users while improving its cost efficiencies.

This strategy has allowed SQ to expand the Cash App capabilities beyond the basic digital wallet offerings, to include many other personal transactions such as, savings (albeit without interest), loans application, Buy Now Pay Later, in store/ online purchases, investments in stocks/ bitcoins, and filing taxes.

In addition, the fintech offers Cash App business accounts for small business owners. This is on top of its physical debit/ credit cards, thanks to its partner banks, Lincoln Savings Bank/ Sutton Bank and payment processor, Visa (V).

As a result of Jack Dorsey’s conviction surrounding Bitcoin, it is also unsurprising that Bitcoin transactions command the majority of Cash Apps’ revenues at $2.39B (+10.6% QoQ/ +34.2% YoY) and to a smaller extent, gross profits at $44.25M in the latest quarter (-12.5% QoQ/ +6.7% YoY).

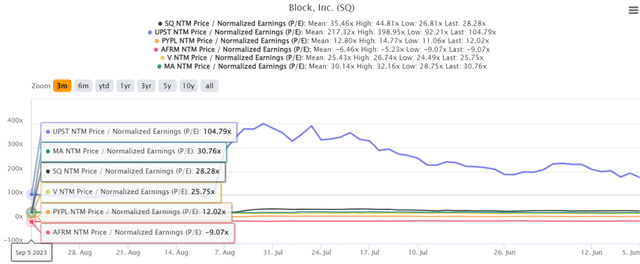

SQ 5Y P/E Valuations

S&P Capital IQ

With Cash App being SQ’s bottom line driver while boasting a high growth cadence, we are not surprised that the stock still commands a growth premium at NTM P/E of 28.28x. This is compared to some of its fintech peers and the Diversified Financial Services sector median P/E of 13.81x.

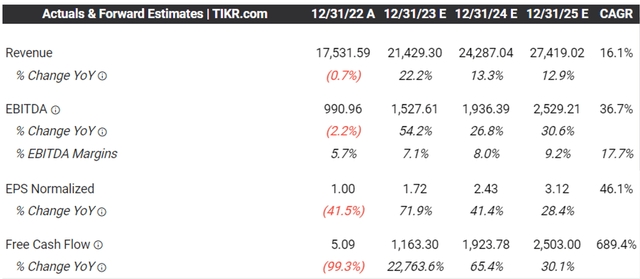

Consensus Forward Estimates

Tikr Terminal

Perhaps much of the optimism embedded in SQ’s stock valuations is attributed to the bullish consensus estimates, with it expected to record an impressive top and bottom line expansion at CAGRs of +16.1% and +46.1% through FY2025, respectively.

The fintech is also expected to generate sustainable Free Cash Flow over the next few years, building upon the $345.9M reported in H1’23 (+1,080.5% YoY).

For now, the optimistic estimates have been validated by SQ’s raised FY2023 profit guidance, with adj EBITDA of $1.5B (+51.5% YoY) and adj operating income of $25M (+117.1% YoY). This is compared to the previous guidance of $1.3B (+31.3% YoY) and -$115M (+ 20.9% YoY) offered in the FQ4’22 earnings call.

Assuming that the fintech is able to achieve these numbers, we are looking at FY2023 adj EBITDA per share of $2.47, based on its FQ2’23 share count of 606.69M. This will bring us to its near term fair value of $52.48, based on its NTM EV/ EBITDA of 21.25x.

Based on the consensus FY2025 adj EBITDA estimates of $2.52B, it seems that there is still a decent upside potential of +50.4% to our long-term price target of $88.40 as well.

However, we must also highlight that SQ has yet to achieve sustainable GAAP profitability, with it still reporting GAAP EPS of -$0.20 (-566.6% QoQ/ +44.4% YoY) while recording adj EPS of $0.39 (-2% QoQ/ +116.6% YoY) in the latest quarter.

The fintech’s operating expenses of $2.01B (+15.9% QoQ/ +21% YoY) have accelerated against its top-line expansion to $5.53B (+10.8% QoQ/ +25.6% YoY) in FQ2’23 as well, despite the consistent gross margins of 34% (+0.3 points QoQ/ +0.2 YoY).

At the same time, its Stock-Based Compensation has grown drastically to $319.25M (+14.1% QoQ/ +24.3% YoY), naturally contributing to the sustained dilution of its long-term shareholders with FQ2’23 share count of 606.69M (+4.46M QoQ/ +25.34M YoY).

Furthermore, SQ investors must be aware that with high growth comes great expectations, with the management’s conservative commentary in the recent earnings call already triggering the collapse in its stock price by over -20% at the time of writing:

Since the third quarter of 2022, we’ve seen an 8 point slowdown in Square’s global GPV growth from 20% or so to 12% or so. For the fourth quarter, we expect a slight moderation in Cash App’s gross profit growth, driven by stabilization in Cash App’s monetization rate, and as we lapse stronger growth in the prior year period. (Seeking Alpha)

So, Is SQ Stock A Buy, Sell, or Hold?

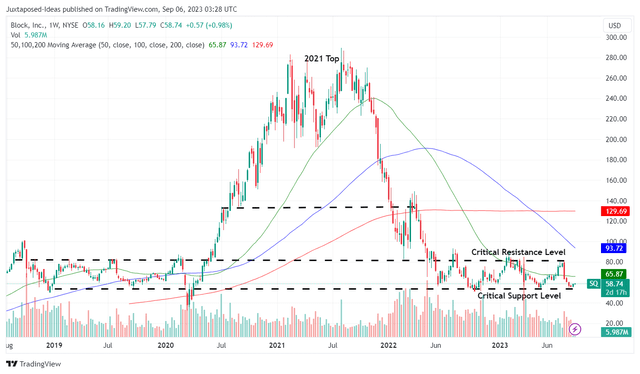

SQ 5Y Stock Price

Trading View

Then again, based on the historical stock movement since June 2022, we believe that SQ is still an interesting buy here, with the recent correction bringing the stock nearer to its critical support level of $53s.

As a result of the excellent upside potential to our price target, as discussed above, we are cautiously rating the SQ stock as a Buy.

However, investors that add here must also be very patient, since it is uncertain when the stock may break out of its resistance levels of $80, with it notably trading sideways over the past five quarters.

While SQ’s Cash App has been gaining momentum with 54M active users by June 2023 (+1M QoQ/ +7M YoY), there is no moat to its offerings, with many other fintechs offering similar services.

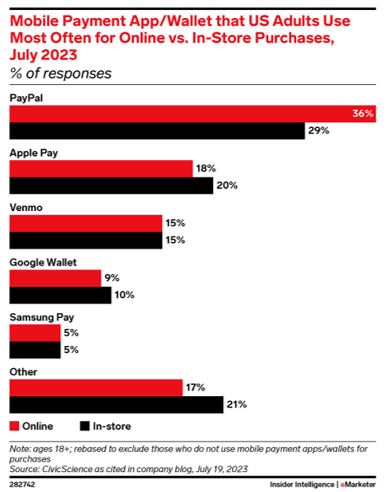

US Mobile Wallet User Preference

Insider Intelligence

Most importantly, PayPal and Venmo remain two of the most popular digital wallet platforms for the US users, while recording 431M in global active accounts in the latest quarter (-2M QoQ/ +2M YoY).

This is on top of Apple Pay’s (AAPL) 45.4M users in the US as of early 2023, with it being second most used digital wallet in the country after PayPal.

Therefore, while PYPL’s top and bottom line expansion may have matured compared to SQ’s high growth cadence, investors may also want to note the former’s dominance in the fintech market and expanding annualized adj EPS of $4.64 (+1.7% QoQ/ +24.7% YoY) in the latest quarter.

There is no shortage of competition as well, with the US big banks offering Zelle/ Paze, as a direct rival to SQ’s Square and Cash App.

As a result of its embedded growth premium compared to its peers, any earnings miss and/ or deceleration in SQ’s growth may also trigger further volatilities in its stock valuations and prices.

Therefore, existing investors may want to temper their intermediate-term expectations, while keeping their portfolio appropriately sized according to their risk tolerance.

Read the full article here