On our last coverage of Alliance Resource Partners, L.P. (NASDAQ:ARLP) we examined the fundamentals of this coal company and left with a strong endorsement of the near-term maturity notes. We update our thesis with the Q2-2023 numbers and corporate actions and tell you why this remains our number one pick for income seekers looking for a high yield with the lowest risk.

Q2-2023

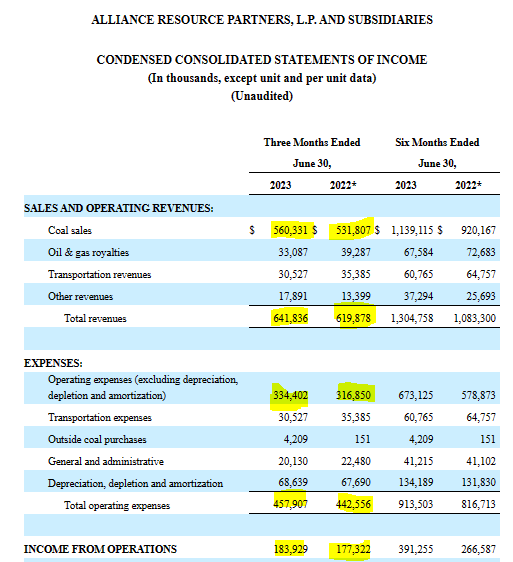

ARLP had an extremely Q2-2023 with revenue increasing by about $22 million from the prior year. This was driven by coal sale pricing while total tons sold decreased slightly. Expenses were up as well, notably on the operating side, driven by lower tons sold (higher cost per ton) and labor expenses. Overall, the income from operations was up 3.7% and GAAP earnings per share were $1.30 per share.

ARLP Q2-2023 10-Q

ARLP is stunningly profitable at a GAAP level, that is after those pesky depreciation and depletion charges are put through. Looking at this from the distributable cash flow perspective also shows the remarkable cash gusher this company has become. While EBITDA was up from last year, thanks to maintenance capex that increased over 30%, distributable cash flow was down almost 4%. Nonetheless, the distributable cash flow came in near $174 million, almost twice the distributions paid to shareholders.

Guidance

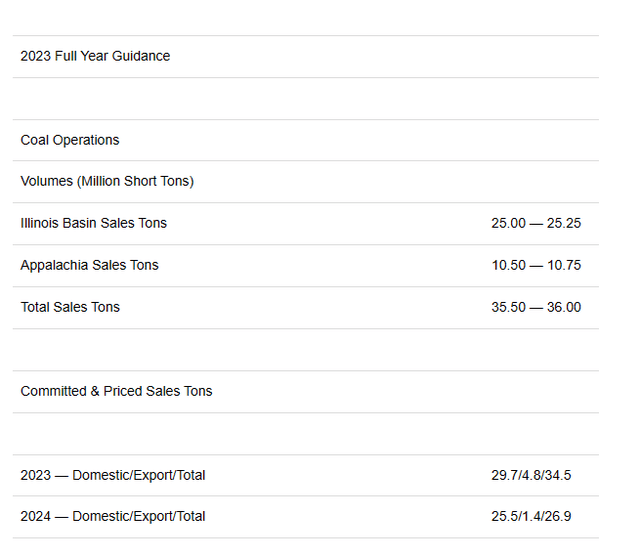

One key thing we are looking for here is the amount of hedges that ARLP has in place. It calls these “committed and priced sales tons”. While 2023 is wrapping up as we write this, we are more interested in the 2024 numbers.

Q2-2023 Press Release

On the 2024 year, we have 26.9 million tons priced and committed. That works out to about 75% of the expected volumes for this year (36 million tons). When we last wrote about it, the 2024 figure was at 23.9 million tons and the additional hedging continues to further derisk the investment we like. In addition to these 3 million committed sales, 5.6 million more were layered in 2025 and 2026.

“During the 2023 Quarter, we agreed to sell an additional 8.6 million tons with multiple customers for coal to be delivered over the 2024 to 2026 time period. We expect there will be more opportunities this year to fill out our future contract book.”

Source: Q2-2023 Press Release

The Notes

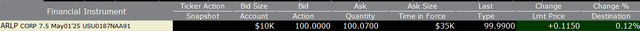

We like the May 1, 2025 ARLP notes that trade at par today.

Interactive Brokers Sep 8, 2023

The continued appeal here comes from 4 factors.

1) ARLP remains a cash flow gusher and even if it had to service this debt for the next 10 years it would not be an issue. But these are short maturity bonds and we like that with the high likelihood of a recession around the corner.

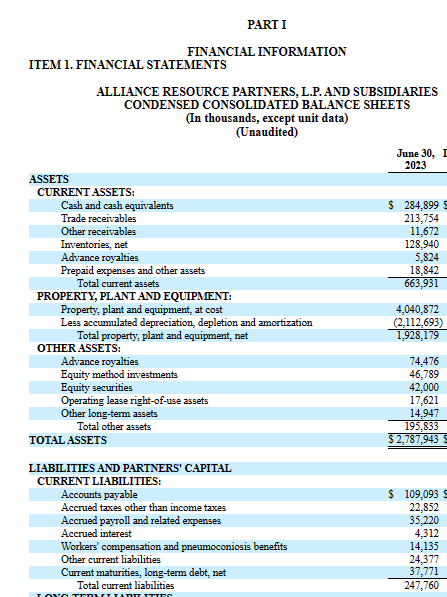

2) ARLP has accumulated a lot of cash on the balance sheet. Current assets less current liabilities are at about $416 million.

ARLP Q2-2023 10-Q

That is a very liquid balance sheet, especially combined with distributable cash flow exceeding distributions by about $350 million a year.

3) ARLP is committed to buying back these notes whenever they trade cheaply. This can be seen by the statement from the Q2-2023 press release.

Repurchased $34.2 million of outstanding senior notes during the 2023 Quarter and redeemed an additional $50.0 million of senior notes in July 2023.

Source: Q2-2023 Press Release

4) Partial redemption is great for remaining bonds. Besides creating confidence that the company is a buyer should they trade cheaply, one can also likely deduce that those notes will likely hang around for at least a few more months. ARLP did a partial call on these and if they were planning to redeem all, they would have done so in that transaction. These transaction setups involve extra work on part of the company, so we would wager that the remaining notes will likely stay in circulation for at least 6 more months, perhaps even till their maturity. So you get a chance to earn 7.5% with virtually no risk.

Verdict

This continues to be a great setup for income investors. That leverage ratio is something you would expect from AAA rated corporation, not from a BB-rated one.

As of June 30, 2023, total debt and finance leases outstanding were $417.8 million, including $339.2 million in ARLP’s 2025 senior notes. The Partnership’s total and net leverage ratio was 0.40 times and 0.14 times, respectively, as of June 30, 2023. ARLP ended the 2023 Quarter with total liquidity of $717.2 million, which included $284.9 million of cash and cash equivalents and $432.3 million of borrowings available under its revolving credit and accounts receivable securitization facilities.

Source: Q2-2023 Press Release

One reason that ARLP has probably not redeemed these completely is that it is earning about 5.25%-$5.50% on its cash hoard as well. So in effect, it is only paying 2% to have the additional financial flexibility to buy some distressed assets if it gets the chance to do so. We like the notes and even though these show as SEC 144A but we had no problems buying them on Interactive Brokers. We are buyers at or below $100.00.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here