Thesis

When evaluating the various E&P companies in the Permian basin, it becomes hard to differentiate between all of the different drillers. They are all drilling in what, to the common eye, is the same place and extracting the same product. Is it even possible to determine who is the best?

That obviously is a loaded question, but we can start to formulate an idea of who belongs in the discussion for the best. We start by looking for differentiators. EOG Resources (NYSE:EOG) has a unique portfolio with advantages that you won’t find elsewhere.

EOG is not a “lighting in a bottle” investment. It’s more of a slow consistent burn that shines light even when the oil patch is starting to get dark. EOG uses its advantages to sustain that slow burn by safeguarding both its cash and every single molecule.

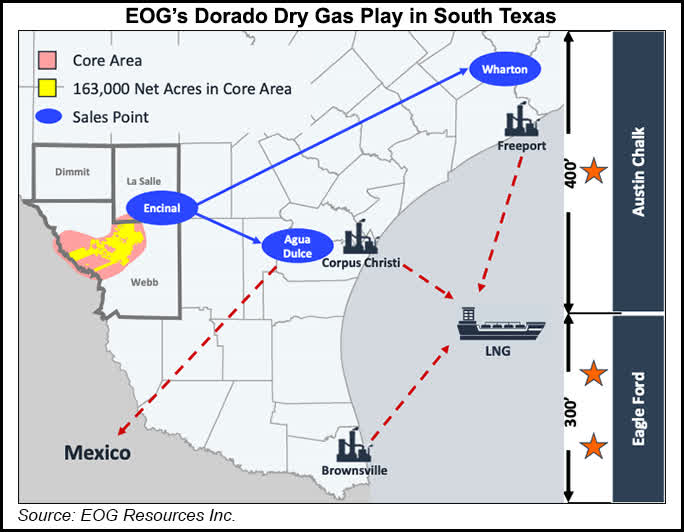

Further, EOG has the Dorado basin that largely remains undeveloped and has the potential to be one of the most profitable natural gas plays in the United States. EOG is strategically preparing this asset for the next natural gas swing that is projected to start in the next 12 to 18 months.

Advantage #1 – Cash

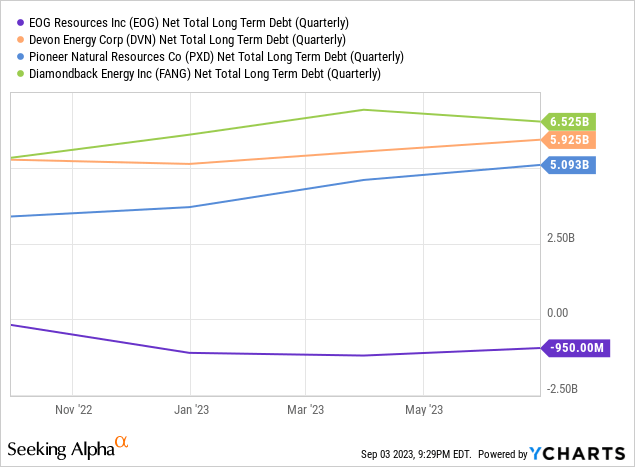

As the old saying goes, cash is king, and in this area, EOG is king. While not entirely debt-free, the net debt position is starkly different than its peer group in the Permian. You will see below that EOG has a better net debt position than its Permian peers by between $6 and $7.5 billion.

Having more cash on hand than total debt is the same as having a giant shock absorber for when the oil patch gets tough. It also allows EOG to be aggressive on the bottom end of the cycle, potentially flexing the cash muscles for bolt-on deals or bargain basement prices on materials.

A few examples of this strategy are provided by CEO, Ezra Yacob.

We find ourselves now with cash on the balance sheet as well, and we do have some strategic initiatives for that. The first thing is just to keep some reserve cash to run the business, to stay out of commercial paper markets and things like that. The second piece, though, is really for countercyclic investment. In past years, we’ve opportunistically pre-purchased casing during 2020 at a relatively very low time in the industry. We pre-purchased some line pipe that is actually going in the ground right now to help service Dorado, and last year we had done some small acquisitions. We prefer small bolt-on, dominantly undrilled acquisitions when we can get them. Last year in the Utica, we purchased acreage including 130,000 net acre minerals, mineral acres as opposed to just the lease, which provides tremendous value.

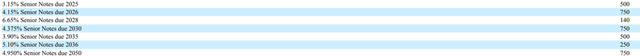

Digging down to another level, we will find that EOG’s debt profile is structured in a way that is extremely supportive of free cash flow and shareholder returns. Of its $3.78 billion in long-term debt, there are no maturities due until 2025. Even then, the largest payment that needs to be made is $750 million. This is extremely manageable either through the use of cash on hand or free cash flow that will not significantly disrupt the cadence of dividends, special cash disbursements, or share repurchases.

EOG could flat-out repay all of its debt and still have $1 billion left in the bank. With an average weighted cost of debt of 4.35% the health of the balance sheet is fantastic.

EOG 10-K

Advantage #2 – Every Molecule Matters

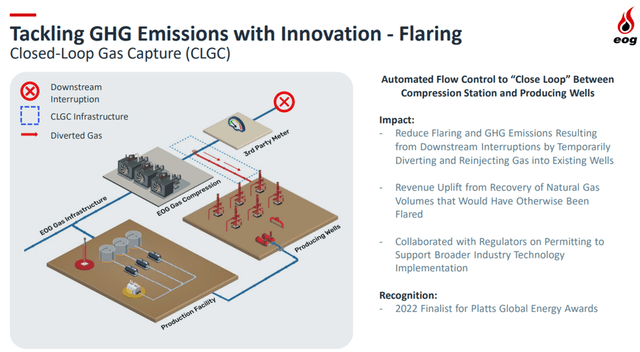

One of the things that I like about EOG is its commitment to using closed looping technology. This technology is aimed at eliminating the need for flaring when there are downstream interruptions in the natural gas supply network. The primary purpose of this initiative is to improve emissions but the side effect is that it preserves the molecules for future sales, thus allowing the company to be more efficient overall.

The technology works by diverting the otherwise flared gas back into a reservoir where it can be stored for extraction later when the interruption clears. This makes sure every molecule that is on company property eventually gets sold instead of wasted. This innovation makes money while also being environmentally friendly, so it is a win-win.

When I was looking into this technology, I realized I didn’t really have a grasp for how much natural gas was actually flared. So my first trip to a sustainability report showed some surprising numbers. Each of the four companies in my “peer group” flares on the order of BCF of natural gas per year.

Granted, the dollar figure doesn’t amount to a big impact on these billion-dollar companies but if you watch your pennies, the dollars will take care of themselves. All data was obtained from each company’s most recent sustainability report and are annualized data.

| EOG | DVN | PXD | FANG | |

| Flared Volume (BCF) | 0.77 | 3.8 | 3.22 | 4.54 |

| Lost Revenue @ $2.50/MCF | $1.93m | $9.5m | $8.05 | $11.35m |

| Lost Revenue @ $5.00/MCF | $3.86m | $19.0m | $16.1m | $22.7m |

EOG

Advantage #3 – The Whites of Their Eyes

For the history buffs out there, in my opinion, EOG subscribes to the command given in 1775, at the Battle of Bunker Hill by William Prescott against the British. This command to “Not fire until you see the whites of their eyes” was given to maximize the ammunition on hand to be able to withstand the repeated onslaught by the British.

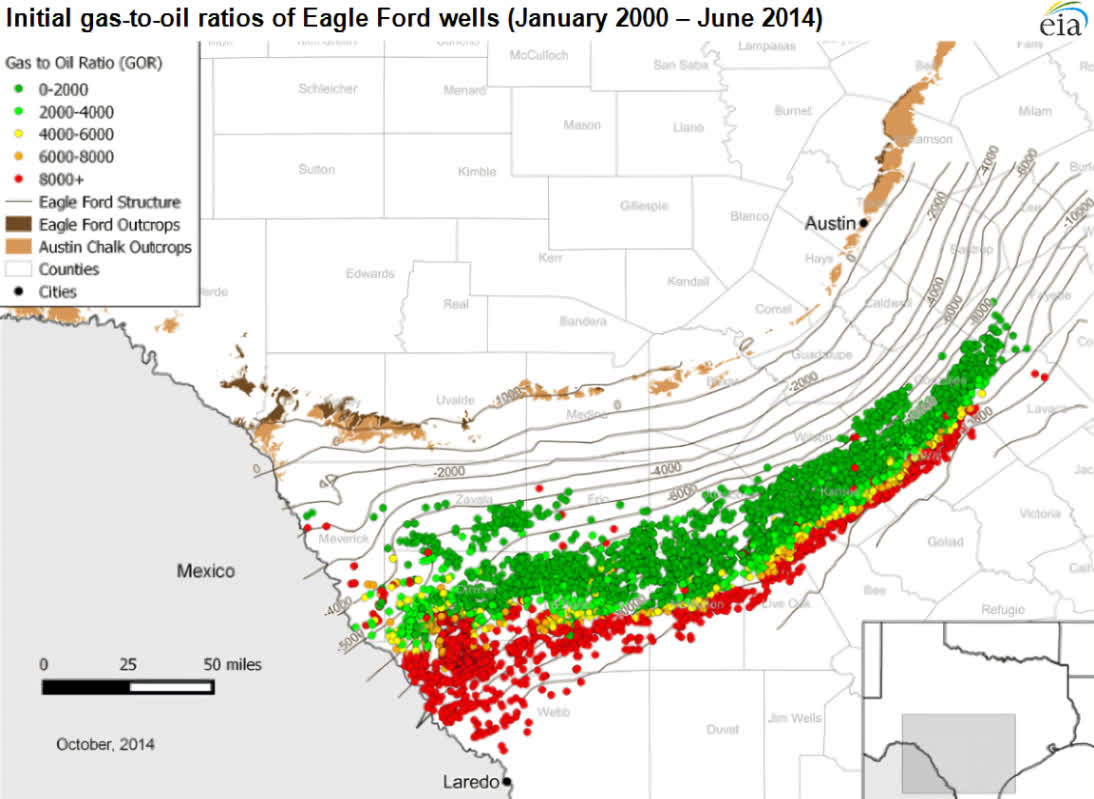

In a similar fashion, EOG has been developing the Dorado natural gas play in the Eagle Ford since 2020. From the images below you can see how the acreage that has been assembled by EOG is exclusively in the natural gas portion of the Eagle Ford basin.

EIA

EOG

EOG’s management is being very strategic in how it views and invests in the Dorado basin. In past earnings calls the company has laid out its vision for the Dorado.

It’s our South Texas Dorado play which we believe will compete as the lowest cost natural gas play, better positioned than much of the gas out there across the U.S….. the most important thing we look at when we develop Dorado is to really invest in that at the right pace for the long term.

In light of the incredible drop in natural gas prices this year, EOG has delayed 5 wells into next year. Concurrently, EOG plans to slowly build out the necessary infrastructure to support the expected boom in demand that will begin to materialize in the next 12-18 months. The second half of 2024 marks the beginning of the next wave of LNG export projects coming online.

So far in 2023, roughly 5 BCF/d of export capacity projects have been given the green light. The largest project, Rio Grande has decided to move forward with its FID and also has awarded shipping contracts for the project. In addition, Port Arthur Trains 1 and 2 also reached FID in March of this year.

The Rio Grande project is slated to be one of the largest LNG export projects in the country, tipping the scales at 3.6 BCF/d. This project alone would account for over 1/3 of the existing US capacity. The cumulative impact of these projects should not be underestimated. As exports continue to rise, the price signals for natural gas will trigger new supplies to come online. EOG is just waiting for the right moment to fire, saving its resources for optimal price points. See the CEO commentary below.

The last thing you want to see, and we all know that there’s a lot of LNG demand coming online, the last thing you want to have is six months before all that LNG demand comes on here, the industry ramps up 100 rigs in gas basins to try and meet that demand, right – what a squandering of resources and efficiencies that would be, and so slow and steady, continue to invest in these assets to the best of your ability at the right pace, so that you’re learning and pushing them forward, but always with an eye on being low cost, doing everything to the point where you can guarantee that the assets will be able to provide value through the cycle.

Rising Tides Lift All Boats

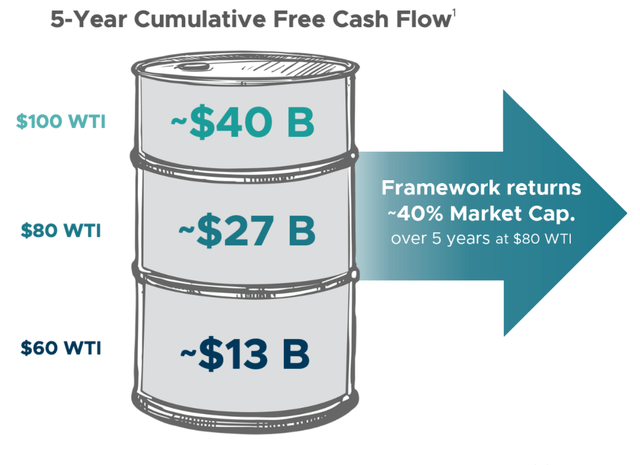

The oil producer space benefits from exponential profitability as crude prices rise. As shown in the example below (provided by Pioneer) a $20 change in WTI oil price (33% change), translates into greater than 100% FCF growth.

PXD investor slides

The good news for EOG is that WTI has experienced this $20/barrel increase since the lows of June. WTI has averaged over $78/barrel now that we are two-thirds of the way done with Q3. The average in Q1 and Q2 were roughly $76 and $73 respectively. If we continue on our current trajectory, Q3 will average over $80/barrel which will be a significant boost to free cash flow.

EOG’s shareholder return policy is to return 60% of FCF. This is spread across a fixed dividend and a variable return portion that is altered between special dividends and share repurchases. With suppressed oil prices and in turn share price, EOG has favored share repurchases thus far this year. The average repurchase price has been $108/share.

However, now the fundamentals have changed. With a significant increase in both WTI prices and EOG’s share price breaking into the $130 range, I believe EOG will again explore the special dividend. For reference, WTI averaged $82.67 in Q4. At this level, EOG experienced enough surplus FCF to pay out a $1.00 special dividend on top of the base $0.825/share dividend.

Valuation and Risks

As with any investment in an oil and gas producer, I believe your risk elevates significantly as the commodity price rises. Buying when the commodity is high decreases the odds of a successful investment. Ultimately, buying above the average price of the commodity cycle will expose you to losses and/or smaller yields when markets are in a bottom swing. So the entry point really depends on your view of the average oil price on a long-term basis.

If we look at history, the last decade gives us an average WTI price in the mid-$60 range. That doesn’t bode well for starting an investment in any producer in today’s market. However, OPEC+ appears very motivated to keep oil prices above $80/barrel to meet their budgetary requirements. So where does that leave us?

In Q1, EOG spent roughly $2.25 billion between its dividend and debt repayment. This accounts for $1.825/share paid out in dividends declared in Q4 ($1 billion spent), plus $1.25 billion in debt retirements. Given that there are no debt repayments until 2025 and it looks like oil will sustain over $80/barrel for at least the near future, EOG has a clear path to significantly higher shareholder returns.

This gives EOG compelling value below the $130/share level for a long-term position. I would consider any withdrawal from this price point to be a buying opportunity.

Summary

EOG is a producer with advantages that help separate it from the pack. These advantages are a net positive cash position, its approach to preserving its molecules for sale, and the potential it has in the Dorado natural gas play. To be the best you have to refine your game at every level, and that’s what EOG does.

To build on that, the crude oil markets are recovering. This will boost the FCF available for shareholders. I believe based on past practice and the lack of debt obligations, that shareholders are in store for special dividends.

Overall, EOG looks compelling at these levels and investors should look to add to/start a position on any pullback from the $130/share mark.

Read the full article here