Money grows on SCHD trees.

Investment Thesis

If I had a dollar for every time I saw Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) mentioned, I’d take that money and buy more SCHD. The ETF that dominates portfolios and subreddits alike, SCHD needs no introduction, but for those new to dividend investing or to SCHD, it might be worth highlighting a few characteristics about what this ETF is made of and what role it can play in your portfolio. In this article, I want to provide SCHD investors the dividend numbers we need to see in 2023 to ensure the exceptional dividend growth has continued.

Strategy and Methodology

SCHD is composed of 104 individual companies using a rigorous screening methodology, according to the fund’s website.

- Minimum of 10 consecutive years of dividend payments

- Minimum float-adjusted market capitalization of $500M

- Minimum 3-month average daily trading volume of $2M

The index components are then selected by evaluating the highest dividend yielding stocks based on four fundamentals-based characteristics

- Cash flow to total debt

- Return on equity

- Dividend yield

- 5-year dividend growth rate

Holdings Breakdown

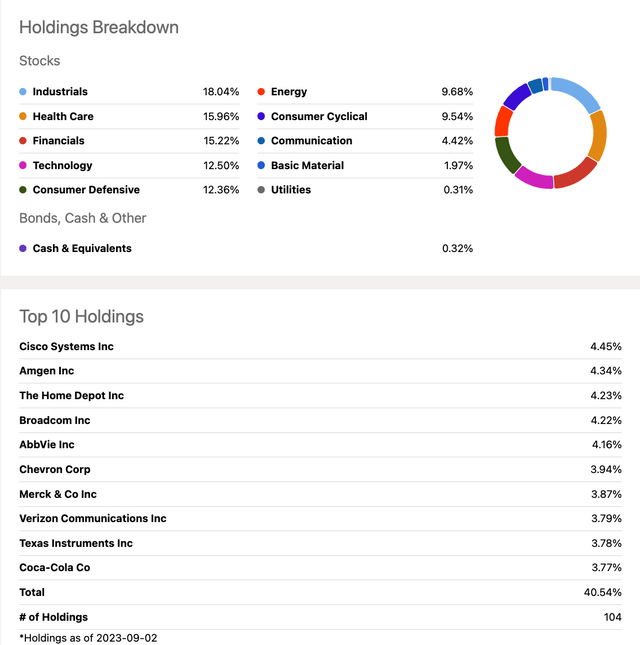

Only the top 104 of 4266 US companies, less than 2.5%, are selected for this ETF. After being screened, the ETF enforces strict weighting and rebalancing rules. No single stock can represent more than 4% of the ETF and no single sector can represent more than 25% of the index, rebalanced quarterly. Additionally, there is a daily weight cap check: if the sum of stocks with weights greater than 4.7% exceeds 22% in the ETF, they are re-balanced within two days to conform to the weighting rules above.

SCHD Holdings (Seeking Alpha)

The top ten holdings constitute about 40.5% of SCHD with household names like Cisco, The Home Depot, Chevron, Verizon, and Coca-Cola among the ranks. The top sector is industrials at 18% weighting with a notably tame technology sector weighting of 12.5% compared to over 30% in SPY or DGRW.

Fund Performance & Peers

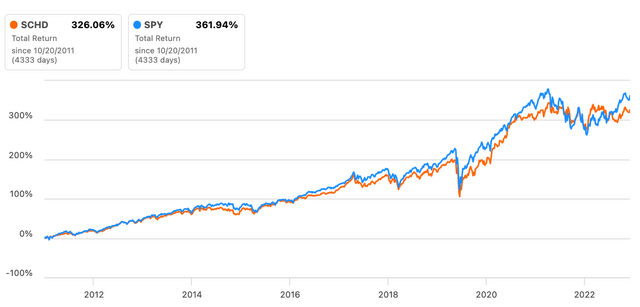

SCHD has been around for just under 12 years, since October 2011, and is based on the Dow Jones US Dividend 100 Index. With $49.25B AUM and competitive 0.06% Expense Ratio, the fund has performed well in terms of total return of 326% since inception vs. the SPDR S&P 500 ETF Trust’s SPY of ~362% over the same time period. Of note, the two funds had the same total return until SPY overtook SCHD around April 2023.

SCHD vs. SPY Total Return Comparison (Seeking Alpha)

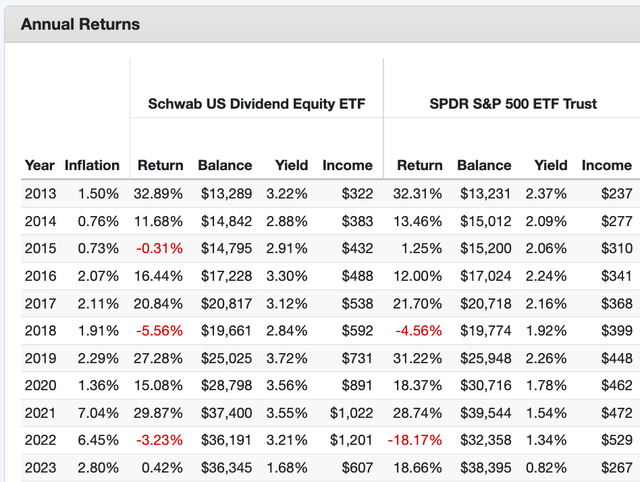

Additionally, much of SPY’s performance is driven by its top tech holdings, recently dubbed the “magnificent seven”: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META), and Tesla (TSLA), which SCHD does not contain. They are two different funds and serve different purposes, but I will say it’s impressive SCHD has not had a year with a significant negative total return, its lowest being -5.56% in 2018 vs. SPY’s -18.17% in 2022, this is one reason I feel more comfortable using SCHD’s dividends for income vs. selling 4% of SPY annually in retirement.

SCHD Annual Returns Backtest (Portfolio Visualizer)

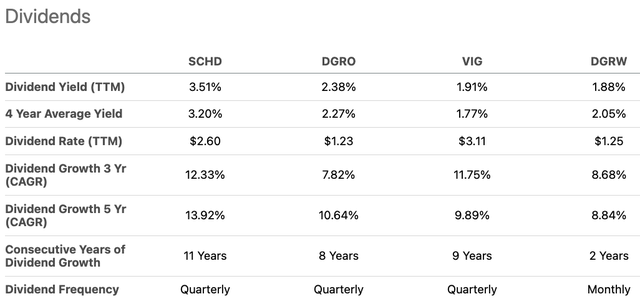

Aside from total returns, let’s talk about the main attraction: SCHD’s dividend metrics, which are superior to peers like DGRO, VIG, and DGRW.

- It has a dividend yield of 3.51%

- 5-year Dividend Growth CAGR of 13.92%

- 11 consecutive years (since inception) of dividend growth

Popular Dividend Growth ETF Dividends Comparison (Seeking Alpha)

Based on the data, a $10,000 initial investment in SCHD would produce an annual income from $322/mo. to $1,201/mo. as of 2022, with dividends reinvested. Of note, that’s beating inflation by almost 3X in real purchasing power, $322 in 2011 dollars is worth about $419 in 2022 dollars. This is another reason I love SCHD: the dividend growth significantly beats inflation. I ran the back-test without reinvesting the dividends as well, and it would still beat inflation almost 2X at $904 in 2022 dollars vs. $419 in inflation adjusted 2011 dollars.

Overall, SCHD has provided capital appreciation and higher yield & dividend growth than its peers. I expect this performance to continue as the fund contains exceptionally high-quality dividend paying companies. However, I’ll admit, 2023 has me anxiously awaiting not only some price appreciation, but the Q3 and Q4 dividend payouts as they indicate the dividend growth rate or lack thereof, for 2023.

Dividend Growth Insights

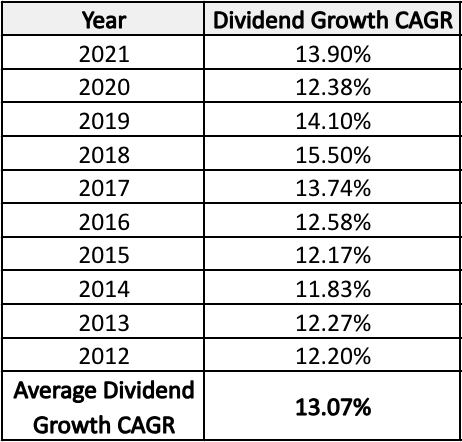

SCHD has grown its dividend payout every year without fail since inception, but will the dividend growth continue? Let’s run some numbers and figure out what we need to see at the upcoming dividend announcements. I averaged the dividend growth CAGR data from Seeking Alpha, which is 13.07%. By the way, that’s a 13% raise every year, that’s the raise we all wish we got in 2023, let alone every other preceding year!

SCHD Average Dividend Growth CAGR (Seeking Alpha, Nicholas Bratto)

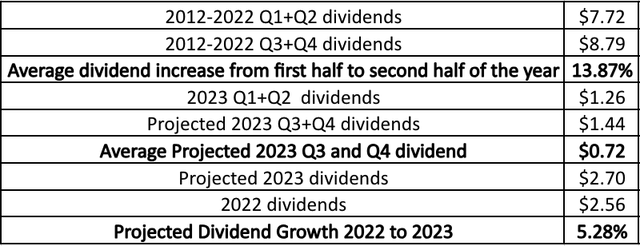

To date, 2023’s Q1 and Q2 payouts are only slightly higher than 2022s Q1 and Q2 payouts. I took a deeper look and noticed Q3 and Q4 tend to be where we get the significant dividend growth, 13.87% on average. $1.26 has been paid in 2023, and therefore, I’m expecting at least $1.44 or an average $0.72 between Q3 and Q4 to be paid out, making the total payout $2.70 in 2023 vs. $2.56 in 2022. This would be a 5.28% payout growth YoY, the lowest since inception, with the lowest in 2017/2018 of just under 7%. To put it simply, we need to see the last two payouts of 2023 somewhere in the $0.70 to low $0.80 range or higher to keep the dividend growth streak alive and well.

Semi-Annual Dividend Growth History & Projections (Seeking Alpha, Nicholas Bratto)

Investment View Risk

2022 and 2023 have been a challenging year in the markets and SCHD is no exception. With the effects of above average inflation setting in and high interest rates, investors and companies are feeling the pressure. While SCHD’s lower market correlation, beta of 0.82 (Yahoo Finance), can be beneficial when the market is down, it can hurt when the market is up, and we see SCHD is so far lagging behind the S&P 500. The effects of higher than inflation applied to each of SCHD’s holdings will have to either pass an increase in cost of goods and services onto customers, improved operational efficiency, or a combination of both to increase their dividend payouts. If sales decline as a result of price increases, companies will have to improve their operations or take loans to continue increasing their dividend for shareholders. Additionally, one of SCHD’s holdings, 3M (MMM), currently faces massive legal risks related to faulty earplugs which could affect their dividend payout, should they have to pay a large settlement.

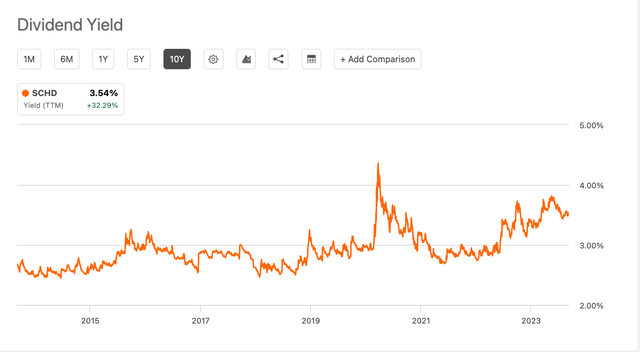

Finally, there are the effects of rising interest rates, which puts downward pressure on SCHD’s valuation while investors continue investing in bonds, savings, and alternative assets. This effectively increases the dividend yield, but also makes it such that increasing the dividend will not make sense valuation-wise unless the underlying stock prices rise. SCHD likes to be around 3% yield historically. There was a quick spike from 2020, recovery about 1 year later, and a gradual increase, due to downward pressure, since mid-2022. This is unsustainable if SCHD is to continue their aggressive dividend growth investors like myself love.

SCHD 10 Year Dividend Yield (Seeking Alpha)

Forward-Looking Discussion

All in all, SCHD offers a dividend growth investor an ETF with excellent quality, performance results, and diversification to sleep well at night. With an investment in SCHD, not only is your principal growing but your income as well. This is particularly empowering for those who will one day spend their dividend income: they do not need to stress about reinvesting enough money or buying more shares to keep up with inflation or to simply grow their income.

I do have faith we will get paid more in 2023 than 2022. Remember, these 104 companies have consistently raised their dividend for 10+ years, and they are in the best position to do so based on the valuations which got them screened into this ETF. Nonetheless, it will be a great data point to see how the challenges in the market, inflation, and rising interest rates impacts the nation’s top dividend equities of SCHD. I’m bullish for its screening methodology to keep up the consistent performance, especially its dividend growth continuing in the future. Remember to look out for the last two payouts in September and December to be somewhere in the $0.70 and $0.80 range. This may end up being one of the biggest tests for SCHDs Q3 and Q4 dividends since its inception!

Read the full article here