Introduction

Autolus Therapeutics (NASDAQ:AUTL) is a leading biopharmaceutical firm innovating T cell therapies for cancer treatment. They’ve developed unique T cell programming technologies, with “obe-cel” showing promise in trials and anticipated FDA submission by 2023’s end. Partnering with University College London, they’re involved in the CARPALL and ALLCAR19 studies. In 2023, their Stevenage-based facility, The Nucleus, made strides, aiming to produce 2,000 batches yearly. In the U.S., they’ve partnered with Cardinal Health for efficient CAR T-cell therapy distribution.

The following article discusses Autolus’ financial status, the potential of its obe-cel cancer therapy, regulatory challenges, and commercial viability. Investment recommendation: Hold.

Q2 Earnings

Looking at Autolus’ most recent earnings report, as of June 30, 2023, the company held $307.8M in cash and equivalents, down from $382.8M at the end of 2022. Operating expenses for the quarter reached $47.9M, slightly up from $46.5M the previous year. Notable changes in expenses included a reduction in R&D costs to $36.7M, largely from a $5.9M decrease in clinical and manufacturing costs for obe-cel. However, general and administrative expenses rose to $11.1M, primarily due to a $1.5M increase in commercial readiness costs. The net loss attributed to shareholders was $45.6M for the quarter, with a loss per share of $(0.26). The company anticipates its current cash and projected Blackstone milestone payments will sustain operations into 2025.

Cash Runway & Liquidity

Turning to Autolus’ balance sheet, as of June 30, 2023, the combined value under ‘Assets’ for ‘cash and cash equivalents’ stands at $307.5M. The net cash used in operating activities for the six months ended June 30, 2023, is $80.566M, translating to an estimated monthly cash burn of approximately $13.4M. Given the aforementioned asset amount, the company has a cash runway of approximately 23 months. It’s worth noting that these values and estimates are based on past data and may not be indicative of future performance.

In evaluating the company’s liquidity status, Autolus appears to be in a fairly liquid position, with the majority of its assets being easily convertible to cash. However, their operational activities have consumed a significant portion of their cash reserves over the past six months. As for the company’s debt, while there isn’t a direct line item labeled “debt,” there are various liabilities, including a notable “Liability related to future royalties and sales milestones” at $135.764M. Given their current financial standing and the state of the balance sheet, it might be feasible for Autolus to secure additional financing, should they require it. These are my personal observations, and other analysts might interpret the data differently.

Capital Structure, Growth, & Momentum

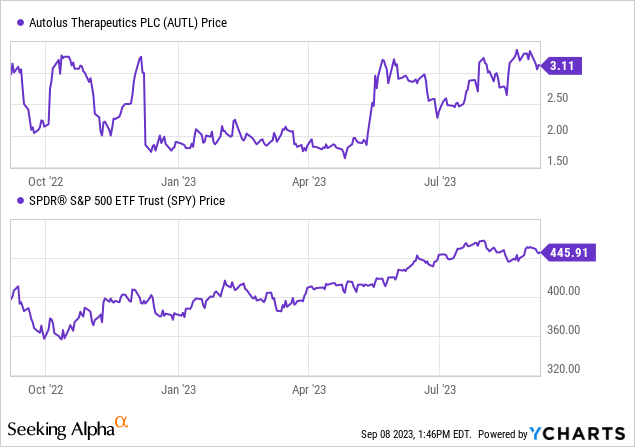

According to Seeking Alpha data, Autolus exhibits a capital structure where cash holdings are substantial relative to its market capitalization and total debt, resulting in an enterprise value of $274.90M. As a pre-revenue biotech company focused on T cell therapies for cancer treatment, Autolus’ developmental phase is of significance. Notably, while 2023 projects a sales figure of just $1.68M, analysts anticipate a rapid ascent in revenues to $17.55M by 2024, and further to $70.24M by 2025. This growth trajectory speaks volumes about the company’s potential earnings and the industry’s confidence in its pipeline. Lastly, in terms of stock momentum, Autolus has outperformed the S&P500 over the last 6 months, but has slightly underperformed over the past year, indicating a mixed sentiment among investors.

Obe-cel: Crafting Cures, One Cell at a Time

Obe-cel, a pioneering autologous CD19 CAR T cell therapy, has the potential to reshape the cancer treatment landscape. Being crafted from the patient’s own cells, it epitomizes personalized medicine. Yet, the journey from the laboratory bench to bedside is fraught with hurdles.

Regulatory intricacies emerge as a primary concern. Due to obe-cel’s innovative nature, it is subject to thorough scrutiny by health authorities. This vetting ensures patient safety and treatment efficacy but can be protracted and exacting. The individualized nature of obe-cel complicates its standardization. Each dose, being distinct, challenges conventional evaluation methods. There’s also a heightened focus on post-market tracking for such therapies, demanding advanced systems to monitor patient results over the long run.

Commercially, obe-cel’s production is cost-intensive since each dose is tailored for a specific patient, unlike mass-produced traditional drugs. This pricing model could potentially exclude patients unless covered by insurance, and even then, the steep costs may stir reimbursement debates. Moreover, the logistics of transporting these viable cells without compromising their quality is a significant hurdle. Any logistical lapse could compromise the therapy’s effectiveness.

Additionally, the emergence of therapies like obe-cel necessitates comprehensive training for healthcare practitioners. This training spans the gamut, from understanding the therapy, its administration procedures, to managing potential side effects.

Recent management insights shed light on obe-cel’s trajectory. The FELIX study illuminated its promising profile for certain adult leukemia patients, showcasing an overall response rate of 76%, an improvement from an earlier 70%. This success is credited to the company’s adept product delivery framework. They aim to submit licensing applications to regulatory bodies by 2024, with launch preparations for obe-cel in full swing. The FELIX data also underscored challenges related to treating patients with extensive tumor presence, especially in bone marrow. However, the company remains buoyant, given the consistent positive results from their research. Management emphasized obe-cel’s franchise potential, exploring multi-target strategies and applications for other conditions, confident in obe-cel’s capacity to tackle diverse hematological and possibly autoimmune conditions.

My Analysis & Recommendation

In wrapping up, the prospects for Autolus Therapeutics and its flagship therapy, obe-cel, are indeed captivating. As it stands, obe-cel has the potential to set new paradigms in personalized cancer treatments, given its remarkable efficacy results. However, the complexity inherent to such individualized therapies, from regulatory clearances to commercialization challenges, cannot be downplayed.

The market, it appears, is already hedging against these uncertainties. The relatively low enterprise value of Autolus, juxtaposed against its cash reserves and minimal debt, might indicate a cautious investor sentiment. Given obe-cel’s individualized nature, standardization and logistical complexities could be pivotal determining factors in its market success. It is crucial for investors to keep a keen eye on regulatory developments, particularly the FDA’s verdict on obe-cel’s submission by the end of this year. Furthermore, monitoring the company’s ability to successfully navigate the cost-intensive production model, insurance reimbursement negotiations, and efficient distribution mechanisms will provide invaluable insights into its potential commercial success.

The weeks and months ahead are crucial. While obe-cel boasts an impressive response rate, it remains to be seen how this translates into broader patient accessibility, healthcare adoption, and ultimately, commercial viability. The company’s partnership with Cardinal Health, aiming to streamline CAR T-cell therapy distribution, can be a significant positive catalyst if executed adeptly.

My investment recommendation is “Hold.” The rationale behind this is multifold: Firstly, while the innovative potential of obe-cel is indisputable, there’s considerable uncertainty regarding its regulatory and commercial trajectory. The market’s cautious stance, evident from the company’s enterprise value, seems warranted given the inherent complexities of obe-cel’s roll-out. Secondly, with a cash runway extending into 2025, Autolus seems to be in a position to weather any short-term turbulence. For investors, it might be prudent to await clearer signals from the regulatory landscape and commercial readiness initiatives before making any drastic changes to their positions.

Read the full article here