Introduction

London-based BP p.l.c. (NYSE:BP) released its second quarter 2023 results on August 1, 2023.

Note: I have followed BP quarterly since 2014. This new article updates my article published on June 26, 2023.

1 – Q2’23 results snapshot

BP reported second-quarter adjusted earnings of $0.89 per ADR share on a replacement cost basis, missing analysts’ expectations. Adjusted earnings were down from $2.61 reported a year ago.

Total revenues (including other investments) were $49.479 billion, down significantly from $69.506 billion last year.

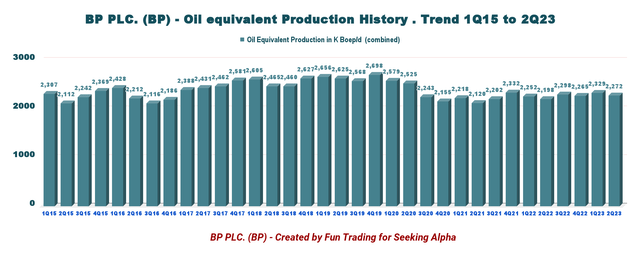

Weak quarterly results were due to lower realizations of commodity prices and a drop in refinery throughputs. However, Boe Production was up 3.4% YoY to 2,272 Boepd from 2,198 Boepd last year.

BP announced a quarterly dividend increase of 10% or $0.4362 per ADR share and plans a $1.75 billion share buyback program to be completed before the end of the third-quarter results. The dividend yield is now 4.51%.

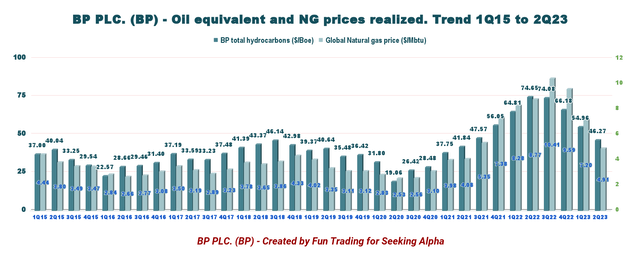

Note: The price of hydrocarbons per Boe received by BP this quarter was $46.27 per Boe, and the natural gas price was $4.91 per MMBtu.

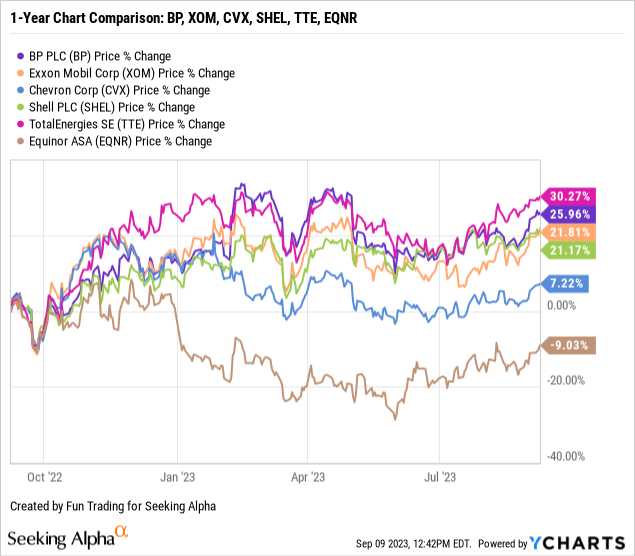

2 – Stock performance

BP is part of my “six oil majors” group, including Exxon Mobil (XOM) and Shell plc (SHEL), Equinor (EQNR), TotalEnergies SE (TTE), and Chevron (CVX).

BP is up 26% on a one-year basis and has outperformed nearly all its peers on a one-year basis, besides TotalEnergies, up over 30%.

CFO Murray Auchincloss said in the conference call:

Our five priorities and guidance remain unchanged. We have today announced a dividend increase of 10% for the second quarter to $7.27 dividend per ordinary share. The dividend remains our first priority and is underpinned by a cash balance point of $40 Brent, $11 RMM and $3 Henry Hub. We remain committed to maintaining a strong investment-grade credit rating and we are targeting further progress within the A-grade credit rating.

3 – Investment thesis

BP’s fundamentals have changed for the better starting in 2022 and continued to offer a solid future, especially with the increase in oil prices beginning in July 2023 after Saudi Arabia decided to cut oil supply by 1.2 million barrels.

In July, oil supply from the OPEC+ alliance fell by 1.2 mb/d to a near two-year low as a voluntary reduction from Saudi Arabia came into effect.

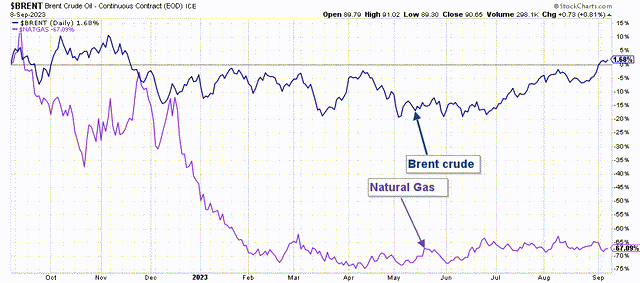

As we can see in the chart below, oil prices are now up nearly 2% on a one-year basis, whereas natural gas has reached solid support.

1-Year Brent versus NG Prices (Fun Trading StockCharts)

CFO Murray Auchincloss said in the conference call:

Looking forward, based on BP’s current forecast at around $60 per barrel Brent and subject to the board’s discretion each quarter, BP continues to expect to be able to deliver share buybacks of around $4 billion per annum at the lower end of the $14 billion to $18 billion capital expenditure range and have capacity for an annual increase in the dividend ordinary share of around 4%.

As we can see, Brent is over $90 per barrel and looks strong for the remainder of 2023. BP is well-positioned to profit from this situation. The oil price outlook is very positive. According to CEO Bernard Looney:

Oil and gas will continue to be a significant energy source globally for many decades to come. Oil and gas, used to power vehicles, airplanes and in several industries, constitute 55% of the world’s energy needs. Per International Energy Agency projections, global oil demand is set to rise to new high in 2023.

However, the stock price has largely factored in this situation, and the stock is now technically overbought. It is time to consider taking some profit off the table.

Investors should keep BP long-term, but not without conditions. Investing in BP requires a specific strategy due to the inherent fluctuating nature of the oil prices. Combining a long-term investment with short-term trading LIFO or similar strategy (options) is crucial.

Thus, as I said in my preceding article, long-term investors should continue accumulating this cyclical stock on any significant weaknesses. About 40% to 50% should be allocated to this task to minimize the risks of a sudden severe retracement, which has recurred like clockwork every two or three years.

BP Plc – Financial Table Q2’23: The Raw Numbers

Note: Each BP ADS represents six (6) “ordinary shares” of BP. Ordinary shares are the English equivalent of common stock in a U.S. corporation.

| BP | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Revenues in $ Billion | 67.87 | 55.01 | 69.26 | 56.18 | 48.54 |

| Total Revenues and others in $ Billion | 69.51 | 57.81 | 70.36 | 56.95 | 49.48 |

| Net income in $ Billion | 9.26 | -2.16 | 10.80 | 8.22 | 1.79 |

| EBITDA $ Billion | 18.21 | 6.29 | 21.09 | 16.54 | 8.58 |

| EPS diluted in $/share | 2.83 | -0.69 | 3.50 | 2.70 | 0.60 |

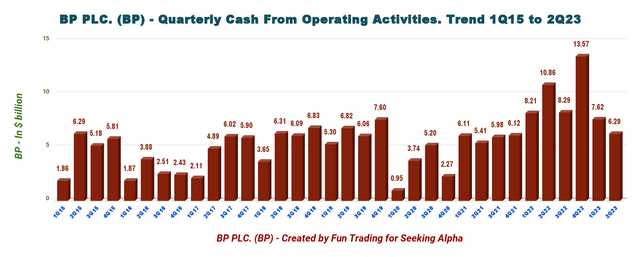

| Cash from operating activities in $ Billion | 10.86 | 8.29 | 13.57 | 7.62 | 6.29 |

| Capital Expenditure Quarterly in $ Billion |

2.67 |

3.11 |

3.70 |

3.13 |

3.45 |

| Free Cash Flow in $ Billion | 8.20 | 5.18 | 9.88 | 4.49 | 2.84 |

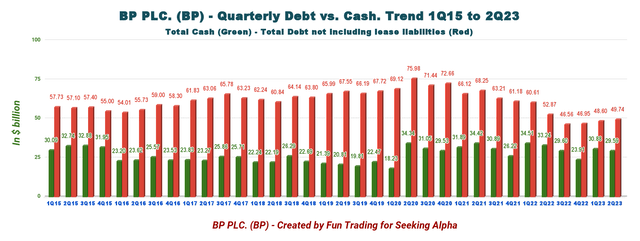

| Total cash (+other investments) $ Billion | 33.24 | 29.60 | 23.91 | 30.88 | 29.59 |

| Gross Debt in $ Billion (not including lease) | 52.87 | 46.56 | 46.95 | 48.60 | 49.74 |

| Dividend per share in $ | 0.36036 | 0.36036 | 0.3966 | 0.3966 | 0.4362 |

| Shares outstanding (diluted) in Billion | 3.270 | 3.148 | 3.028 | 3.040 | 2.984 |

| Oil Production Detail and Renewable | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Oil Equivalent Production in K Boep/d | 2,198 | 2,298 | 2,265 | 2,329 | 2,272 |

| Global liquid price ($/Boe) | 74.65 | 74.08 | 66.18 | 54.74 | 46.27 |

| Global Natural gas price ($/M BTU) | 8.77 | 10.41 | 9.59 | 7.20 | 4.91 |

| Total Developed renewables to FID and Renewables pipeline in net GW | 30.1 | 31.5 | 43.0 | 44.7 | 45.7 |

Sources: Company release

* The total equivalent Production represents the gas production operations for 903K Boepd and oil production operations for 1,369K Boepd in Q2’23.

Analysis: Revenues, Earnings Details, Free Cash Flow, And Upstream Production

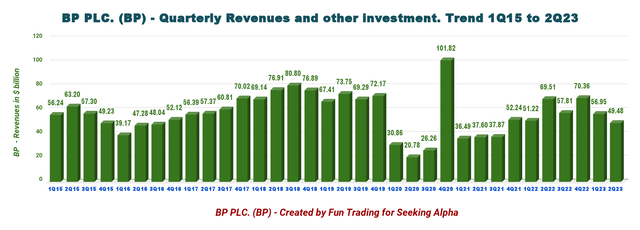

1 – Quarterly total revenues and other investments were $49.48 billion in Q2’23

Note: The company has restated the four quarters of 2020.

BP Quarterly Revenues History (Fun Trading)

BP had total revenues of $49.479 billion for the quarter (oil revenues are $48.538 billion). CapEx in the second quarter of 2023 was $3.453 billion, compared with $2.666 billion in the second quarter of 2022.

The income attributable to BP’s shareholders in the second quarter was $1.792 billion, compared with $9.257 billion last year.

Weak quarterly results were due to lower realizations of commodity prices and a decline in refinery throughputs.

Operating cash flow in the quarter was $6.293 billion compared to $10.863 billion in 2Q22.

At the end of the second quarter, net debt was $23.660 billion, gearing at 21.7%.

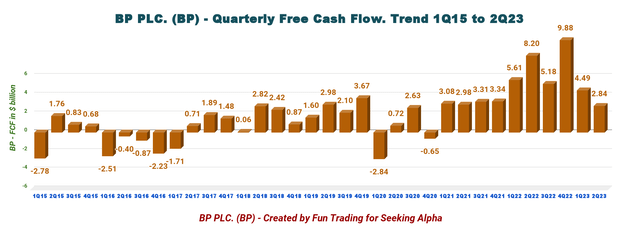

2 – Free cash flow (not including divestitures)

BP Quarterly Free Cash Flow History (Fun Trading)

Note: Generic free cash flow is cash from operating activities minus Capex.

The trailing 12-month free cash flow (“ttm”) was $22.391 billion, with a second-quarter 2023 of $2.840 billion.

The chart below shows that cash flow from operations decreased sequentially to $6.293 billion.

BP Quarterly Cash Flow from Operations History (Fun Trading)

3 – Oil equivalent production

BP Quarterly Oil Equivalent Production History (Fun Trading)

- Upstream: The total quarter’s production was 2,272K Boepd, up 3.4% compared to last year and down 2.4% sequentially. Oil production and operations represent 1,369K Boepd, and gas and low carbon energy represent 903K Boep/d. Production this quarter was better than expected.

The company sold its total hydrocarbon per Boe at $46.27 during the second quarter compared with $74.65 in the same period last year. The natural gas price was $4.91 per thousand cubic feet compared with $8.77 in the year-ago quarter.

BP Quarterly Price per Boe and NG Price (Fun Trading)

BP operates under three different segments:

- Gas and low-carbon energy

Profits increased to $2,777 million in Q2’23 from a profit of $5,902 million last year, mainly due to decreased liquid and gas prices YoY.

In the second quarter, total production was 903K Boepd, down from 924K Boepd last year. Also, in this category, the company indicates the total developed renewables to FID and renewables pipeline jumped to 45.7 GW, up from 30.1 GW last year.

- Oil production and operations

The total production of 1,369K Boepd for the second quarter was up from 1,277K Boepd in the year-ago quarter.

- Customer & products

Underlying RC earnings before interest and tax were $796 million in Q2’23, up from $4,006 million last year. The company suffered a significant decline in refining marker margin this quarter.

BP-operated refining availability in March was 95.7%, increasing from 93.9% in the year-ago quarter.

Total refinery throughputs from the second quarter were reported at 1,364 thousand barrels per day, declining from 1,480 MBbl/D in the prior year quarter.

4 – Net debt is $23.66 billion in 1Q23. Net debt, including liabilities, was $34.485 Billion

BP Quarterly Cash versus Debt History (Fun Trading)

BP’s net debt is now $23.66 billion, nearly unchanged QoQ. Gearing improved slightly sequentially to 21.7%.

The company had $29,585 million in cash, cash equivalent, and marketable securities; long-term debt, including current, was $49,738 million.

The debt-to-equity ratio has dropped to 0.7071, according to YCharts. As we can see in the chart above, debt is climbing again in 2Q22. It is a sign that the company’s buyback program should be postponed until BP can reduce debt to a ratio below 0.5.

Technical Analysis and Commentary

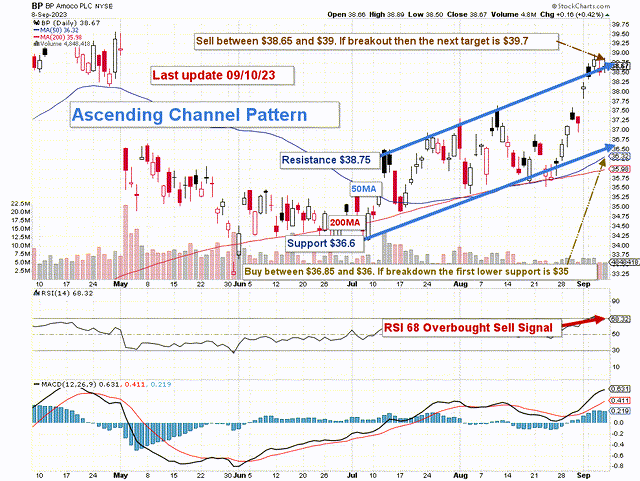

BP TA Chart short-term (Fun Trading StockCharts)

Note: The chart has been adjusted for the dividend.

BP forms an ascending channel pattern with resistance at $38.75 and support at $36.60.

The trading strategy is to sell 40%-50% of your long position, partially between $38.65 and $39, with possible higher resistance at $39.7.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices, but only after a downside penetration of the lower trend line.

Conversely, I recommend buying BP between $36.85 and $36.0, with possible lower support at $35.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here