Investment thesis

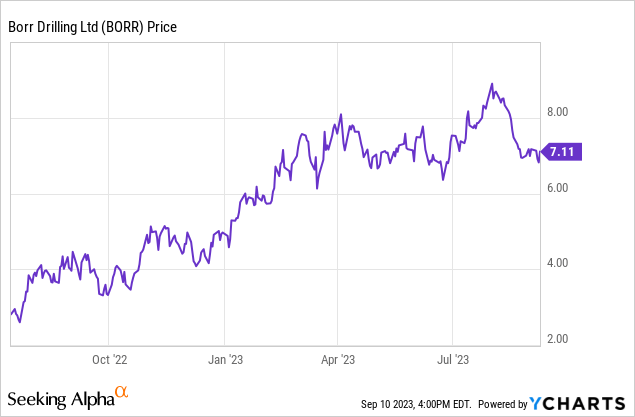

Borr Drilling Limited (NYSE:BORR) is a highly levered offshore driller that specializes in modern jack-up rigs (used for drilling in shallow waters). I previously wrote about BORR in July 2022 when I opined the refinancing problems the company was facing at the time would ultimately be resolved. This has largely played out with the stock up 150% since last summer:

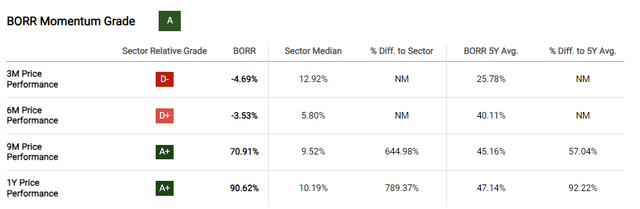

The strong performance has made BORR look like a momentum stock:

Seeking Alpha

However, I would contend that BORR remains a value play despite the run-up. The offshore services industry is in a secular bull market that has been unfazed by recessionary fears or even oil briefly falling into the $60s earlier this year.

As BORR’s drilling contracts re-rate (meaning that legacy contracts at lower rates get replaced by new contracts at higher market rates), the company could easily be generating $750 million in annual EBITDA a couple of years out. Yet, the stock price today only implies a measly 4x enterprise value to EBITDA multiple.

The low valuation suggests there is much upside left and the returns to equity holders may be magnified by the high leverage, especially as the debt gets gradually de-risked. I rate BORR a “buy.”

Why invest in offshore drilling services?

I cover the bull case for oilfield (and in particular offshore) services in greater detail in some of my recent macro-oriented articles:

Oilfield Services Update: Offshore And International Make Up For North America Weakness.

3 Things To Consider Before Buying Oil Stocks.

SLB Stock: Energy Services To Become A Trillion Dollar Industry This Year.

To make a long story short, long-cycle offshore plays underwent years of underinvestment from 2014-2021 as short-cycle U.S. shale production had become the swing producer. Offshore projects require multiple years to pay out, so there is a lot of hesitancy to respond to price signals when shale may ramp up and balance the market before an offshore project has even reached production.

At this point it should be clear to everyone that shale is reaching its limits and is no longer quick to ramp up production when oil prices rise. As I have argued already in the linked articles, there is evidence many producers now require $60 oil to break even.

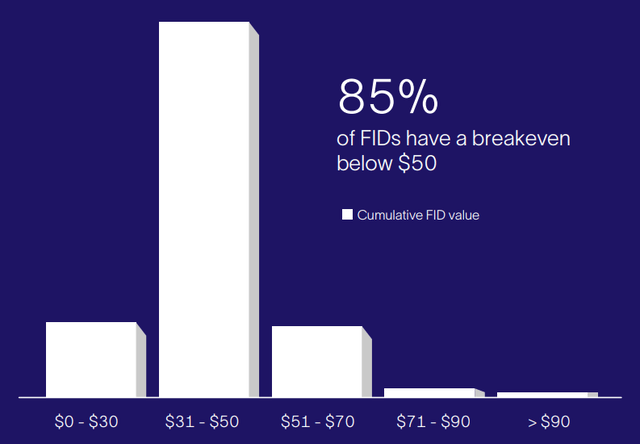

In contrast, industry bellwether Schlumberger (SLB) now believes that 85% of the offshore FIDs have a breakeven below $50:

SLB Presentation

As oil prices remain comfortably above $50, we have seen quite a rush by the advantaged operators to develop their reserves. On the deepwater side Petrobras (PBR) has been a major driver behind rig demand while on the shallow waterside where BORR plays there has been a lot of demand from Middle Eastern NOCs like Saudi Aramco and ADNOC.

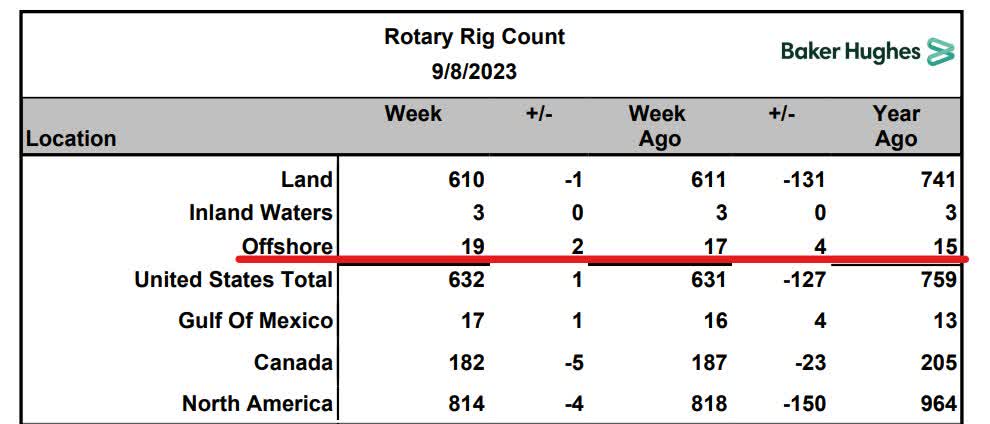

Even within the U.S. itself, offshore shows stronger activity. Based on last Friday’s Baker Hughes (BKR) rig count, U.S. onshore rigs are -20% YoY while offshore is up +25% for the same period:

Baker Hughes Rig Count

Unfortunately for the offshore operators, during the lean years of 2014-2021 many rigs were retired as the drillers couldn’t afford to maintain them (and many drillers had to undergo reorganization too, resulting in further industry consolidation).

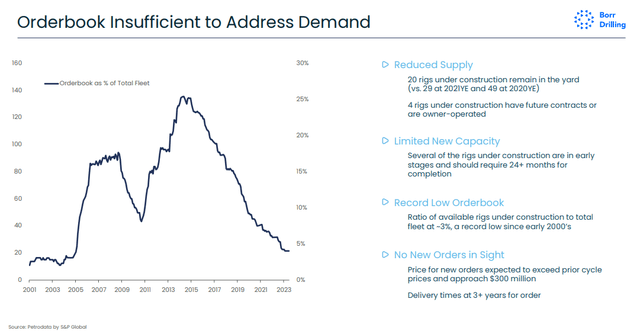

It is not so easy to come up with newbuild rigs either. This is especially true on the deepwater side where estimates of $1 billion are thrown around for a newbuild drillship, but is also valid for jack-ups where the orderbook is at its lowest in 20 years (as pointed out in BORR’s recent presentation):

BORR Presentation

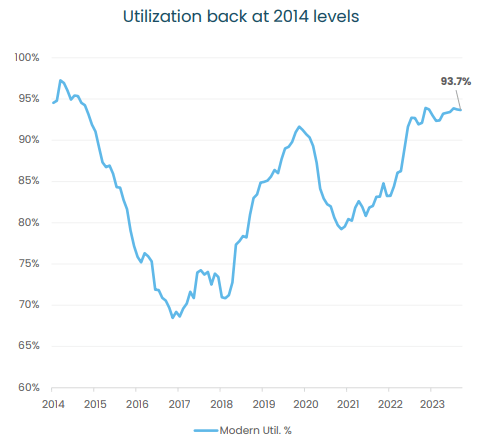

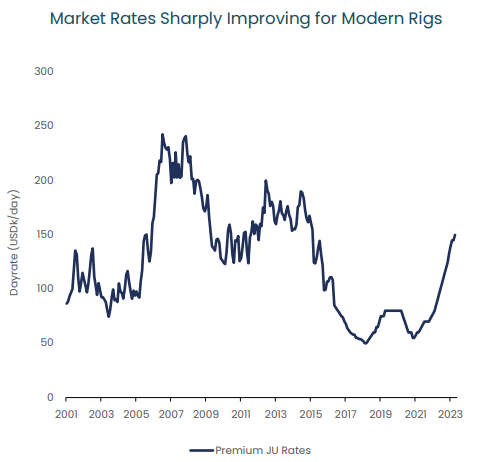

Part of the reason is rising building costs and more expensive financing, but shipyards are also backlogged with other orders such as LNG carriers. So when demand rises but supply is constrained, utilizations and day rates for the existing fleet go up:

BORR Presentation BORR Presentation

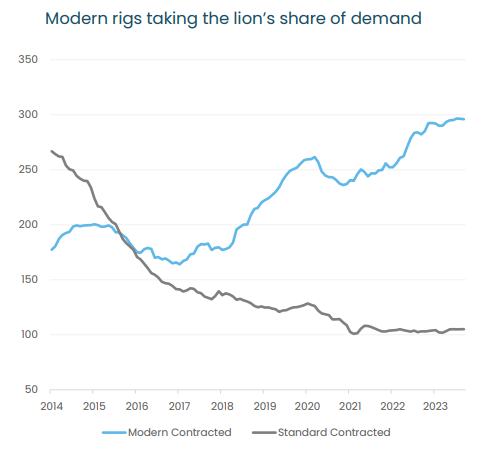

This is clearly very bullish for BORR, especially as the company has a modern fleet (average age of six years) that is in even higher demand compared to older rigs:

BORR Presentation

The only negative is that rigs are contracted long-term, so BORR is still realizing revenue based on legacy contracts that were concluded at lower rates. It will take some time for the re-rating process to play out until the high rates we see today fully filter down to the bottom line. For this reason focusing on 2023 or 2024 EBITDA here doesn’t make as much sense and Seeking Alpha’s standardized valuation scores may be misleading.

The valuation remains discounted

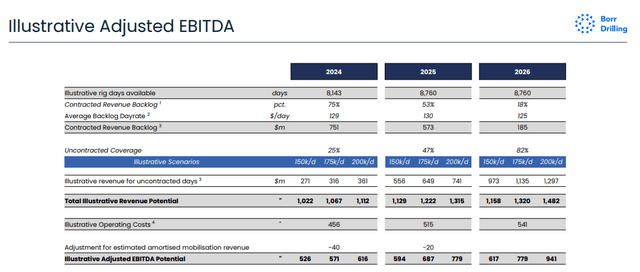

BORR believes that it can get close to $1 billion in EBITDA by 2026:

BORR Presentation

As a high-level calculation, $750 million certainly looks possible:

24 rigs x 175k/d rate x 365 days x 95% utilization x 50% EBITDA margin = $728m

Note the company’s calculation is a lot more detailed as it considers the phasing out of the legacy contracts.

All this means the current enterprise value of $3.2 billion is only about 4x the EBITDA we could have in 2025-2026. How high should the multiple be?

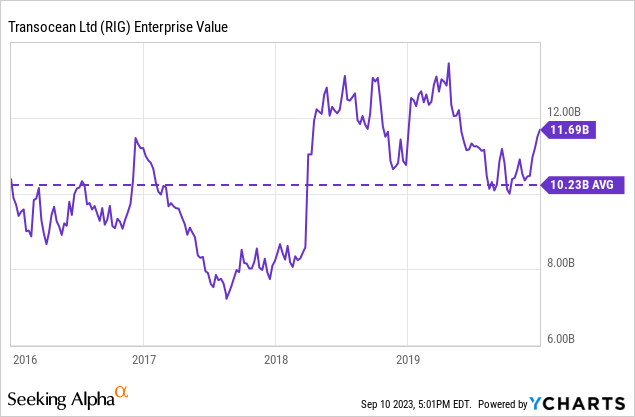

I don’t know, but I think it could easily be 5x or 6x. BORR doesn’t have a long history, so we can look at Transocean (RIG) as a potential reference; during 2016-2020 (offshore bear market), RIG’s EV averaged $10 billion.

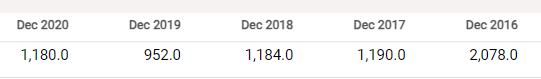

In the meantime, RIG was generating annual EBITDA between $1 and $2 billion:

Seeking Alpha

So on average, RIG was able to sustain 6x EBITDA even when things were already bad in the industry.

Assuming BORR can get to 6x (50% EV increase), that would essentially double the equity value due to the financial leverage.

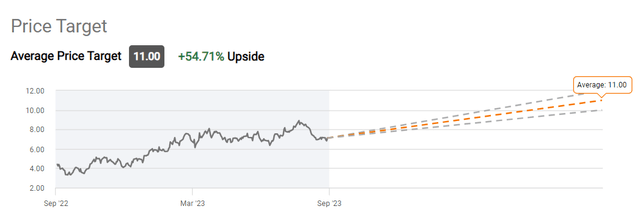

Even the average Wall Street target suggests +50% upside:

Seeking Alpha

The debt is getting de-risked

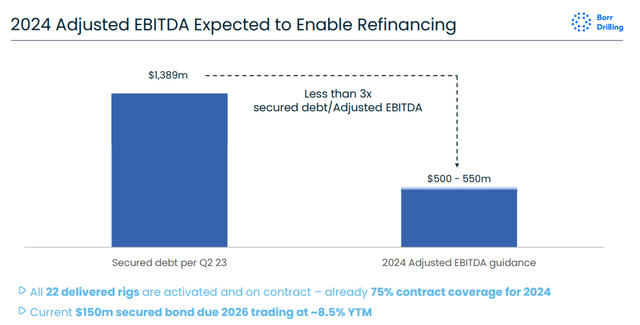

BORR’s management still has to carry out a significant refinancing in 2025. However, it looks like this refinancing will happen under a more favorable 3x debt/EBITDA:

BORR Presentation

The company’s secured debt now has a single-digit yield too.

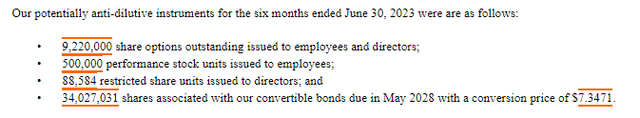

It is important to note though that BORR also has $250 million in convertible bonds with a conversion price of about $7.35 per share. Right now this is out of the money, but there will be some dilution if we hit my 2x price target.

As of the latest financial report, the 34 million in shares associated with the convertible bonds were considered anti-dilutive:

BORR SEC Filings

In other words, recalculating EPS assuming the conversion would result in higher EPS. However, that won’t be the case for much longer as the rig contracts re-rate and the EPS improves.

Bottom line

BORR is a nice way to play the offshore services thesis. Even though I am very bullish on deepwater plays like Transocean, I think BORR provides a good counterbalance as the number one competitive threat to deepwater is probably shallow water.

BORR’s backlog is also now two-thirds from NOCs which I think will be the more resilient customer group this decade (energy security is also a strong imperative for government-owned companies):

BORR presentation

I rate BORR a “buy” with a view towards $14, although don’t expect the path to be linear. BORR is also a highly volatile stock, so you should make sure it agrees with your risk tolerance.

Read the full article here