In a June 1, 2023, Seeking Alpha article, I highlighted Brent crude oil and the United States Brent Oil Fund, LP ETF (NYSEARCA:BNO). In that article, I wrote, “Risk-reward favors the upside, and United States Brent Oil Fund, LP ETF is a product that provides exposure to Brent, the world’s leading crude oil benchmark and grade OPEC controls.“

On June 1, nearby Brent futures were at the $74.95 per barrel level, and the BNO ETF was trading at $25.28 per share. Over the past three months, crude oil prices and BNO have increased significantly, and more gains could be on the horizon.

Brent Crude Oil: A significant rise from the May 2023 low – Breaking out from the bearish price path since the 2022 high

Brent crude oil is the benchmark for approximately two-thirds of the world’s petroleum. Brent is the crude oil pricing mechanism for European, Russian, African, and Middle Eastern crude oil.

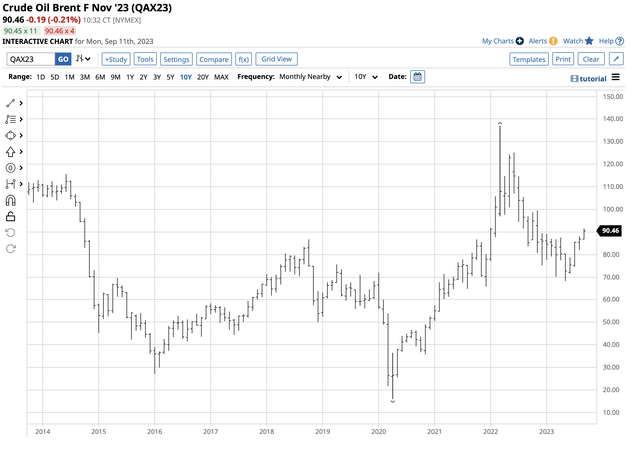

Monthly Brent ICE Futures Chart (Barchart)

From the May 2023 $68.20 low to $90.46 per barrel on September 11. Since June 1, Brent has moved 20.7% higher.

Meanwhile, the rise above the January 2023 $89.10 peak sent the futures to a new high for this year. The move was a technical break out to the upside, ending the bearish trend since the March 2022 $137 fourteen-year high.

OPEC+ wants Brent crude oil prices as high as possible – Production cuts will continue for three reasons: China, the Saudi budget, and Russia

Over the past years, the Brent benchmark crude oil has traded at a premium over West Texas Intermediate crude oil.

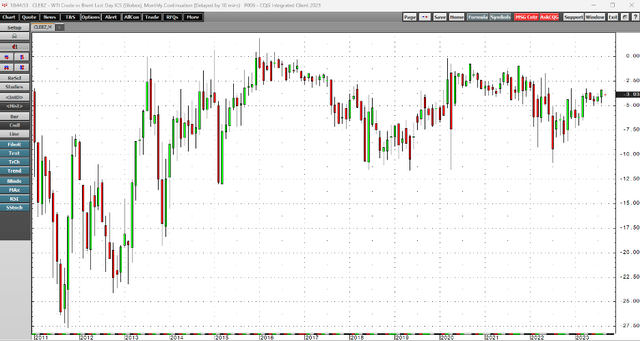

Monthly Chart of the November 2023 WTI minus Brent crude oil futures spread (CQG)

The chart highlights the premium of nearby Brent over WTI crude oil for more than a decade. As of September 11, Brent futures were trading at $3.93 per barrel higher than WTI futures for November delivery. Brent is the global dominant benchmark price controlled by OPEC and its most influential non-member, Russia. Since 2016, Russia has cooperated with the international oil cartel on production quotas. Output decisions are a function of negotiations between Riyadh, Saudi Arabia, and Moscow.

OPEC+ has cited Chinese economic weakness as the reason for the most recent quotas limiting crude oil production. However, the cartel’s mission is the highest possible price that balances supply and demand fundamentals. Meanwhile, the Saudis require a minimum of $80 per barrel to balance the domestic budget. Moreover, Russia depends on crude oil revenues to fund the ongoing war in Ukraine and has used crude oil as an economic weapon against countries supporting Ukraine. China, OPEC’s mission, and Russian aggression are why quotas will likely continue, and further production cuts are on the horizon.

The war is bullish for oil prices – Brent and distillates are the most sensitive

Crude oil prices rose to the highest since 2008 in March 2022 when Russia invaded Ukraine. The first major war in Europe since WW II caused supply and price concerns that launched nearby Brent futures to $137 and WTI futures to $130.50. However, the prices stopped short of the all-time 2008 high for Brent at $148.41. In 2008, WTI futures peaked at $147.27 per barrel.

Meanwhile, oil product prices did not follow crude oil as they rose to record highs in 2022.

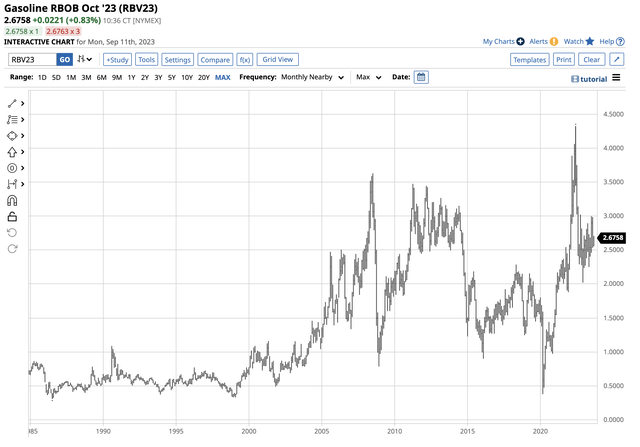

Long-Term NYMEX Gasoline Futures Chart (Barchart)

The long-term gasoline futures chart shows the June 2022 $4.3260 per gallon wholesale price eclipsed the 2008 $3.6310 previous all-time peak.

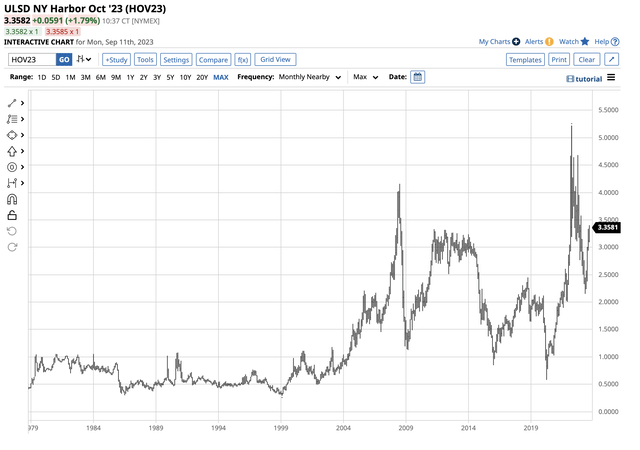

Long-Term NYMEX Heating Oil (Distillates) Chart (Barchart)

Heating oil futures rose even more, reaching $5.2217 per gallon wholesale, far above the 2008 $4.1586 high.

WTI is the preferred crude oil for gasoline processing, while Brent’s slightly higher sulfur content makes it the ideal petroleum for distillate refining. As they are distillates, heating oil is a proxy for jet and diesel fuels.

Since Brent is the benchmark for OPEC+ petroleum, it is most sensitive to supply and price concerns caused by the war in Ukraine and the cartel’s grip on international prices.

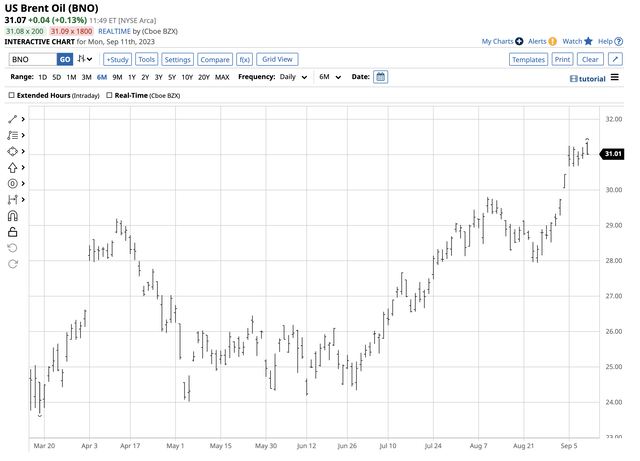

BNO tracks Brent crude oil prices – A significant rally since May

The United States Brent Oil Fund, LP ETF (BNO) has done an excellent job tracking Brent crude oil prices since the May $68.20 low and June 1 when the price was $74.95 per barrel. Brent gained 32.6% and 20.7%, respectively, as of the September 11 $90.46 level.

Six-Month Chart of the BNO ETF Product (Barchart)

The chart highlights BNO moved 29.2% higher from $24.02 on May 4 to $31.07 per share on September 11. Since June 1, when BNO closed at $25.04, the ETF moved 24.1% higher.

At $31.07 per share, BNO had over $189.5 million in assets under management. BNO trades an average of more than 475,000 shares daily and charges around a 1% management fee.

U.S. energy policy, the SPR, and China are critical factors for the coming months.

China remains a critical factor for the path of least resistance of Brent and WTI crude oil prices. Any signs of economic recovery will likely push petroleum prices higher.

Meanwhile, the U.S. energy policy that supports alternative and renewable fuel sources and inhibits the production and consumption of fossil fuels remains bullish as it weighs on the potential for worldwide output and allows the cartel and Russia to control prices. Moreover, the U.S. sale from its Strategic Petroleum Reserve to cap prices in 2022 and 2023 caused the SPR to drop from over 600 million barrels in late 2021 to 350.3 million as of September 4. The Biden Administration’s Department of Energy had said it planned to repurchase the sold SPR barrels at $67 to $72 in October 2022. However, when the price was in the range and fell below the low end in March through May 2023 in Brent and in December 2022, March, May, June, and July 2023, the DoE did not add to the SPR. Only recently has the administration purchased crude oil, but the buying has not made a dent as the level remains at a four-decade low. With Brent over $90 and WTI at the $87.51 per barrel level on September 8, the price is well above the administration’s target. On any decline, the U.S. will likely support the price with purchases.

The trend is always your best friend in markets, and it is bullish in crude oil in September 2023. Brent could be heading over the $100 level, and WTI could follow, making BNO a compelling ETF product.

Read the full article here