Investors have cut $310 billion — or 10% — from Apple’s peak market capitalization of $3.1 trillion in late July.

Two news items — China’s ban on central government employees use of the iPhone and a surprise Chinese rival Huawei’s new products aimed at the iPhone 15 — have contributed to the drop in Apple’s market value, according to the Wall Street Journal.

The 10% drop could be the tip of the iceberg.

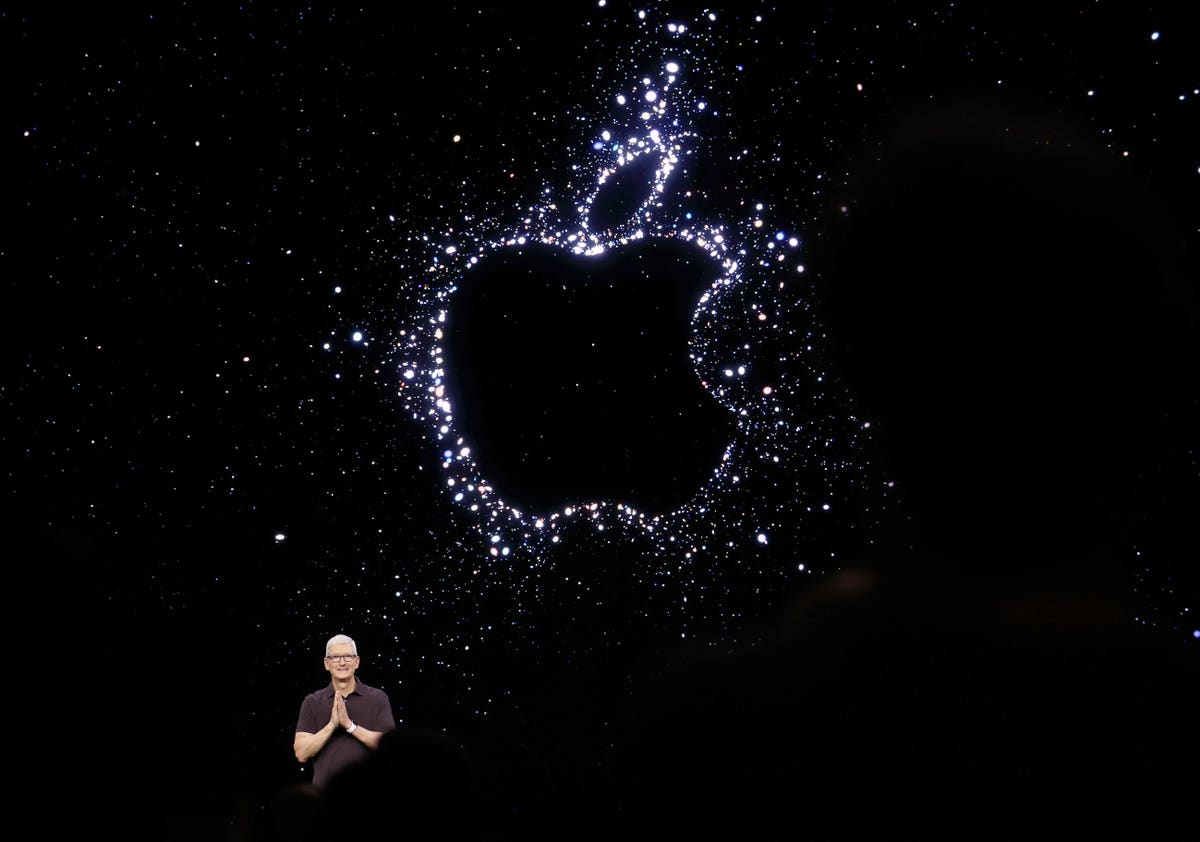

That’s because Apple’s growth is slowing down and shows no sign of accelerating. Steve Jobs’ second turn as CEO yielded faster revenue and stock price growth. But under his successor, Tim Cook — given the slower revenue growth over which he has presided since 2011 — Apple enjoyed a disproportionate boost in its stock price.

How so? During Jobs’ second time as CEO — from 1997 to 2011, Apple revenue grew at a 21.5% average annual rate, to $108 billion— while its stock rose at a 36% annual rate. Since Tim Cook became CEO, Apple’s revenue has moved up at a 12.5% average annual rate to $394.3 billion in 2022 — while its stock increased at a 23% annual rate.

Does the $310 billion drop in its market capitalization make Apple stock a screaming buy? I see three reasons its shares could fall further:

- Disappointing third quarter results and forecast.

- China IPhone sales are poised to drop.

- The company fails to create new products with high-growth potential.

Warren Buffett — who likes the tech giant’s $573 billion in stock buybacks since 2012 — should take his Apple profits. His company, Berkshire Hathaway, has 45.6% of its portfolio in Apple stock, according to Yahoo! Finance.

I requested a comment from Apple and will update this post if I receive a reply.

Disappointing Third Quarter Results And Forecast

Apple’s top line is slowly shriveling. According to the Wall Street Journal, Apple’s sales declined in its latest quarter (ending June 2023) for the third quarter in a row. Its biggest product, the iPhone, decreased 2.4% — falling $500 million below analyst expectations of $40.2 billion.

While Apple happily pointed out its growing lines of business, they did not make up for the decline in iPhone sales — which account for half its revenue. For example, Apple’s services revenue — from streaming music, TV products, and software bought in the App Store — “reached a new all-time high of $21 billion,” the Journal reported. Sadly, at a little more than half the size of the iPhone, services growth could not offset Apple’s top line fall.

Apple did not provide specific guidance for its fourth quarter ending in September 2023. According to CNBC, since 2020, the company has not provided guidance due to “uncertainty.” Its stock fell further last month after CFO Luca Maestri said Apple “expected revenue to decline in the September quarter,” CNBC reported.

Maestri told investors the tech leader “expects its iPhone and services businesses to accelerate year-over-year.” Meanwhile analysts estimated Apple’s fourth quarter revenue will increase less than 1% to $90.2 billion, wrote the Journal.

Apple’s Growth In China

Cook was thrilled with Apple’s performance in China — which is Apple’s third largest geographic market. Revenue there grew 7.9% to $15.8 billion — $2.2 billion more than analysts estimated. Cook told investors Chinese consumers switching to the iPhone from a competitor were “at the heart of our results there,” the Journal reported.

Cook also waxed eloquent about Apple’s sales in India. While acknowledging Apple’s low market share, he told investors India is the world’s second largest smartphone market and the company is putting “all our energies” into capturing a large share of the opportunity.

Yet Apple’s performance in both countries has room for improvement.

In China, Apple’s iPhone did not compete effectively against rival products. According to “Apple in China and India,” a business school case I co-authored with Sam Hariharan, Apple forecast a 5% drop in total revenue in early 2019 due to a loss of market share in China. Compared to rivals such as Huawei, the iPhone was over-priced, lacked the popular WeChat app, and was missing other features Chinese consumers craved.

Apple’s Improvement In India Does Not Move The Needle On Revenue Growth

In India, Apple also fell short. Its revenues there were far below the company’s 2020 goal of $5 billion in revenue, according to Apple in China and India. Apple entered the Indian smartphone market in 2008 and a decade later it had a mere 2.5% share of the market. There are many reasons why:

- Overpriced product ($1,040). Apple’s least expensive iPhone for the Indian market — the iPhone 9 — was priced way above the $150 average smartphone price there.

- Weak manufacturing strategy. The tech giant incurred a 20% tariff because it did not make its iPhones in India.

- Short battery life. The iPhone battery was too short-lived for the long commutes in India.

- Poor customer service. Apple’s partners delivered terrible service.

- High turnover. The company suffered high executive turnover. In 2019, Ashish Chowdhary became Apple’s third India general manager since 2016.

Apple’s smartphone market share in India improved over the next five years. In September 2023, Apple was poised to finish the year with a 7% share of the Indian smartphone market, according to Business Insider India.

In the first half of 2023, Apple iPhone shipments grew 68%. The company dominated the super-premium smartphone segment (priced between $600 and $1,200) with a 63% share of that high-end category, Business Insider India reported. Apple has made significant strides in its manufacturing in India initiative.

Nevertheless, Apple’s India business is a rounding error for the tech giant and its $394 billion in 2022 revenue. Corporate filings in the country suggest Apple’s sales totaled around $4 billion in fiscal year 2022. In April 2023, Bloomberg reported Apple’s revenue in India totaled nearly $6 billion in the year ending in March, according to CNBC.

China IPhone Sales Are Poised To Drop

The iPhone has recently enjoyed relatively high growth in China. However, last week, two significant news events suggested Apple’s fortunes there are going to get worse.

The first event was China’s ban on the use of iPhones by central government employees. Through chat groups or meetings, staff in China learned from managers they should not bring their iPhones into work or use them for business.

This ban — on which Apple has not commented as of this writing — also applies “to a swath of employees at state-owned companies in the space and energy industries,” the Journal reported.

Xiaomeng Lu, a director at risk consulting firm Eurasia Group, said Apple will probably try to understand the government’s concerns and address them through “behind the scenes” communication with the Chinese government. “They are very good at this game and Tim Cook is very proactive on this type of thing,” Lu added, according to the Journal.

Dan Morgan, a senior portfolio manager at Apple investor Synovus, expressed concern the iPhone could join the chip industry in becoming a political football between China and India. Morgan said “it would be worrisome if a similar dynamic emerged for Apple that exists in the chip industry, which has suffered a geopolitical tit-for-tat with trade sanctions being imposed by both countries,” the Journal reported.

The second piece of news was the surprisingly fast reemergence of Huawei as a rival to Apple in the Chinese smartphone market. Due to Western sanctions on critical chip technology in 2020, Huawei had to withdraw from China for several years. As a result, its market share in China fell from 27% in 2020 to 11% by September 2023, Reuters reported.

That worked out well for Apple — which was able to step in and dominate the premium smartphone market in China.

All that appeared to be changing last week, when Reuters reported Huawei “made a surprising return” to fast cellular wireless and began selling two more high-end models — the foldable Mate X5 and the Mate 60 Pro+. Huawei could ship 12 million Mate 60 phones in the next year, according to Reuters.

These models were equipped with chips from the Chinese semiconductor manufacturer, SMIC, noted the New York Times

NYT

Failure To Create New Products With High Growth Potential

After a revenue decline in 2023, can any new Apple products restore the nearly 22% average annual revenue growth over which Steve Jobs presided between 1997 and 2011? I don’t know, but here is why I am skeptical:

- Most of its upcoming product launches tweak existing ones — such as the Mac, iPhone, and iPad. Each of them experienced declining revenue in the latest quarter — drops of 7%, 2.4%, and 20% respectively, according to CNN. Due to the “incremental nature” of these products, investors do not expect them to lift Apple’s stock, according to Investor’s Business Daily.

- Its major new hardware product — the Apple Vision Pro, a virtual reality headset — is expensive ($3,499) and not expected to contribute meaningful revenue quickly. In July, Apple cut its 2024 production to 150,000 units, according to Forbes — one-tenth of the company’s original estimate.

- The long-rumored Apple Electric Vehicle, about which I co-authored a recently published case, appears likely to remain a rumor for the foreseeable future.

Where Apple Stock Goes From Here

Despite the absence of revenue growth drivers, Apple stock will rise in the view of analysts. How so? Thirty Wall Street analysts set a median price of $206.86 — a 16.1% increase from where Apple stock closed September 8, according to TipRanks.

Low-growth forecasts are the best thing Apple investors have going for them. If Apple reveals faster than expected growth when it reports its results for the September-ending quarter, its shares will rise.

The bad news for Apple’s iPhone business in China and the lack of investor enthusiasm for its new products make that harder to pull off.

Berkshire Hathaway and Buffett should take heed.

Read the full article here