It’s been a little over two months since I put out a cautious note on Wynn Resorts, Limited (NASDAQ:WYNN), where I suggested that there are much better risk-adjusted investments out there. Since that article was published, the shares have dropped another 6.3% against a gain of about 1.3% for the S&P 500 (SP500). This is an ongoing trend for this stock, as it’s down about 14.5% against a gain of 8.10% for the S&P 500 since I wrote about it last May. At some point, though, the shares will represent good value, so I’m compelled to review the name yet again. After all, just because something priced at $111.30 was a bad investment doesn’t mean it’s a bad investment at $95. I’ll see whether it makes sense to buy back in based on the latest financials and the current valuation.

If you’re one of my regular readers, you know that I put a “thesis statement” at the beginning of each of my articles. I do this because I’m absolutely obsessed with making my reader’s lives as pleasant as possible, and one of the ways I can do that is by saving them time. In the thesis statement, you have the opportunity to get into the article, get the gist of my thinking, and then get out again before you’re exposed to too much of my silliness or proper spelling. You’re welcome.

I’m much more favorably disposed toward Wynn Resorts today, and I think there’s much to like in the financials here. The dividend is very well covered, and all cylinders of the business are firing well in my view. The problem is that “Casino” has still not recovered to pre-pandemic levels, and that’s significant given how important that business is. That written, it’s recovered nicely relative to the same period a year ago, so the trend is very much in the right direction. The problem for me is the relative valuation here. In a world where “TINA” no longer exists, and I can earn 4.5% in a risk-free investment, why would I buy this stock with all of the risk associated with it? I will certainly reconsider if and when the shares continue to drop in price, but for the moment, I’m going to remain on the sidelines.

Financial Snapshot

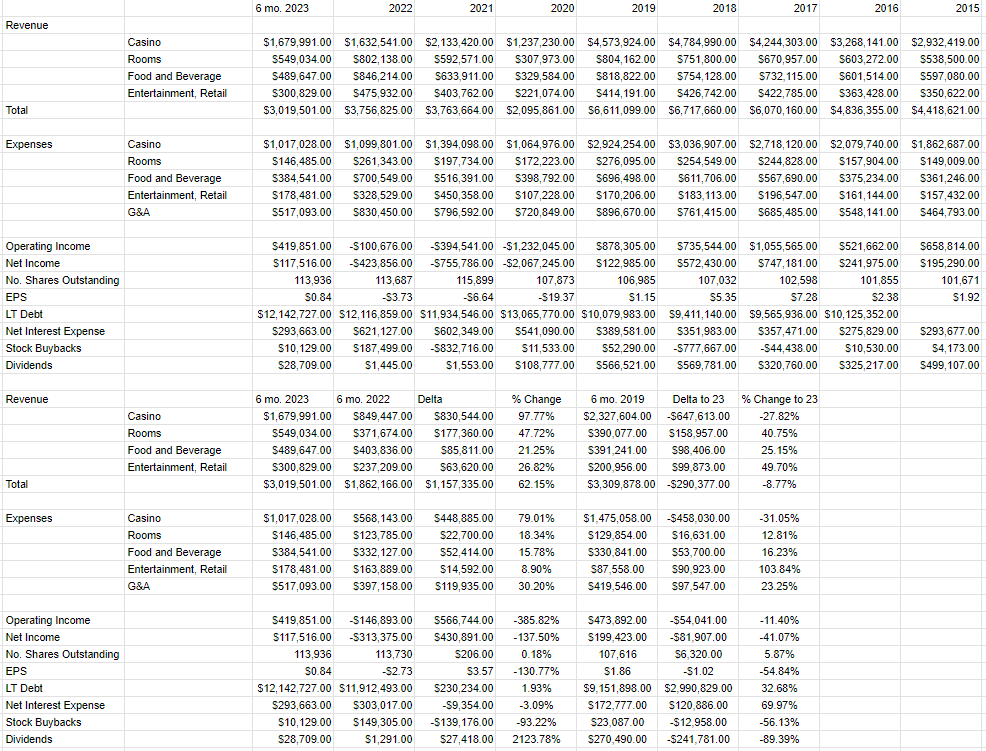

The financial performance has been either “great” or “middling” depending on your perspective. Relative to the same period a year ago, the latest financial results have been amazing, with revenue and net income up by $1.157 billion, and $430 million, respectively. The problem is things have yet to return to where they were in 2019, with revenue and net income lower by 8.8% and 41% respectively. Revenue from Rooms, Food & Beverage, and Entertainment, Retail are higher by 41%, 25%, and 49%, respectively, which is great.

The problem is that this is still a casino-driven business. It’s not as much of a casino driven business, given that the casino has fallen from 70% of revenue in 2019 to about 56% today, but it’s still the biggest piece of this puzzle. Thus, any percentage drop in this revenue will have an outsized impact on total operations.

All that written, I should point out that casino revenue is trending in the right direction, up nearly double (97%) from the year ago period, so I estimate that by early 2024, this figure will be back on trend. Additionally, at a payout ratio of only 24%, I think the dividend is reasonably well covered. Given all of that, and with apologies to the writer of a famous game show tagline, I’m willing to buy the stock if the price is right.

Wynn Resorts Financials (Wynn Resorts investor relations)

The Stock

I’ve written it before, and I’m absolutely certain that I’ll write it again. I may risk boring my readers, but if it isn’t obvious to you by now, that’s very obviously a risk I’m willing to take. The more you pay for $1 of future gains, the lower will be your subsequent returns. This is why I try my best to buy shares when they are cheaply priced. Put another way, there’s a strongly negative relationship between price paid and future returns.

I write this incessantly because I’ve frequently come across people who are of the view that “we don’t buy stocks, we buy businesses.” In my view, these poor souls have been fed some propaganda. I’m going to do my bit to try to dispel this nonsense by offering a thought experiment. Let’s consider the tale of two investors who bought Wynn Resorts, then please consider the following idea. An investor who bought these shares on September 1st, the day “Macau casino revenue hits post-pandemic high” and another who bought six days later. The former is down about 6.8%, and the latter is up about 3.25%. Not enough changed over these six days to account for a 10%+ variance in returns. We buy stocks, and I feel very compelled to point out that the person who bought more cheaply did better.

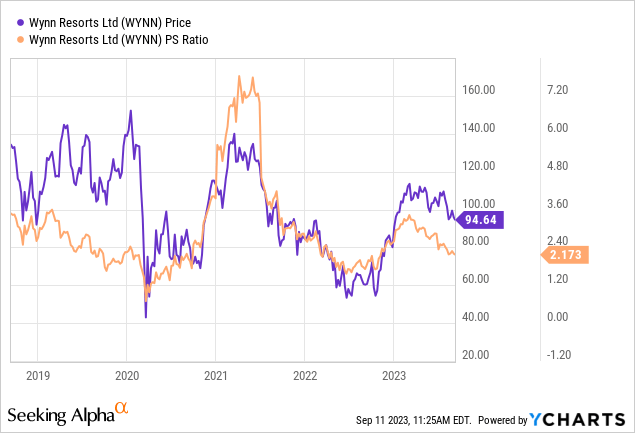

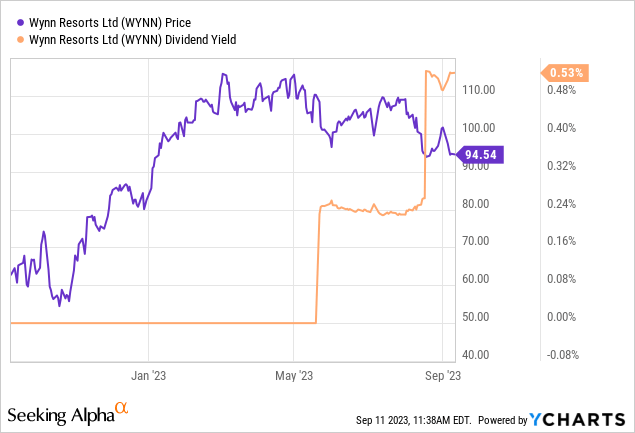

With that sermonizing out of the way, I should point out that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at ratios of price to some measure of economic value, like earnings, free cash, book value, and the like. I like to see shares trading at a discount to both their own history and the overall market. When I last reviewed Wynn Resorts, the price to sales ratio was sitting around 2.675 times, which was down nicely from the 3.385 times it was trading the time I reviewed the stock back in May. Additionally, the dividend yield was a paltry .25%, which was about 375 basis points lower than the risk-free rate at the time.

Fast-forward to the present, and the shares are actually about 18% cheaper on a price to sales basis, and the dividend yield has doubled. Even after doubling, though, the dividend yield here is still about 400 basis points lower than the 20-year Treasury Bond. So, the shares are cheaper in some ways, and investors are receiving much more than they did when I last reviewed the name. The problem for me is that investors could take on far less risk to generate much greater levels of cash flow.

As I wrote above, in addition to looking at simple ratios, I also look at more complex measures of valuation. In particular, I want to try to unpack the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to do this. This approach uses stock price itself as a source of information. This method involves “reverse engineering” the assumptions that cause the current price. I do this by employing the magic of high school algebra to a pretty standard finance formula to isolate the “g” (growth) variable.

Using this approach, the market is currently forecasting a growth rate of about 5% for Wynn going forward. This is a pretty optimistic forecast in my estimation, suggesting that the shares aren’t yet cheap enough to consider buying. I’m also troubled by the fact that the analyst community is forecasting an EPS CAGR of about 25% over the next six years. Given the above, I’m going to continue to avoid the shares, and I may change this view if shares continue to drop in price, and the delta between the risk free rate and the dividend yield shrinks further. To remind my readers, we’re not seeking “returns.” We’re seeking “risk adjusted returns,” and the alternatives available to Wynn Resorts, Limited offer decent returns at far less risk in my estimation. Given that, why would someone buy these shares?

Read the full article here