Overview

My recommendation for Definitive Healthcare (NASDAQ:DH) is still a buy rating for the medium-to-long term, as I do not see any fundamental change to the business. Instead, I believe the business has gotten stronger. However, the near-term stock price sentiment seems pretty bad, and I would recommend keeping any existing position small as the stock price could get a lot more volatile. Note that I previously gave a buy rating to DH due to my belief that DH is in a good position to benefit from a re-acceleration of top-line growth following a reduction in macro-level pressures. However, I also stated that investors should expect elevated share prices and business performance volatility in 2H23.

Recent results & updates

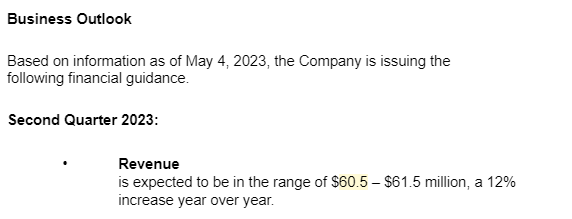

At their core, DH’s Q2 results were solid, with revenue largely in line and adjusted EBITDA slightly ahead. Revenue of $61 million was just slightly below the consensus estimate of $61.1 million, representing 12% year-over-year growth and falling smack in the middle of the company’s guidance range ($60.5 million to $61.5 million).

DH

Independent of the stock price, I think DH’s 2Q23 performance has continued to reflect well on the company’s underlying fundamentals. Keep in mind that a year has passed since the company first noticed a longer sales cycle, but that revenue has grown and DH has added more enterprise customers. At the end of the quarter, the company had 527 enterprise customers, an increase of 41 from 2Q22. It is true that costs associated with bringing online more Atlas data sources dragged down gross margin by 260 basis points. However, DH did successfully controlled operating costs and produced $17.2 million in adjusted EBITDA, up from $16.3 million in 2Q22.

However, I am also aware that the current investment climate is harsh on companies that have a shaky near-term outlook, especially those that are sensitive to the macroeconomic climate. Sales have remained difficult, according to management, because customers are being cautious with their spending and waiting for internal approval. I still think the macro impact will have an effect on DH’s business for the rest of the year, which will likely have a negative effect on the share price (in the near-term). The macro-situation impact should surface in DH’s churn metric. This was well reflected in 2Q23 results, where the number of customers using the DH platform at the end of 2Q23 was around 2,957, down 1.1% year over year and 1.8% sequentially due to the continued macro pressure. Even though it was up 8.4% year-over-year, the number of customers with $100k ARR decreased to 527 in 2Q23, a decrease of 0.4% quarter-over-quarter. In addition to higher customer turnover, I also expect sales cycles to remain persistently longer. Typically, sales transactions take between three and six months to close, though longer timelines are typical for larger deals. Some deals are being delayed until the next annual budget cycle, which is having a negative effect on DH’s sales cycle, which is currently anywhere from five to nine months.

Management’s reiteration of FY23 guidance has also helped to confirm my view that the 2H23 share price will remain weak. They still anticipate lower-than-anticipated revenue and higher-than-anticipated profits. For FY23, they are predicting the same range of $249-255 million in revenue and $67-71M in EBITDA, which works out to 27% margins on average.

The same macro-driven weakness from the previous quarters persists, in my opinion. Thus, the bear case, which affects the near-term, has not changed significantly. The short-term effects are minor, but the long-term is where my “buy” recommendation comes into play. It seems to be getting better to me. The growth of DH’s Atlas Dataset was announced in 2Q23. More than 1.5 million installations of technology at different healthcare providers will be updated as a result. The impact on DH’s coverage of installations by vendor and installations by product would be enormous. Information like which electronic health record systems a given provider uses is included. In addition, DH declared that it had purchased Populi, a commercial intelligence firm that aimed to improve network efficiency by optimizing physician relationships.

I’m thrilled to announce that we have completed the acquisition of Populi, a leading Healthcare Commercial Intelligence company that specifically targets the provider market. Populi provides healthcare organizations including hospitals and health systems with dynamic analytics to optimize their physician relationships, reduced network leakage, and expand their market share both geographically and across service lines. This acquisition furthers Definitive Healthcare’s commitment to leadership in the Healthcare Commercial Intelligence market across the entire healthcare ecosystem, including life sciences, providers, and diversified industries. Founded in 2020, Populi serves some of the country’s largest healthcare systems, including the University of Pennsylvania Health System and Henry Ford Health. The Populi acquisition will deepen Definitive Healthcare’s value to our provider clients. Helping them drive growth and expansion with the addition of powerful analytics that are utilized across multiple departments and functions. From: 2Q2023 earnings call

Although it is currently a loss-making business, management has high hopes of one day reaching the same profitability as the rest of DH’s operations. Importantly, DH’s competitive advantage – its proprietary intelligence and data – should increase as a result of these two strategic moves, I believe.

Valuation and risk

Author’s valuation model

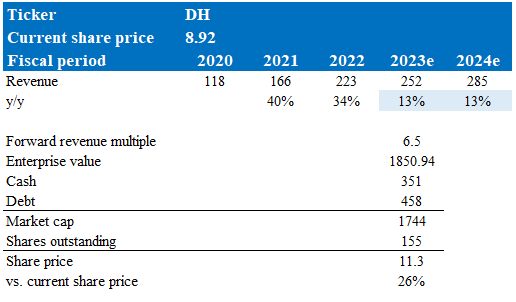

According to my model, DH is valued at $11, representing a 26% increase, similar to my previous model. This target price is based on my growth forecast of 13% in FY23 and 13% in FY24, as per management guidance for FY23, and a similar growth trajectory in FY24. Note that I did not assume growth acceleration in FY24, which should happen as the macro economy recovers, reducing the sales cycle.

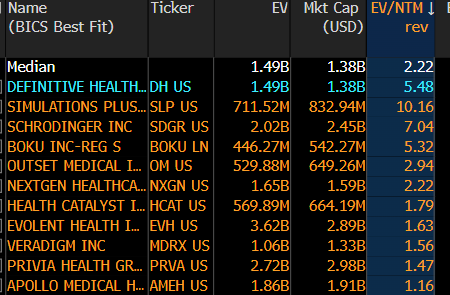

The key driver for returns is that multiples should revert higher as the economy recovers and the market starts to value DH on a normalized-environment basis. When compared to other application software businesses in the healthcare environment, DH has historically (in 2022) traded at a premium of 2.2x (EV/forward revenue basis). Assuming the same ratio is applied today, DH should be trading at 6.5x (peers trading at an average multiple of 3x * 2.2).

Bloomberg

DH’s investment risk lies mainly on near-term expectations, further hurting the share price even though medium- to long-term business fundamentals are not heavily impacted. Investors expectations drive share prices, and by the look of DH’s current price chart, it is clear that the sentiment is not great. Worse than expected performance in the near term, driven by macro or internal issues, will send the stock price down.

Summary

While Q2 results showcased resilience, the near-term sentiment around the stock appears unfavorable due to macroeconomic uncertainties and extended sales cycles. I maintain a buy rating for medium-to-long-term investors, believing that DH’s proprietary data and intelligence will drive growth as macro conditions improve. The recent acquisition of Populi and expansion of the Atlas Dataset add depth to DH’s capabilities. Valuation suggests significant upside potential, with a target price of $11, reflecting a 26% increase. However, short-term volatility and market sentiment could impact share prices adversely.

Read the full article here