Dear readers/followers,

In this article, I’m going to provide an update on one of my primary Scandinavian Finance investments, Handelsbanken (OTCPK:SVNLF). While not exactly the highest RoR in my portfolio, Handelsbanken has nonetheless provided a safe 5-9% yield over the years that I’ve owned it, and together with covered calls and selling it at overvalued prices, I’ve been able to make a decent amount of profit trading this stock.

With interest rates rising significantly, banks are set to enjoy NII trends and overall positive fundamentals that we’ve not seen for over 10 years in Scandinavia, seeing for how long the trends have been fee-driven as opposed to interest-rate-driven.

In this article, I’m showing you my update for Handelsbanken and why this remains one of my larger positions in both my commercial and personal portfolio.

Handelsbanken – A lot of long-term safety in this investment.

Since my last article, Handelsbanken hasn’t really seen any significant “pop” to speak of. The company is doing very well, and the quarterly results are impressive, but a variety of macro factors are currently making sure that overall, Swedish banks are not trading as high as they might in other contexts.

My avenue of investing has remained combining covered calls with attractive buying when the company has dropped, as well as harvesting some of that impressive annual yield, over 7.5% for me with my cost basis. When I last wrote about Handelsbanken I actually bought back my CCs at a nice profit, over 93% – and I’ve been waiting to write new ones ever since. So far, this hasn’t been possible.

Now that we have the 2Q23 results, here is what I expect from Handelsbanken going forward.

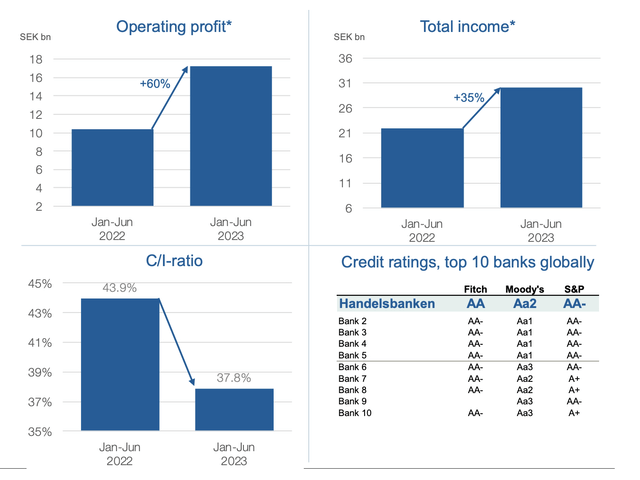

2Q23 was equally impressive as the 1Q23 results. Income for the bank continues to grow much faster than cost, and Handelsbanken was able to showcase a 60% underlying growth in operating profit at a C/I ratio of 37.8%. Take that in for a moment. That’s a sub-38% C/I ratio when some banks I’ve recently written about in the US are well over 50%. Handelsbanken is at a 15.6% RoE, and with a superb asset quality.

I’ve called this bank one of the best investments you can make in Sweden, and this is a stance I retain for this article. Handelsbanken is one of the strongest banks in existence, and certainly among the best in Sweden.

Handelsbanken IR (Handelsbanken IR)

Also, this bank has a CET-1 of almost 20%. Really compare that to what else is available. Reviews of this company continue to put the bank as one of the most loved and most trusted institutions in all of Sweden, with a 12% market share for Mutual funds, an 18% national market share of deposits for households, and 23% deposits for the corporate side.

Also, Handelsbanken handles 22% of the corporate lending and holds over a fifth of all household mortgages.

That’s the sort of bank you’re talking about here.

Handelsbanken IR (Handelsbanken IR’)

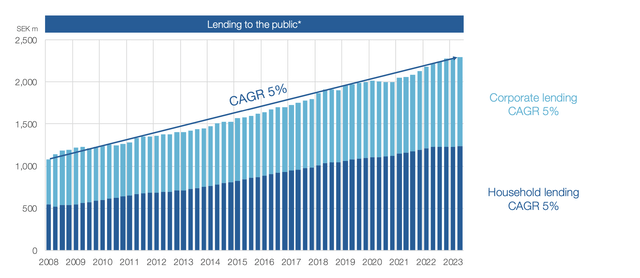

Despite the rocking in the finance market, household lending is up 4% CAGR, and Corporate is up 7% CAGR since 2022. The only place where things are showing negative trends is in deposits. Despite the belt-tightening, Swedes aren’t depositing more money – and corporations are even depositing less. This has to do with increasing costs and the like, but it’s worth mentioning.

NII is really starting to show some good increase here, with a 2% sequential improvement from margins and funding, despite lower overall volumes and impacts from Handelsbanken’s liquidity portfolio.

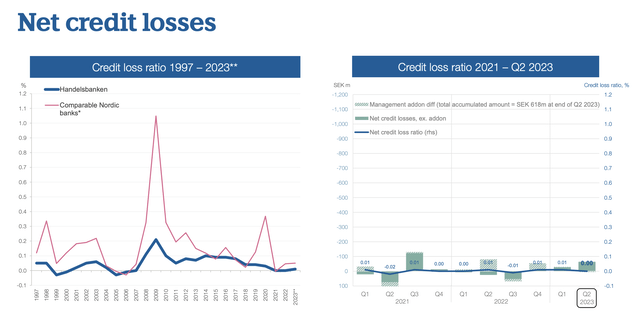

Handelsbanken remains one of the best banks in the world in terms of Credit Losses. Why?

Because Handelsbanken has no credit losses.

Handelsbanken IR (Handelsbanken IR)

This bank is so stringent in terms of its underwriting and safety calculations, especially with the new environment that we’re in now, that any credit losses are likely to be extremely low or non-existent. To remind you, there I s a ~15% regulatory minimum for CET1-, which means that the company is almost a full 4%+ over the current regularity minimum, or around 430 bp above the FSA, and 130 bps above its own targets.

It sounds like Handelsbanken is preparing for a storm – and indeed they are. The problem with the bank is also its greatest asset – market share in loans. Due to the sheer size of the household mortgage portfolio that the bank holds, Handelsbanken’s fortunes are intimately tied to the Swedish housing/mortgage market.

A market that has been used to 0.6%-1.9% mortgages for over 8 years. There is an entire generation of home lenders that have never seen 1.5%+ mortgage rates in Sweden, and that are for the first time realizing that owning a home can cost some serious money in a rising interest rate environment. I know personally of friends of friends that are having to sell their homes because their interest (just interest, not amortization) rose from the equivalent of $300/month to $1,500/month. And how attractive do you think those assets are on a market where locking in anything below a 4.8% 5-year mortgage is considered “good”?

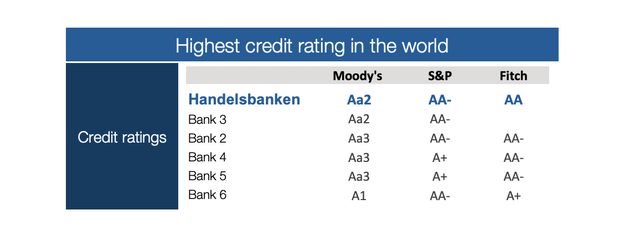

Even though the bank can present itself with “the highest credit rating in the world”…

Handelsbanken IR (Handelsbanken IR)

…there is some risk here. And when the bank says “highest credit rating globally”, it compares to peer banks in Europe, and the highest global rating when combining the Fitch, Moody, and S&P ratings. (Source: 2Q23 report)

So on an overall metric basis, there is absolutely no issue. The company’s profits and costs continue to show very good trends. Operating profit is up 61% YoY. NII is up, lending is up, and on a quarterly basis, the C/I for 2023 2Q is down to 28.7% in the Swedish segment due to the extreme highs.

It will take something very serious to derail the trend you see below here.

Handelsbanken IR (Handelsbanken IR)

However, an environment where this bank’s asset quality is going to be tested is coming, and may already be here. That’s why the bank has tightened requirements further. It’s now more difficult than ever to get a mortgage in Sweden. The fact that Handelsbanken has so few NPLs continues to be a point in its favor, as do the specifics of its real estate/property management lending, with very low LTVs of below 42-50% for the sectors of Resi, Logistics/industrials and retail.

The bank had a very good 2Q23. Extremely good, in fact. However, it’s a bit of the “calm before the storm”, as I see it. Because a storm is coming. In the next 4-8 months, many of the previously fixed interest rate mortgages are going to be refinanced. The 2-5 years are expiring, and that means a whole host of corporate and private customers are going from 1-1.5% to almost or over 5% interest rate.

There will be, I forecast, an increase in NPLs. I don’t foresee a crisis – the housing supply in Sweden is far too tight, so even with many homes on the market, prices can only drop so low before people with capital (such as myself!) start scooping things up for 50 cents on the dollar.

But that’s not where we currently are.

Let’s look at the bank’s valuation and why I see continued upside here.

Valuation for Handelsbanken – Remains conservative, even in this environment.

Handelsbanken here remains at a very attractive price considering the sheer upside from NII that it offers. I am in the camp believing that while the next few years will bring about changes in the real estate market in Sweden, these changes are necessary, and they will in no way “break” the market.

Because this is what I believe and because Handelsbanken continues to trade, at this time, at what amounts to a lower than 7.5x P/E, this bank is still attractive. Handelsbanken currently yields around 6%, but given its payout ratio should give us a dividend of somewhere around 8 SEK for the next year, which is closer to a yield of 9%.

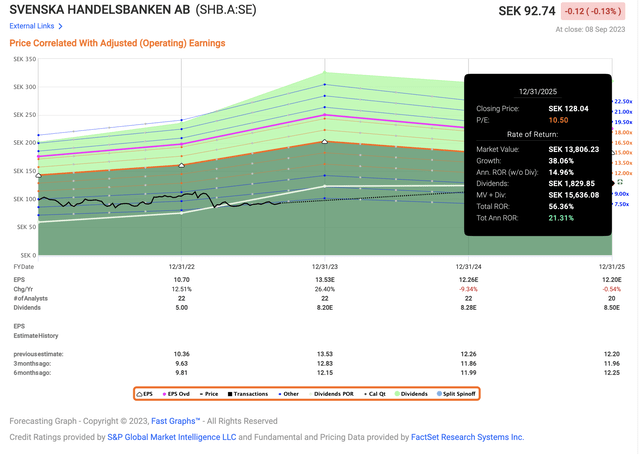

The current upside even to a P/E of around 10x here is over 20% per year, and that’s conservatively speaking.

Handelsbanken Upside (F.A.S.T Graphs)

However, while 10x P/E for this sort of earnings quality with AA rating is indeed conservative, I caution you in trying to value or estimate this bank at a higher valuation. Handelsbanken typically does not go above 125-130 SEK – and I don’t see it going much above this either.

When it comes to buying this bank, I find it relatively easy. Any time it’s below 85 SEK/share, it becomes what amounts to a “STRONG BUY”. Between 85-100 SEK, it’s essentially a good “BUY” with a very solid upside.

Anything above 100 SEK, that’s where you’re risking sub-par or flat returns – and where I would be careful going in.

I have tens of thousands of dollars in this stock, both commercially and in my personal investment account. My strikes for CCs have typically been between 125-135 SEK/share, where I would be willing to rotate and wait for the bank to “drop back down”.

I argue that you can actually trade many of the Scandinavian banks in this fashion, as they tend to move between valuation ranges. So despite analysts giving this bank average PTs going all the way up to 140 SEK/share, and an average of around 111 SEK/share, I would stick closer to the double-digit share price to make sure you’re getting your money’s worth.

However, if you do end up and manage to actually buy the company at that share price, as we can do now, then you’re “golden”. You’re getting a high yield from the financial sector, backed by one of the safest banks on earth.

I’m fully invested in the company both privately and commercially. For my commercial portfolio, that means a solid 3% exposure to this company. And I have no intentions of selling or rotating here.

Thesis

- Handelsbanken is a theoretically attractive and fundamentally appealing bank with a sound set of capital safeties, a 6%+ yield, and overall one of the more conservative banks in the entire Swedish banking market. It’s also one of my largest financial holdings, and I frequently sell both puts and calls on the bank.

- At a double-digit price inching closer to 93 SEK, I believe this bank offers enough safety and conservative appeal to make it a “buy” here. But given certain fundamental troubles brewing in the EU/Swedish economy, I would be careful where I start “going in” to the bank as an investment – though at this price, it’s favorable.

- I give the bank a conservative PT of SEK95/share, which at this point means the bank is actually still a “buy” as of this article update for September of 2023.

- There is trouble heading for the Swedish mortgage market, but I don’t believe Handelsbanken will see any sort of fundamental decline from it.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here