Investment Thesis

Nu Skin Enterprises (NYSE:NUS) has been battered, firstly as a result of COVID-19 which hampered its direct sales operations, and now due to challenging macro and inflationary headwinds squeezing consumer wallets. It reported resilient earnings for Q2 with sustained gross margins and in line EPS, however, lowered its 2023 guidance on expected lines. We believe post the steep fall of over a third of its value in last 3 months, valuation appears attractive and risk reward is favorable as we play on recovery in China and a forward dividend yield of 6.7%. Initiate at Buy with target price of $30 (at 11x 1-Year Fwd P/E, 20% discount to its long term average).

Company Overview

Nu Skin Enterprises is a direct selling company offering beauty and wellness solutions in 50 markets globally. Its key brands includes Nu Skin, focused on beauty products; Pharmanex, offering nutritional supplement products and ageLOC, its anti-aging brand. It also has its strategic investment arm, Rhyz Investments, which focuses on investments in beauty and product manufacturing companies, which contributed 7% of total sales to vertically integrate its overall business.

Resilient Q2 Earnings

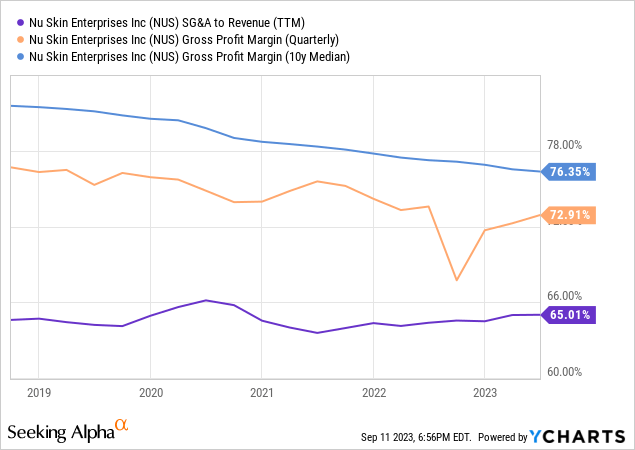

NUS reported Q2 2023 revenues of $500 mn declining by 11% YoY (vs guidance of 6.4% – 13.5% decline) with constant currency sales tumbling by 8% YoY. The sales decline was primary due to 10% decline in US as well as broadbase declines across Asia Pacific and European markets with China remaining a silver lining. China CC sales growth inflected positively up 8% YoY with management being cautiously optimistic that current trends will persist in 2H23 based on the improvement in KPIs & activity level from sales leaders, but macros remain volatile. Gross margins declined by 70 bps YoY with Nu Skin business reporting resilient gross margins at 77.2% compared to 77.0% previous year offset by Rhyz segment. While gross margins have improved, it remains below its historical medians, signifying the near-term challenges amidst the current tough macro backdrop partially offset by shift towards its own manufacturing which has led to a reduction in selling expenses.

SG&A expenses largely remained flat as lower selling expenses due to growth in its own manufacturing as well as lower compensation in China were largely offset by sticky fixed costs and G&A expenses. Operating margins declined 70 bps YoY to 8.5% as a result of lower gross margins. In all, it reported EPS of $0.54 largely in line with estimates.

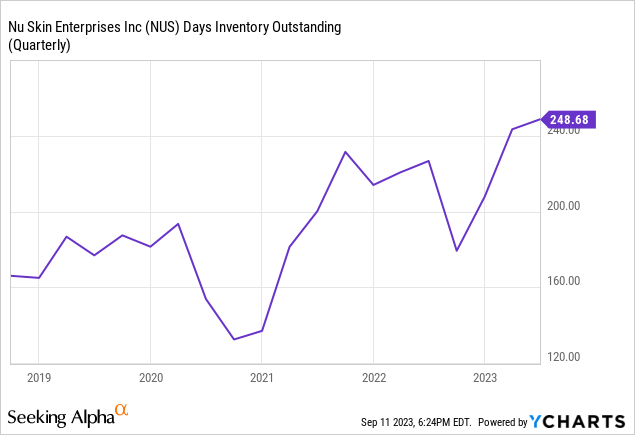

Balance sheet position remains stable, although total debt outstanding increased from over $400 mn at the end of last year to over $500 mn currently as it draws down for acquisition and capital expenditure (it recently acquired BeautyBio, an omnichannel beauty brand). Cash balance remained stable at $252 mn currently vs $279 mn at the end of 2022. Inventories remained flattish at $372 mn vs $350 mn at the end of last year, however it still remains significantly elevated compared to historical levels with inventory days jumping to 250 days.

Management revised its 2023 guidance lower citing continued uncertain and tough macro backdrop with modest incremental support from new product launches. It now expects 2023 revenues to decline 6 – 10% YoY (vs previously expecting -2% to -9%) on the back of constant currency sales declining 4 – 7% (vs previously expecting -1% to -7%) and Adj. EPS of $2.45 at mid point (vs $2.61 previously).

Valuation

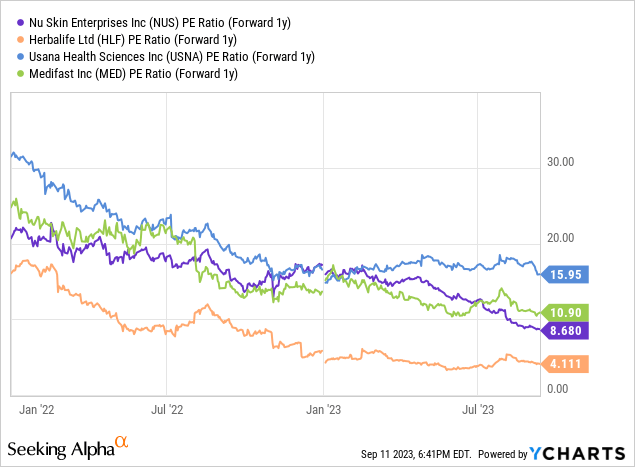

Post the steep fall of over a third of its value in last 3 months, valuation seems reasonable as NUS trades at 8.7x 1 year Fwd PE ratio, at a discount compared to its peer average of 10.3x (13.3x ex-Herbalife). Street is increasingly concerned on the growth trajectory particularly in China as a result of slower recovery there as well as touch macro challenges which has battered most of the skin care companies. Along with that, forward dividend yield of 6.7% is attractive in the current market, and we believe the company is likely to be able to meet its guidance on EPS and dividends driven by continued improvement in sales activity in China as well as stabilising trends elsewhere. We assign a Buy rating with a target price of $30 at 11x 1 Year Fwd Earnings (at a 20% discount to its long term average to reflect the current challenging macro) and healthy dividend yield of 6.7%.

Seeking Alpha’s valuation grade assigns a ‘A-‘ rating, underlining its relative cheap valuation compared to its peers as well as to its own historical averages.

Risks to Rating

Risks to rating include

1) Prolonged macro pressure to suppress consumer discretionary spends and hamper sales

2) Slower than expected recovery in China could lead to further pressure on management to revise its guidance lower

3) Lower than anticipated growth from new product launches including ageLOC TRM and ageLOC WellSpa iO could put a dampener on growth recovery

4) Competitive pressures could lead to heightened promotional activity which can lead to suppression of its gross margins

Final Thoughts

NUS has been under significant pressure along with rest of the peers as the company faces declining sales trajectory and profitability amidst a tough macro backdrop. However, it has been able to sustain its gross margins and with China market improving as a result of improving macros and recovery from severe COVID lockdowns since past 3 years, we believe the company is likely be able to meet its current guidance. With a forward dividend yield of 6.7% and an inexpensive valuation of just 8.7x Fwd P/E, we believe the current risk reward is favorable and assign a Buy rating with a target price of $30 (at 11x 1 Year Fwd P/E)

Read the full article here