Hmmm…need a permit, hunh? I know a guy…but, it’s gonna cost ya.

Introduction

There is a good bit of churn in the marginal LNG space. When I say marginal, I mean plants that are not likely to be up and running until the latter part of this decade, or early in the next decade. (You got that pun, didn’t you? Old mud engineers can’t resist a pun.) NextDecade Corporation’s (NASDAQ:NEXT) Rio Grande proposed facility in Brownsville, fits neatly into that category, as does Tellurian’s (TELL), Driftwood plant south of Lake Charles, and Energy Transfer’s (ET) Lake Charles LNG. They are all swimming upstream engaged in regulatory and legal battles. NEXT recently passed an important milestone, reaching FID on the initial 17 MPTA , Phase I Rio Grande LNG Phase 1, and issued an NTP to its prime contractor, Bechtel.

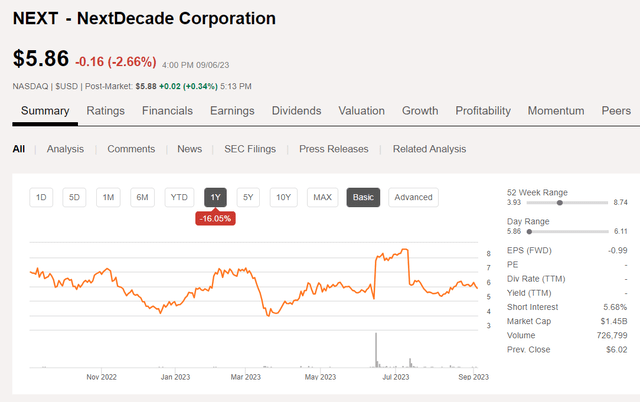

NextDecade Price chart (Seeking Alpha)

Rio Grande, will add 27 MPTA (if all trains are built) to the U.S. Gulf Coast export market. NEXT had a ~37 mm share BUY-day in June, shortly before the FID was announced on July, 12th, but crated shortly thereafter when it was revealed how little ownership they retained at that point. There doesn’t appear to have been an exodus out of the stock, but prices have fallen ~30% since.

With two recent upgrades by analyst firms, Stifel and Wolfe Research, analysts have a buy rating on the stock. Price targets range from $6.00-$12.00, with a median of $9.00. When the seagulls are circling and diving, there’s usually fish below. But not always.

That bullish outlook and a current price well below the median provide a rational basis to take a deeper look at NEXT.

The thesis for LNG exports from Brownsville

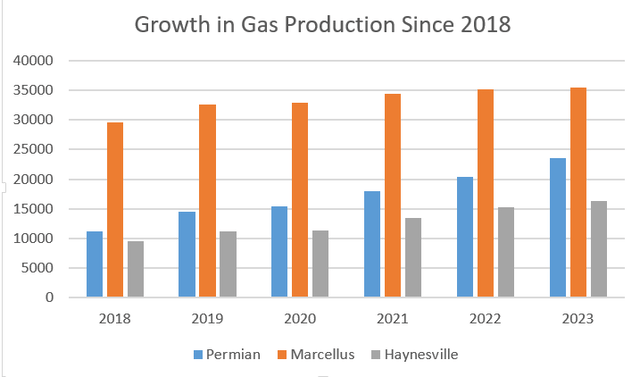

We can all probably use a bit of grounding about this matter. America is the King of gas. Our three major gas basins, the Marcellus-Utica, Haynesville, and the Permian, collectively spew forth about ~75 BCF/D. Let’s talk about the Permian for a second. It’s been mentioned in past articles that the Permian is getting gassier, as I am sure you will recall. What we haven’t done is to put some metrics to that assertion. Here they are taken from EIA-DPR data.

Gas production EIA data (EIA DPR)

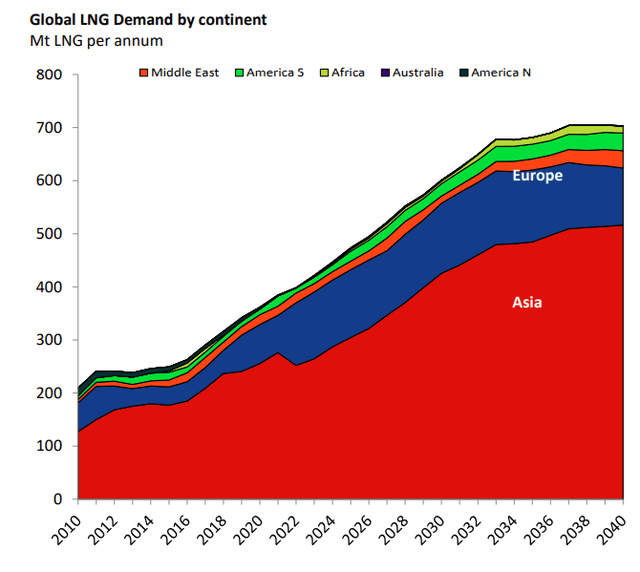

The Marcellus is still the King of Gas, but the Permian is closing in having nearly doubled in output over the last six years. All that gas has got to go somewhere, since it’s “Associated Gas” that comes with the light oil the Permian produces. Fortunately, the European and Asian markets are set to need imported supplies of LNG to make electricity for the foreseeable future, as this graphic from Rystad notes.

Global LNG Demand by Continent (Rystad)

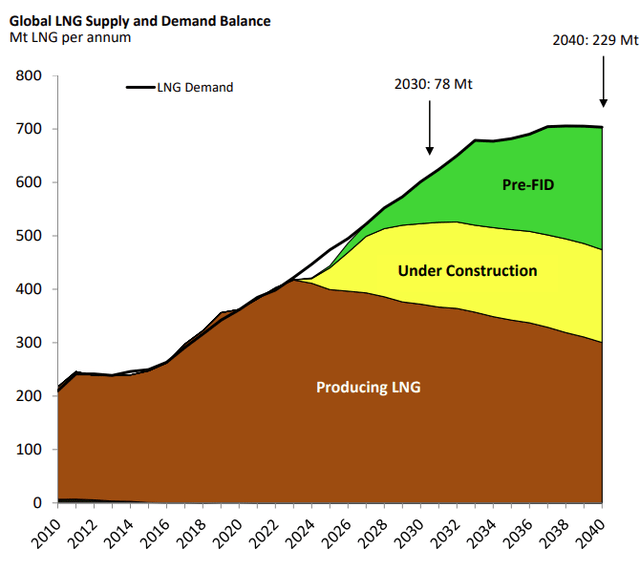

This not to say that U.S. LNG plants won’t have competition for this export revenue. Australia, Canada, Mexico, and Qatar, among others are stepping into this space in a big way, but thanks to growth in the Permian and Haynesville the U.S. cost advantage is expected to remain, as demand outstrips supply. Rystad sees a shortfall of 229 mpta by 2040, creating a robust market for all producers through the middle part of this century.

Global LNG Demand/Supply Rystad (Rystad)

That sets the stage for a project like Next’s Rio Grande LNG plant in Brownsville to rip and run if it can just get built. The fun, logical part of this article is now over, and we must discuss the problems besetting NEXT in its quest to export LNG.

Rio Grande LNG

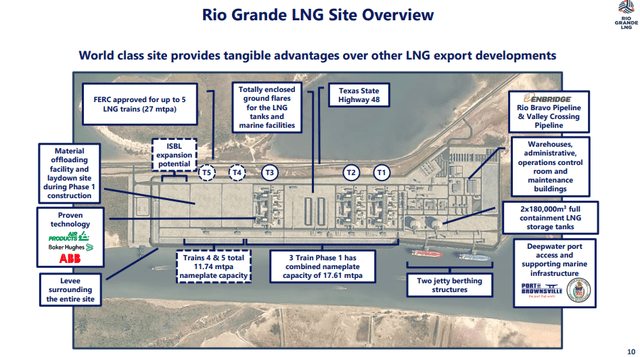

Superficially, it seems like most of the “T’s” are crossed and the “i’s” are dotted with Rio Grande, located on the Brownsville ship channel. The FID has been taken, and a notice to proceed-NTP, issued to Bechtel, their general contractor. They have FERC approval for the overall, five-train project. (It should be noted some issues remain and will be discussed in the Risks section.) Funding is lined up with $12.3 bn of debt financing in place. Enbridge is ready to build a pipeline-Rio Bravo, dedicated to Rio Grande from the Permian. Partners, Global Infrastructure Partners-GIP, and TotalEnergies (TTE) have bought into the project, with GIP becoming the majority holder of NEXT common stock. SPA’s are lined up with 9 offtakers for 92% of the first three train’s output.

Carbon neutrality is also a stated goal of NEXT with a CCUS project being developed to substantially decarbonize Rio Grande.

Rio Grande site overview (NEXT)

The project is expected to come on line in 2027-28, absent delays that might crop up. Delays that might throw a spanner in the works, as we will discuss in our next section.

Not everyone is onboard with Rio Grande

As noted in the linked article, when FERC approved Rio Grande with a divided 3-1 vote, the dissenting member, Allison Clements commented-

“What I see happening here is an insufficient order that creates a lose-lose situation,” Clements said. “It’s going to invite further litigation and further delay for the project sponsors who want to get this done. And it is a loss for the potentially impacted communities who haven’t had the chance to comment on the proceedings.”

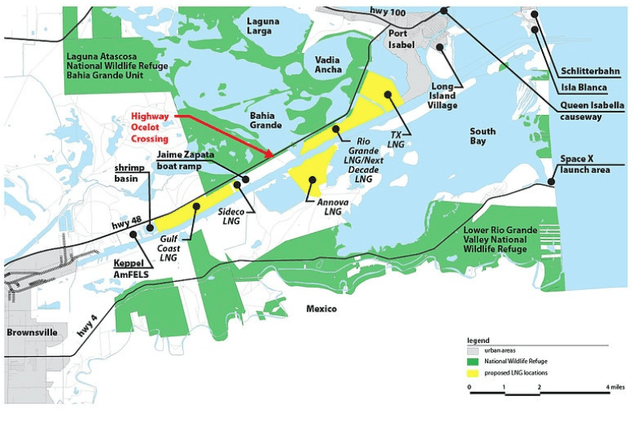

Commentary eerily prophetic when in July, three groups filed new lawsuits regarding FERC’s re-approval of Rio Grande. The litigants, the Sierra Club, the Carrizo Comecrudo Tribe of Texas, and the City of Port Isbel claimed FERC had not properly considered a court’s decision requiring an amended GHG appraisal and impact on marginalized communities. Something about, “Environmental Justice.”

In August, to no one’s great surprise, the court agreed with the litigants and ordered FERC to go back to work on these aspects of the approval.

The D.C. Circuit agreed with the challengers that FERC had an obligation under NEPA compliance rules for federal agencies to either attempt to address their concerns about failing to use the social cost of carbon, which is used to put a price tag on carbon pollution, or offer an explanation for why it could not apply the metric.

Commentary from the litigants makes it pretty clear that NEXT and indeed FERC have a tough row to hoe, to eliminate opposition to the Rio Grande project. Samples of comments from the article are included below.

Sierra Club -Over and over, we have made it clear that we do not want these massive gas facilities in our low-income communities of color because they would put our families in danger with pollution and risk of explosions, destroy wildlife habitat, destroy sacred lands, and exacerbate the climate crisis, all in the name of corporate polluter profit,” said Rebekah Hinojosa, Gulf Coast Campaign Representative for the Sierra Club. “The court recognized that our concerns were valid and needed to be addressed, and yet FERC continues to cut corners and ignore the harm these projects would cause. We are not backing down, and we will continue to fight back against these dangerous gas export projects until they are shut down for good.”

Carrizo Indian tribe– “Rio Grande LNG and Texas LNG are tearing up the land,” said Juan Mancias, Carrizo Comecrudo Tribal Chairman. “The FERC and the LNG companies have never consulted with the Carrizo Comecrudo Tribe about their plans to destroy our sacred lands to build these gas plants that do not help our people and would only benefit the fossil fuel corporations and their shareholders. We won’t allow these disastrous gas processing plants to move forward and poison the health of our tribal members and destroy sacred lands and burial sites. We will fight to protect our ancestral heritage.”

Local community “The City of Port Isabel is proud to join the Sierra Club and other advocates in this action because we believe the future of our community is worth fighting for,” said Jared Hockema, city manager for the City of Port Isabel. “Time and time again, we’ve shown that the process by which both the applicant and the state and federal authorities reviewed this project for compliance with environmental laws was deeply flawed. With the prospects of environmental degradation, harm to our natural resource-based economy or even an explosive disaster being so high, we are determined to continue this fight. We won’t rest until our community, and our people, are safe.”

This is all really inflammatory rhetoric-destroy, deeply flawed, environmental degradation…are not words used lightly. This rhetoric ticks every environmental “heart-string” box on the form. There isn’t a pathway to compromise that I can see, nor do I see an end-point here. These groups are implacably opposed to this project, and if they get a legal result that isn’t in their favor, will simply file another suit. Actors like the Sierra Club have had some success with wearing down companies with endless litigation, and that seems to be the strategy here.

It’s not NEXT hasn’t made the right genuflections about contributing to the community, yatta, yatta, yatta. They have. Take a look below at the lengths to which NEXT is willing to go to win over their detractors.

NEXT commitments to local community (NEXT)

It may be a sign at just how out of touch NEXT management is with the local community and the Indians, as they don’t realize…none of this matters.

Schematic of Rio Grande site (UCONN)

Of all the litigants, the cause espoused by the City of Port Isbel makes the most sense to me. It’s a clear case of NIMBY. If you zoom in with Google Maps, you will get it too. Port Isbel is a sleepy little coastal community of fishing camps, and trailer parks primarily. They’ve got a Walmart and a Dollar General and that’s about as industrialized as it gets. These folks want a giant LNG plant in their backyard, like they want a hole in the head.

These people are content, and don’t care about the millions of dollars that the Rio Grande plant would pay them in taxes. Port Isbel is a little strip of paradise, and up to a week or so ago, it wouldn’t have surprised me to see Jimmy Buffett at the White Sands Bar and Grill, margarita in hand, strumming a 6-string, and waiting on his (I am sorry, I can’t resist)-Cheeseburger in Paradise.

Risks

Other than the legal challenges discussed above, which seem quite daunting to me, are the new rules applied to projects like Rio Grande, in terms of extent of CO2 and AGW impacts. These rules were never remotely contemplated when the projects were first conceived, six or eight years ago. It’s hard to remember after the last couple of years, but when Rio Grande was first put forward, there was an entirely different mindset in government. With this new mindset and an activist judiciary, building Rio Grande just seems too high of a hill. The best they can hope for is a new government in a year or so with a less intense focus on reducing/eliminating fossil fuels.

Your takeaway

In spite of all this, analysts are surprisingly sanguine about NEXT’s prospects for success, as noted above. I don’t share that optimism.

I have been involved with companies dealing with the Sierra Club and Indian tribes before. They managed to shut down a number of Chevron’s (CVX) projects offshore California in the 1980s simply from lack of popular support and endless litigation. Chevron ultimately sold off its offshore California stuff for a song, and no longer operates in the state that birthed it decades ago. (Although the exec’s still hang out in the San Ramon corporate HQ, in California-just north of San Francisco and south of the wine country.) There is simply no way to win these days, and think that NEXT is a weaker prospect than Tellurian, which at least has some revenue coming from its Haynesville gas wells.

The City of Port Isbel is another matter. As I have discussed, these folks don’t care about Climate Change-hey, they’re obviously not too worried about living right at sea level, they don’t care about their ancestors and sacred…”whatever,” as does the Native American tribe. Nope, this is a true quality of life matter for the Port Isbelians, and no amount of money bridges that gap.

As I said, there may be a sea change in government in the not too distant future, but also, there may not be. In the latter scenario, the way forward for Rio Grande becomes too murky to contemplate.

Accordingly, I have to rate NEXT as a sell. They might become a speculative trade on the ebb and flow of news as is TELL, but it would require a much lower price to pique my interest.

Read the full article here