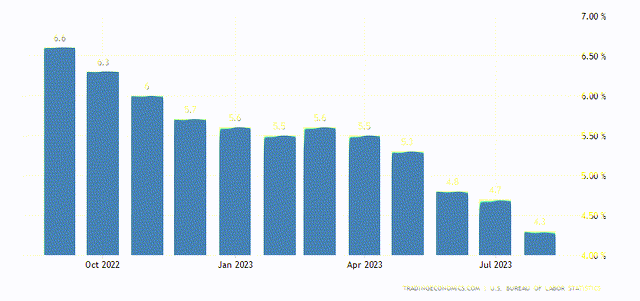

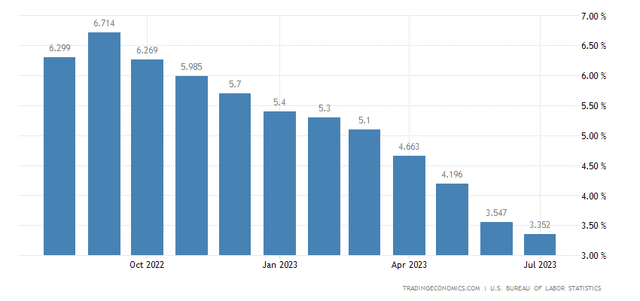

As expected, the headline CPI for August came in slightly hotter than expected at 0.6%, resulting in an increase in the annualized rate from 3.2% to 3.7%. That increase was due to the rise in energy prices with gasoline accounting for over half of the entire increase. The more important number is the core rate, which excludes food and energy and is the primary focus of the Federal Reserve. The disinflationary trend in the core rate continues with its 0.3% monthly increase, resulting in another notch lower in the annualized rate from 4.7% to 4.3%. This fact that shelter costs continue to be the largest contributor to the increase in the core rate is encouraging, because we know that new rental rates, where price increases are now negligible, will bring that number down meaningfully in the year ahead. This tells me that the Fed’s rate-hike cycle concluded in July.

TradingEconomics

The “core core” rate, which also excludes shelter, and used cars and trucks, is just as promising. This rate fell from 3.5% to 3.3%. Again, the disinflationary trend is fully intact.

TradingEconomics

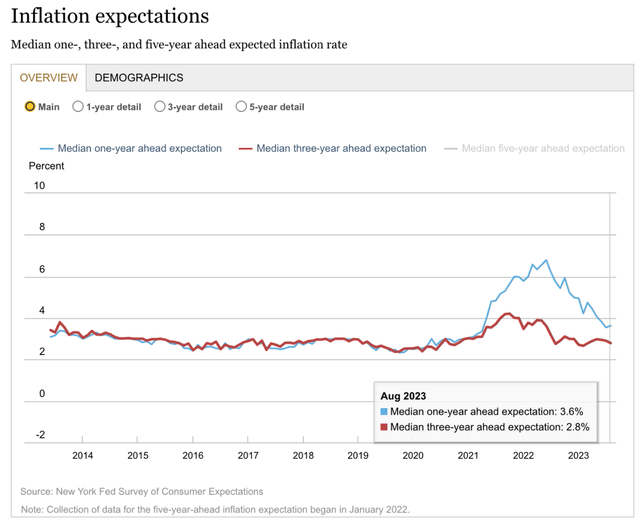

We know that used car and truck price increases have collapsed from their post-pandemic highs, but shelter costs remain stubbornly high. The New York Fed released its Survey of Consumer Expectations on Monday, which is a report that Chairman Powell says he focuses on when assessing inflation expectations. The good news is that three-year expectations continue to taper to what is just 2.8% in the latest survey. One-year expectations rose 0.1% to 3.6%, but I view that as even better news.

NY Fed

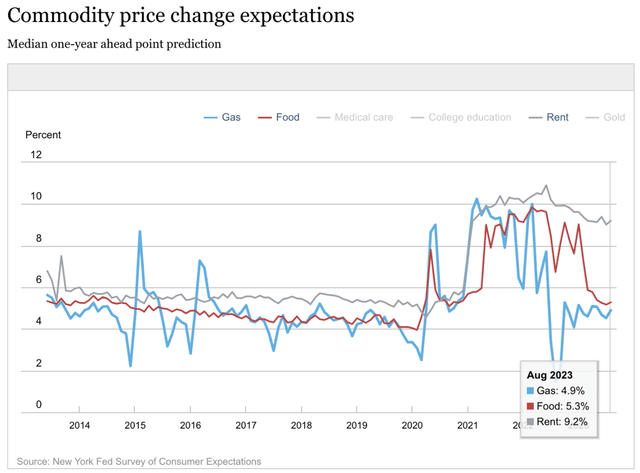

The greatest concern consumers have about living expenses in the year ahead is rent. They think rents will increase more than 9%, which is what is driving the median one-year expectation to 3.6%. Yet the reality is that rents are not likely to increase at all.

NY Fed

Apartment rent prices are rapidly approaching negative territory year-over-year. According to RealPage, rents in August rose just 0.3% compared to the previous August. That is down from the 11% increase one year ago. The occupancy rate remains healthy at 94%, which is partly due to the increase in mortgage rates preventing would-be buyers from entering the new home market. The good news is that the number of new apartment units being built is at a 50-year high with 460,000 to be completed this year alone. That additional supply should keep rents from increasing well into 2025. Therefore, consumers are likely to be pleasantly surprised, based on current expectations, which should help strengthen consumer sentiment.

As the negligible increase in rents each month works its way into the annualized calculation of both the Consumer Price Index and personal consumption expenditures (PCE) price index, the disinflationary trend should continue, moving both numbers closer to the Fed’s target. Chairman Powell is aware of this, which is why I think the Fed’s rate-hike cycle has ended. Do not expect the Fed to celebrate, as members do not want to loosen financial conditions until they see the whites of their target’s eyes.

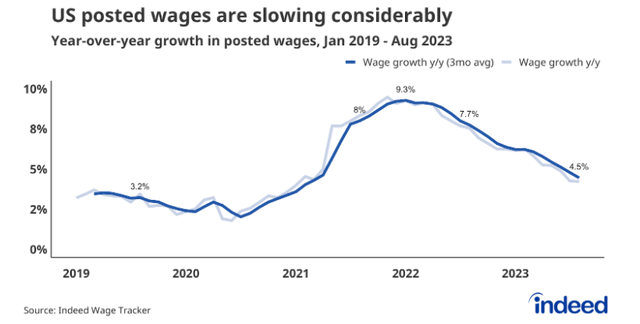

Additionally, we continue to see wage growth soften, which is probably the most important data point to the Fed when determining monetary policy. According to Indeed, wage growth has slowed to just 4.5%. Chairman Powell has said he would like to see that number fall closer to 3.5%, which appears to be a realistic number in 2024, as the labor market continues to soften. Again, the good news here is that wages are increasing modestly more than the rate of inflation, resulting in real wage growth, which should sustain real consumer spending growth and expansion.

Indeed

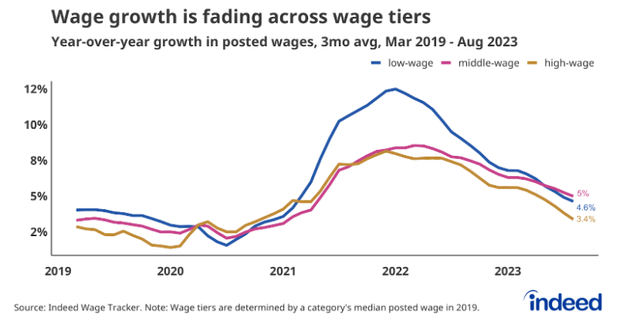

It is also a positive that lower-wage workers are still realizing the highest rate of wage growth, as they tend to be the hardest hit financially when the economy slows. The highest wage earners have home equity and savings to sustain their spending patterns.

Indeed

Today’s CPI numbers tell us what happened over the past 12 months. The data on rents and wages tells us what is likely to happen over the coming 12 months, which is far more important. The stock market has recovered over the past year, largely because of the disinflationary trend that started last summer. That trend should continue, which is why I remain optimistic on both the stock market and economy into the end of this year and beginning of 2024.

Read the full article here