Investment Thesis

Robinhood Markets, Inc. (NASDAQ:HOOD) prospects are starting to find good footing. And more importantly, its valuation has fully compressed. Not only is the business carrying a significant amount of cash, but also, the business has now become GAAP profitable.

Accordingly, there are still some questions outstanding, such as at what rate could Robinhood consistently grow its revenues at? Altogether, there are more positives than negatives in this stock.

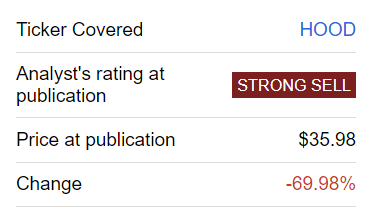

Note, in the past, I was successful in being on bearish this stock.

HOOD author’s performance

Then, I proceeded to become neutral on this stock, calling it a day on my sell rating in what in hindsight turned out to be good timing. And now, I finally turn bullish on this stock. Let’s get to my reasoning.

Rapid Recall,

For a long while, I’ve been skeptical of Robinhood’s prospects. But I now believe that this business has found signs of stability.

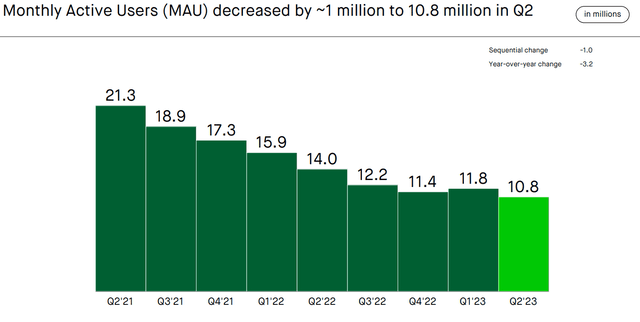

The best indicator I have of its stability is its customer adoption curve, which is no longer exhibiting signs of substantial churn.

HOOD Q2 2023

I strongly believe that, once a business is stable, it can be optimized for profitability. A business that hasn’t quite found its footing is unfocused. However, a stable business can narrow down opportunities and drive its highest ROI investments.

And yet, to be clear, I’m not saying that its financials today are particularly attractive. But I’m always looking ahead and attempting to see what the next 12 months could deliver.

Revenue Growth Rates Are Strong. But How Strong?

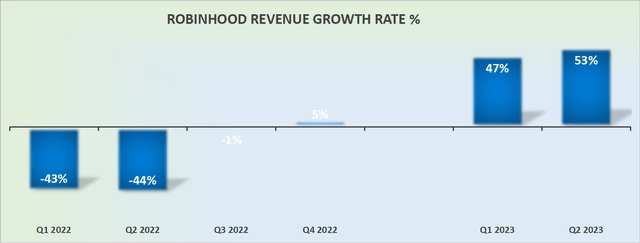

HOOD revenue growth rates

The graphic above shows that Q2 2023 saw Robinhood’s revenues increase significantly. Great right? Well, that’s for the most part being driven by the very strong comparable figures.

The big question that investors are facing, is where do Robinhood’s growth rates stabilize in 2024, once the comparables become significantly more challenging?

To put it more concretely, is it possible that Robinhood could grow by 15% to 20% CAGR in 2024? I don’t know the answer to this question. But neither does anyone else.

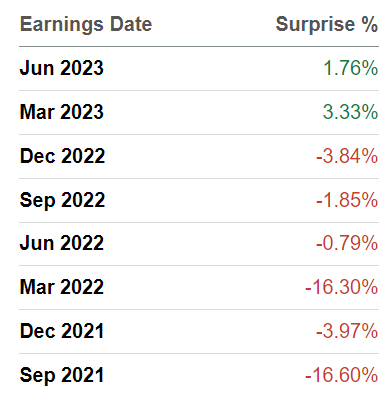

SA Premium, revenue surprises

Case in point, as you can see above, analysts have been frequently wrong on Robinhood’s prospects. Or put another way, Robinhood’s revenues have historically been so volatile that it’s difficult for anyone to have a firm grasp on what its prospects could end up as!

But how much do we truly need to know here, while still having a margin of safety, isn’t that the bigger question?

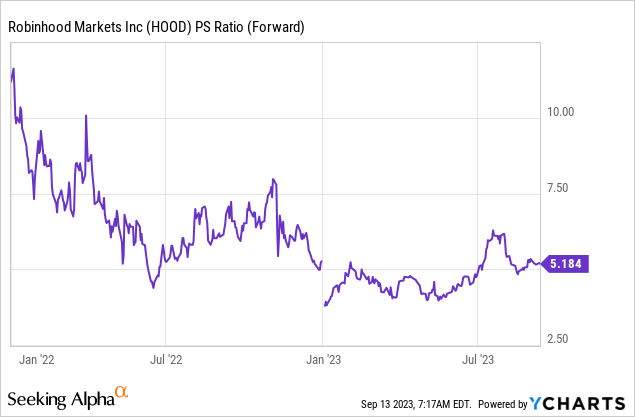

HOOD Stock Valuation — Looks Attractive

As you can see above, investors are being asked to pay 5x forward sales for Robinhood. It’s difficult to make the case that this is the bargain basement. On the other hand, if Robinhood could grow at 15% CAGR for a few years, paying 5x forward sales is a very fair entry point.

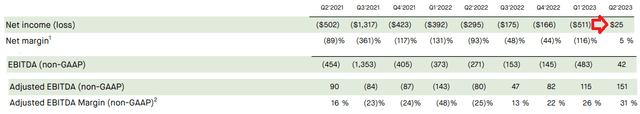

HOOD Q2 2023

What’s more, keep in mind that Robinhood has already reported a clean GAAP profit. It’s not a big profit. But it’s a profit nevertheless. Again, I’m not going to argue that this is a blemish-free stock to buy.

But my assertion is that the business is now more stable than many would perhaps believe. And then, to add a further margin of safety, consider this:

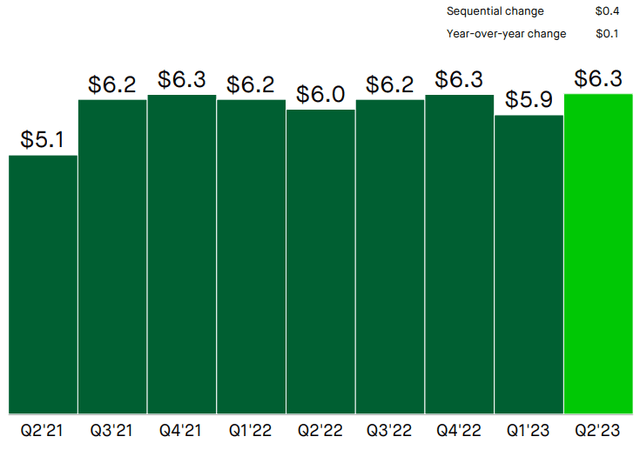

HOOD Q2 2023

What you see above is a reminder that this $10 billion market cap business holds about $6 billion in cash and equivalents on its balance sheet. Obviously, that’s another positive contributing factor.

The Bottom Line

I’ve had my eye on Robinhood for a while, and it seems the company is finally finding its stability and profitability. The recent trends in customer adoption and the fact that Robinhood has become GAAP profitable are positive signs.

While questions about its future revenue growth rate remain, the current outlook is more optimistic than negative. I’ve shifted my perspective on this stock from bearish to neutral in the past, and now I’ve turned bullish. While its current financials may not be extremely attractive, I’m looking ahead to see what the next year could bring.

Robinhood’s recent revenue growth rates have been impressive, but the key question is whether it can maintain this growth in 2024 when comparables become more challenging.

Analysts have struggled to predict Robinhood’s performance due to its historical revenue volatility. Nevertheless, even with some uncertainty, the stock’s valuation appears attractive at 5x forward sales, especially considering its clean GAAP profit and substantial cash reserves of around $6 billion compared to its $10 billion market cap.

These factors suggest a level of stability and potential for growth that makes Robinhood stock worth a closer look in the coming months.

Read the full article here