By Kevin Flanagan

One of the more unexpected developments this year is that a recession has yet to rear its ugly head. Here we are, approaching three-quarters of the way into 2023, and the totality of economic data arguably continues to confound what was perhaps the most widely anticipated economic downturn on record. With 525 basis points’ worth of cumulative Federal Reserve rate hikes in the books, the U.S. economy may still not be completely out of the woods, but signs are pointing to another positive performance for third-quarter real gross domestic product (GDP) as well (more on that later).

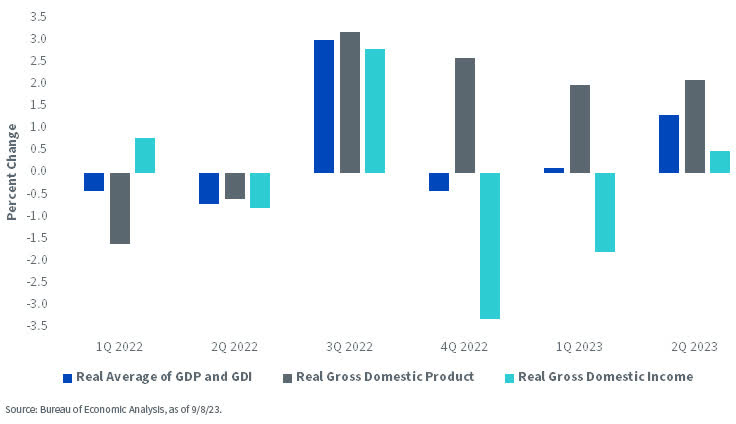

U.S. Economic Activity Measures

Notably, if you go back to last year, economists were fighting the complete reverse battle. Indeed, real GDP had printed two consecutive negative performances during Q1 and Q2 of 2022, but it seemed as if the narrative was trying to dismiss these readings as not being indicative of a recession, especially because of the solid labor market data setting (sound familiar?).

Back then, we were being told that we should look at an alternate measure of economic growth, gross domestic income (GDI). I blogged on this exact topic in early October of last year and thought it would be intriguing to look at how things have changed almost a year later.

As a refresher, according to the Bureau of Economic Analysis (BEA), GDI is defined as a measure of the incomes earned and the costs incurred in the production of GDP and is another way of measuring economic activity. For the record, GDP measures the value of the final goods and services produced in the U.S. To sum up, GDP calculates economic activity by expenditures, while GDI focuses on the incomes generated during the process. Interestingly, the BEA states that both are “conceptually equal.” While each series can produce different short-term results, they tend to come together over the longer haul.

The above table underscores how the “2023 experience” has essentially been the opposite of last year’s. While real GDP has been enjoying growth of around 2%, GDI has either been negative or just barely positive. However, another way of looking at economic activity is to average real GDP and GDI together, a component the BEA produces as well. Thus far in 2023, this average has produced basically no growth in Q1 (+0.1%) and a more modest 1.3% reading for Q2.

Conclusion

So will the real economy “please stand up?” That brings us to where Q3 activity is. According to consensus forecasts, real GDP for the July–September period is expected to post another 2% performance, but the Atlanta Fed’s GDPNOW gauge has growth surging to 5.6%, as of this writing. Either way, it would appear the recession may have to wait yet again, with all eyes turning to how this year ends and 2024 begins.

Kevin Flanagan

Head of Fixed Income Strategy

As part of WisdomTree’s Investment Strategy group, Kevin serves as Head of Fixed Income Strategy. In this role, he contributes to the asset allocation team, writes fixed income-related content and travels with the sales team, conducting client-facing meetings and providing expertise on WisdomTree’s existing and future bond ETFs. In addition, Kevin works closely with the fixed income team. Prior to joining WisdomTree, Kevin spent 30 years at Morgan Stanley, where he was Managing Director and Chief Fixed Income Strategist for Wealth Management. He was responsible for tactical and strategic recommendations and created asset allocation models for fixed income securities. He was a contributor to the Morgan Stanley Wealth Management Global Investment Committee, primary author of Morgan Stanley Wealth Management’s monthly and weekly fixed income publications, and collaborated with the firm’s Research and Consulting Group Divisions to build ETF and fund manager asset allocation models. Kevin has an MBA from Pace University’s Lubin Graduate School of Business, and a B.S in Finance from Fairfield University.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here