GMS Inc. (NYSE:GMS) offers ceiling, steel, and residential building materials. The stock has risen more than 15% since my last report was published. I still believe it has a lot of potential and is undervalued. Currently, the housing market is suffering due to high interest rates, and it is affecting company sales. So, considering the headwinds I am changing the buy rating to a hold rating.

Financial Analysis

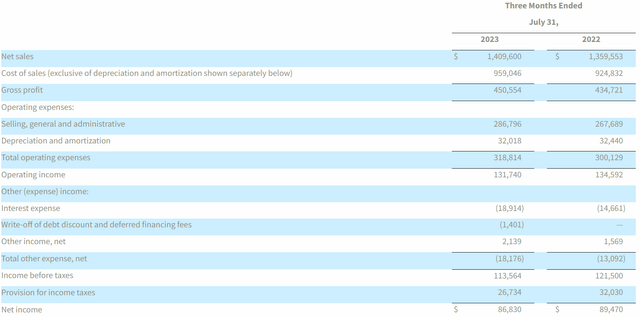

GMS recently posted its Q1 FY24 results. The net sales for Q1 FY24 were $1.4 billion, a rise of 3.6% compared to Q1 FY23. The increased sales of wallboard, ceilings, and complementary products were the reason behind the increased sales. The wallboard sales were up by 9.6% in Q1 FY24 compared to Q1 FY23. The U.S. commercial and multifamily wallboard volume was up by 5.9% and 22.1% in Q1 FY24 compared to Q1 FY23, which was the major reason behind the increased wallboard sales. Other than the strong volumes, strong pricing was also a significant aspect that contributed to a rise in wallboard sales. The pricing in Q1 FY24 was 7.6% higher than Q1 FY23. The ceilings and complementary sales increased by 4.7% and 7.7% in Q1 FY24 compared to Q1 FY23. Both benefitted from higher pricing. Its gross profit margin in Q1 FY24 was the same as it was in Q1 FY23.

GMS’s Investor Relations

The net income in Q1 FY24 was $86.8 million, a decline of 3% compared to Q1 FY23. The decline was mainly due to acquisition costs, so the decline in net income should not be a concern. During the Q1 FY24, they acquired Home Lumber in the Vancouver Island market, and the company also added an AMES store location in Texas. The company is continuing its acquisition strategy to boost its sales growth. Their sales growth in Q1 FY24 wasn’t significant, but still, it was impressive because the market environment wasn’t favorable in the quarter. The mortgage and interest rates were sky-high, and as a result, the construction industry was affected, adversely affecting the company’s single-family market sales. The wallboard volumes of single-family in the U.S. were down 12.5% in Q1 FY24 compared to Q1 FY23. Still, the company managed to grow its sales, which is impressive. Despite the headwinds, I expect the company to grow its sales in the coming quarters. I am stating this because they continue to make acquisitions, and the company’s operation is quite diverse and not dependent on a single industry. But still, I expect the sales growth might not be significant due to the market headwinds.

Technical Analysis

TradingView

My technical analysis worked very well. I mentioned in my last report that if the stock breaks $56, it can reach $61, and it did. It broke its all-time high in May and created a new high of $76. After breaking its all-time high in May, the stock rallied around 23% in the next three months. Generally, when a stock breaks its all-time high, it gives a rally, and after that, it comes back to the breakout level for a retest, and after the retest, the stock once again starts its upward rally. So, the stock is coming back to the breakout level of $62 for the retest. It might correct around 5% from the current level. But once the retest is done, we might see a fresh upward momentum in the stock. So if the stock forms a green candle, around $62 new buyers who missed investing in the stock when I last posted about the company can enter. But until the retest is done, I would advise new investors to avoid it.

Should One Invest In GMS?

GMS performed well despite tough market conditions, and it might continue to perform. But due to the headwinds, I expect that the sales growth might not be significant. So, creating a new position in the stock right now might be risky because the current market conditions are not favorable, and the company’s financial performance might be adversely affected. So, I would advise everyone to wait for the market conditions to become normal and those who invested after my article was published. I would advise them to continue to hold the stock as there is still a lot of potential left, and once the market conditions become favorable, the company might continue its upward trajectory.

Lastly, talking about the valuation. It has a P/E [FWD] ratio of 8.17x, lower than the sector median of 17.20x, and has an EV / EBIT [FWD] ratio of 8.7x, which is also lower than the sector median of 15.33x. The ratios and the company’s ability to perform in adverse market conditions make it undervalued. GMS still has a lot of potential, but headwinds like high mortgage rates might affect them in the short term. Hence, I assign a hold rating on GMS stock.

Risk

For fiscal years 2023, 2022, and 2021, their ten biggest clients contributed roughly 7.1%, 8.1%, and 9.0% of their total revenues. One cannot promise that they will be able to keep or strengthen their relationships with these clients, that they will be able to effectively take over the client relationships of any businesses they buy, or that they will continue to provide these clients with the same level of service as in the past. Numerous consumers are typically subject to the same business and economic dangers as they give them credit. One or more of its important clients could go bankrupt due to unfavorable market conditions. Their capacity to completely recover receivables from these larger customers could be hampered if their financial conditions worsen. If a situation like this occurs, it might affect the company’s financials.

Bottom Line

They were able to grow their sales in tough market conditions, which is impressive. I still believe they have a lot of potential, but the high-interest rates headwind is affecting the housing market. So, it might affect the company’s financial performance in the short term. Hence, I assign a hold rating on GMS.

Read the full article here