Investment thesis

Celestica (NYSE:CLS) is Seeking Alpha Quant’s top-rated stock at the moment. Indeed, the stock has been on fire this year, with the price more than doubling year-to-date. This was due to consistently high YoY revenue growth in the last six quarters, which is unusual for the company. But for the long-term, profits and free cash flow matter the most. And the company has massive industry-inherent constraints to expand its profitability metrics. Operating in a highly competitive environment forces to be aggressive in pricing, which keeps margins razor-thin even during periods of notable revenue expansion. It is also important to mention that revenue growth is expected by consensus to return back to normal in the upcoming quarter. The valuation does not look attractive after a massive rally either. All in all, I assign the stock a “Hold” rating.

Company information

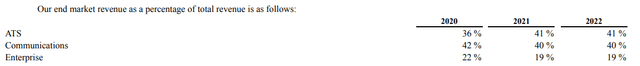

Celestica is a Canadian company that delivers innovative supply chain solutions globally to customers in two segments: Advanced Technology Solutions [ATS] and Connectivity & Cloud Solutions [CCS]. Celestica’s offerings in both segments include design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.

Celestica’s latest annual SEC filing

The company’s fiscal year ends on December 31. According to Celestica’s latest annual SEC filing, the company generated 66% of its FY2022 sales from the top ten customers.

Financials

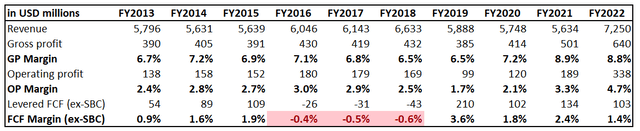

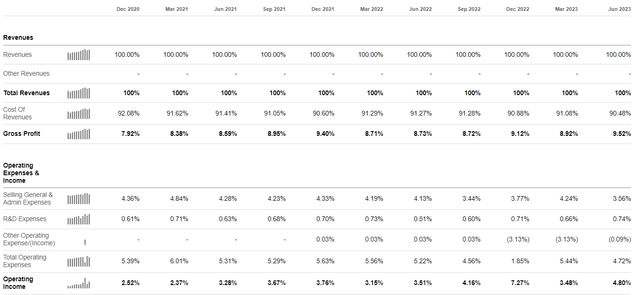

The company’s financial performance over the last decade looks nothing special. The revenue growth rate hardly outpaced the long-term average inflation rate with a 2.5% CAGR. The gross margin never climbed above single digits over the last decade, and the operating margin is razor-thin. The average free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] is 1.2%, almost nothing.

Author’s calculations

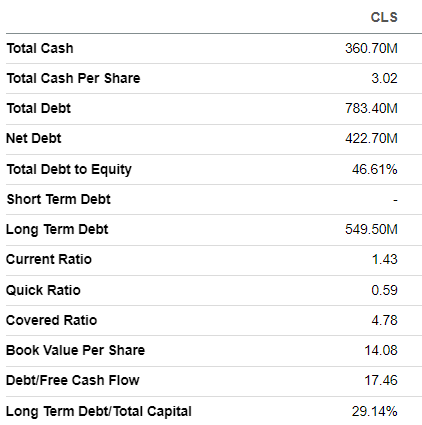

Razor-thin margins mean the company has little room to reinvest in innovation and business expansion. Low profitability metrics also do not allow Celestica to keep shareholders happy with dividend payouts or substantial stock buybacks. The average financial strength also does not surprise me due to low margins.

Seeking Alpha

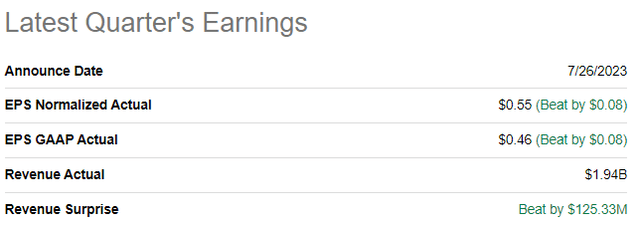

On the other hand, the revenue dynamics starting from Q1 FY2022 have been impressive, with YoY growth consistently at double digits. The latest quarter’s earnings were released on July 26, and the company topped consensus estimates. Revenue grew almost 13% YoY, and the adjusted EPS expanded from $0.44 to $0.55.

Seeking Alpha

Despite massive growth momentum over recent quarters, profitability metrics remain low. In Q2 FY 2023, the gross margin was still below 10%, and the operating margin was below 5%. Quarterly revenue increased by about 37% compared to Q2 of FY 2021, but margin expansion was relatively insignificant. This clearly indicates to me that the economies of scale effect is very insignificant for the company, and revenue growth does not add much value to shareholders.

Seeking Alpha

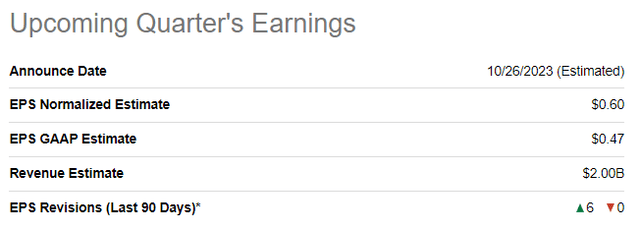

The upcoming quarter’s earnings release is scheduled for October 26. Quarterly revenue is expected by consensus at $2 billion, which indicates a 4% YoY growth. The adjusted EPS is expected to expand YoY from $0.52 to $0.60. Revenue growth deceleration suggests that solid momentum is cooling down, and the pace steadily returns back to the long-term trajectory.

Seeking Alpha

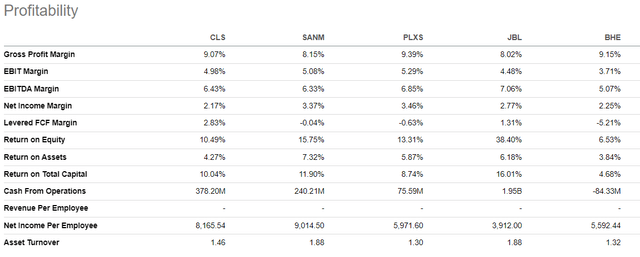

The management underlines that the company operates in a highly competitive environment in its annual SEC filings. If we look at the profitability metrics of the company’s competitors, we can see that all of them are low. That said, the industry’s pricing competition is very intense, meaning CLS has tiny room for profitability metrics expansion. As we can see below, CLS leads regarding the levered FCF margin but mostly lags in other profitability metrics. That said, I do not see any competitors having strong long-term competitive advantages.

Seeking Alpha

Valuation

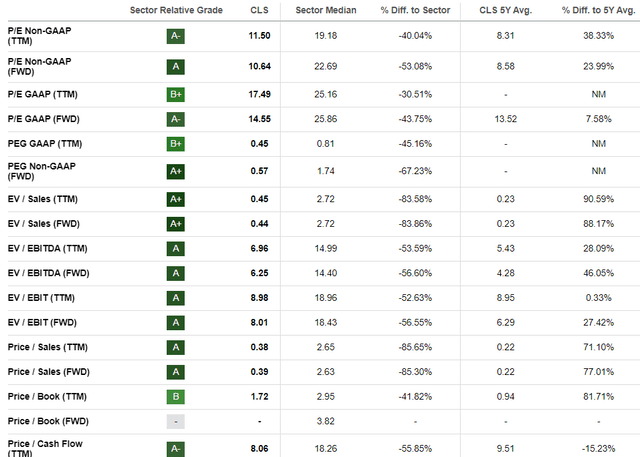

The stock more than doubled in 2023 with a 106% year-to-date rally, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns the stock with a high “A-” valuation grade since its multiples are substantially lower than the sector median across the board. At the same time, current valuation ratios are significantly higher than the company’s historical averages.

Seeking Alpha

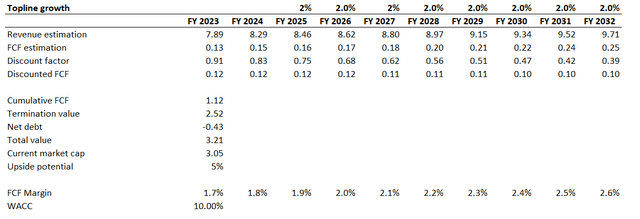

The outcomes of multiple analyses are mixed, so I need another valuation approach to run. Celestica does not pay dividends, so the discounted cash flow [DCF] simulation looks like the only viable option to proceed with. I use a 10% WACC for discounting. A 1.7% FCF margin is the last five-year average, which looks fair for the DCF. Consensus revenue estimates are available only for the two upcoming years. For the years beyond, I incorporate a modest 2% revenue growth.

Author’s calculations

According to my DCF simulation, the business’s fair value is $3.2 billion, which is very close to the current market cap. The upside potential is 5%, meaning that the target price for the stock is $24.5. Given all the risks and uncertainties I discuss below, I consider the upside potential unattractive.

Risks to consider

I consider the company’s low profitability metrics a significant shareholder risk. The 1-2% FCF margin means that even slight increases in commodity prices and labor costs might turn free cash flow negative. Narrow profitability metrics over the long term suggest the company has almost no pricing power to share rising costs with customers. That said, there is only one way to increase profits in absolute terms: by expanding the business scale. But the competitive landscape is very intense, and it will be tough to grow rapidly.

High revenue concentration, which results in 66% of sales generated from top-ten customers, also does not strengthen the company’s position in negotiating favorable terms and conditions. Concentration risk also includes high dependence on Celestica’s operations and earnings on the financial health of its largest customers, which can cut orders during challenging times.

The company trades internationally with notable foreign sales, meaning it faces substantial risks of foreign exchange volatility. Unfavorable swings in currency exchange rates might adversely affect the company’s earnings. Trading internationally also means high regulatory and geopolitical risks.

Bottom line

To conclude, Celestica’s stock is a “Hold”. The company operates in a highly competitive environment, which makes profitability metrics very low due to the competition’s aggressive pricing. Even after a massive revenue growth momentum in the last six consecutive quarters, the gross margin never climbed to double digits. It is also important to note that the revenue growth momentum is cooling down as the upcoming quarter’s revenue consensus estimates forecast YoY growth returning closer to normal. The valuation also does not look very attractive after a massive year-to-date rally with a mere 5% upside potential.

Read the full article here