Intuitive Machines, Inc. (NASDAQ:LUNR) is a wild stock and one that we provided a very profitable trade for you this spring. In the last few weeks, the stock has been absolutely obliterated. The purpose of today’s column is to highlight this stock once again for a trade and to review some recent information that we believe suggests speculating here will once again pay off. We remain very intrigued by its technological capabilities and possible future. While a long-term investment will require patience for future catalysts that drive revenue, the stock has round-tripped back to well under $5, making it ripe for a near-term move on some news. That is what this stock does. It moves with volatility before slowly eroding. We think the time is now to re-enter for a trade after it has been absolutely smashed.

We like the prospects for this company as it is doing some great work in the field of space exploration, infrastructure, and related services. The future of the company could indeed be very bright if they execute, but we see another rip higher in this stock in the near-term future, whether through added contracts, or hitting deliverables. That said, there is risk, as failure to execute could send the stock tumbling again, with gusto, perhaps toward being a sub $2 stock. Thus, you need to have your stops in place.

The play

Target entry 1: $4.20-$4.30 (25% of position).

Target entry 2: $3.90-$3.95 (35% of position).

Target entry 3: $3.60-$3.65 (35% of position).

Stop loss: $2.75.

Target exit: $5.50+.

Note: This is the style of trading suggestions we generally offer. There are no options trading and no suggestions thereof for this ticker.

Discussion

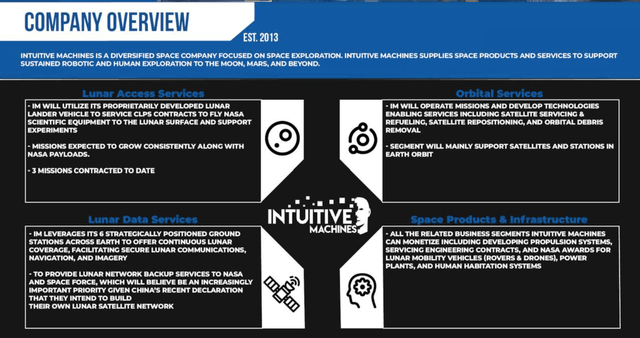

This remains a volatile stock. In the last one month alone, the stock has traded in a range of about $3.80 to $8.20. Yes, it is indeed wild. We are currently at $4.37 at the time of this writing, and we want to buy just a bit lower, per the trade. Here is an overview of what the company does if you are new to the ticker.

Q2 investor presentation

Why do we still think the stock can make another run? Well, first the very recently reported earnings were pretty decent, but the pending catalysts are the key to the forward movement. The company is likely to be flying its first mission in the third quarter of this year. The mission, expected to land on the South Pole region of the Moon, is the first mission to that region of the lunar surface. It would mark the United States going back to the Moon for the first time in more than 50 years. It is exciting. There was a recent update from the CEO on this front. Intuitive Machines CEO Steve Altemus said:

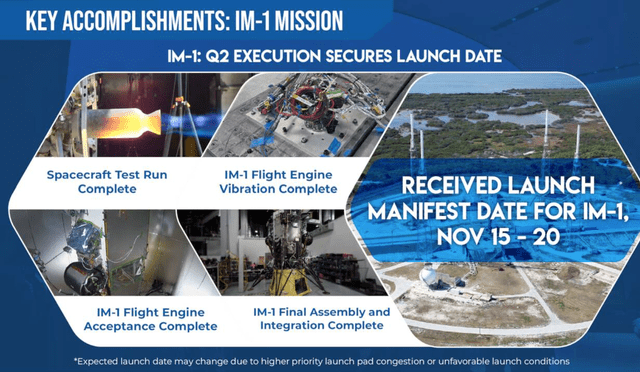

During the second quarter, we were laser-focused on the final assembly process in preparing IM-1 for launch. Our lunar lander is complete and will be prepared for delivery in September. The Company has secured a launch window from pad 39A, preserving a six-day launch window starting on November 15th.

Intuitive Machines Q2 presentation

This mission will be a huge catalyst for the stock, make no mistake about it. Now, the company receives a lot of funding. But to secure more cash, the company recently got a $20 million investment in new shares from a big investor. The cash position is looking good here, especially when you consider the company has a contracted backlog of nearly $140 million. One big contract to remind you of is the NASA OMES III contract with a contract ceiling of $719 million for five years.

Make no mistake, the company won’t be earnings-positive for a long time, but the development of the company’s tech is the investing attraction for future space exploration and more. So forthcoming catalysts will be more contracts for development and exploration. And, it is possible more equity will be issued to help the company meet its goals. That is a risk of course for long-term investment. Thus, we embrace trading it, and we strongly believe the company will continue to bid for contracts and win some of them.

In addition to the OMES III mentioned above which was huge, there was some more contract activity in the just-reported quarter. Intuitive submitted proposal for NASA’s Near Space Network Services (or NSNS) to provide Lunar distance communications to and from Earth as well as data relay services around the Moon. The company also submitted a separate proposal for NASA’s Lunar Terrain Vehicle Services bid as the Moon Reusable Autonomous Crewed Exploration Rover Team. If awarded Intuitive would help to develop NASA’s next-generation Lunar Terrain Vehicle for exploration and development of the south pole region of the Moon.

There are some developments to be aware of as well. We think there will be some buzz later this month with the grand opening of Intuitive’s Lunar Production and Operations Center at the Houston Spaceport, scheduled for September 29, 2023. The company also has readied systems for launch for its moon mission later this year.

From a fiscal perspective, we did mention the $20 million investment received after the close of Q2. In the most recent quarter, in addition to the aforementioned contract success and bids, the company still had a contracted backlog of nearly $140 million and nearly $90 million was expected to convert to revenue over the remainder of the year. More on that in a minute. Overall revenue was $18 million, driven primarily by three NASA CLPS contracts within lunar access services. The company, of course, is in a cash burn situation for testing and research and development and ended up with an operating loss of $13.2 million versus $2.2 million a year ago. As such, the company had an ending cash balance of $39 million as of the end of Q2, with as mentioned another $20 million investment. With contract revenue, the company should have sufficient funding with existing contracts to operate through 2024. So why did the stock get crushed? Because 2023 revenue is in jeopardy.

Why? The company cited in the release “delays to government customer acquisition timelines”, as well as U.S. federal budget uncertainty and the uncertain cadence and timing of new contractual awards. As such the company withdrew its financial guidance for 2023. While that is alarming, the Street is missing one key component. The funding is simply pushed back. The guidance change is “not a result of the loss of any anticipated material government customer commitments or contract awards.” That is key.

Here is the thing. With all of their applications and proposal submissions, Intuitive Machines, Inc. stock can easily rally on more deals being struck, and/or proposals being accepted. And what you may not realize, Intuitive has submitted more than $3 billion in proposals spread across the aerospace and defense sectors, including human spaceflight. While nothing is guaranteed, the company has proven it is a reliable government partner, and more success ahead will mean more awards. The next catalyst is likely around the corner. As such, we are thinking you can position for a very speculative trade here that is likely to surge on this news. Keep the position small, however, as execution risk always remains. The stock has been obliterated and it is overdone.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here